Ourpalm Co., Ltd.'s (SZSE:300315) recent earnings report didn't offer any surprises, with the shares unchanged over the last week. Our analysis suggests that shareholders might be missing some positive underlying factors in the earnings report.

See our latest analysis for Ourpalm

How Do Unusual Items Influence Profit?

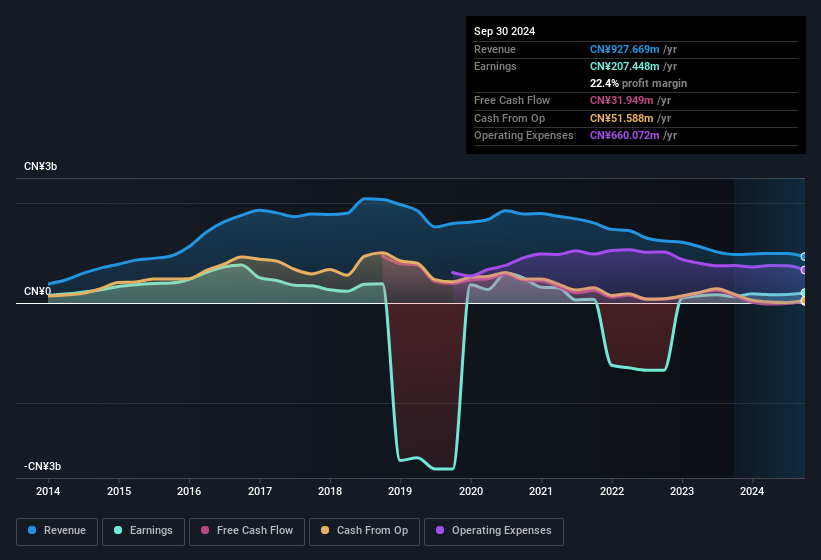

For anyone who wants to understand Ourpalm's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by CN¥38m due to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. In the twelve months to September 2024, Ourpalm had a big unusual items expense. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Ourpalm's Profit Performance

As we mentioned previously, the Ourpalm's profit was hampered by unusual items in the last year. Based on this observation, we consider it possible that Ourpalm's statutory profit actually understates its earnings potential! And on top of that, its earnings per share increased by 54% in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Obviously, we love to consider the historical data to inform our opinion of a company. But it can be really valuable to consider what other analysts are forecasting. Luckily, you can check out what analysts are forecasting by clicking here.

Today we've zoomed in on a single data point to better understand the nature of Ourpalm's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

If you're looking to trade Ourpalm, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300315

Ourpalm

Focuses on the development, distribution, and operation of online games in China and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives