- China

- /

- Entertainment

- /

- SZSE:300133

Great Microwave Technology And 3 Insider Picks For Growth

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, with U.S. equities facing pressure from inflation concerns and political uncertainties, investors are increasingly looking for resilient opportunities amidst this volatility. In such an environment, growth companies with high insider ownership can present compelling prospects, as they often indicate strong confidence from those closest to the business in its long-term potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.2% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's review some notable picks from our screened stocks.

Great Microwave Technology (SHSE:688270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Great Microwave Technology Co., Ltd. focuses on the research, development, production, and sale of integrated circuit chips and microsystems in China with a market cap of CN¥6.99 billion.

Operations: Great Microwave Technology Co., Ltd. generates its revenue from the research, development, production, and sale of integrated circuit chips and microsystems in China.

Insider Ownership: 21%

Revenue Growth Forecast: 41.6% p.a.

Great Microwave Technology shows potential as a growth company with high insider ownership, despite recent challenges. Earnings and revenue are forecast to grow significantly faster than the market, at 67.24% and 41.6% annually, respectively. However, profit margins have decreased from last year’s levels, and the share price has been highly volatile recently. The company announced a CNY 40 million share buyback program to convert corporate bonds into shares but has not yet repurchased any shares under this plan.

- Dive into the specifics of Great Microwave Technology here with our thorough growth forecast report.

- According our valuation report, there's an indication that Great Microwave Technology's share price might be on the expensive side.

Guangdong Create Century Intelligent Equipment Group (SZSE:300083)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Create Century Intelligent Equipment Group Corporation Limited, with a market cap of CN¥9.92 billion, is involved in the research, development, production, and sale of high-end intelligent equipment in China.

Operations: Revenue Segments (in millions of CN¥): null

Insider Ownership: 17.9%

Revenue Growth Forecast: 22% p.a.

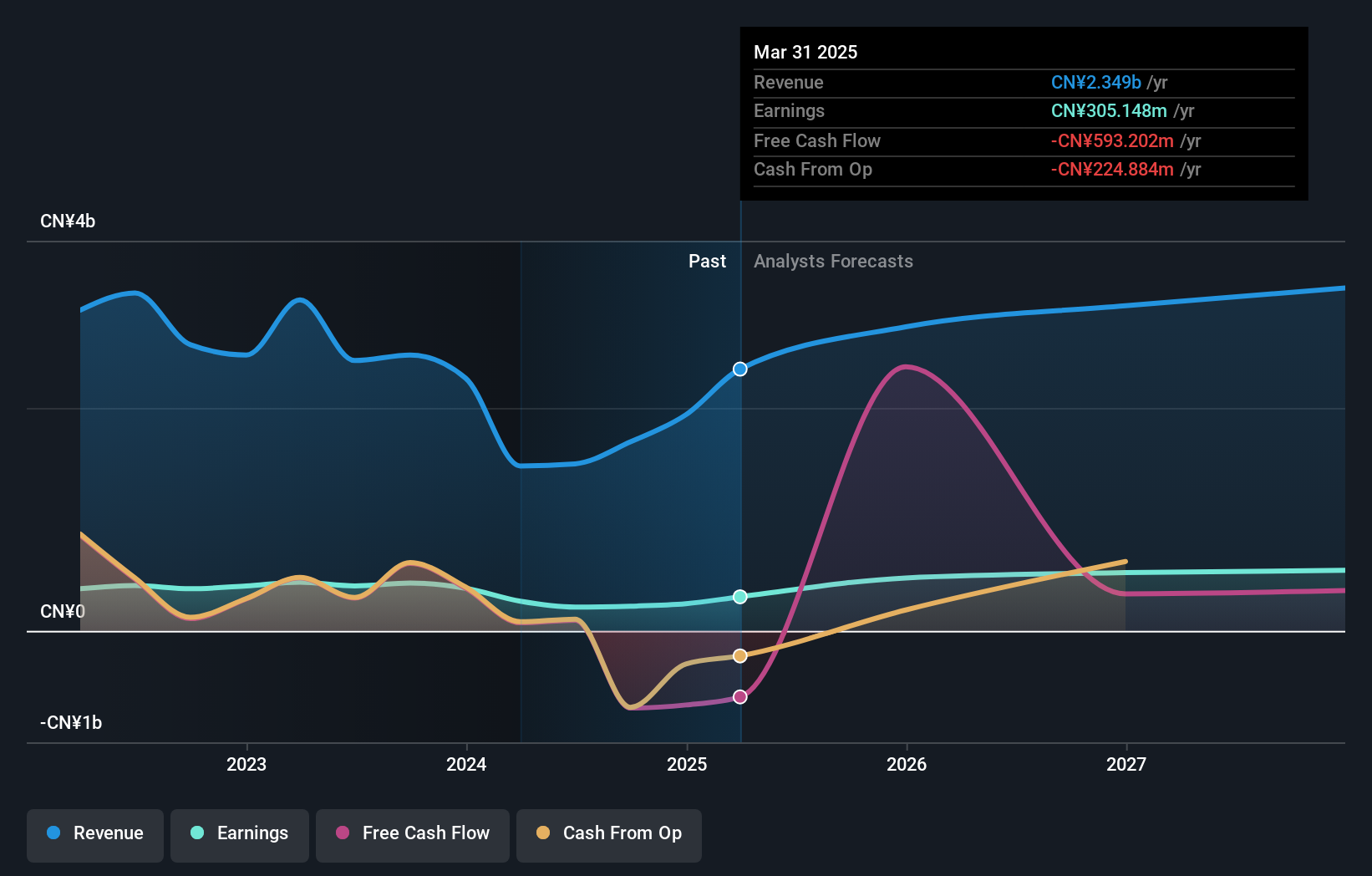

Guangdong Create Century Intelligent Equipment Group demonstrates strong growth potential with earnings projected to rise 37% annually, outpacing the market. Revenue is also set to grow at 22% per year, surpassing the broader CN market. Despite low forecasted return on equity and large one-off items affecting results, recent earnings showed significant improvement. The company completed a share buyback worth CNY 100.04 million and held a special meeting to discuss financial strategies for 2025.

- Get an in-depth perspective on Guangdong Create Century Intelligent Equipment Group's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Guangdong Create Century Intelligent Equipment Group is priced higher than what may be justified by its financials.

Zhejiang Huace Film & TV (SZSE:300133)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Huace Film & TV Co., Ltd. is involved in the production, distribution, and derivative of film and television dramas both in China and internationally, with a market cap of CN¥12.04 billion.

Operations: The company's revenue is primarily derived from its activities in producing, distributing, and creating derivatives of film and television dramas both domestically and abroad.

Insider Ownership: 22.5%

Revenue Growth Forecast: 22% p.a.

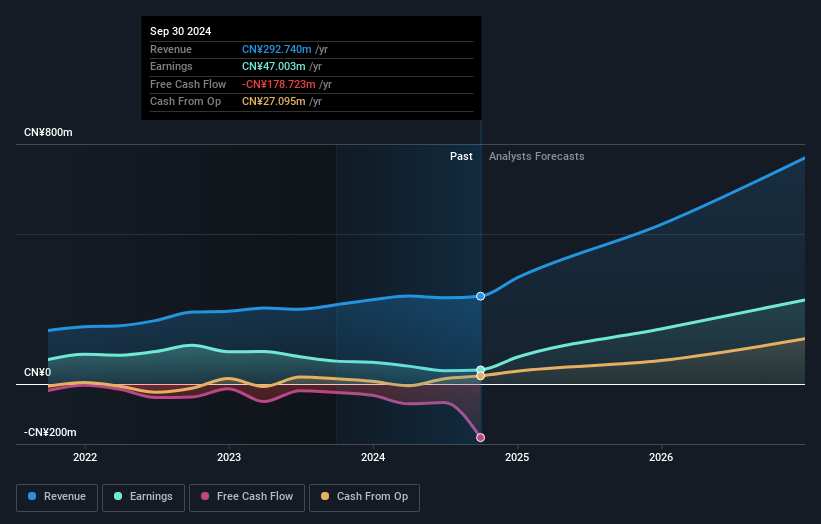

Zhejiang Huace Film & TV shows promising growth prospects, with earnings expected to increase by 33.67% annually, exceeding the Chinese market average. Revenue is forecasted to grow at 22% per year, also surpassing market expectations. Despite a recent decline in sales and net income for the nine months ending September 2024, no substantial insider trading activity was reported over the past three months. However, its return on equity is projected to remain low at 6.7%.

- Click to explore a detailed breakdown of our findings in Zhejiang Huace Film & TV's earnings growth report.

- In light of our recent valuation report, it seems possible that Zhejiang Huace Film & TV is trading beyond its estimated value.

Seize The Opportunity

- Embark on your investment journey to our 1442 Fast Growing Companies With High Insider Ownership selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Zhejiang Huace Film & TV, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Huace Film & TV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300133

Zhejiang Huace Film & TV

Engages in the production, distribution, and derivative of film and television dramas in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives