- Philippines

- /

- Hospitality

- /

- PSE:JFC

3 Asian Stocks That May Be Undervalued By Up To 30.3%

Reviewed by Simply Wall St

As global markets face challenges such as trade uncertainties and inflation concerns, Asian markets have shown resilience with modest gains in Japan and stimulus-driven optimism in China. In this environment, identifying stocks that may be undervalued by up to 30.3% can offer potential opportunities for investors looking to capitalize on market inefficiencies and growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Cfmoto PowerLtd (SHSE:603129) | CN¥178.81 | CN¥351.04 | 49.1% |

| Insource (TSE:6200) | ¥804.00 | ¥1584.36 | 49.3% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.40 | CN¥30.37 | 49.3% |

| APAC Realty (SGX:CLN) | SGD0.42 | SGD0.83 | 49.7% |

| JSHLtd (TSE:150A) | ¥561.00 | ¥1107.45 | 49.3% |

| GMO internet group (TSE:9449) | ¥3149.00 | ¥6181.69 | 49.1% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.665 | SGD1.33 | 49.9% |

| BalnibarbiLtd (TSE:3418) | ¥1092.00 | ¥2179.32 | 49.9% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.54 | CN¥16.97 | 49.7% |

| Doosan Fuel Cell (KOSE:A336260) | ₩15910.00 | ₩31537.45 | 49.6% |

Underneath we present a selection of stocks filtered out by our screen.

Jollibee Foods (PSE:JFC)

Overview: Jollibee Foods Corporation develops, operates, and franchises quick service restaurants with a market capitalization of ₱290.99 billion.

Operations: The company's revenue is primarily derived from its Food Service segment at ₱287.68 billion and Franchising at ₱25.47 billion, with additional income from Leasing amounting to ₱8.63 billion.

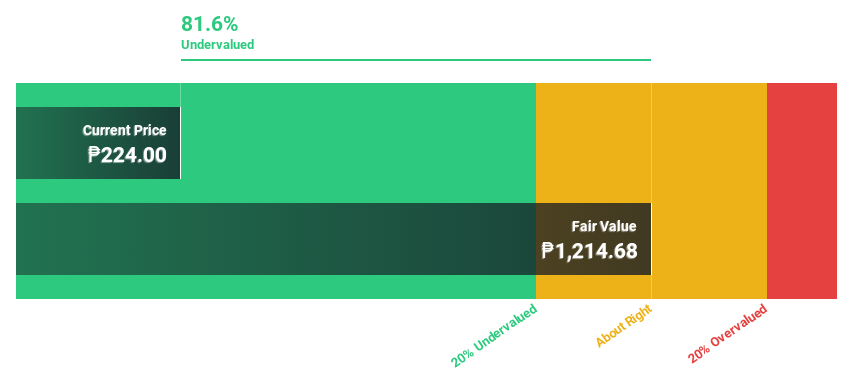

Estimated Discount To Fair Value: 14.8%

Jollibee Foods is trading 14.8% below its fair value estimate, with revenue and earnings growing faster than the Philippine market. Recent earnings showed a net income increase to PHP 10.32 billion, supported by strategic initiatives like a new U.S. beverage program partnership with Botrista and product expansions in chicken tenders. Despite high-quality earnings impacted by large one-off items, the stock remains undervalued based on cash flows but not significantly so.

- Our expertly prepared growth report on Jollibee Foods implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Jollibee Foods stock in this financial health report.

Bosideng International Holdings (SEHK:3998)

Overview: Bosideng International Holdings Limited operates in the apparel business in the People’s Republic of China, with a market capitalization of HK$48.48 billion.

Operations: The company's revenue segments include Down Apparels at CN¥20.66 billion, Ladieswear Apparels at CN¥735.22 million, Diversified Apparels at CN¥254.12 million, and Original Equipment Manufacturing (OEM) Management at CN¥2.97 billion.

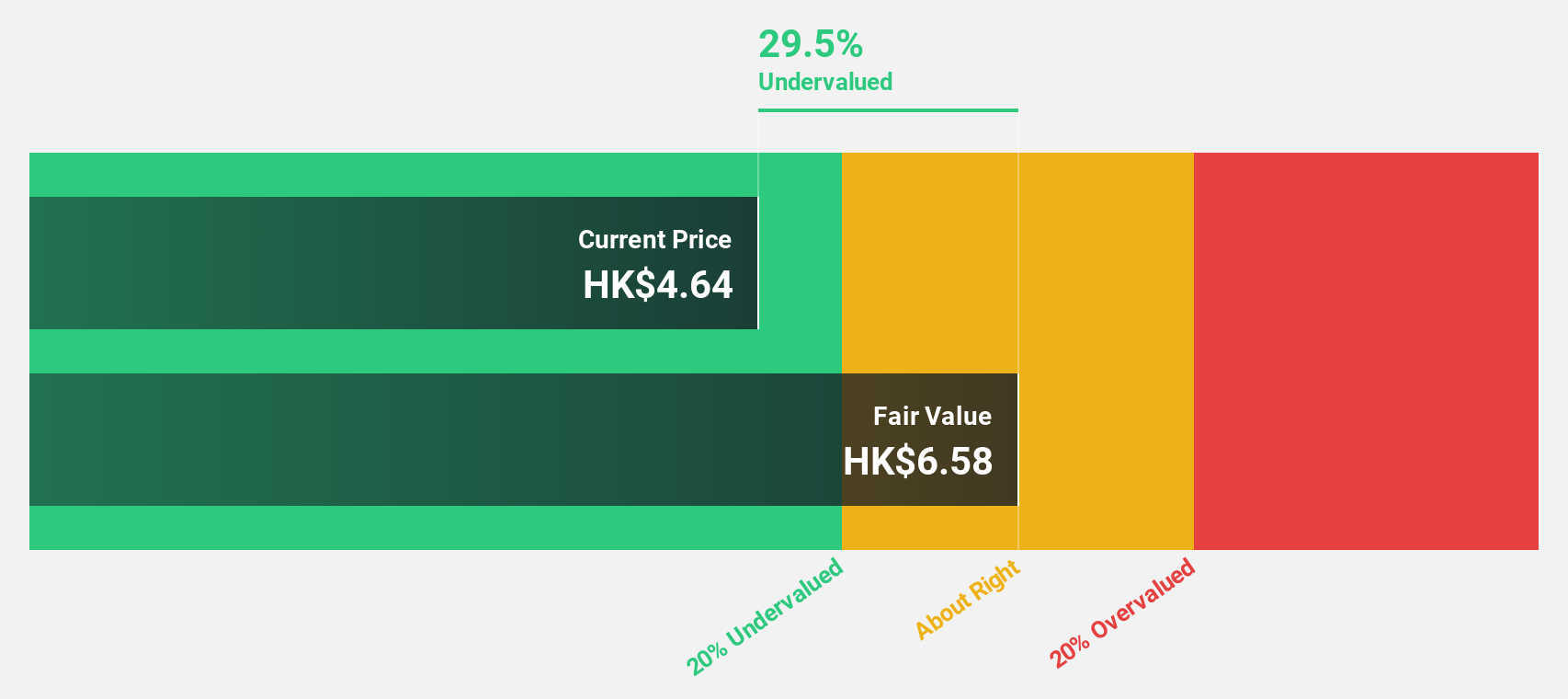

Estimated Discount To Fair Value: 30.3%

Bosideng International Holdings is trading at a significant discount, 30.3% below its fair value estimate of HK$6.07, with earnings projected to grow annually by 13.1%, outpacing the Hong Kong market's forecasted growth. The company recently initiated a share buyback program aimed at enhancing net asset value and earnings per share, funded by available cash flows. However, revenue growth is expected to be moderate at 11.2% per year and dividends remain unstable.

- In light of our recent growth report, it seems possible that Bosideng International Holdings' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Bosideng International Holdings.

Yunnan Energy New Material (SZSE:002812)

Overview: Yunnan Energy New Material Co., Ltd., along with its subsidiaries, provides film products both in China and internationally, with a market cap of CN¥32.67 billion.

Operations: The company generates revenue from its film product offerings across domestic and international markets.

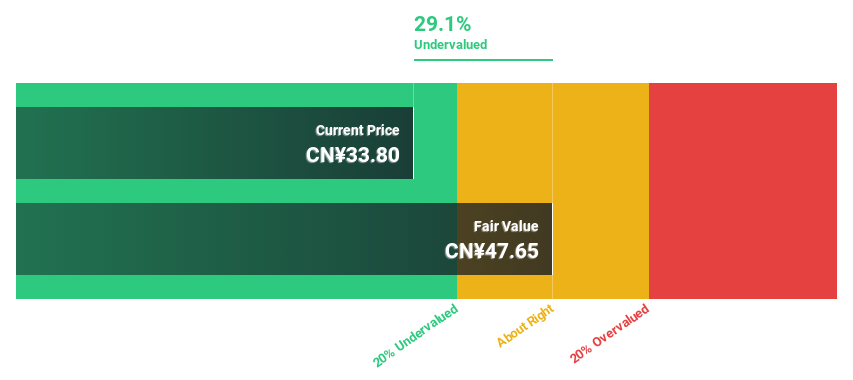

Estimated Discount To Fair Value: 20.6%

Yunnan Energy New Material is trading at CN¥33.89, more than 20% below its estimated fair value of CN¥42.69, suggesting it may be undervalued based on discounted cash flow analysis. Earnings are projected to grow significantly at 43.2% annually, surpassing the Chinese market's average growth rate of 25.2%. However, profit margins have decreased from last year and the company's debt coverage by operating cash flow remains a concern despite strong earnings forecasts.

- The analysis detailed in our Yunnan Energy New Material growth report hints at robust future financial performance.

- Take a closer look at Yunnan Energy New Material's balance sheet health here in our report.

Taking Advantage

- Reveal the 276 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:JFC

Jollibee Foods

Develops, operates, and franchises quick service restaurants.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success