Hubei Yihua Chemical Industry Co., Ltd. (SZSE:000422) Soars 30% But It's A Story Of Risk Vs Reward

Hubei Yihua Chemical Industry Co., Ltd. (SZSE:000422) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 76% in the last year.

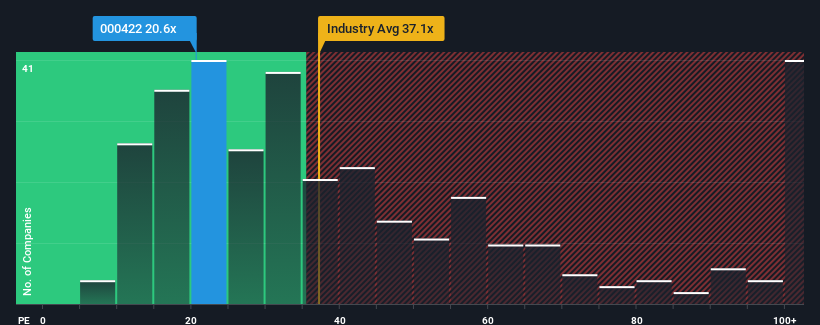

In spite of the firm bounce in price, Hubei Yihua Chemical Industry may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 20.6x, since almost half of all companies in China have P/E ratios greater than 39x and even P/E's higher than 75x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Hubei Yihua Chemical Industry certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Hubei Yihua Chemical Industry

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Hubei Yihua Chemical Industry would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 78%. However, this wasn't enough as the latest three year period has seen a very unpleasant 58% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 41% over the next year. Meanwhile, the rest of the market is forecast to only expand by 37%, which is noticeably less attractive.

With this information, we find it odd that Hubei Yihua Chemical Industry is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Hubei Yihua Chemical Industry's P/E?

Hubei Yihua Chemical Industry's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Hubei Yihua Chemical Industry currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Hubei Yihua Chemical Industry is showing 3 warning signs in our investment analysis, and 2 of those are a bit concerning.

If these risks are making you reconsider your opinion on Hubei Yihua Chemical Industry, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Yihua Chemical Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000422

Hubei Yihua Chemical Industry

Manufactures and sells chemical raw materials and products in China.

Good value with proven track record.

Market Insights

Community Narratives