- Philippines

- /

- Food

- /

- PSE:AXLM

3 Intriguing Penny Stocks With Market Caps Under US$200M

Reviewed by Simply Wall St

As global markets navigate a period of fluctuating consumer confidence and mixed economic indicators, investors are increasingly exploring diverse opportunities. Penny stocks, though an outdated term, still represent smaller or less-established companies that can offer significant value. By focusing on those with strong financials and potential for growth, investors might uncover promising opportunities in this niche segment.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.88 | HK$42.73B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Al Waha Capital PJSC (ADX:WAHA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Al Waha Capital PJSC is a private equity firm that manages assets across sectors such as financial services, fintech, healthcare, energy, infrastructure, industrial real estate and capital markets, with a market cap of AED3.25 billion.

Operations: The company generated AED149.88 million in revenue from its private investments, excluding Waha Land.

Market Cap: AED3.25B

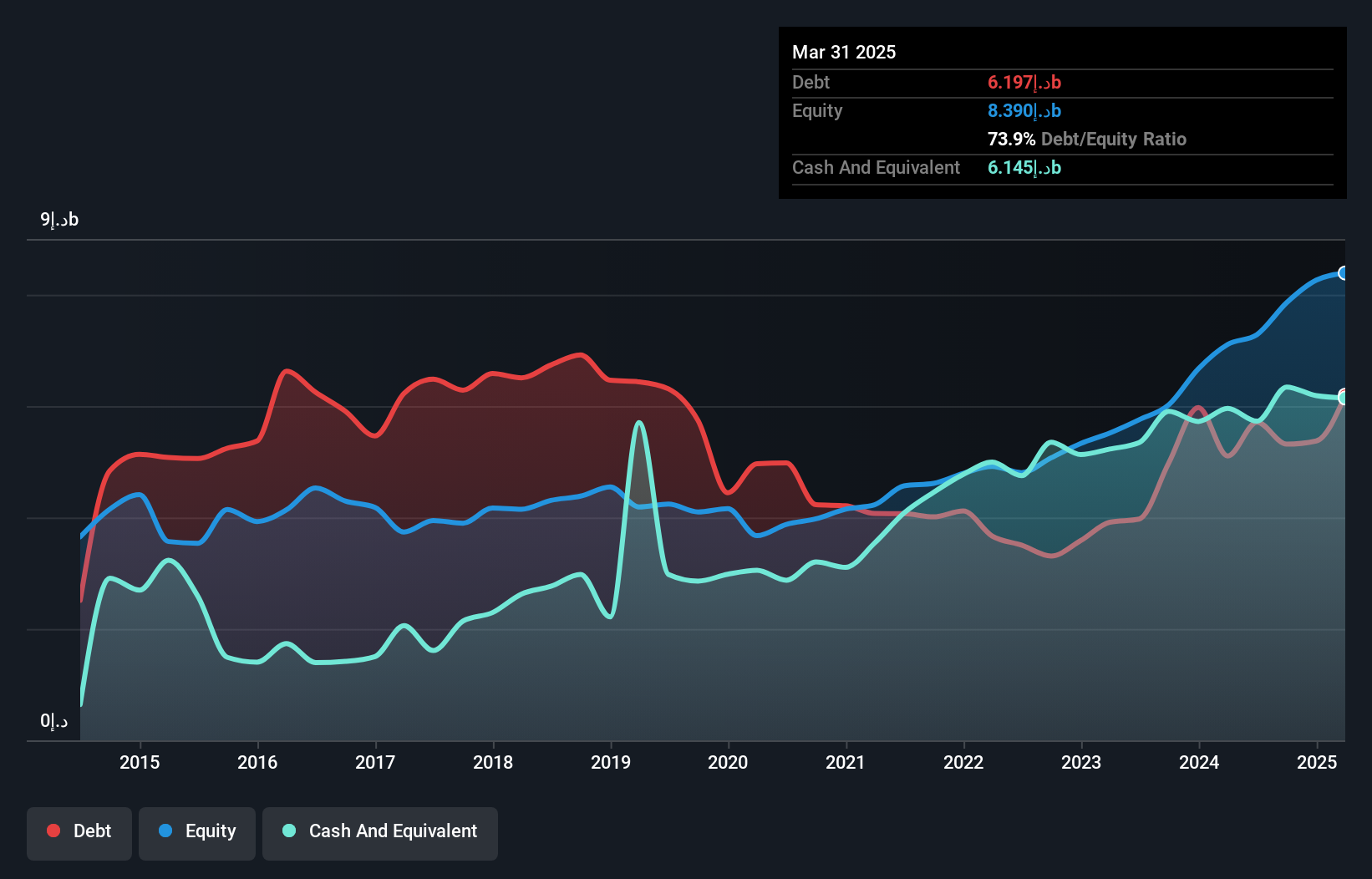

Al Waha Capital PJSC, with a market cap of AED3.25 billion, has shown stable weekly volatility and no significant shareholder dilution over the past year. Its debt to equity ratio has improved significantly from 140% to 67.7% in five years, and the company holds more cash than total debt. Despite negative operating cash flow affecting debt coverage, short-term assets comfortably exceed both short and long-term liabilities. Recent earnings growth of 31.6%, although below its five-year average of 46.1%, outpaced the industry rate of 26%. However, its dividend is not well covered by free cash flows.

- Navigate through the intricacies of Al Waha Capital PJSC with our comprehensive balance sheet health report here.

- Examine Al Waha Capital PJSC's past performance report to understand how it has performed in prior years.

Axelum Resources (PSE:AXLM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Axelum Resources Corp. manufactures and distributes coconut products in the Philippines, the United States, and Australia, with a market cap of ₱9.84 billion.

Operations: The company's revenue primarily comes from the sale of coconut-based products, amounting to ₱6.52 billion.

Market Cap: ₱9.84B

Axelum Resources Corp., with a market cap of ₱9.84 billion, has demonstrated significant revenue growth, reporting sales of ₱1.90 billion in Q3 2024, up from ₱1.46 billion the previous year, and achieving net income of ₱130.39 million compared to a net loss previously. Despite being unprofitable over the past five years with increasing losses at 33.4% per year, recent earnings indicate improvement. The company benefits from a seasoned management team and board, while its financial stability is supported by more cash than debt and short-term assets exceeding liabilities significantly. However, share price volatility remains high compared to peers.

- Click to explore a detailed breakdown of our findings in Axelum Resources' financial health report.

- Gain insights into Axelum Resources' historical outcomes by reviewing our past performance report.

Zhejiang Renzhi (SZSE:002629)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhejiang Renzhi Co., Ltd. offers professional services in the oil and gas drilling and engineering sectors mainly in China, with a market cap of CN¥1.80 billion.

Operations: The company's revenue primarily comes from its operations in China, amounting to CN¥184.82 million.

Market Cap: CN¥1.8B

Zhejiang Renzhi Co., Ltd., with a market cap of CN¥1.80 billion, operates in the oil and gas sector in China. Despite being unprofitable, it has reduced its losses by 48.4% annually over the past five years and reported sales of CN¥131.68 million for the first nine months of 2024, down from CN¥155.1 million a year earlier. The company has more cash than debt and covers both short-term and long-term liabilities with its assets, though it faces less than a year of cash runway if current free cash flow trends persist. Shareholders experienced dilution last year amidst high share price volatility.

- Dive into the specifics of Zhejiang Renzhi here with our thorough balance sheet health report.

- Evaluate Zhejiang Renzhi's historical performance by accessing our past performance report.

Make It Happen

- Investigate our full lineup of 5,815 Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:AXLM

Axelum Resources

Engages in the manufacture and distribution of coconut products in the Philippines, the United States, and Australia.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives