- China

- /

- Paper and Forestry Products

- /

- SZSE:300703

3 Promising Growth Companies With Insider Ownership Up To 15%

Reviewed by Simply Wall St

As global markets continue to react positively to recent political developments, with U.S. stocks reaching record highs amid optimism surrounding trade policies and AI investments, growth stocks have notably outperformed their value counterparts. In this buoyant market environment, companies with high insider ownership can be particularly attractive as they often signal confidence in the business's future prospects by those who know it best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Underneath we present a selection of stocks filtered out by our screen.

Nordic Semiconductor (OB:NOD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordic Semiconductor ASA is a fabless semiconductor company that designs, sells, and delivers integrated circuits (ICs) for short- and long-range wireless applications across Europe, the Americas, and the Asia Pacific, with a market cap of NOK22.65 billion.

Operations: The company's revenue is primarily derived from the design and sale of integrated circuits and related solutions, amounting to $469.41 million.

Insider Ownership: 10.7%

Nordic Semiconductor's insiders have significantly increased their holdings over the past three months, indicating confidence in its growth trajectory. The company is expected to achieve profitability within three years, with earnings forecasted to grow at 57.02% annually. While revenue growth of 15.2% per year surpasses the Norwegian market average, it remains below 20%. Despite a low projected return on equity of 16.7%, insider activity suggests strong internal belief in future performance.

- Delve into the full analysis future growth report here for a deeper understanding of Nordic Semiconductor.

- Our valuation report here indicates Nordic Semiconductor may be overvalued.

NSFOCUS Technologies Group (SZSE:300369)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NSFOCUS Technologies Group Co., Ltd. offers Internet and application security services globally, with a market cap of CN¥5.74 billion.

Operations: The company generates revenue primarily from the Information Security Industry, amounting to CN¥1.75 billion.

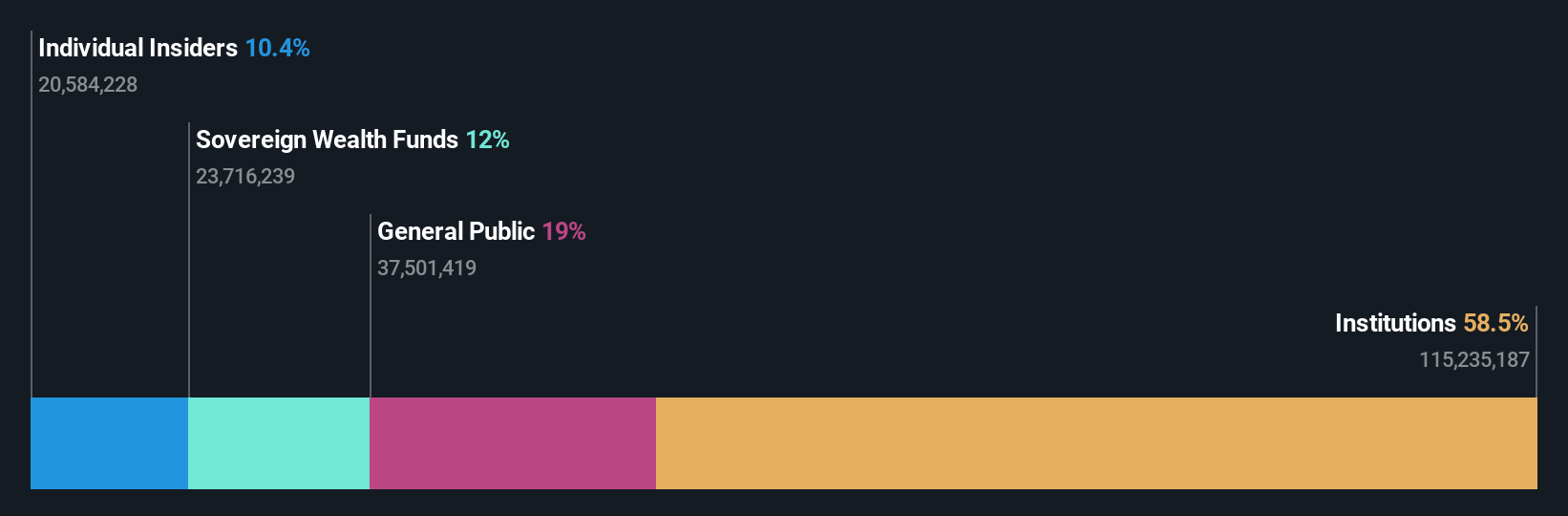

Insider Ownership: 10.2%

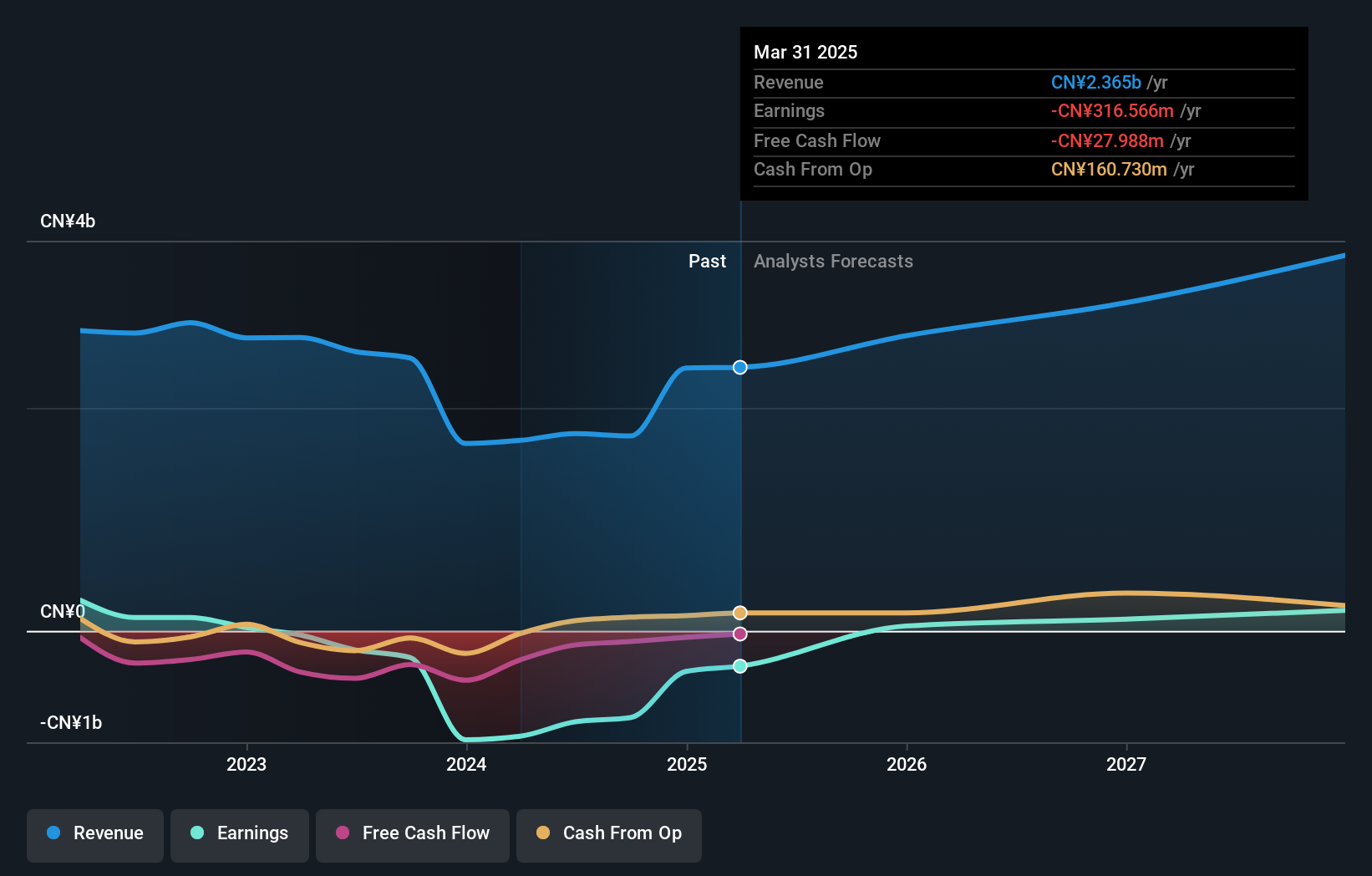

NSFOCUS Technologies Group is forecasted to achieve profitability within three years, with impressive earnings growth of 127.33% annually. Although its revenue growth rate of 18.1% per year is slower than the ideal benchmark, it surpasses the Chinese market average. Recent earnings results show a reduction in net loss to CNY 326.02 million from CNY 524.28 million a year ago, reflecting positive momentum despite low projected return on equity at 4%.

- Unlock comprehensive insights into our analysis of NSFOCUS Technologies Group stock in this growth report.

- Our comprehensive valuation report raises the possibility that NSFOCUS Technologies Group is priced lower than what may be justified by its financials.

Cre8 Direct (NingBo) (SZSE:300703)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cre8 Direct (NingBo) Co., Ltd. designs, develops, produces, and sells paper-based products with a market cap of CN¥2.88 billion.

Operations: The company's revenue primarily comes from its paper and paper products segment, totaling CN¥1.74 billion.

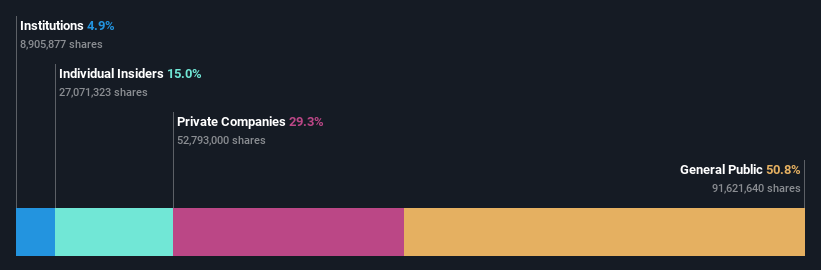

Insider Ownership: 15%

Cre8 Direct (NingBo) is expected to experience robust revenue growth at 27% annually, outpacing the Chinese market average. Earnings are projected to rise significantly by 39.34% per year, indicating strong growth potential despite a volatile share price recently. However, the forecasted return on equity of 18.8% in three years suggests room for improvement. The current dividend yield of 0.94% is not well supported by free cash flow, highlighting potential concerns for dividend sustainability.

- Click here and access our complete growth analysis report to understand the dynamics of Cre8 Direct (NingBo).

- The analysis detailed in our Cre8 Direct (NingBo) valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Reveal the 1465 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300703

Cre8 Direct (NingBo)

Designs, develops, produces, and sells paper based products.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives