- Turkey

- /

- Basic Materials

- /

- IBSE:BOBET

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by political shifts and mixed economic signals, major U.S. indices have shown resilience with record highs in growth stocks, while value-oriented segments face challenges. Amidst these dynamics, dividend stocks continue to attract investors seeking steady income streams and potential stability in an uncertain environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.95% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.63% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.50% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.78% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.54% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.85% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi (IBSE:BOBET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi, operating under the Bosphorus Concrete brand, produces and sells ready-made concrete and aggregates in Turkey with a market cap of TRY9.63 billion.

Operations: The company's revenue from the cement segment amounts to TRY6.76 billion.

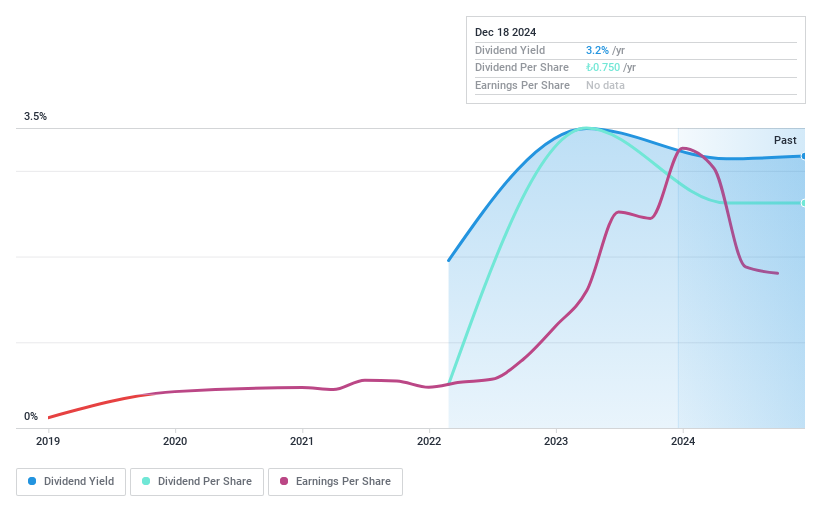

Dividend Yield: 3%

Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi's dividend payments are well covered by earnings and cash flows, with payout ratios of 41.2% and 26.6%, respectively. However, the dividends have been unreliable and volatile over the past three years, despite being in the top 25% of dividend payers in Turkey with a yield of 2.96%. Recent earnings showed a decline, impacting net income significantly compared to last year.

- Dive into the specifics of Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi shares in the market.

Yapi ve Kredi Bankasi (IBSE:YKBNK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yapi ve Kredi Bankasi A.S., along with its subsidiaries, offers a range of banking products and services both in Turkey and internationally, with a market cap of TRY273.85 billion.

Operations: Yapi ve Kredi Bankasi A.S. generates revenue through several segments, including Corporate Banking (TRY13.81 billion), Other Foreign Operations (TRY4.95 billion), Other Domestic Operations (TRY12.60 billion), Commercial and SME Banking (TRY51.26 billion), and Retail Banking, which includes Private Banking and Wealth Management (TRY80.12 billion).

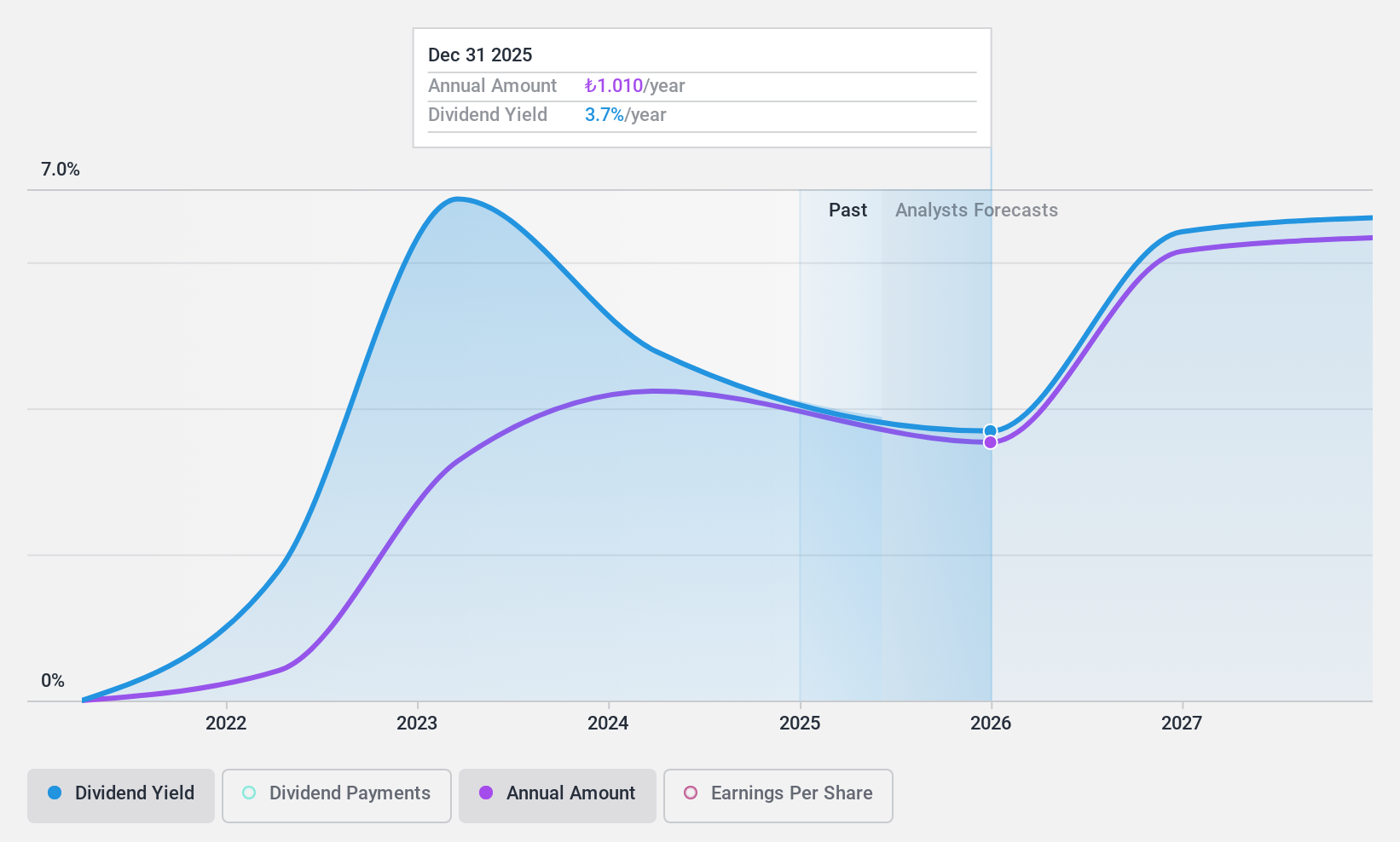

Dividend Yield: 3.7%

Yapi ve Kredi Bankasi's dividend yield of 3.73% places it among the top 25% in Turkey, supported by a low payout ratio of 24.5%, indicating strong coverage by earnings. Despite this, the bank's dividends have been volatile and unreliable over the past decade. Recent earnings showed a significant decline in net income to TRY 22.41 billion from TRY 48.70 billion last year, reflecting challenges that may affect future dividend stability despite forecasted growth in earnings.

- Get an in-depth perspective on Yapi ve Kredi Bankasi's performance by reading our dividend report here.

- According our valuation report, there's an indication that Yapi ve Kredi Bankasi's share price might be on the expensive side.

SAF-Holland (XTRA:SFQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SAF-Holland SE manufactures and supplies chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses with a market cap of €659.13 million.

Operations: SAF-Holland SE generates its revenue from three main segments: €798.85 million from the Americas, €256.11 million from Asia/Pacific (APAC)/China/India, and €914.68 million from Europe, The Middle East, and Africa (EMEA).

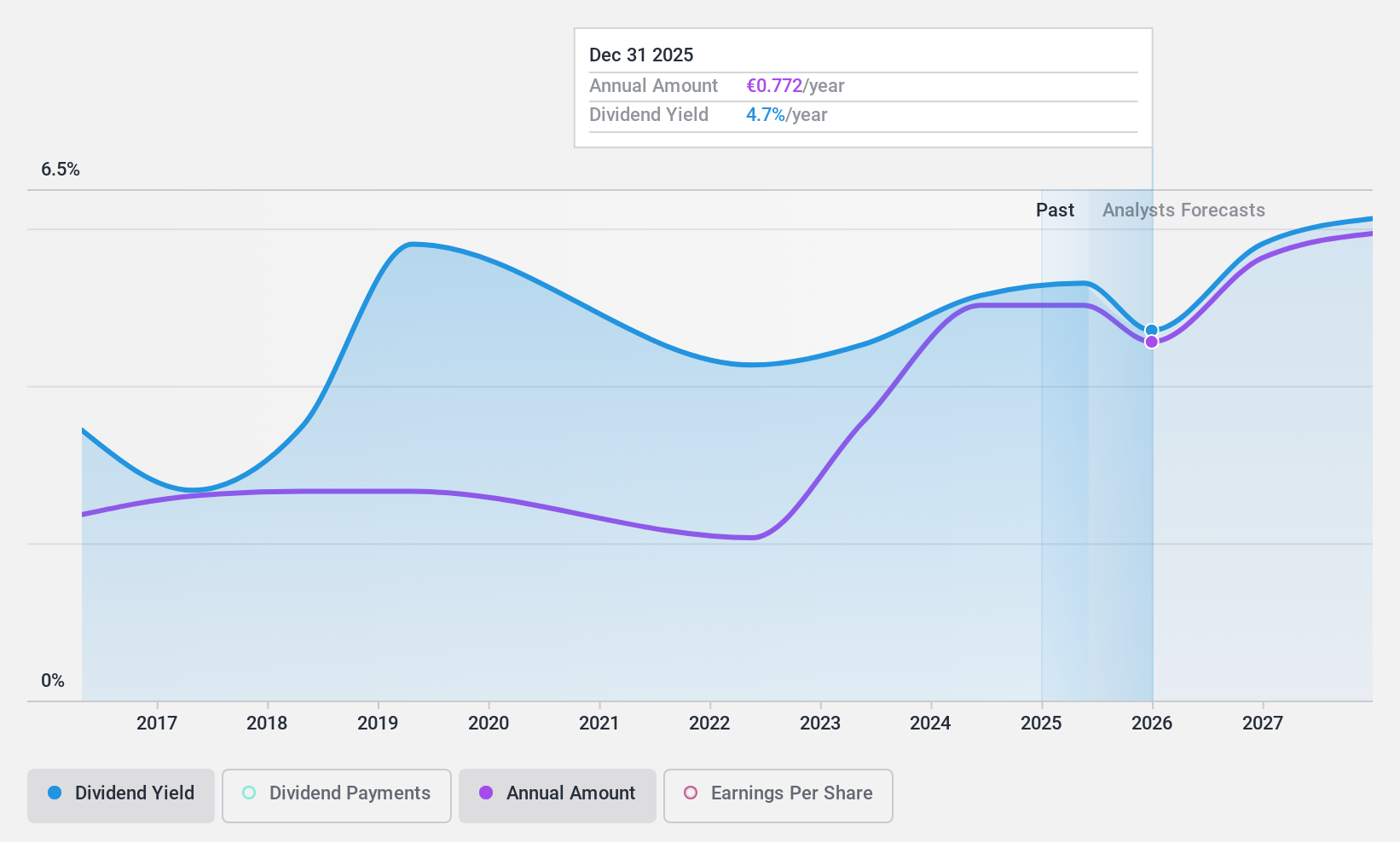

Dividend Yield: 5.9%

SAF-Holland's dividend yield of 5.85% ranks it in the top 25% of German dividend payers, with a payout ratio of 50% and a cash payout ratio of 31.4%, indicating dividends are well covered by earnings and cash flow. However, its dividend history is volatile and unreliable over the past decade. Recent earnings showed a decline, with Q3 net income at €9.31 million from €25.1 million last year, potentially impacting future payouts' stability.

- Click here to discover the nuances of SAF-Holland with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of SAF-Holland shares in the market.

Make It Happen

- Click through to start exploring the rest of the 1935 Top Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:BOBET

Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi

Produces, manufactures, and sells ready-made concrete and aggregates under the Bosphorus Concrete brand in Turkey.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives