- China

- /

- Metals and Mining

- /

- SZSE:000890

3 Global Penny Stocks With Market Caps Up To US$2B

Reviewed by Simply Wall St

As global markets show optimism with major U.S. stock indexes climbing on hopes of interest rate cuts, investors are keenly observing economic indicators like manufacturing activity and employment trends. Amidst these developments, penny stocks continue to capture attention for their potential to offer unique investment opportunities. Although the term "penny stocks" might seem outdated, these smaller or newer companies can still provide significant value when backed by strong financials and growth prospects.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Cloudpoint Technology Berhad (KLSE:CLOUDPT) | MYR0.67 | MYR356.17M | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.47 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.105 | £470.93M | ✅ 5 ⚠️ 0 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.56 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.00 | SGD405.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.37 | SGD13.26B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6475 | $376.41M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.205 | MYR315.87M | ✅ 4 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.095 | £174.76M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,591 stocks from our Global Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Jiangsu Fasten (SZSE:000890)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Fasten Company Limited, with a market cap of CN¥1.87 billion, produces and sells steel wires and wire ropes both in China and internationally through its subsidiaries.

Operations: No specific revenue segments are reported for Jiangsu Fasten Company Limited, which produces and sells steel wires and wire ropes domestically and internationally.

Market Cap: CN¥1.87B

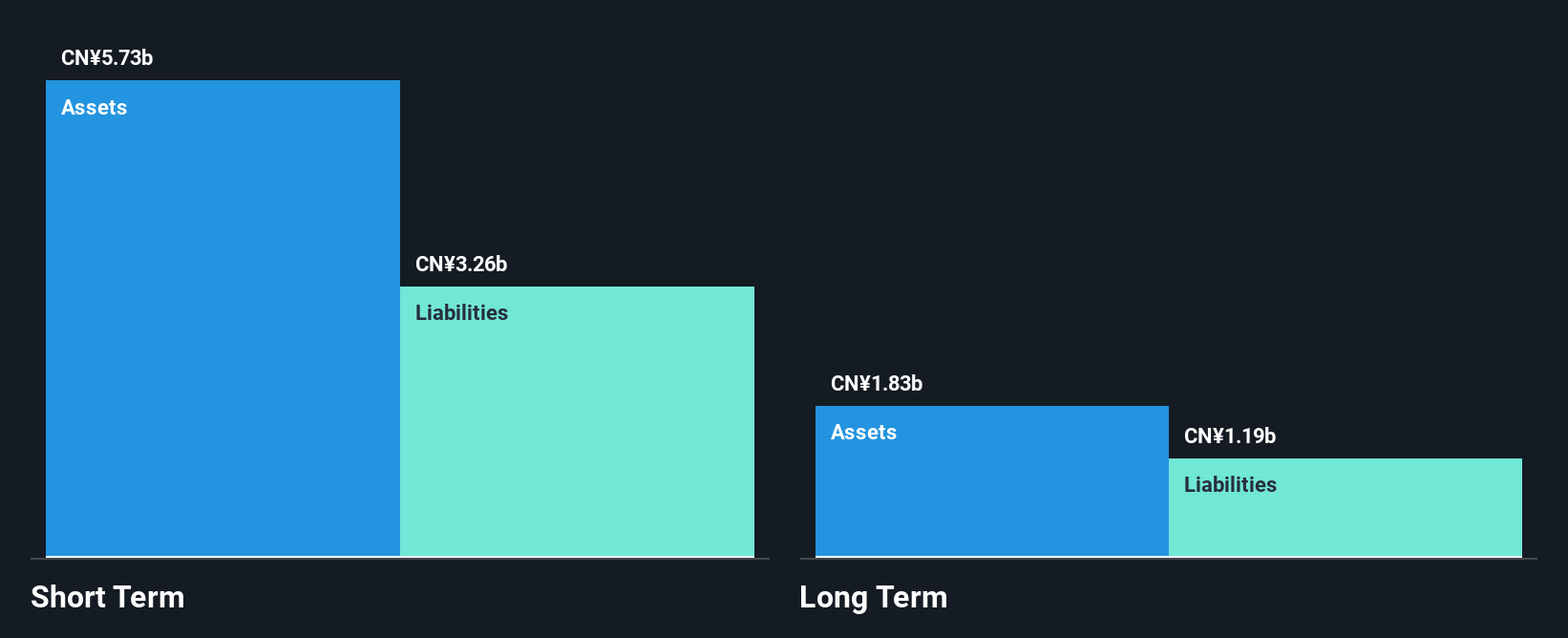

Jiangsu Fasten Company Limited, with a market cap of CN¥1.87 billion, has faced challenges as evidenced by its net loss of CN¥22.77 million for the nine months ending September 2025, though this is an improvement from the previous year's larger loss. The company maintains a sufficient cash runway exceeding three years despite being unprofitable and having a high net debt to equity ratio of 1414.4%. Its management and board are experienced, with average tenures of 7.5 and 5.6 years respectively, suggesting stability in governance amidst financial restructuring efforts such as recent amendments to its articles of association.

- Unlock comprehensive insights into our analysis of Jiangsu Fasten stock in this financial health report.

- Understand Jiangsu Fasten's track record by examining our performance history report.

Cosmos Group (SZSE:002133)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cosmos Group Co., Ltd. operates in the real estate development and trading sector in China, with a market cap of CN¥2.62 billion.

Operations: The company generates its revenue primarily from operations in China, amounting to CN¥5.20 billion.

Market Cap: CN¥2.62B

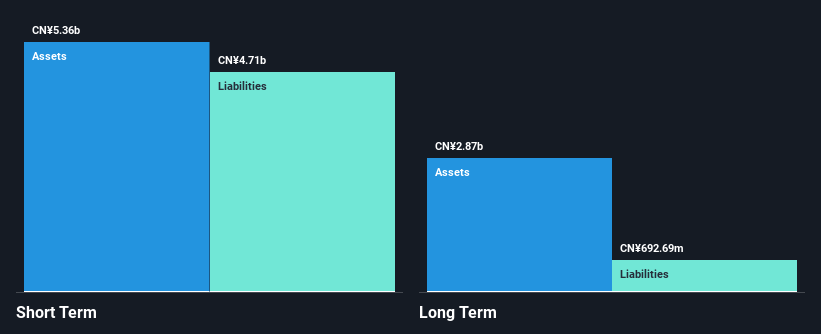

Cosmos Group Co., Ltd. operates within the real estate sector in China, reporting a market cap of CN¥2.62 billion and revenues of CN¥3.90 billion for the nine months ending September 2025, indicating growth from the previous year. Despite being unprofitable with a negative return on equity, its debt management shows improvement as its debt-to-equity ratio has decreased over five years to 47.3%, and operating cash flow covers 54.8% of its debt well above satisfactory levels. Recent strategic moves include completing a share buyback program worth CN¥30 million and declaring an interim dividend, reflecting efforts to enhance shareholder value amidst financial challenges.

- Dive into the specifics of Cosmos Group here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Cosmos Group's track record.

Nanfang Pump Industry (SZSE:300145)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nanfang Pump Industry Co., Ltd. operates through its subsidiaries to research, design, develop, produce, and sell pump products both in China and internationally, with a market cap of CN¥8.11 billion.

Operations: There are no specific revenue segments reported for Nanfang Pump Industry Co., Ltd.

Market Cap: CN¥8.11B

Nanfang Pump Industry Co., Ltd. has demonstrated steady financial performance, with revenues reaching CN¥3.63 billion for the nine months ending September 2025, reflecting a slight increase from the previous year. The company's earnings have grown significantly over the past five years, although recent growth of 5.9% lags behind its historical average and industry benchmarks. While its return on equity remains low at 9%, Nanfang maintains satisfactory debt levels with net debt to equity at 37.4%. Additionally, short-term assets comfortably cover both short and long-term liabilities, highlighting stable liquidity amidst recent corporate governance changes.

- Click to explore a detailed breakdown of our findings in Nanfang Pump Industry's financial health report.

- Review our growth performance report to gain insights into Nanfang Pump Industry's future.

Taking Advantage

- Explore the 3,591 names from our Global Penny Stocks screener here.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000890

Jiangsu Fasten

Engages in the production and sale of steel wires and wire ropes in China and internationally.

Adequate balance sheet with minimal risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion