- China

- /

- Entertainment

- /

- SZSE:300315

Exploring January 2025's Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a turbulent start to 2025, marked by inflation concerns and political uncertainties, small-cap stocks have notably underperformed their larger counterparts, with the Russell 2000 Index slipping into correction territory. In this climate of volatility and cautious optimism, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking opportunities amidst broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Saudi Azm for Communication and Information Technology | 12.21% | 17.40% | 21.14% | ★★★★★☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Ourpalm (SZSE:300315)

Simply Wall St Value Rating: ★★★★★★

Overview: Ourpalm Co., Ltd. is engaged in the development, distribution, and operation of online games both within China and internationally, with a market cap of approximately CN¥13.90 billion.

Operations: Ourpalm generates revenue primarily from the Information Service Industry, amounting to CN¥927.67 million.

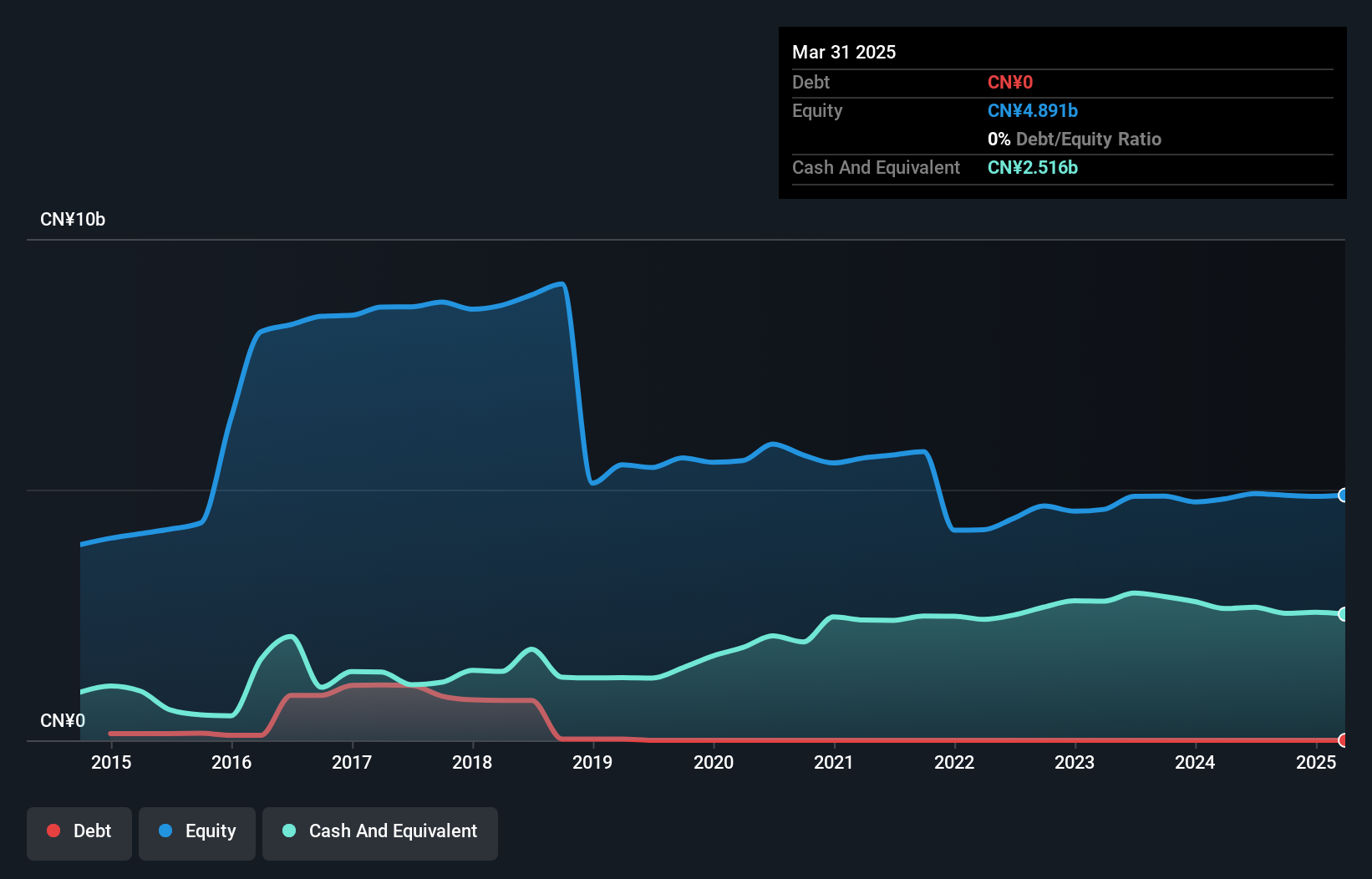

Ourpalm, a smaller player in the entertainment sector, showcases impressive financial resilience. The company reported net income of CNY 195.96 million for the first nine months of 2024, up from CNY 175.44 million the previous year, indicating solid profitability despite a dip in sales to CNY 650.61 million from CNY 704.71 million. With no debt on its books and positive free cash flow, Ourpalm's financial health appears robust. Earnings grew by an impressive 65% over the past year, outpacing industry averages significantly and suggesting potential for continued growth as earnings are forecasted to rise by over 34% annually.

Jiangxi Tianli Technology (SZSE:300399)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Tianli Technology, INC. offers mobile information services in China and has a market cap of CN¥4.28 billion.

Operations: The company generates revenue primarily from its mobile information services in China. It has a market capitalization of CN¥4.28 billion.

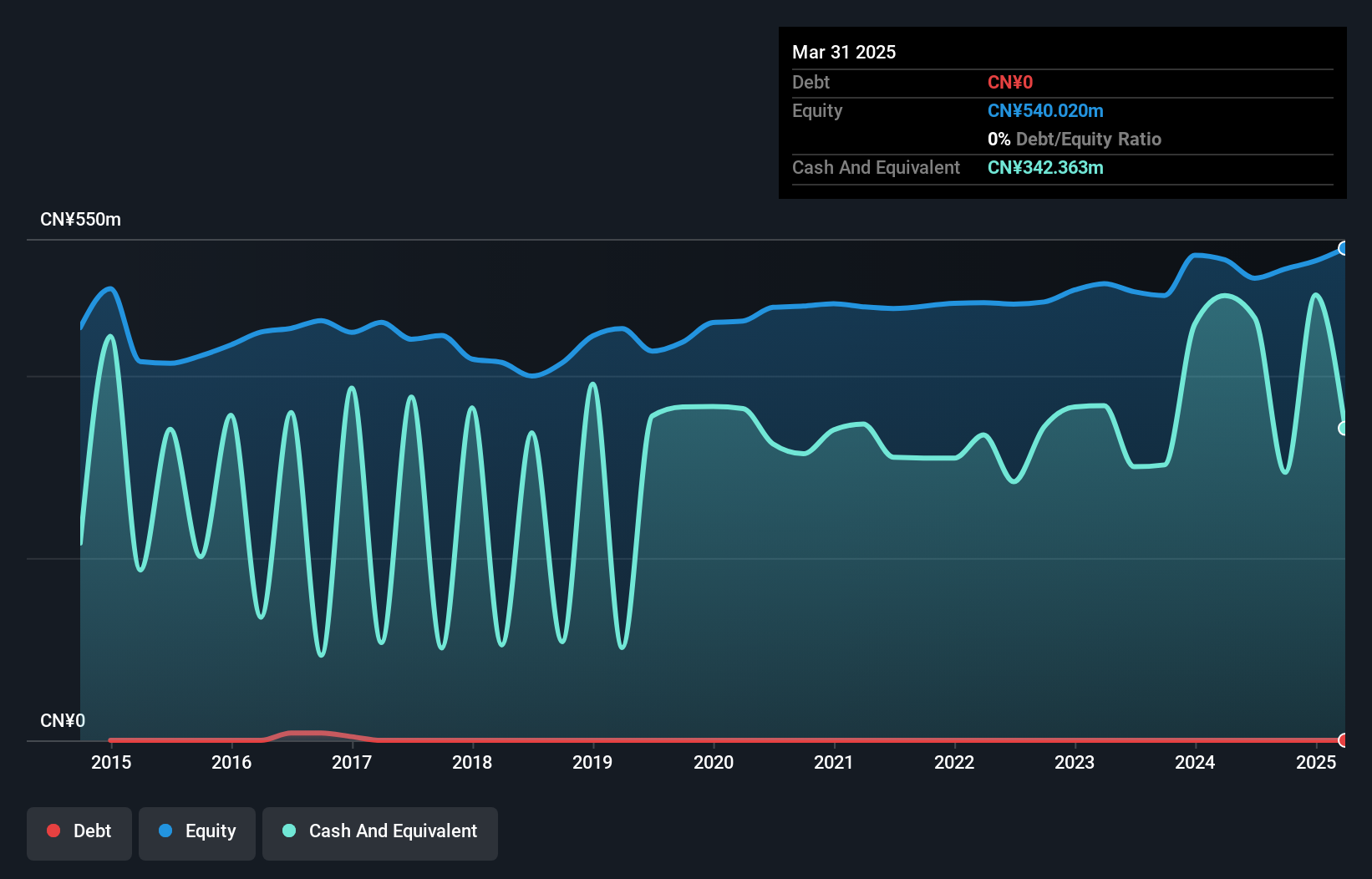

Jiangxi Tianli Technology, a smaller player in the tech space, showcases intriguing dynamics. The company's earnings surged by 389% over the past year, significantly outpacing the software industry's -10% performance. Despite this impressive growth, it reported a net loss of CN¥7.84 million for the nine months ending September 2024, compared to CN¥5.94 million in the previous year. A notable one-off gain of CN¥16 million influenced recent results, highlighting potential volatility in earnings quality. With no debt on its books and positive free cash flow recorded at various intervals within recent years, there's a solid foundation for future stability amidst market fluctuations.

Aerospace Intelligent Manufacturing Technology (SZSE:300446)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aerospace Intelligent Manufacturing Technology Co., Ltd. operates in the field of intelligent manufacturing solutions for the aerospace industry, with a market cap of CN¥13.05 billion.

Operations: The company generates revenue primarily through providing intelligent manufacturing solutions tailored for the aerospace sector. It has a market capitalization of CN¥13.05 billion, reflecting its standing in the industry.

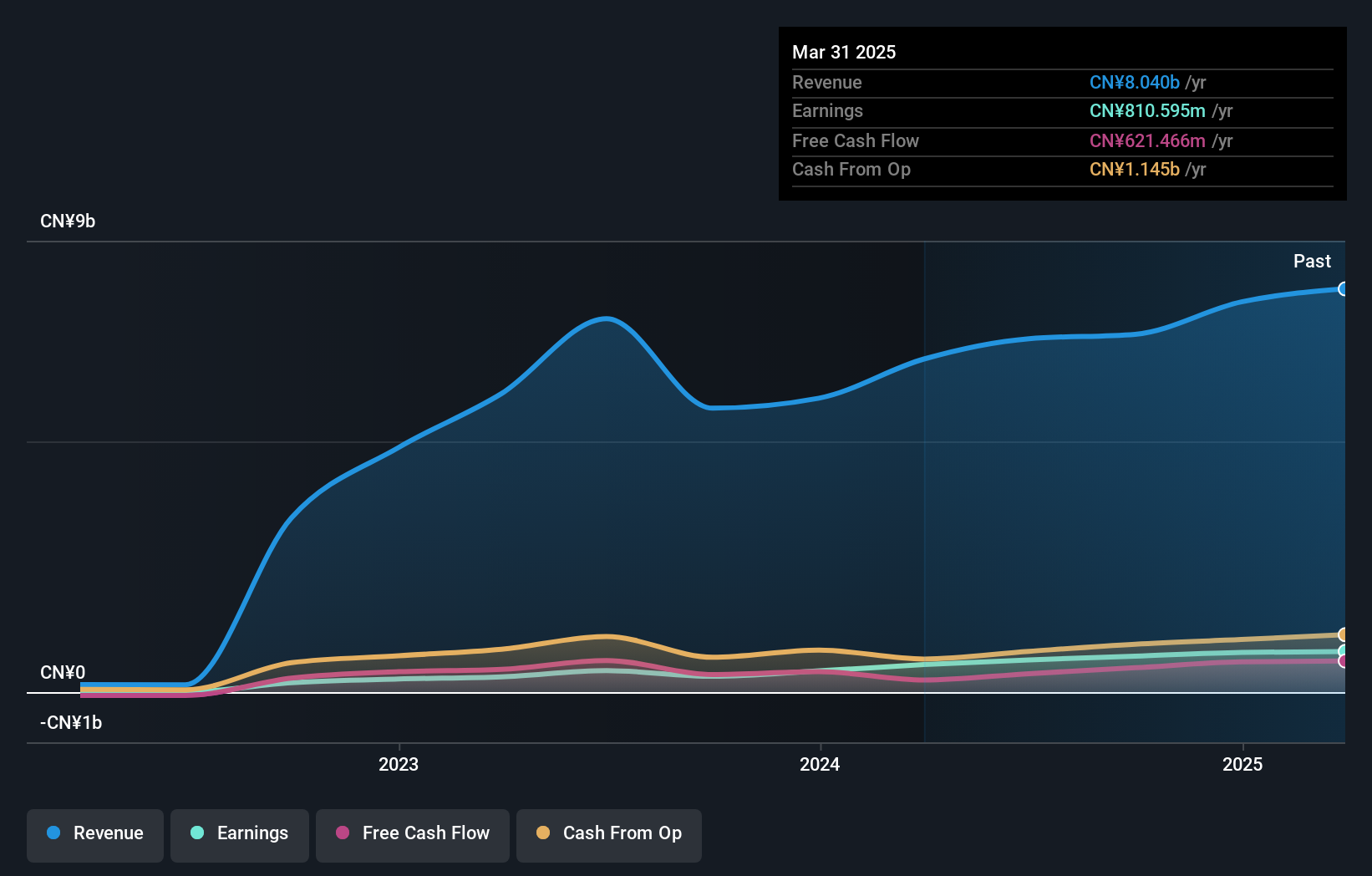

Aerospace Intelligent Manufacturing Technology, a smaller player in its field, has shown impressive performance with earnings growth of 127% over the past year, surpassing the broader Chemicals industry's -3.4%. The company's net income for the first nine months of 2024 reached CNY 535.88 million, up from CNY 242.73 million in the previous year, reflecting strong operational efficiency. With a price-to-earnings ratio of 19.4x below the CN market average of 31.8x and high-quality past earnings backed by well-covered interest payments (117.2x EBIT coverage), it seems positioned for robust financial health amidst industry challenges.

Summing It All Up

- Discover the full array of 4518 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300315

Ourpalm

Focuses on the development, distribution, and operation of online games in China and internationally.

Flawless balance sheet very low.

Similar Companies

Market Insights

Community Narratives