- Hong Kong

- /

- Commercial Services

- /

- SEHK:3316

3 Asian Stocks That Could Be Trading At Discounts Of Up To 49%

Reviewed by Simply Wall St

As global markets face cautious sentiment amid hawkish commentary from the U.S. Federal Reserve and mixed economic signals, Asian stock markets present intriguing opportunities for investors seeking value. In this environment, identifying stocks that are potentially undervalued can be a strategic approach, especially when considering companies with strong fundamentals and resilience in navigating current market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥83.78 | CN¥165.09 | 49.3% |

| Takara Bio (TSE:4974) | ¥938.00 | ¥1829.46 | 48.7% |

| SRE Holdings (TSE:2980) | ¥3250.00 | ¥6471.62 | 49.8% |

| NexTone (TSE:7094) | ¥2274.00 | ¥4465.49 | 49.1% |

| Mobvista (SEHK:1860) | HK$19.03 | HK$37.83 | 49.7% |

| Kolmar Korea (KOSE:A161890) | ₩79300.00 | ₩155402.21 | 49% |

| HAESUNG DS (KOSE:A195870) | ₩30750.00 | ₩61294.35 | 49.8% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.60 | CN¥77.71 | 49% |

| Dajin Heavy IndustryLtd (SZSE:002487) | CN¥47.28 | CN¥94.11 | 49.8% |

| Chanjet Information Technology (SEHK:1588) | HK$11.03 | HK$21.58 | 48.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Binjiang Service Group (SEHK:3316)

Overview: Binjiang Service Group Co. Ltd. offers property management and related services in the People's Republic of China, with a market cap of HK$6.80 billion.

Operations: The company's revenue segments include CN¥2.19 billion from property management services, CN¥1.26 billion from value-added services, and CN¥528.80 million from value-added services to non-property owners.

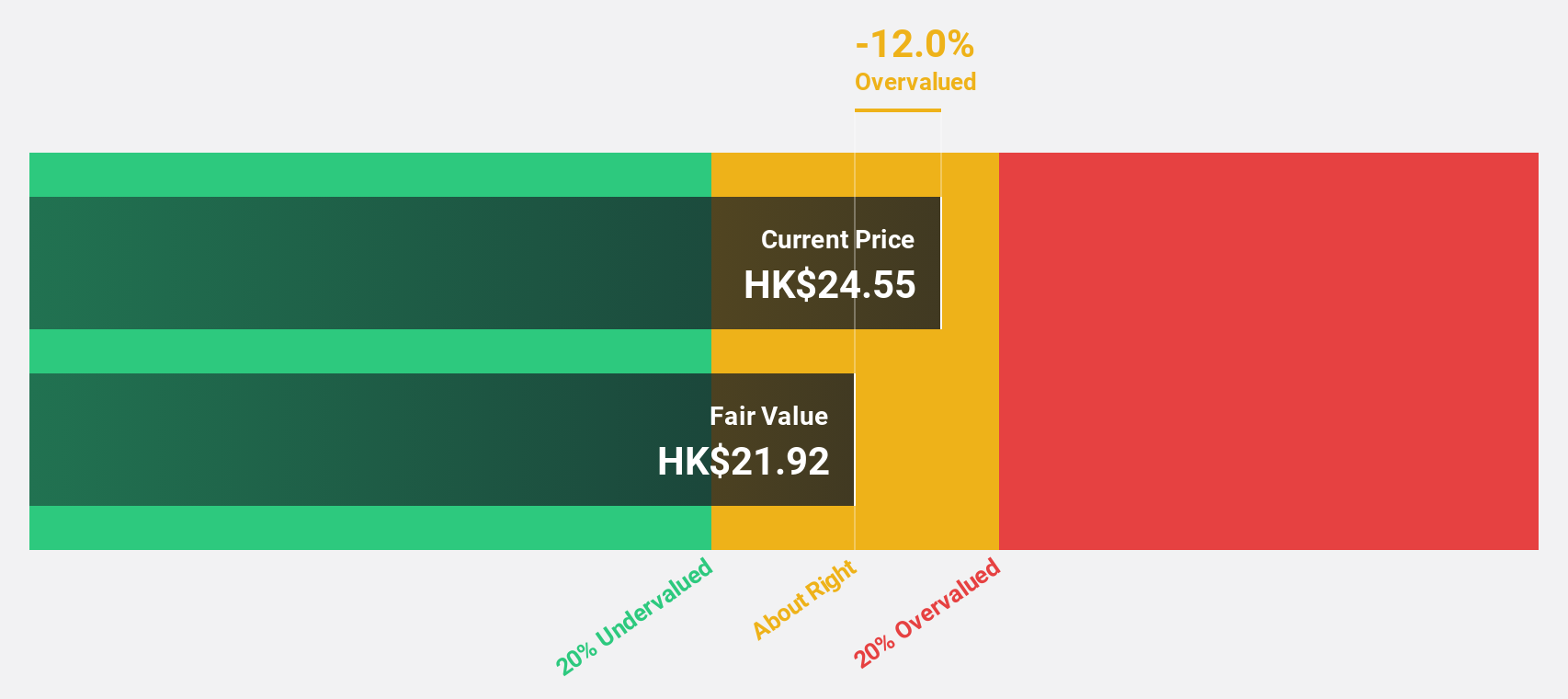

Estimated Discount To Fair Value: 26%

Binjiang Service Group is currently trading at HK$24.6, which is 26% below its estimated fair value of HK$33.24, highlighting its undervaluation based on discounted cash flow analysis. Recent earnings show a net income increase to CNY 297.71 million for the first half of 2025, with revenue growth expected to outpace the Hong Kong market at 13% annually. However, dividend sustainability remains uncertain due to an unstable track record despite recent increases.

- In light of our recent growth report, it seems possible that Binjiang Service Group's financial performance will exceed current levels.

- Get an in-depth perspective on Binjiang Service Group's balance sheet by reading our health report here.

Guangdong Marubi Biotechnology (SHSE:603983)

Overview: Guangdong Marubi Biotechnology Co., Ltd. focuses on the research, design, production, sale, and service of cosmetics in China with a market cap of CN¥15.88 billion.

Operations: The company generates revenue from its Personal Products segment, amounting to CN¥3.39 billion.

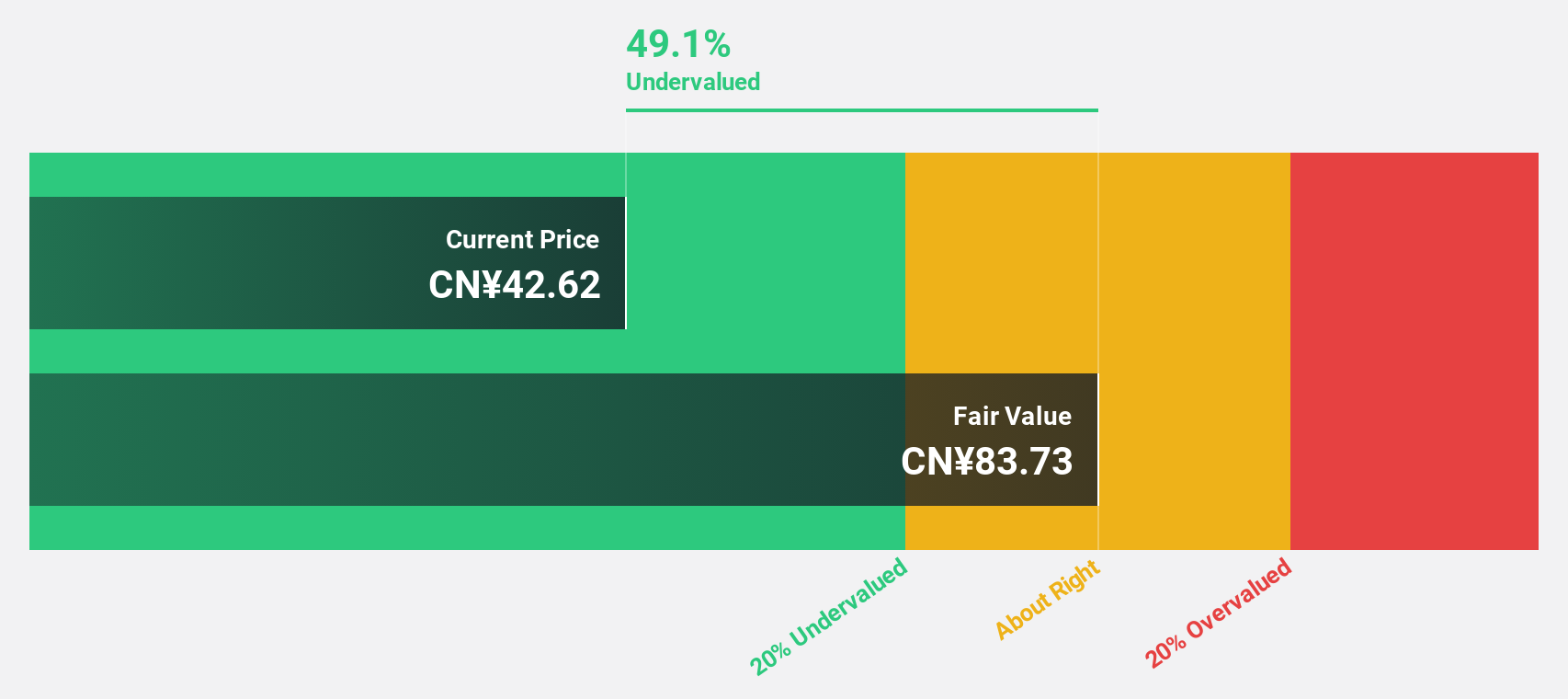

Estimated Discount To Fair Value: 49%

Guangdong Marubi Biotechnology is trading at CN¥39.6, significantly below its estimated fair value of CN¥77.71, indicating undervaluation based on discounted cash flow analysis. Recent earnings show a net income increase to CNY 185.74 million for the first half of 2025, with revenue growth expected to surpass the Chinese market at 21.3% annually. However, dividend sustainability is questionable as it isn't well covered by earnings or free cash flows despite positive growth forecasts.

- According our earnings growth report, there's an indication that Guangdong Marubi Biotechnology might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Guangdong Marubi Biotechnology.

Shenzhen Batian Ecotypic Engineering (SZSE:002170)

Overview: Shenzhen Batian Ecotypic Engineering Co., Ltd. operates in the ecological engineering sector and has a market cap of CN¥10.33 billion.

Operations: The company's revenue is primarily derived from Chemical Fertilizer Manufacturing, contributing CN¥2.75 billion, and Phosphate Mining, which accounts for CN¥1.52 billion.

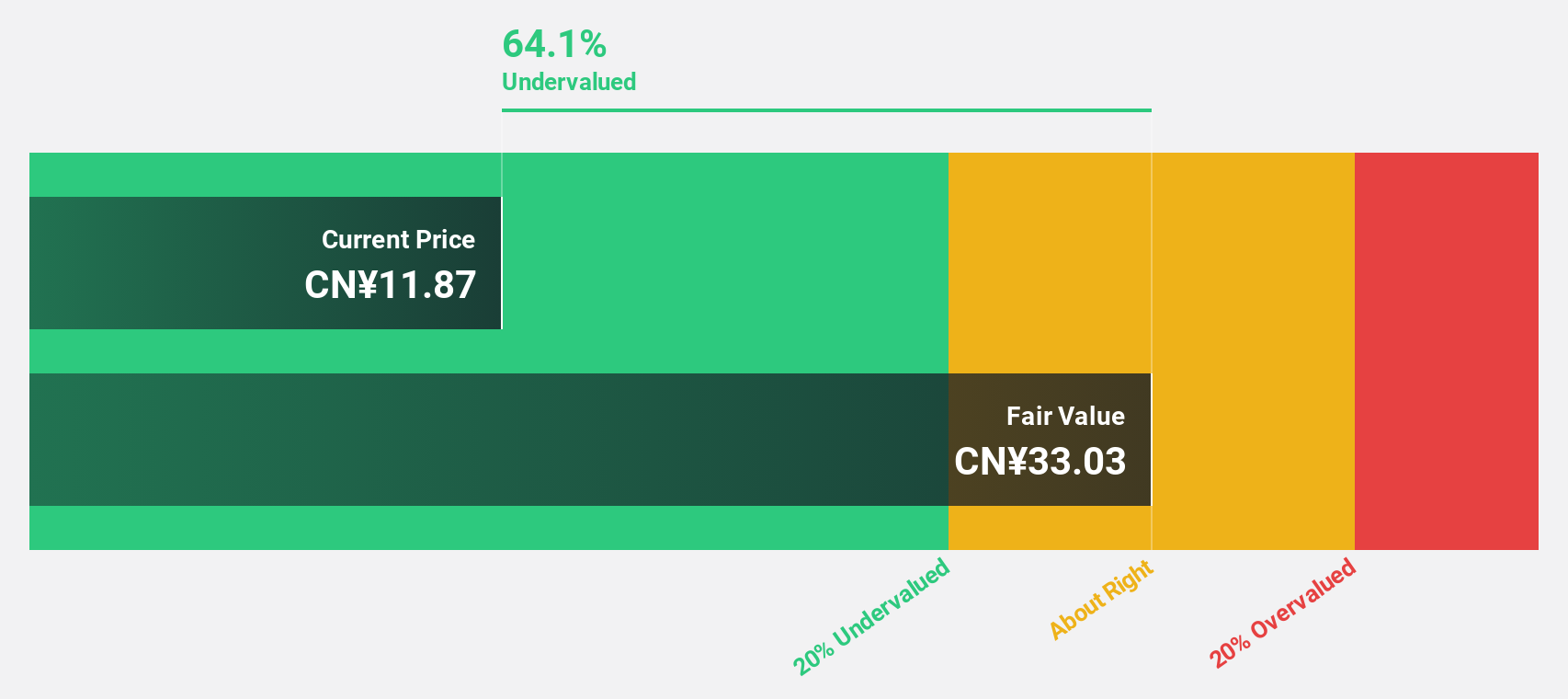

Estimated Discount To Fair Value: 41.9%

Shenzhen Batian Ecotypic Engineering, trading at CN¥10.68, is significantly undervalued with a fair value estimate of CN¥18.37 based on discounted cash flow analysis. Recent earnings show a robust net income increase to CNY 456.17 million for the first half of 2025, reflecting strong profit growth and exceeding the Chinese market's revenue growth forecast at 19.3% annually. However, its dividend track record remains unstable despite promising high earnings growth projections over the next three years.

- Upon reviewing our latest growth report, Shenzhen Batian Ecotypic Engineering's projected financial performance appears quite optimistic.

- Dive into the specifics of Shenzhen Batian Ecotypic Engineering here with our thorough financial health report.

Make It Happen

- Embark on your investment journey to our 286 Undervalued Asian Stocks Based On Cash Flows selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Binjiang Service Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3316

Binjiang Service Group

Provides property management and related services in the People’s Republic of China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)