Top Chinese Dividend Stocks Including Luzhou LaojiaoLtd And 2 Others

Reviewed by Simply Wall St

As Chinese stocks have recently retreated amid concerns about deflationary pressures, investors are increasingly looking for stability in dividend-paying equities. In this article, we explore three top Chinese dividend stocks, including Luzhou Laojiao Ltd., that stand out for their potential to provide steady income even in volatile market conditions.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 4.96% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.71% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.65% | ★★★★★★ |

| Kweichow Moutai (SHSE:600519) | 3.48% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.16% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.70% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 6.19% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 5.02% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.67% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.58% | ★★★★★★ |

Click here to see the full list of 261 stocks from our Top Chinese Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

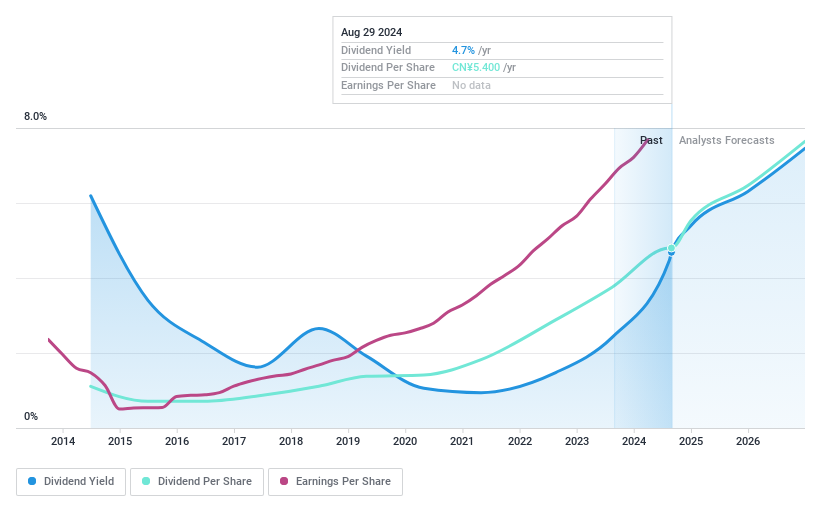

Luzhou LaojiaoLtd (SZSE:000568)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Luzhou Laojiao Co., Ltd, with a market cap of CN¥190.11 billion, is a company that provides liquor products in China.

Operations: Luzhou Laojiao Co., Ltd generates its revenue primarily from the sale of liquor products in China.

Dividend Yield: 4.2%

Luzhou Laojiao Ltd. offers a mixed outlook for dividend investors. Despite a volatile dividend history over the past decade, recent increases and a payout ratio of 56.2% indicate dividends are well-covered by earnings and cash flows (66%). Trading at 69.8% below its estimated fair value, it presents good relative value compared to peers. Recent board changes and amendments to company bylaws were approved at the June 2024 AGM, reflecting active governance adjustments.

- Unlock comprehensive insights into our analysis of Luzhou LaojiaoLtd stock in this dividend report.

- Our valuation report here indicates Luzhou LaojiaoLtd may be undervalued.

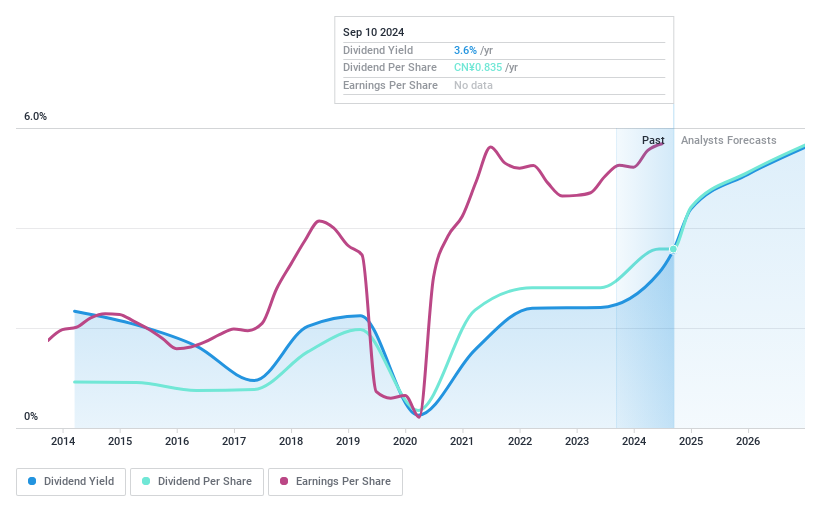

Beijing New Building Materials (SZSE:000786)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing New Building Materials Public Limited Company, with a market cap of CN¥43.40 billion, manufactures and sells building materials both in China and internationally.

Operations: Beijing New Building Materials Public Limited Company generates revenue through its manufacturing and sales of building materials both domestically and internationally.

Dividend Yield: 3.3%

Beijing New Building Materials has seen its dividend payments increase over the past decade, with a recent cash dividend of CNY 8.35 per 10 shares approved for distribution in June 2024. Trading at 53% below estimated fair value, it offers good relative value compared to peers. Despite an unstable dividend track record, its dividends are well-covered by earnings (37.6% payout ratio) and cash flows (37% cash payout ratio). Earnings grew by 18% last year.

- Click here to discover the nuances of Beijing New Building Materials with our detailed analytical dividend report.

- Our expertly prepared valuation report Beijing New Building Materials implies its share price may be lower than expected.

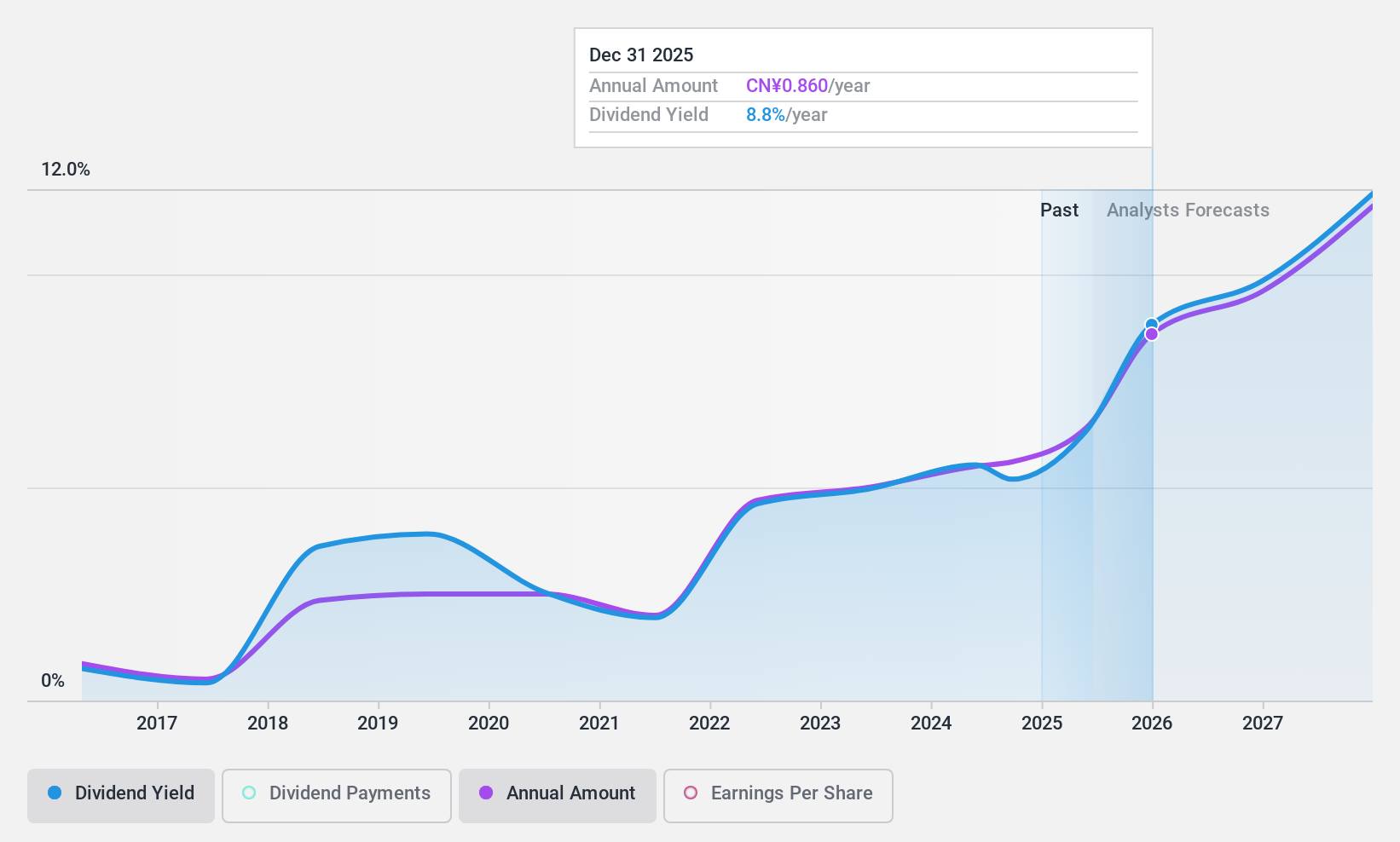

DeHua TB New Decoration MaterialLtd (SZSE:002043)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DeHua TB New Decoration Material Co., Ltd. produces and sells environmentally friendly furniture panels in China and internationally, with a market cap of CN¥8.11 billion.

Operations: DeHua TB New Decoration Material Co., Ltd. generates its revenue primarily from the production and sale of environmentally friendly furniture panels both domestically and internationally.

Dividend Yield: 5.6%

DeHua TB New Decoration Material Ltd. offers a dividend yield of 5.61%, placing it in the top 25% of dividend payers in China. Its dividends are well-covered by earnings (63% payout ratio) and cash flows (57.5% cash payout ratio). Despite a volatile and unreliable dividend history, recent increases have been announced with a CNY 5.50 per 10 shares distribution plan for May 2024. The stock trades at good value compared to peers, with analysts expecting price growth.

- Get an in-depth perspective on DeHua TB New Decoration MaterialLtd's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that DeHua TB New Decoration MaterialLtd is trading behind its estimated value.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 258 Top Chinese Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing New Building Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000786

Beijing New Building Materials

Manufactures and sells building materials in China and internationally.

Very undervalued with excellent balance sheet and pays a dividend.