- China

- /

- Food and Staples Retail

- /

- SHSE:600361

Unveiling Opportunities: Innovation New Material Technology And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape marked by interest rate adjustments and shifts in consumer spending, investors are increasingly exploring diverse opportunities across market segments. Penny stocks, though sometimes seen as relics of past trading days, remain relevant for those seeking growth potential in smaller or newer companies. By focusing on firms with strong financial health and promising trajectories, investors can uncover hidden value; this article highlights three such penny stocks that may offer both stability and upside potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.95 | £184.64M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.60 | MYR2.96B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.74 | MYR128.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$488.79M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.28 | CN¥2.07B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.905 | MYR300.41M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.58 | MYR2.59B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$128.44M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.355 | £407.27M | ★★★★☆☆ |

Click here to see the full list of 5,775 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Innovation New Material Technology (SHSE:600361)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Innovation New Material Technology Co., Ltd. operates in the development and production of advanced materials, with a market cap of approximately CN¥17.05 billion.

Operations: The company generates revenue from its Commodity Retail Business, amounting to CN¥76.35 billion.

Market Cap: CN¥17.05B

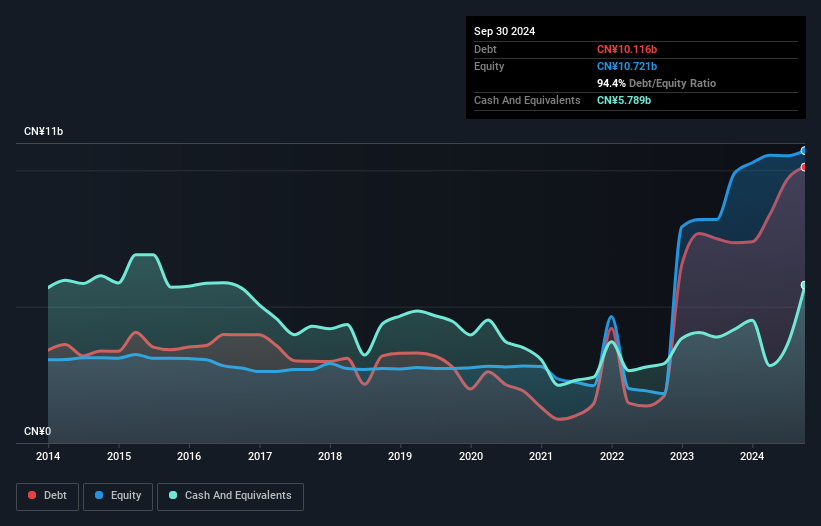

Innovation New Material Technology Co., Ltd. has shown significant revenue growth, reporting CN¥38.73 billion for the first half of 2024, up from CN¥35.23 billion a year earlier. Despite this, its net debt to equity ratio is high at 57.7%, and operating cash flow is negative, indicating potential financial strain in covering debts. The company's earnings have grown substantially over the past five years but have slowed recently with an 11.7% increase last year compared to its historical average of 43.3%. Its Price-To-Earnings ratio suggests it trades at good value relative to peers and the broader market in China.

- Take a closer look at Innovation New Material Technology's potential here in our financial health report.

- Understand Innovation New Material Technology's earnings outlook by examining our growth report.

Tianjin Chase Sun PharmaceuticalLtd (SZSE:300026)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tianjin Chase Sun Pharmaceutical Co., Ltd is involved in the research, development, production, and marketing of pharmaceutical products both in China and internationally, with a market cap of CN¥11.78 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥11.78B

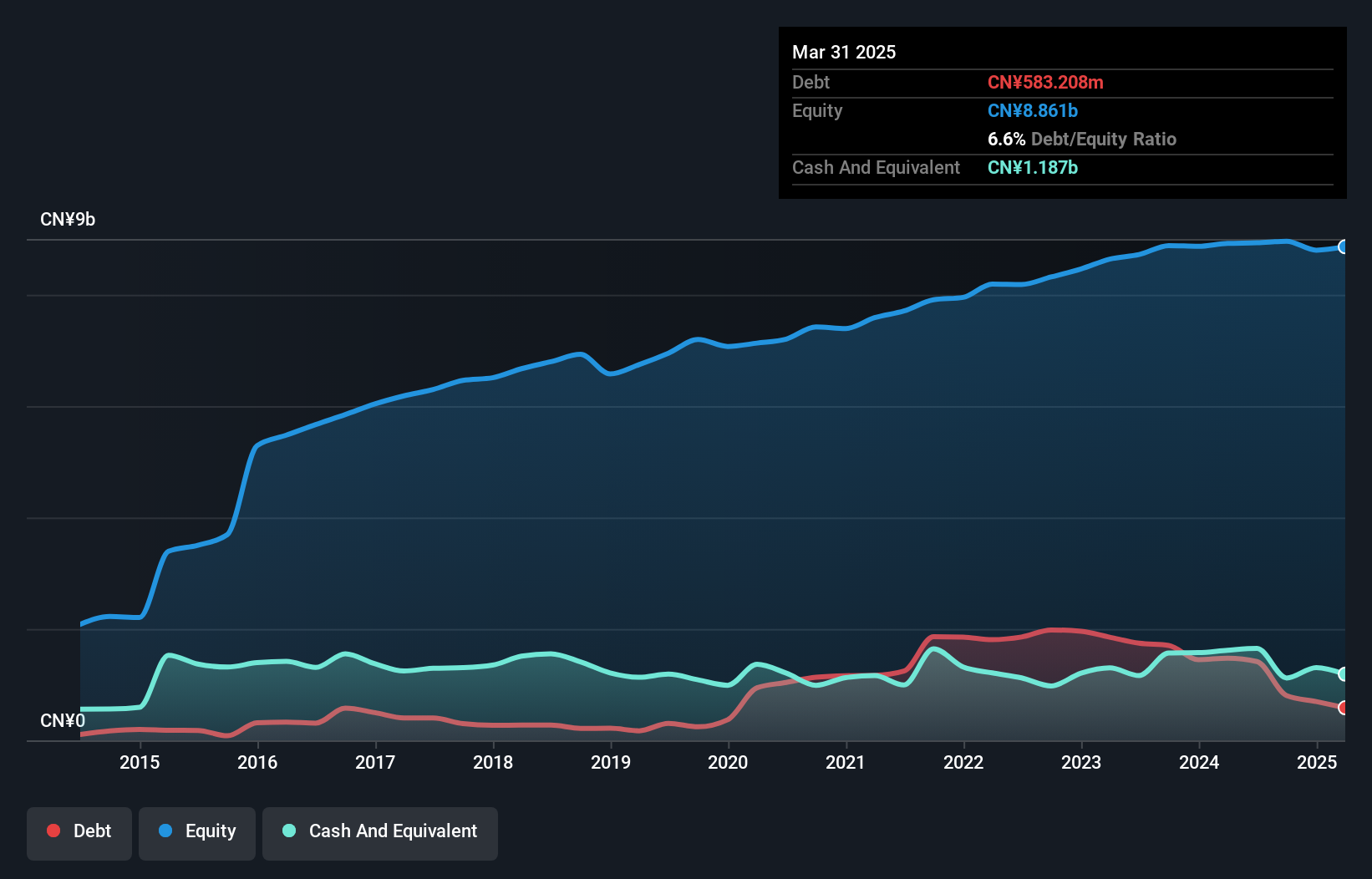

Tianjin Chase Sun Pharmaceutical Co., Ltd. presents a mixed investment case within the penny stock realm. The company's earnings for the first half of 2024 declined, with sales dropping to CN¥2.99 billion and net income falling significantly compared to last year. Despite this, it maintains a solid financial position with cash exceeding total debt and short-term assets covering both short and long-term liabilities comfortably. However, profit margins have decreased from 9.1% to 5.4%, indicating operational challenges. While its management team is experienced, recent negative earnings growth contrasts with optimistic forecasts of future profit increases at 23.2% annually.

- Click to explore a detailed breakdown of our findings in Tianjin Chase Sun PharmaceuticalLtd's financial health report.

- Examine Tianjin Chase Sun PharmaceuticalLtd's earnings growth report to understand how analysts expect it to perform.

Beijing Haixin Energy TechnologyLtd (SZSE:300072)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing Haixin Energy Technology Co., Ltd. operates in the energy technology sector and has a market cap of CN¥7.90 billion.

Operations: Revenue segments for the company are not reported.

Market Cap: CN¥7.9B

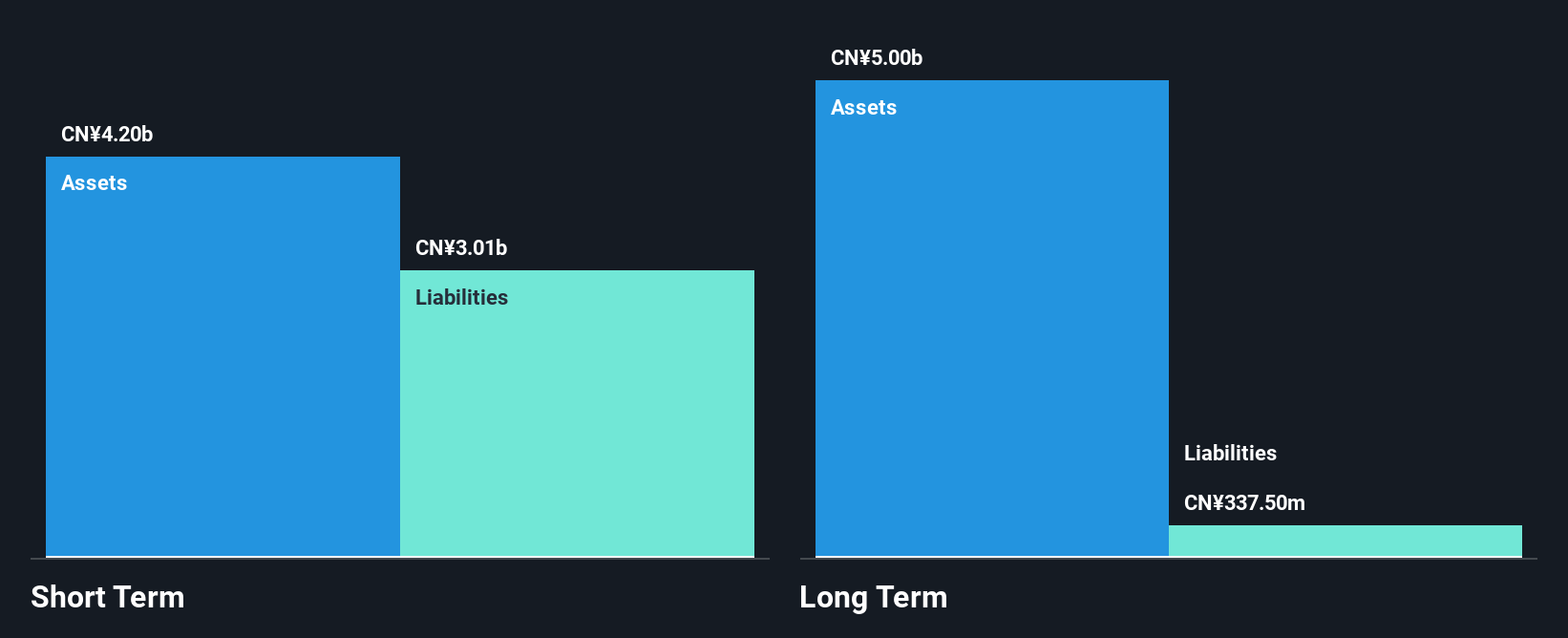

Beijing Haixin Energy Technology Co., Ltd. presents a complex picture in the penny stock landscape, with recent financial results showing a significant decline in revenue to CN¥1.25 billion for the first half of 2024, down from CN¥3.71 billion the previous year, and net losses increasing to CN¥325.96 million. Despite these challenges, its financial structure remains robust as short-term assets exceed both short and long-term liabilities, and cash levels surpass total debt. However, volatility remains high with increased weekly fluctuations and an inexperienced management team potentially impacting stability and strategic direction moving forward.

- Get an in-depth perspective on Beijing Haixin Energy TechnologyLtd's performance by reading our balance sheet health report here.

- Explore historical data to track Beijing Haixin Energy TechnologyLtd's performance over time in our past results report.

Key Takeaways

- Investigate our full lineup of 5,775 Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600361

Innovation New Material Technology

Innovation New Material Technology Co., Ltd.

Adequate balance sheet and fair value.