As global markets navigate economic uncertainties, the Asian market remains a focal point for investors seeking growth opportunities amid fluctuating indices and evolving economic landscapes. In this environment, companies with substantial insider ownership often attract attention as potential indicators of confidence in their long-term prospects.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 113.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 84.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 27.6% |

| Seers Technology (KOSDAQ:A458870) | 34.1% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.9% | 91.9% |

| AprilBioLtd (KOSDAQ:A397030) | 31% | 87.1% |

Underneath we present a selection of stocks filtered out by our screen.

Ocumension Therapeutics (SEHK:1477)

Simply Wall St Growth Rating: ★★★★★☆

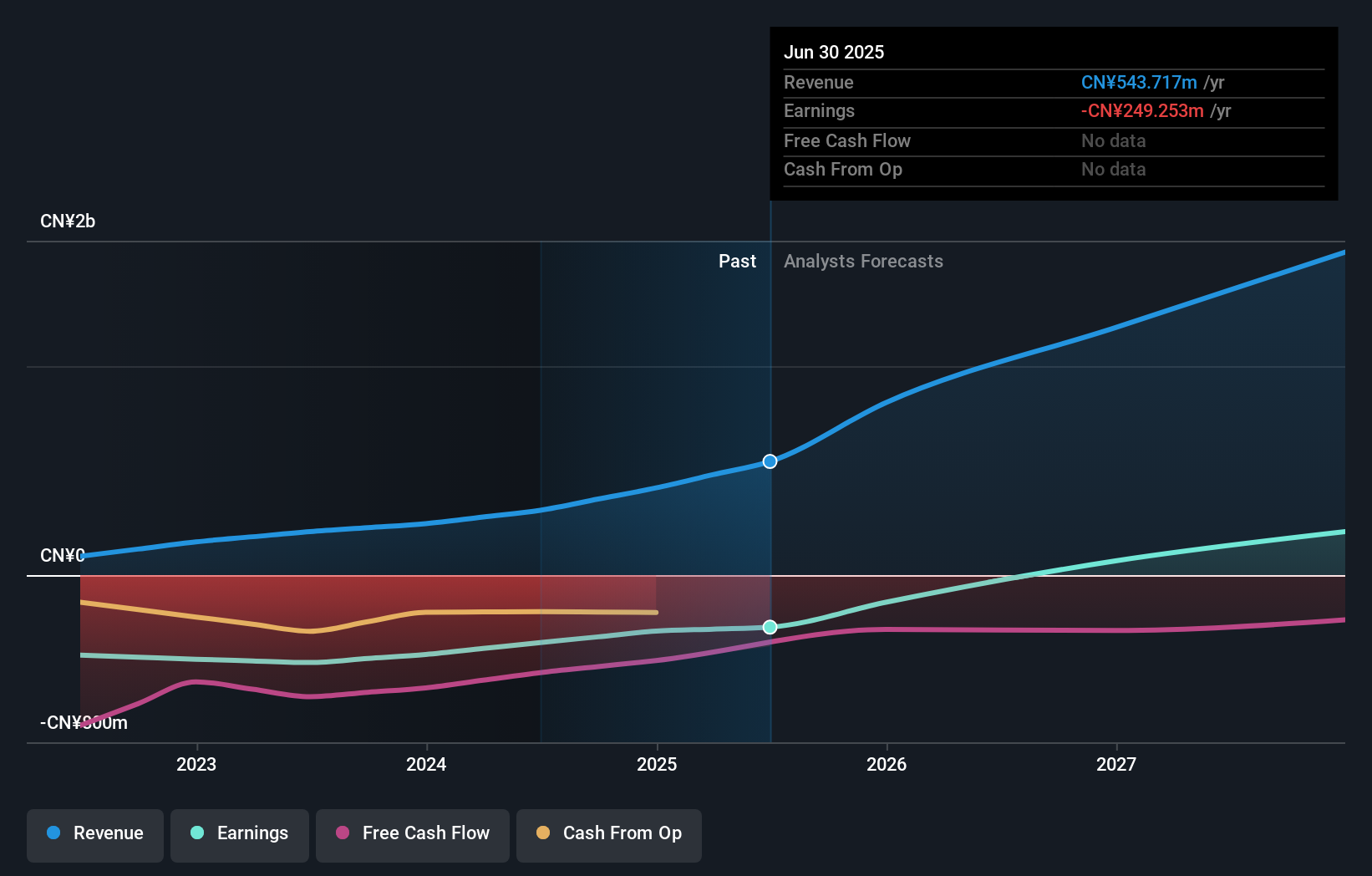

Overview: Ocumension Therapeutics operates as an ophthalmic pharmaceutical platform company in the People's Republic of China, with a market cap of HK$8.56 billion.

Operations: The company's revenue primarily comes from its efforts in discovering, developing, and commercializing ophthalmic therapies, generating CN¥543.72 million.

Insider Ownership: 16.3%

Earnings Growth Forecast: 114.5% p.a.

Ocumension Therapeutics is experiencing robust revenue growth, forecasted at 31.2% annually, outpacing the Hong Kong market. Recent achievements include OT-301's successful phase III trial in China, enhancing its drug pipeline credibility. Despite a net loss of CNY 132.32 million for H1 2025, losses have narrowed from the previous year. Insider ownership remains high with significant recent selling but no substantial buying activity noted over the past three months.

- Click here to discover the nuances of Ocumension Therapeutics with our detailed analytical future growth report.

- Our valuation report here indicates Ocumension Therapeutics may be overvalued.

Shenzhen Senior Technology Material (SZSE:300568)

Simply Wall St Growth Rating: ★★★★★☆

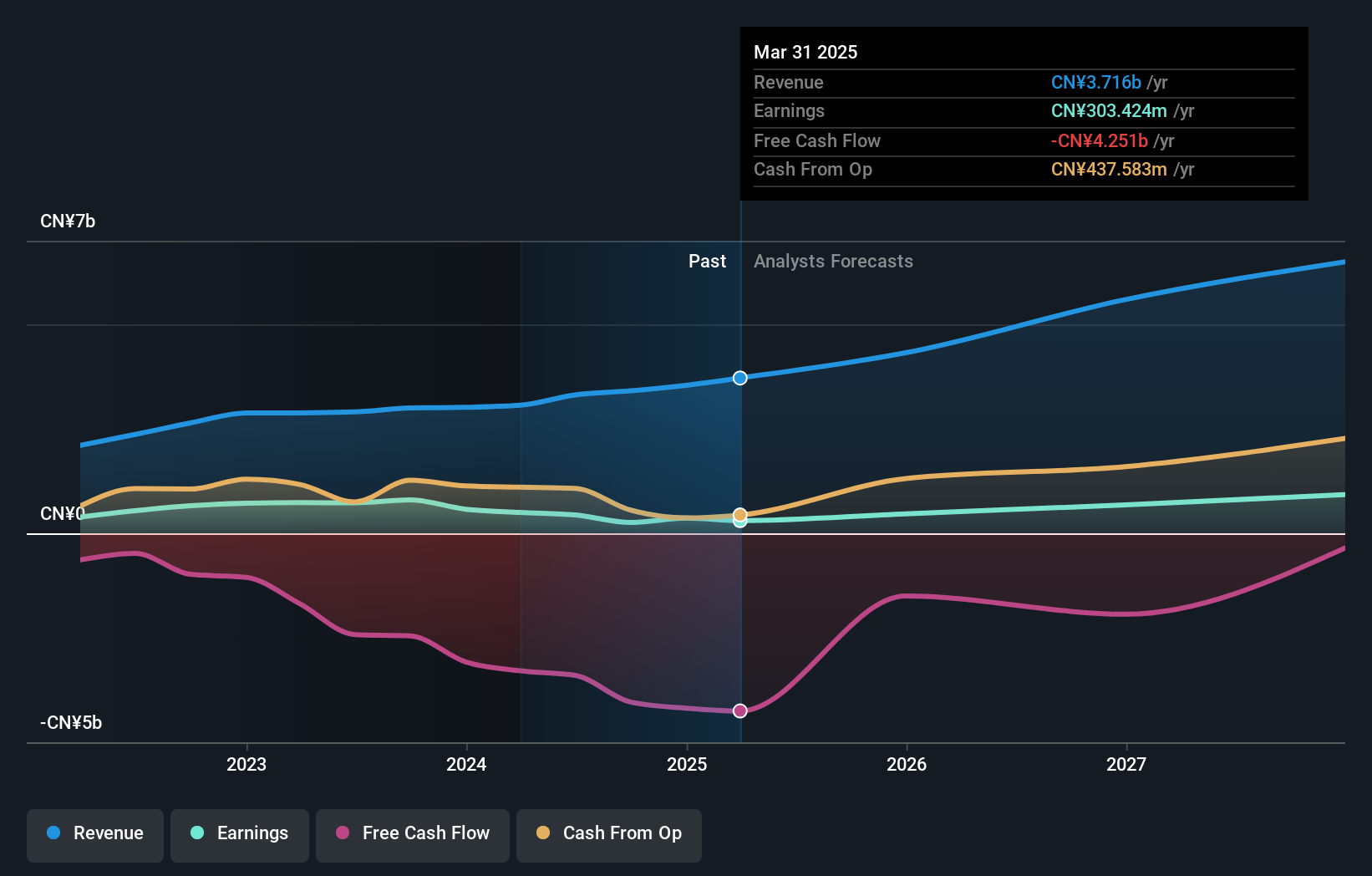

Overview: Shenzhen Senior Technology Material Co., Ltd. (SZSE:300568) operates in the manufacturing sector, focusing on producing materials for lithium-ion batteries, with a market cap of CN¥18.24 billion.

Operations: Shenzhen Senior Technology Material Co., Ltd. generates its revenue primarily from the production of materials used in lithium-ion batteries.

Insider Ownership: 13%

Earnings Growth Forecast: 48.1% p.a.

Shenzhen Senior Technology Material is demonstrating strong revenue growth, projected at 22.8% annually, surpassing the Chinese market average. Despite a decline in profit margins from 13.3% to 5.9%, earnings are expected to grow significantly at 48.1% per year, outpacing the market's growth rate of 26%. The company recently completed a share buyback worth CNY 199.98 million but faces challenges with interest payments not being well covered by earnings and low forecasted return on equity at 6.2%.

- Delve into the full analysis future growth report here for a deeper understanding of Shenzhen Senior Technology Material.

- Our comprehensive valuation report raises the possibility that Shenzhen Senior Technology Material is priced higher than what may be justified by its financials.

PAL GROUP Holdings (TSE:2726)

Simply Wall St Growth Rating: ★★★★☆☆

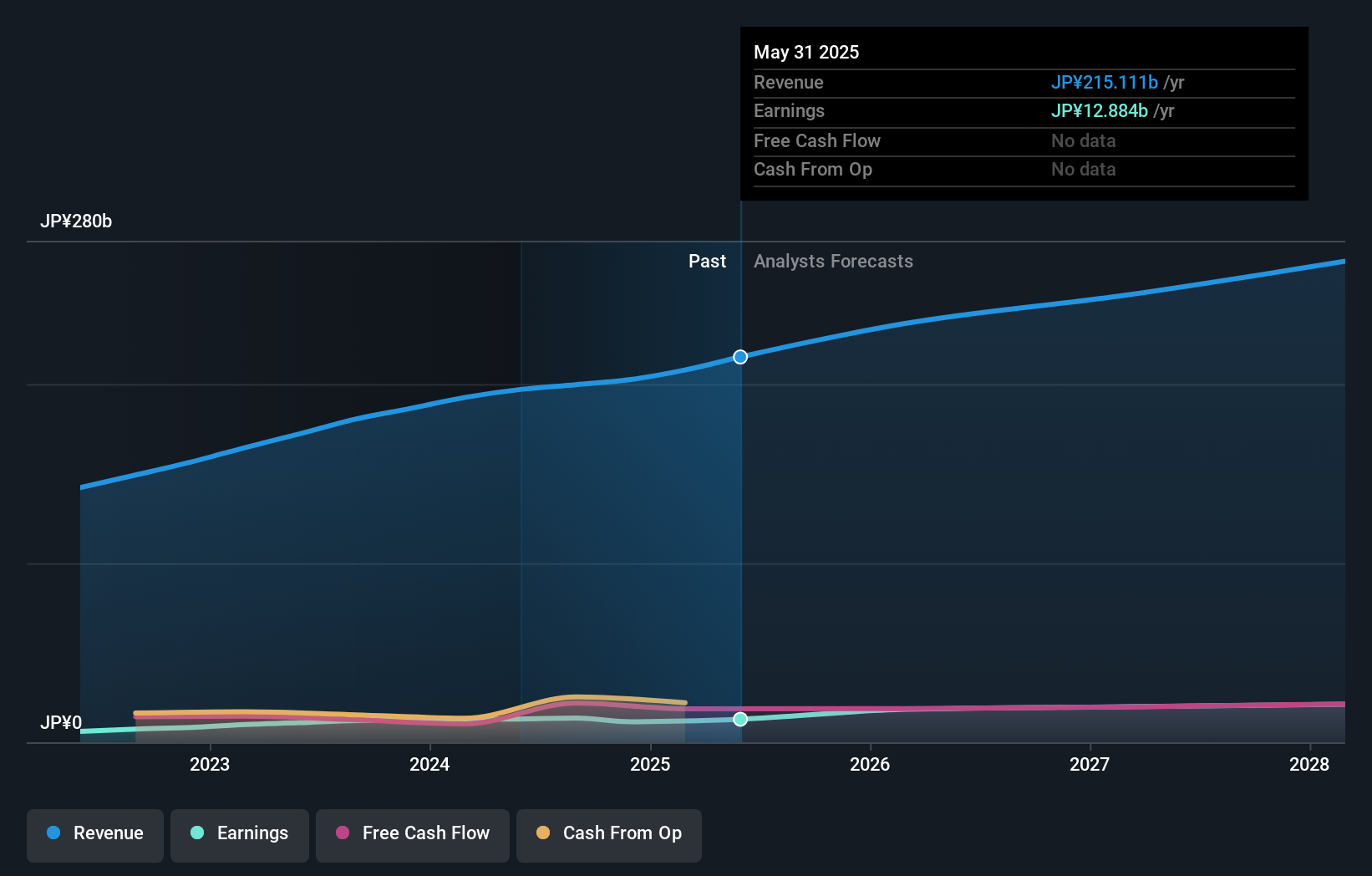

Overview: PAL GROUP Holdings CO., LTD. is involved in the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories in Japan with a market cap of ¥471.45 billion.

Operations: The company's revenue is primarily derived from its clothing business, which generated ¥133.30 billion, and its miscellaneous goods business, contributing ¥81.41 billion.

Insider Ownership: 10.9%

Earnings Growth Forecast: 16% p.a.

PAL GROUP Holdings is experiencing forecasted earnings growth of 16.04% annually, outpacing the Japanese market average. Revenue is also expected to grow faster than the market at 7.9% per year, although not at a high rate of over 20%. The company recently faced delays in its stock split schedule and amended its Articles of Incorporation. Despite high insider ownership, recent months show no significant insider trading activity, and share price volatility has been observed.

- Click here and access our complete growth analysis report to understand the dynamics of PAL GROUP Holdings.

- According our valuation report, there's an indication that PAL GROUP Holdings' share price might be on the expensive side.

Where To Now?

- Embark on your investment journey to our 615 Fast Growing Asian Companies With High Insider Ownership selection here.

- Searching for a Fresh Perspective? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1477

Ocumension Therapeutics

Operates as an ophthalmic pharmaceutical platform company in the People's Republic of China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives