- Turkey

- /

- Metals and Mining

- /

- IBSE:KRDMD

Undiscovered Gems With Promising Potential In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape, major U.S. indices like the S&P 500 and Nasdaq Composite have reached record highs, while small-cap stocks represented by the Russell 2000 have faced recent declines after previous outperformance. Amid this backdrop of mixed sector performances and economic data highlighting labor market resilience, investors are keenly observing potential interest rate cuts from the Federal Reserve as they assess opportunities in smaller companies that may be poised for growth. In such an environment, identifying stocks with strong fundamentals and unique market positions can be crucial for uncovering promising investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi (IBSE:KLKIM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi operates in the building materials and chemicals sector both in Turkey and internationally, with a market cap of TRY15.64 billion.

Operations: Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi generates its revenue primarily from Ceramic Applications, contributing TRY3.17 billion, followed by Concrete, Cement Chemicals and Raw Materials at TRY1.26 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi, a notable player in the chemicals sector, has shown impressive financial strides. Over the past year, earnings surged by 166.9%, significantly outpacing the industry average of -10.5%. The company's debt-to-equity ratio improved from 45.6% to 13% over five years, indicating robust financial health. Despite a negative free cash flow recently at TRY -868 million, Kalekim's profitability and interest coverage remain strong with more cash than total debt on hand. Recent results reflect this strength with third-quarter sales reaching TRY 1,869 million and net income at TRY 241 million compared to a loss last year.

- Get an in-depth perspective on Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi's performance by reading our health report here.

Learn about Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi's historical performance.

Kardemir Karabük Demir Çelik Sanayi Ve Ticaret (IBSE:KRDMD)

Simply Wall St Value Rating: ★★★★★★

Overview: Kardemir Karabük Demir Çelik Sanayi Ve Ticaret A.S. is a Turkish company engaged in the production and sale of iron and steel products, with a market cap of TRY32.49 billion.

Operations: Kardemir generates revenue primarily through the sale of iron and steel products. The company's financial performance is highlighted by a notable trend in its net profit margin, which has shown variability over recent periods.

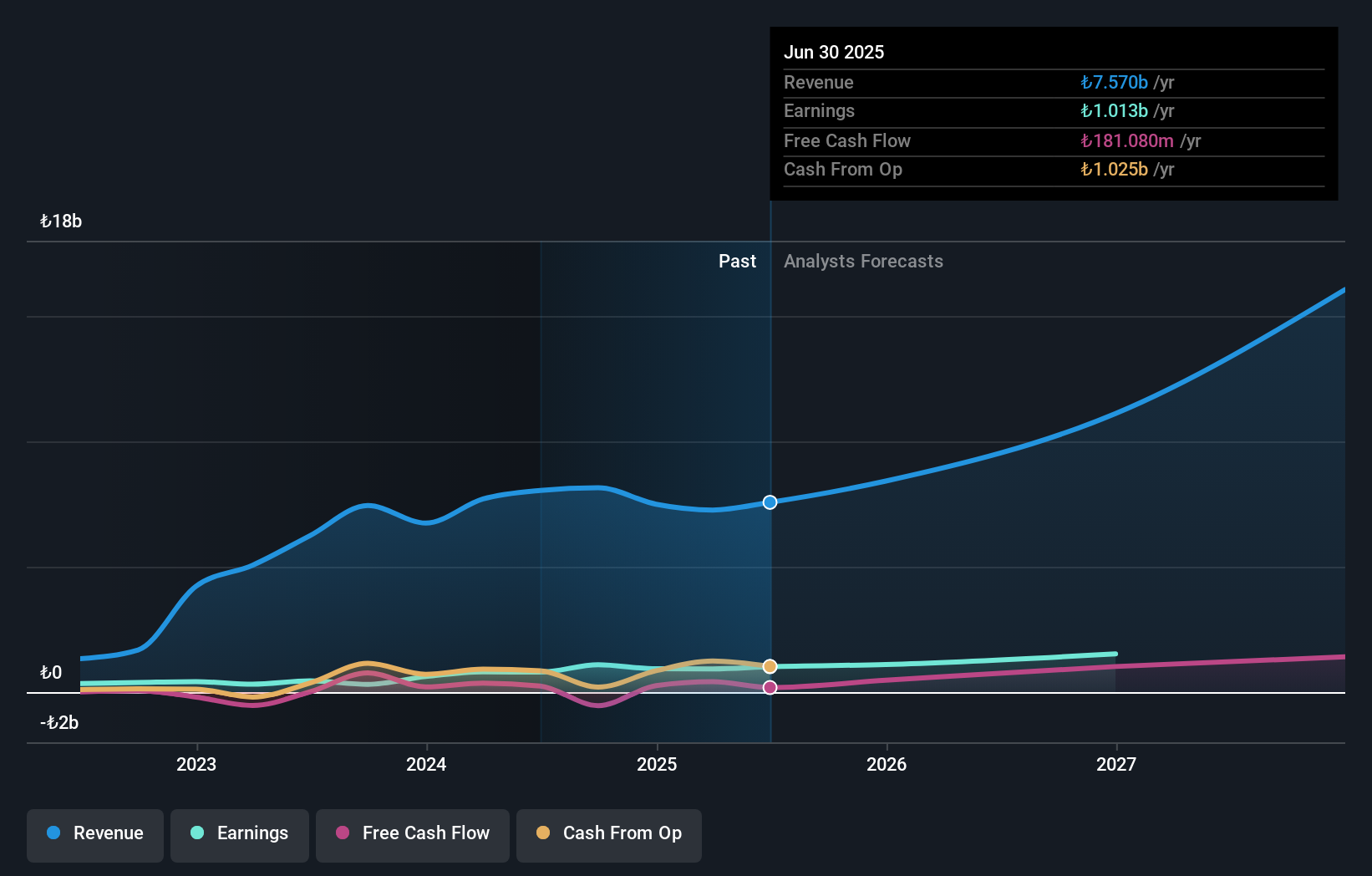

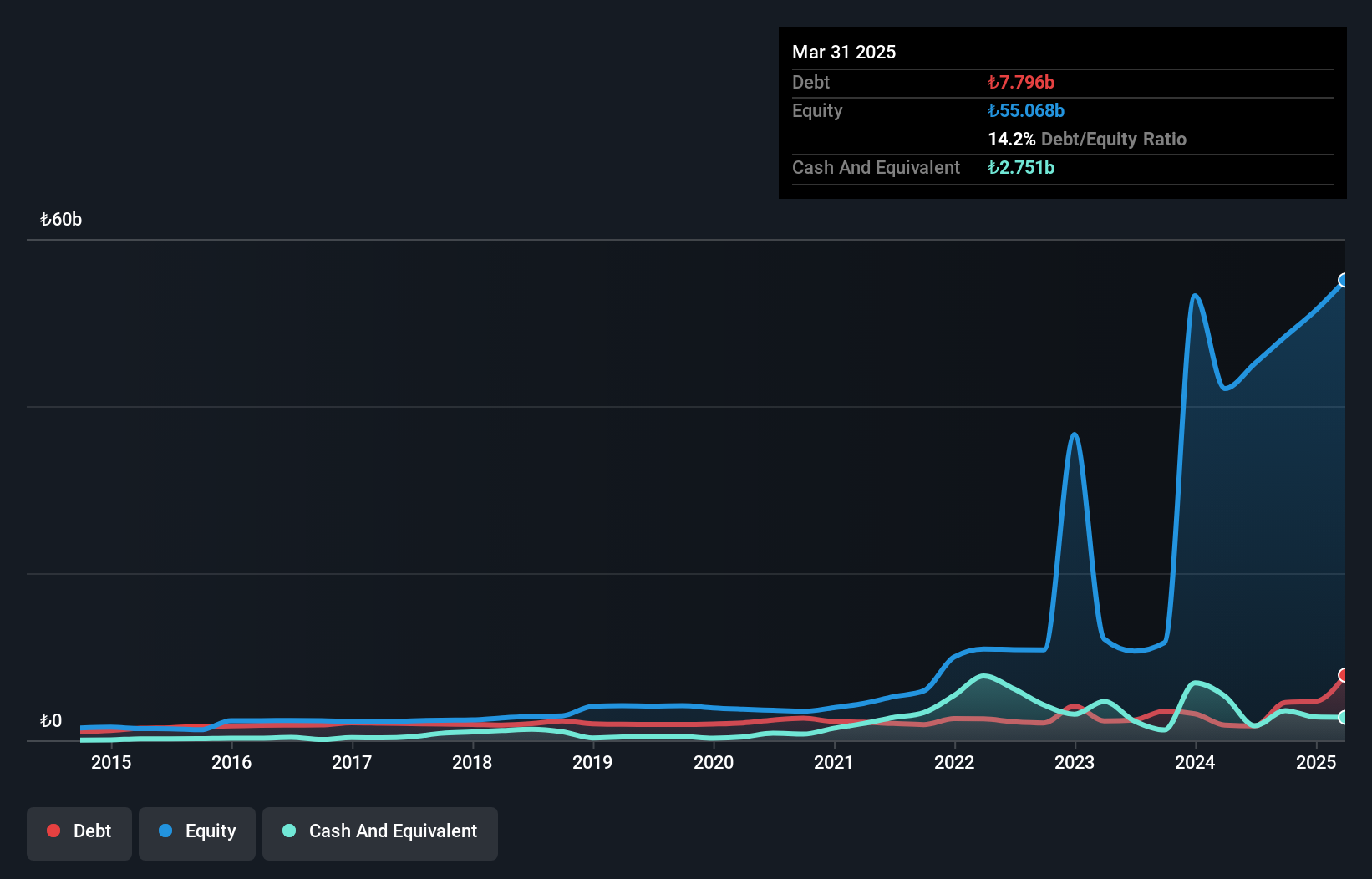

Kardemir Karabük Demir Çelik Sanayi Ve Ticaret, a notable player in the steel industry, has recently turned profitable, outpacing the broader Metals and Mining sector's negative growth of 10.7%. The company's debt to equity ratio impressively decreased from 45.6% to 9.4% over five years, indicating effective debt management. Despite reporting a net loss of TRY 970 million for Q3 compared to TRY 1,465 million last year, Kardemir is trading at an attractive value—74.7% below its estimated fair value—and forecasts suggest earnings could grow by over 136% annually, highlighting potential for future recovery and growth.

Yibitas Yozgat Isçi Birligi Insaat Malzemeleri Ticaret ve Sanayi (IBSE:YBTAS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yibitas Yozgat Isçi Birligi Insaat Malzemeleri Ticaret ve Sanayi A.S. is a company engaged in the construction materials industry, with a market capitalization of TRY11.55 billion.

Operations: YBTAS generates its revenue primarily from the cement segment, which amounts to TRY1.06 billion.

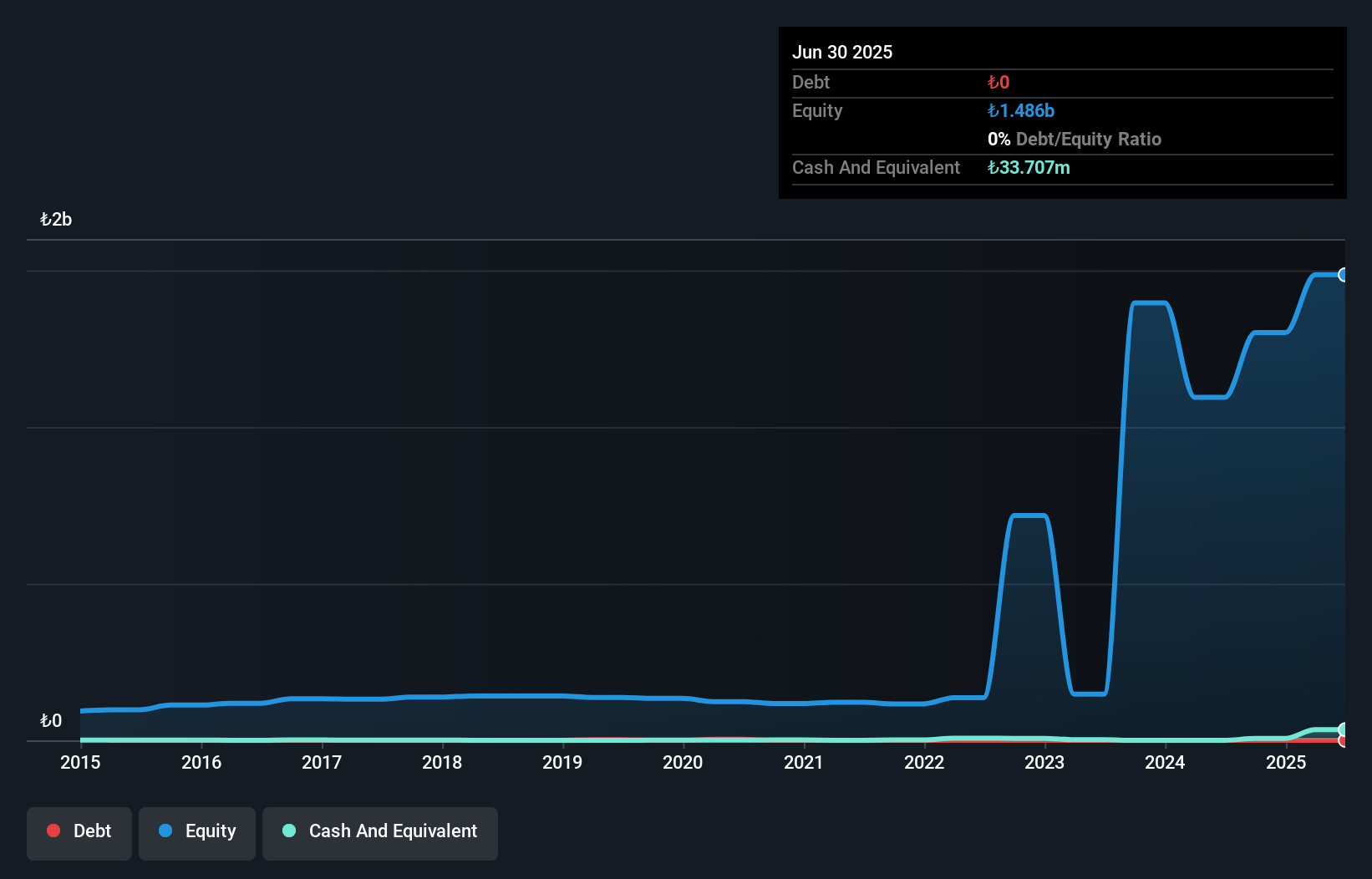

Yibitas, a relatively small player in the industry, has shown notable financial shifts recently. The company reported sales of TRY 523 million for the half-year ending June 2024, down from TRY 575 million last year. Despite a net loss of TRY 112 million compared to a previous net income of TRY 38 million, Yibitas stands debt-free with high-quality earnings and positive free cash flow. Over five years, it eliminated its debt from a ratio of 1.5%. These factors suggest resilience despite recent setbacks and position Yibitas as an intriguing entity within its sector.

Taking Advantage

- Delve into our full catalog of 4645 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kardemir Karabük Demir Çelik Sanayi Ve Ticaret might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:KRDMD

Kardemir Karabük Demir Çelik Sanayi Ve Ticaret

Kardemir Karabük Demir Çelik Sanayi ve Ticaret A.S.

Undervalued with high growth potential.

Market Insights

Community Narratives