- Philippines

- /

- Food and Staples Retail

- /

- PSE:SEVN

3 Growth Companies With High Insider Ownership Seeing Up To 29% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rate adjustments and sector-specific rallies, the focus remains on growth opportunities amid economic shifts. In this context, companies with high insider ownership and robust revenue growth stand out as compelling prospects, offering insights into potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Philippine Seven (PSE:SEVN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Philippine Seven Corporation operates convenience stores in the Philippines with a market cap of ₱113.46 billion.

Operations: The company generates revenue of ₱86.14 billion from its store operations segment.

Insider Ownership: 11.2%

Revenue Growth Forecast: 12% p.a.

Philippine Seven's earnings are forecast to grow at 16.7% annually, outpacing the Philippine market's 11.6%. Recent results show robust growth with second-quarter sales reaching PHP 22.74 billion, up from PHP 19.28 billion year-on-year, and net income rising to PHP 1.12 billion from PHP 1.02 billion. Despite a high return on equity forecast of 25.8%, its dividend yield of 6.4% is not well-covered by earnings, indicating potential financial constraints amidst growth prospects.

- Navigate through the intricacies of Philippine Seven with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Philippine Seven's shares may be trading at a premium.

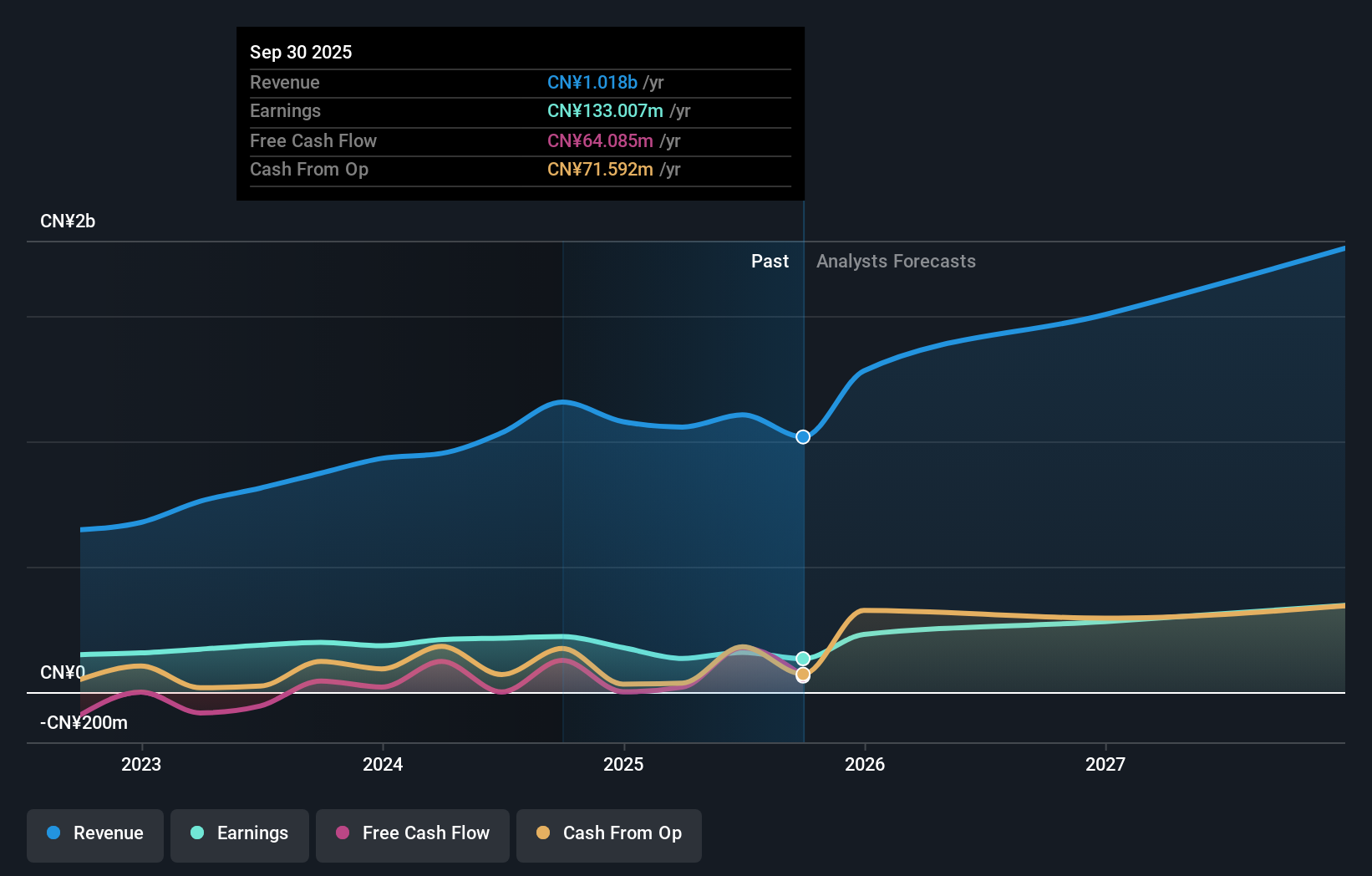

Beijing Sun-Novo Pharmaceutical Research (SHSE:688621)

Simply Wall St Growth Rating: ★★★★★★

Overview: Beijing Sun-Novo Pharmaceutical Research Co., Ltd. is a contract research company focused on drug research and development in China, with a market cap of CN¥4.87 billion.

Operations: The company's revenue is primarily derived from Pharmacy Research Services, which generated CN¥594.85 million, and Clinical Trials and Bioanalytical Services, contributing CN¥434.84 million.

Insider Ownership: 36.7%

Revenue Growth Forecast: 29.4% p.a.

Beijing Sun-Novo Pharmaceutical Research demonstrates strong growth potential with earnings forecasted to rise by 28.1% annually, surpassing the Chinese market's 23.8%. The company's recent half-year results show sales and net income increases to CNY 562.74 million and CNY 148.57 million, respectively. Although its share price has been volatile recently, it trades at a favorable P/E ratio of 22.6x compared to the broader CN market, indicating good relative value amidst high expected revenue growth of 29.4% annually.

- Get an in-depth perspective on Beijing Sun-Novo Pharmaceutical Research's performance by reading our analyst estimates report here.

- Our valuation report here indicates Beijing Sun-Novo Pharmaceutical Research may be undervalued.

Beijing Beetech (SZSE:300667)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Beetech Inc. produces and sells smart sensors and optoelectronic instrument products, with a market cap of CN¥4.08 billion.

Operations: Revenue segments for the company include smart sensors and optoelectronic instrument products.

Insider Ownership: 30.7%

Revenue Growth Forecast: 18.4% p.a.

Beijing Beetech's earnings are forecast to grow significantly at 48.46% annually, outpacing the Chinese market's growth rate. Despite becoming profitable this year, recent half-year results show a decline in revenue and net income to CNY 353.68 million and CNY 2.55 million, respectively, compared to the previous year. The company's share price has been highly volatile recently, and while revenue growth is expected to exceed the market average, its Return on Equity remains low at 7.6%.

- Click here and access our complete growth analysis report to understand the dynamics of Beijing Beetech.

- Our comprehensive valuation report raises the possibility that Beijing Beetech is priced higher than what may be justified by its financials.

Key Takeaways

- Click this link to deep-dive into the 1485 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:SEVN

Solid track record with excellent balance sheet and pays a dividend.