Undiscovered Gems And 3 Promising Small Caps with Strong Potential

Reviewed by Simply Wall St

In a week marked by mixed performances across major indexes, the Russell 2000 Index saw a decline after previously outperforming its larger-cap peers, highlighting the volatility and unique challenges faced by small-cap stocks in today's market. As investors navigate this landscape, identifying small-cap stocks with strong fundamentals and growth potential becomes crucial for those looking to uncover hidden opportunities amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Compañía General de Electricidad | 1.98% | 9.75% | -4.52% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Reysas Tasimacilik ve Lojistik Ticaret (IBSE:RYSAS)

Simply Wall St Value Rating: ★★★★★★

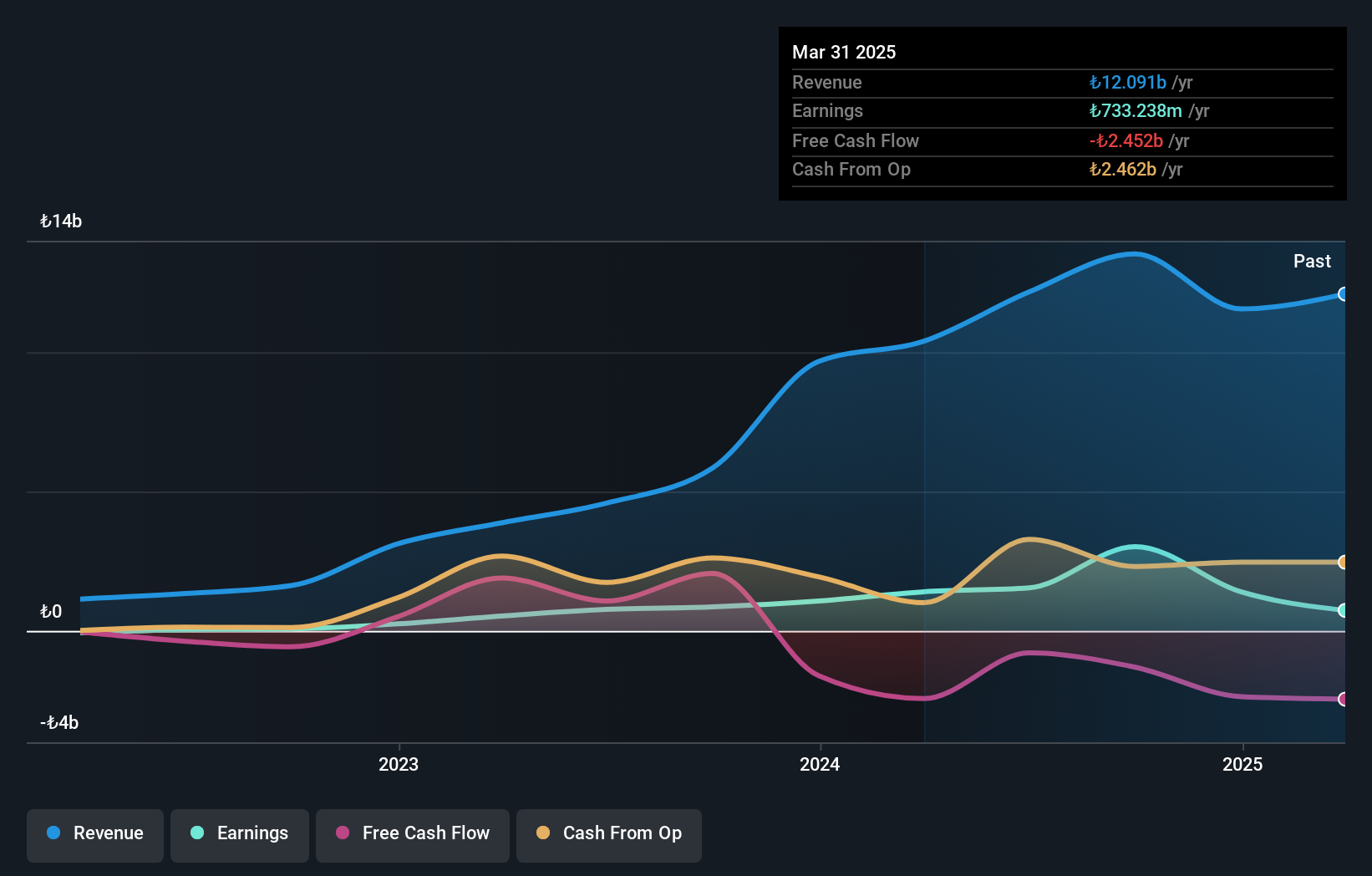

Overview: Reysas Tasimacilik ve Lojistik Ticaret A.S. is a logistics and transportation company with a market capitalization of TRY37.48 billion, focusing on various services including real estate rental, vehicle inspection, and tobacco product storage activities.

Operations: RYSAS generates revenue primarily from transportation storage logistics services (TRY4.77 billion), supplemented by real estate rental activities (TRY3.29 billion) and vehicle inspection services (TRY1.10 billion). The tobacco product storage segment contributes TRY968.82 million to the overall revenue mix.

Reysas Tasimacilik, a dynamic player in logistics, has shown impressive earnings growth of 215.3% over the past year, outpacing its industry significantly. The company's net debt to equity ratio stands at a satisfactory 33%, reflecting prudent financial management. Despite a volatile share price recently, Reysas's price-to-earnings ratio of 13.8x suggests it is undervalued compared to the TR market average of 16.8x. Recent quarterly sales reached TRY 3,147 million from TRY 1,783 million last year and net income soared to TRY 1,624 million from TRY 150 million previously—highlighting robust performance improvements and potential for future growth.

Hubei Zhenhua ChemicalLtd (SHSE:603067)

Simply Wall St Value Rating: ★★★★★☆

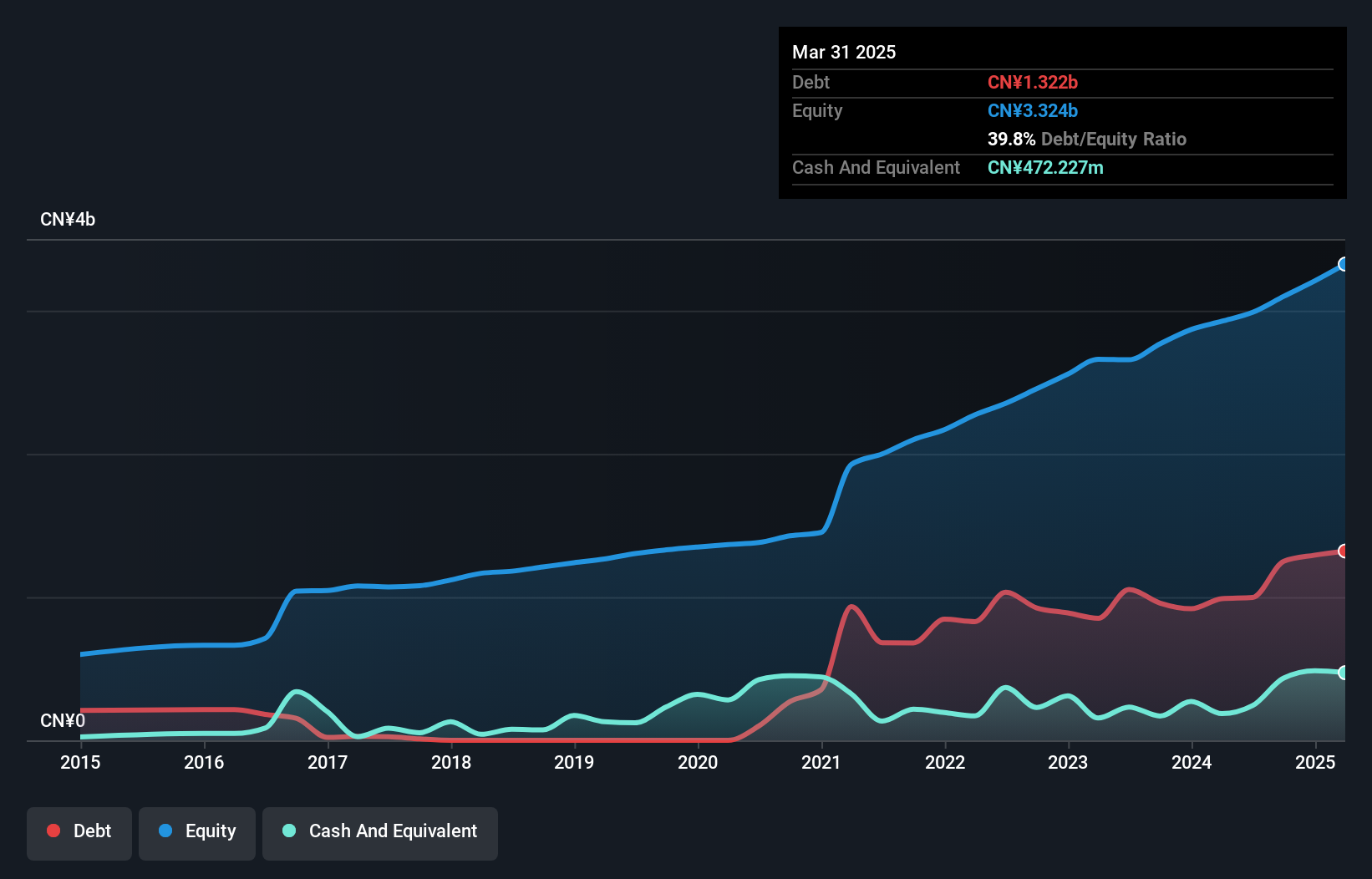

Overview: Hubei Zhenhua Chemical Co., Ltd. focuses on the research, development, manufacture, and sale of chromium salt and related products in China, with a market cap of CN¥6.98 billion.

Operations: Zhenhua Chemical generates revenue primarily from the sale of chromium salt products. The company's net profit margin has shown notable fluctuations over recent periods, reflecting changes in operational efficiency and cost management.

Hubei Zhenhua Chemical, a promising player in the chemicals sector, has shown robust performance with earnings up 15% over the past year, outpacing the industry average of -5%. Its net income for the first nine months of 2024 was CNY 363.87 million, compared to CNY 288.85 million last year. The company seems well-positioned financially with a satisfactory net debt to equity ratio of 26.3% and interest payments covered comfortably by EBIT at 17.5x. Additionally, it completed a share buyback worth CNY 46.38 million this year, indicating confidence in its market value and future prospects.

Zhejiang Huangma TechnologyLtd (SHSE:603181)

Simply Wall St Value Rating: ★★★★★☆

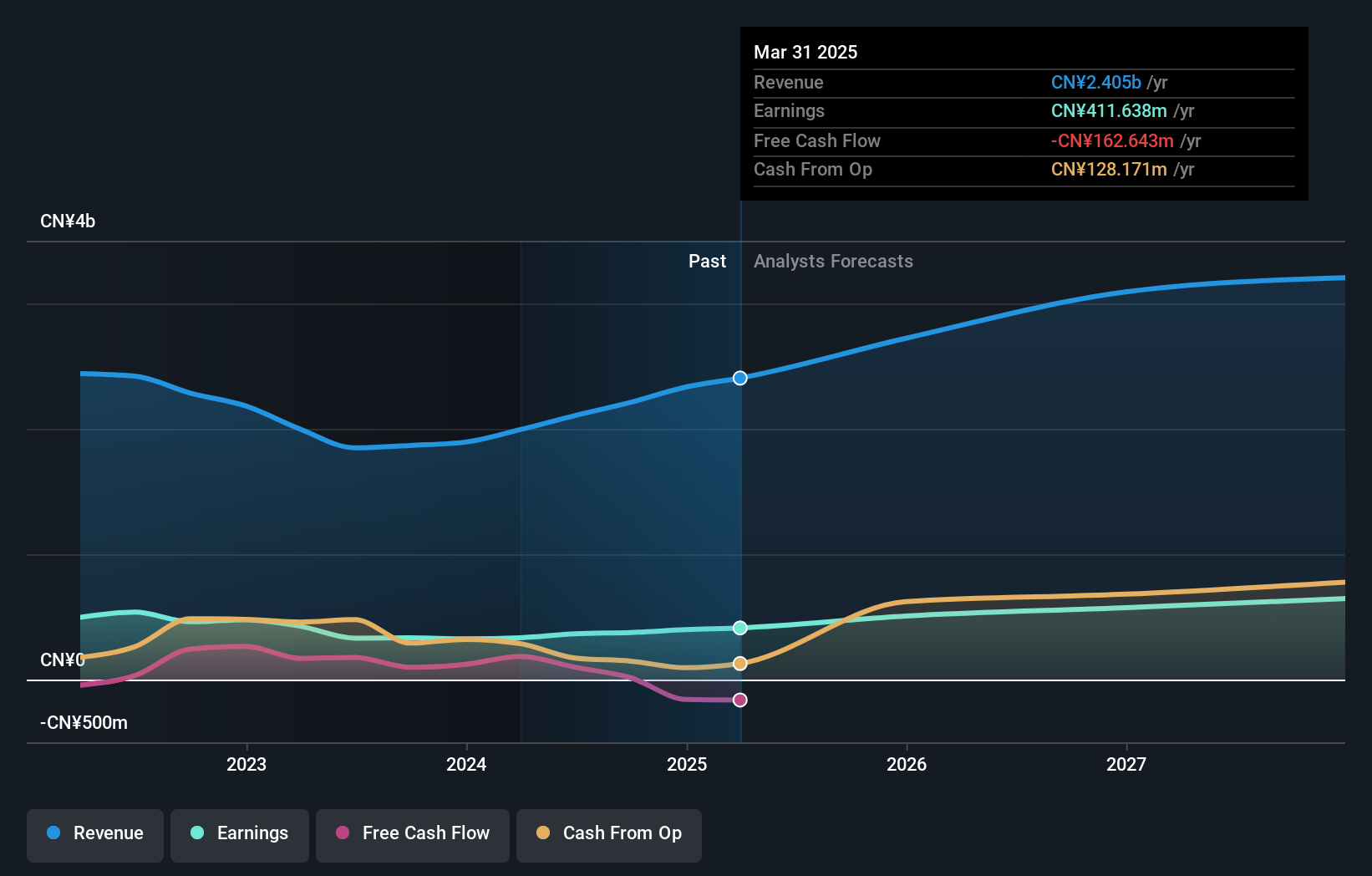

Overview: Zhejiang Huangma Technology Co., Ltd engages in the research, development, production, and sale of surfactants and related products both domestically in China and internationally, with a market capitalization of CN¥7.16 billion.

Operations: Huangma Technology generates revenue primarily from its specialty chemicals segment, which contributed CN¥2.21 billion. The company's financial performance can be analyzed through its net profit margin, which reflects the profitability of its operations after accounting for all expenses.

Zhejiang Huangma Technology, a nimble player in the chemicals sector, has shown robust financial health with earnings growth of 12.7% over the past year, outpacing the industry average. The company's debt-to-equity ratio increased to 13.2% over five years, yet it maintains more cash than total debt, ensuring financial stability. Recent figures reveal sales of CNY 1.72 billion for nine months ending September 2024, up from CNY 1.41 billion last year; net income reached CNY 285 million compared to CNY 235 million previously. Trading at a price-to-earnings ratio of 19x suggests good relative value against market averages.

Summing It All Up

- Click here to access our complete index of 4628 Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:RYSAS

Reysas Tasimacilik ve Lojistik Ticaret

Reysas Tasimacilik ve Lojistik Ticaret A.S.

Flawless balance sheet with solid track record.