- Philippines

- /

- Diversified Financial

- /

- PSE:REG

Spotlight On SolTech Energy Sweden And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic indicators, investors are increasingly looking beyond traditional large-cap stocks for potential opportunities. Penny stocks, though sometimes viewed as an outdated term, continue to hold relevance for those seeking unique investment avenues. These smaller or newer companies can offer intriguing possibilities when backed by strong financials, and in this article, we explore three such penny stocks that combine resilience with the potential for significant growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.76 | MYR449.66M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.78 | HK$41.63B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.18B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £153.96M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,823 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

SolTech Energy Sweden (OM:SOLT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SolTech Energy Sweden AB (publ) develops, sells, and installs energy and solar cell solutions in Sweden and China with a market cap of SEK244.32 million.

Operations: The company generates revenue from several segments, including SEK1.28 billion from Solar, SEK781.14 million from Roof, SEK424.69 million from Electrical Technology, and SEK193.43 million from Facade solutions.

Market Cap: SEK244.32M

SolTech Energy Sweden AB, despite being unprofitable with declining earnings over the past five years, has shown resilience through strategic partnerships and innovative projects. Recent developments include the completion of significant battery parks and energy storage solutions in collaboration with companies like Hylte Paper and Falu Energi & Vatten, enhancing grid stability and efficiency. The company holds a satisfactory net debt to equity ratio of 16.8% and maintains a positive cash runway for over three years due to growing free cash flow. However, its share price remains highly volatile, reflecting broader market challenges for similar stocks.

- Get an in-depth perspective on SolTech Energy Sweden's performance by reading our balance sheet health report here.

- Learn about SolTech Energy Sweden's historical performance here.

Republic Glass Holdings (PSE:REG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Republic Glass Holdings Corporation is involved in the purchase, lease, and sale of various securities primarily in the Philippines, with a market capitalization of ₱2.22 billion.

Operations: The company's revenue segment consists solely of its Core Business, generating ₱168.44 million.

Market Cap: ₱2.22B

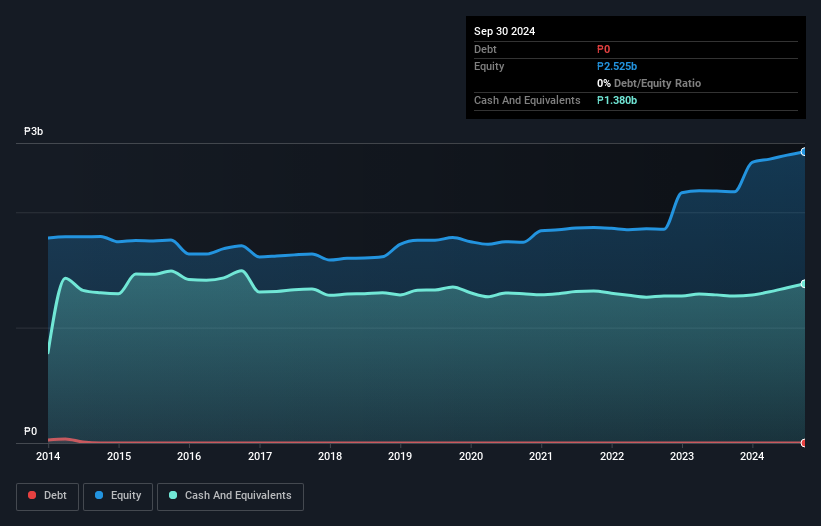

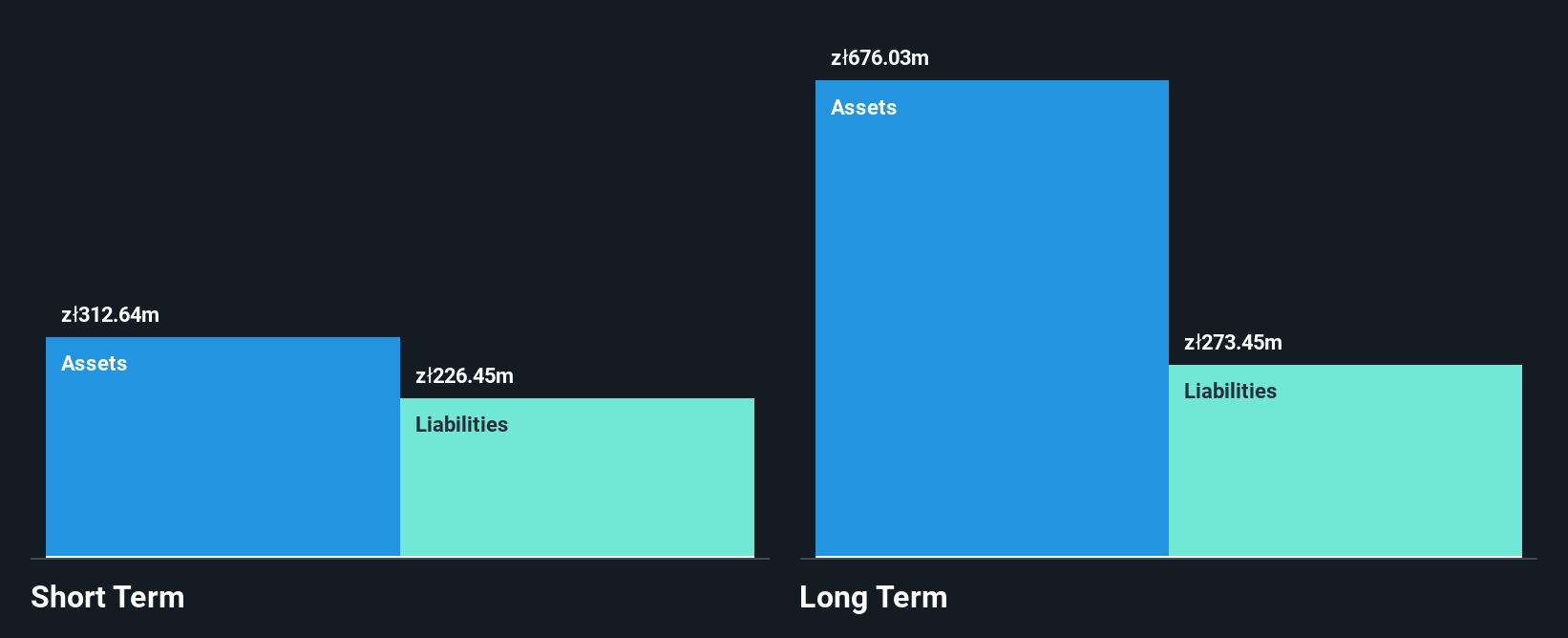

Republic Glass Holdings Corporation has demonstrated significant earnings growth, with recent results showing a net income of ₱49.1 million for the third quarter, reversing a loss from the previous year. This performance aligns with its strong annual earnings growth of 85.5%, surpassing industry averages. The company maintains a robust balance sheet with no debt and substantial short-term assets (₱1.4 billion), covering both short and long-term liabilities comfortably. Despite its low return on equity at 5.6%, Republic Glass benefits from high-quality earnings and an experienced board, though it faces heightened volatility in share price movements recently.

- Jump into the full analysis health report here for a deeper understanding of Republic Glass Holdings.

- Gain insights into Republic Glass Holdings' historical outcomes by reviewing our past performance report.

PCC Exol (WSE:PCX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PCC Exol S.A. is a company that manufactures and distributes surfactants both in Poland and internationally, with a market cap of PLN395.29 million.

Operations: The company's revenue from the Specialty Chemicals segment is PLN915.71 million.

Market Cap: PLN395.29M

PCC Exol S.A. faces challenges with negative earnings growth of -52.3% over the past year, contrasting with a 10.5% annual growth over five years. Despite stable weekly volatility and no significant shareholder dilution recently, the company's net profit margin declined to 3% from 5.7%. PCC Exol's debt levels remain high, though interest payments are well covered by EBIT at 3.7x coverage, and operating cash flow covers debt effectively at 29.9%. Recent earnings reports show a decrease in net income to PLN6.51 million for Q3 compared to PLN13.34 million last year, highlighting ongoing profitability issues despite consistent sales figures.

- Click to explore a detailed breakdown of our findings in PCC Exol's financial health report.

- Gain insights into PCC Exol's past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Explore the 5,823 names from our Penny Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:REG

Republic Glass Holdings

Engages in the purchase, lease, and sale of various securities primarily in the Philippines.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives