- China

- /

- Metals and Mining

- /

- SZSE:000657

Optimistic Investors Push China Tungsten And Hightech Materials Co.,Ltd (SZSE:000657) Shares Up 28% But Growth Is Lacking

China Tungsten And Hightech Materials Co.,Ltd (SZSE:000657) shares have had a really impressive month, gaining 28% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

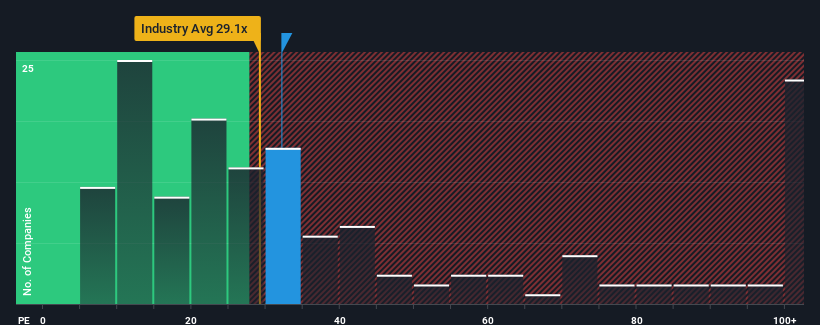

In spite of the firm bounce in price, it's still not a stretch to say that China Tungsten And Hightech MaterialsLtd's price-to-earnings (or "P/E") ratio of 32.1x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 31x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

China Tungsten And Hightech MaterialsLtd hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for China Tungsten And Hightech MaterialsLtd

Does Growth Match The P/E?

In order to justify its P/E ratio, China Tungsten And Hightech MaterialsLtd would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 124% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 35% during the coming year according to the seven analysts following the company. That's shaping up to be materially lower than the 41% growth forecast for the broader market.

In light of this, it's curious that China Tungsten And Hightech MaterialsLtd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

China Tungsten And Hightech MaterialsLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that China Tungsten And Hightech MaterialsLtd currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - China Tungsten And Hightech MaterialsLtd has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on China Tungsten And Hightech MaterialsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000657

China Tungsten And Hightech MaterialsLtd

Researches, develops, produces, sells, and trades in nonferrous metals in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives