- Philippines

- /

- Metals and Mining

- /

- PSE:APX

Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer confidence and mixed economic indicators, small-cap stocks have shown resilience amid these uncertainties. With the S&P 600 for small-cap companies reflecting moderate gains, investors are increasingly on the lookout for lesser-known opportunities that could offer substantial growth potential. In this context, identifying stocks with strong fundamentals and unique market positions becomes crucial in uncovering hidden gems within the current economic climate.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Hong Ho Precision TextileLtd | 7.48% | 36.01% | 84.13% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Posco Dx (KOSE:A022100)

Simply Wall St Value Rating: ★★★★★★

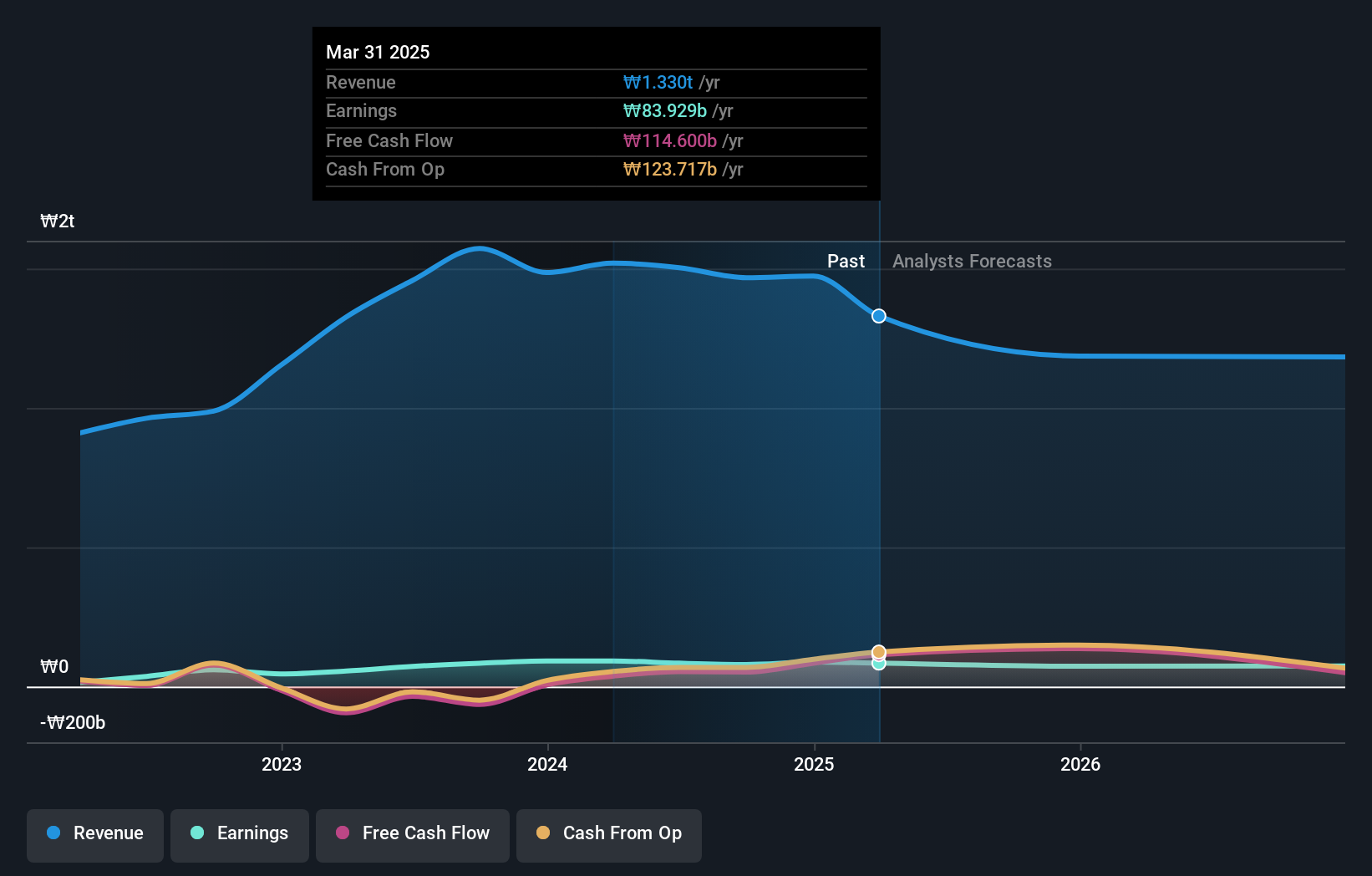

Overview: Posco Dx Company Ltd. offers ICT solutions to the construction and materials industry both in South Korea and internationally, with a market capitalization of ₩2.93 trillion.

Operations: Posco Dx generates revenue primarily from its EIC Business Office and IT Business Office, contributing ₩805.71 billion and ₩572.51 billion, respectively. The Logistics Automation Division also adds to the revenue with ₩56.75 billion.

Posco Dx, a promising player in the IT sector, has faced challenges with a recent earnings dip of 5.2%, yet this is still better than the industry average of 8.5%. The company boasts high-quality past earnings and maintains positive free cash flow, indicating robust financial health. Over five years, its debt-to-equity ratio improved significantly from 0.5 to just 0.02, showing effective debt management. Although future earnings are expected to decrease by an average of 1.2% annually over the next three years, Posco Dx's ability to cover interest payments comfortably suggests resilience amidst industry headwinds.

- Navigate through the intricacies of Posco Dx with our comprehensive health report here.

Examine Posco Dx's past performance report to understand how it has performed in the past.

Apex Mining (PSE:APX)

Simply Wall St Value Rating: ★★★★★☆

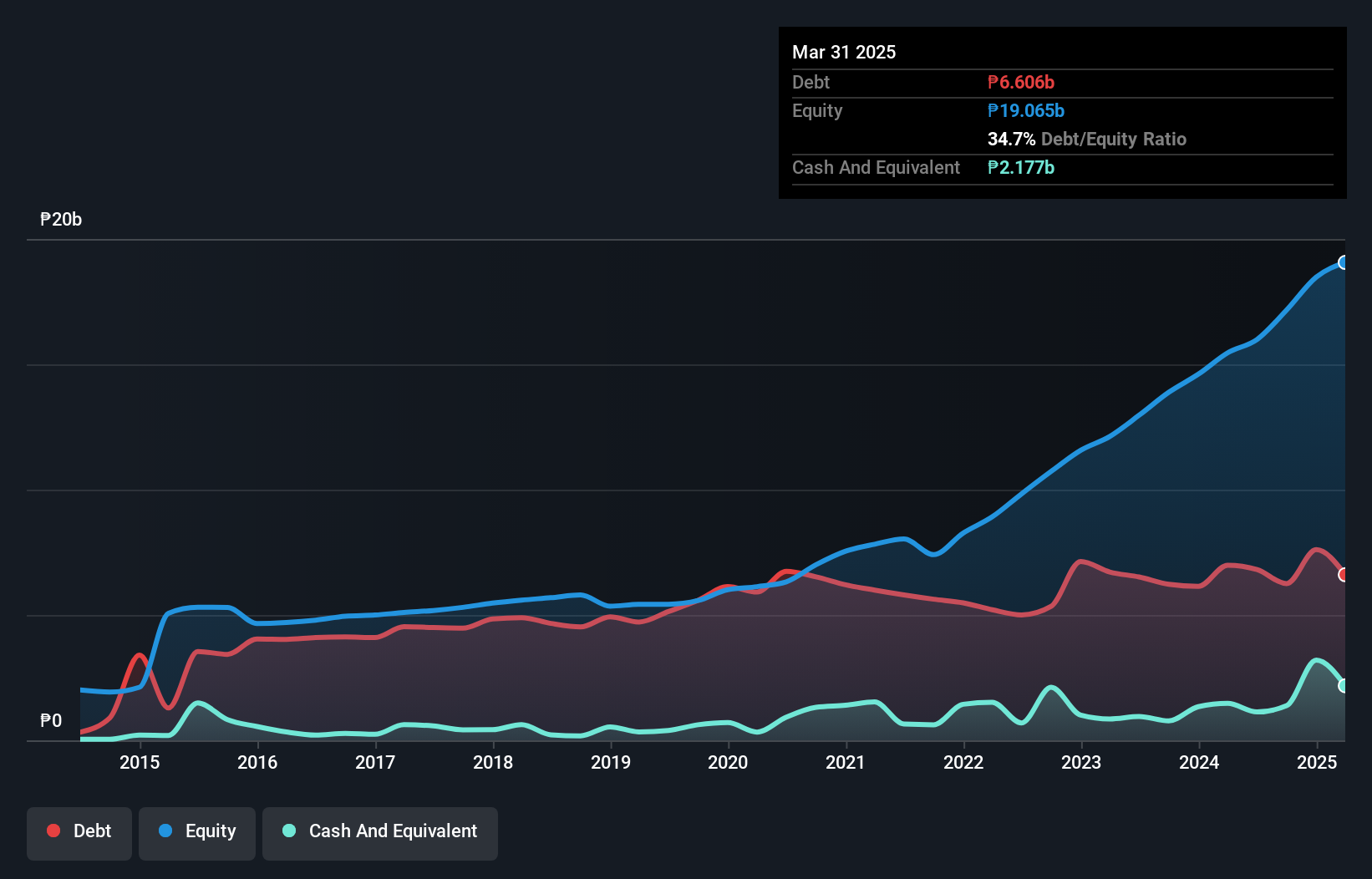

Overview: Apex Mining Co., Inc. operates in the Philippines, focusing on mining and processing gold deposits, with a market capitalization of approximately ₱19.91 billion.

Operations: Apex Mining generates revenue primarily through the mining and processing of gold deposits. The company's financial performance is influenced by its ability to efficiently manage production costs and optimize its operations for profitability.

Apex Mining, a compact player in the metals and mining sector, has shown impressive financial health. Over the past five years, its debt to equity ratio shrank from 100.1% to 36.4%, highlighting strategic debt management. The company reported a net income of PHP 1,309 million for Q3 2024 compared to PHP 1,028 million the previous year, with earnings per share rising from PHP 0.181 to PHP 0.231. Apex's earnings growth of 30.9% last year outpaced the industry average significantly and is trading at nearly half its estimated fair value, suggesting potential undervaluation in market perception.

- Delve into the full analysis health report here for a deeper understanding of Apex Mining.

Assess Apex Mining's past performance with our detailed historical performance reports.

Sichuan Gold (SZSE:001337)

Simply Wall St Value Rating: ★★★★★★

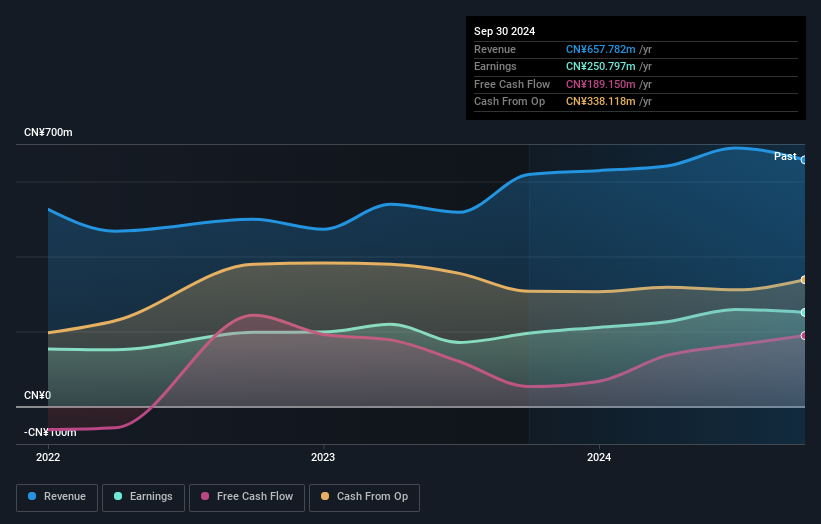

Overview: Sichuan Gold Co., Ltd. is involved in the gold mining industry and has a market capitalization of CN¥8.86 billion.

Operations: The company generates revenue primarily from the production and sale of gold concentrate and alloy gold, amounting to CN¥657.78 million.

Sichuan Gold has been making waves with its notable earnings growth of 28.4% over the past year, surpassing the broader Metals and Mining industry, which faced a 2.3% dip. The company is debt-free, eliminating concerns about interest payments and showcasing high-quality earnings. For the nine months ending September 2024, it reported CNY 527.68 million in revenue up from CNY 498.89 million last year, while net income rose to CNY 197.01 million compared to CNY 157.13 million previously. Basic EPS increased to CNY 0.4691 from CNY 0.3864 a year ago, reflecting strong operational performance amidst industry challenges.

- Click here to discover the nuances of Sichuan Gold with our detailed analytical health report.

Evaluate Sichuan Gold's historical performance by accessing our past performance report.

Seize The Opportunity

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4641 more companies for you to explore.Click here to unveil our expertly curated list of 4644 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:APX

Apex Mining

Engages in exploration and production of metals and minerals in the Philippines.

Undervalued with solid track record.

Market Insights

Community Narratives