Discover Anadolu Efes Biracilik ve Malt Sanayii Anonim Sirketi Among 3 Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by record highs in major U.S. indexes and divergent sector performances, investors are keenly observing the shifting dynamics between growth and value stocks. In this environment, identifying undervalued stocks can be particularly appealing as they may offer potential opportunities for those looking to balance their portfolios amid economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Round One (TSE:4680) | ¥1264.00 | ¥2527.25 | 50% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.26 | US$99.93 | 49.7% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.7% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.32 | US$46.38 | 49.7% |

| EnomotoLtd (TSE:6928) | ¥1441.00 | ¥2877.97 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP289.40 | CLP576.08 | 49.8% |

| Nidaros Sparebank (OB:NISB) | NOK99.60 | NOK198.62 | 49.9% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.10 | HK$54.00 | 49.8% |

| Zalando (XTRA:ZAL) | €34.70 | €69.28 | 49.9% |

| Akeso (SEHK:9926) | HK$66.35 | HK$131.88 | 49.7% |

Let's uncover some gems from our specialized screener.

Anadolu Efes Biracilik ve Malt Sanayii Anonim Sirketi (IBSE:AEFES)

Overview: Anadolu Efes Biracilik ve Malt Sanayii Anonim Sirketi, along with its subsidiaries, is involved in the production, bottling, distribution, and sale of beer, malt, and non-alcoholic beverages both in Turkey and internationally with a market cap of TRY138.26 billion.

Operations: The company's revenue segments comprise TRY64.10 billion from the Beer Group and TRY95.24 billion from Soft Drinks.

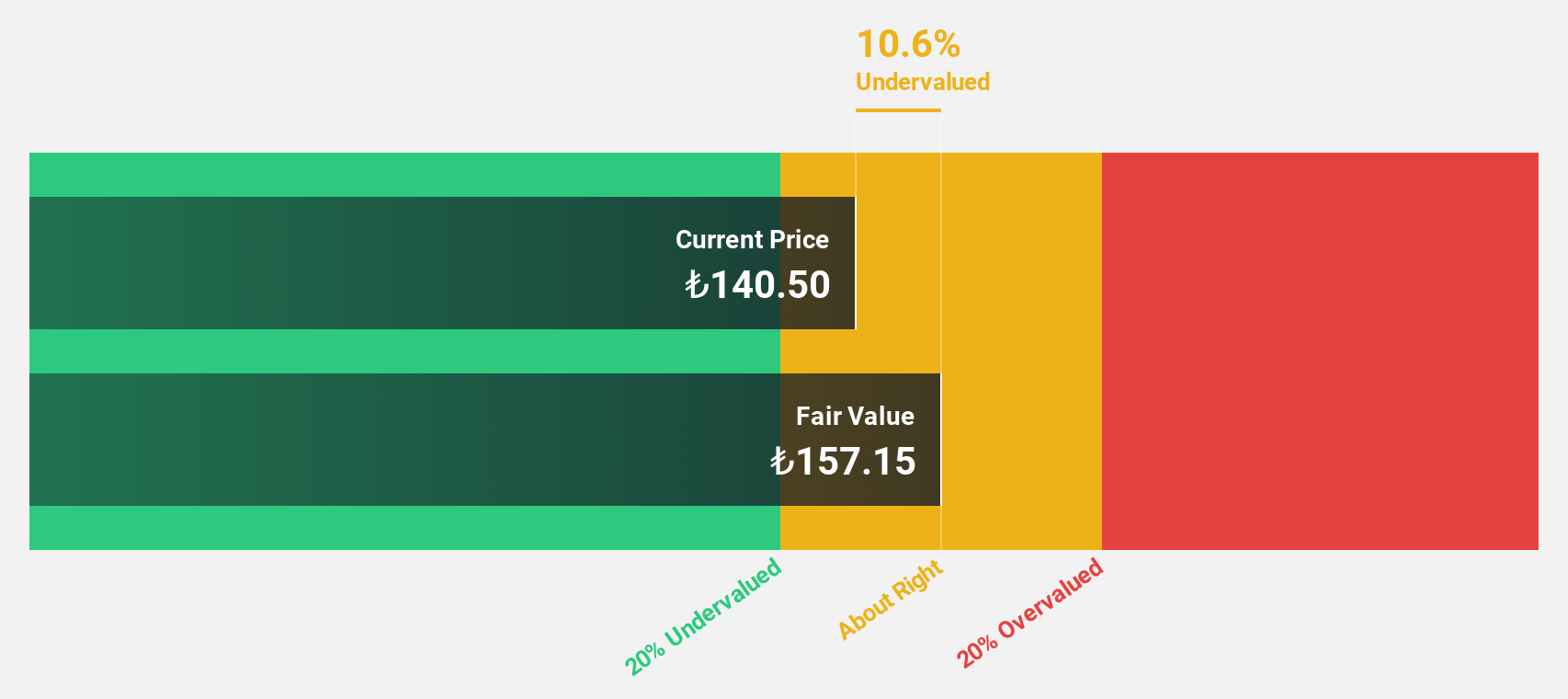

Estimated Discount To Fair Value: 28.0%

Anadolu Efes Biracilik ve Malt Sanayii Anonim Sirketi is trading at TRY 233.5, significantly below its estimated fair value of TRY 324.14, highlighting its undervaluation based on cash flows. Despite a decline in net income to TRY 5.6 billion for the third quarter compared to last year's TRY 13.9 billion, revenue growth is forecasted at a robust 40.3% annually, outpacing the Turkish market's expected growth rate and indicating potential long-term value amidst current profitability challenges.

- Our comprehensive growth report raises the possibility that Anadolu Efes Biracilik ve Malt Sanayii Anonim Sirketi is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Anadolu Efes Biracilik ve Malt Sanayii Anonim Sirketi stock in this financial health report.

Dr. Sulaiman Al Habib Medical Services Group (SASE:4013)

Overview: Dr. Sulaiman Al Habib Medical Services Group operates hospitals, medical complexes, day surgery centers, and pharmaceutical facilities in Saudi Arabia and internationally, with a market cap of SAR104.51 billion.

Operations: The company's revenue segments include Hospitals/Healthcare Facilities generating SAR8.14 billion and Pharmacies contributing SAR2.22 billion.

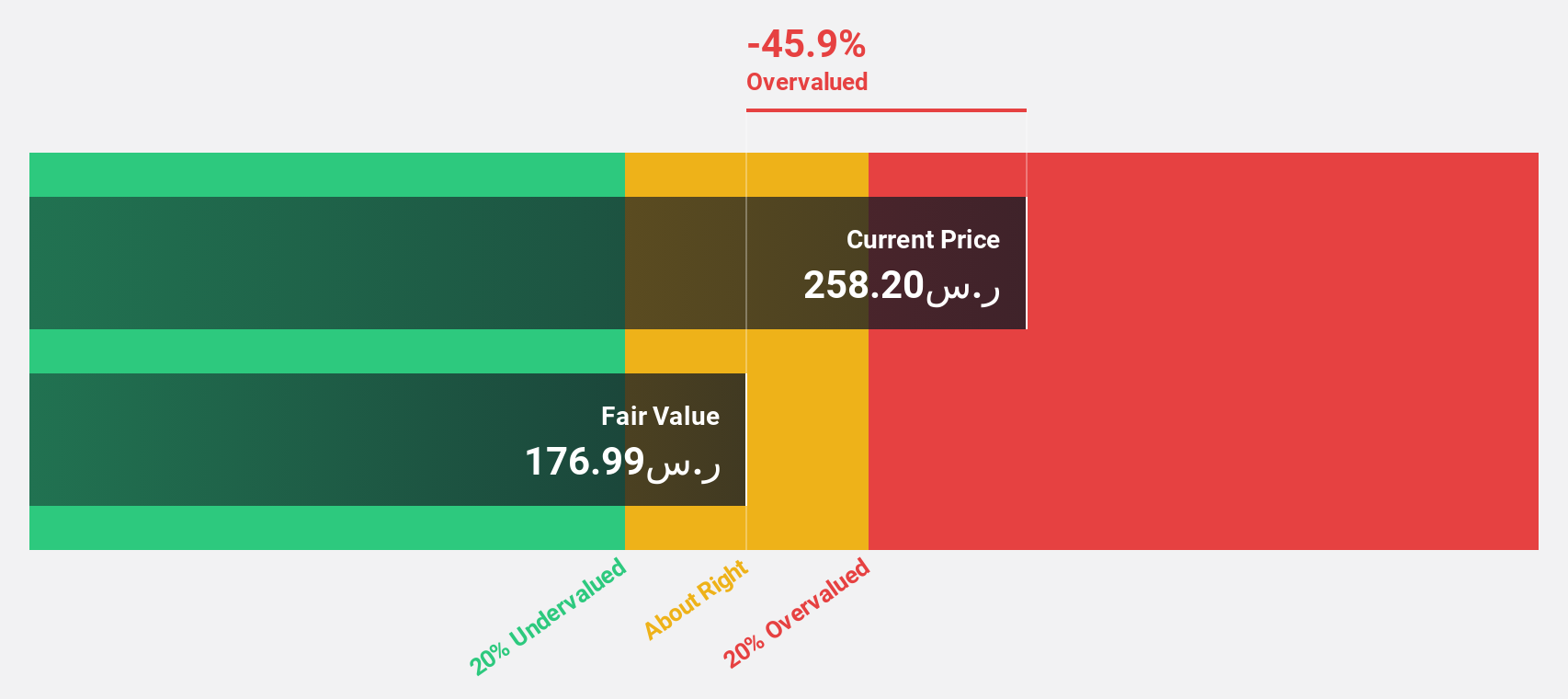

Estimated Discount To Fair Value: 20.5%

Dr. Sulaiman Al Habib Medical Services Group is trading at SAR 298.6, below its estimated fair value of SAR 375.61, indicating undervaluation based on cash flows. Earnings have grown consistently by 20.3% annually over the past five years, with revenue for Q3 reaching SAR 2.98 billion compared to last year's SAR 2.44 billion. Despite high debt levels, earnings are forecast to grow faster than the Saudi Arabian market, supporting its investment potential amidst robust financial performance.

- Our growth report here indicates Dr. Sulaiman Al Habib Medical Services Group may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Dr. Sulaiman Al Habib Medical Services Group's balance sheet health report.

Zalando (XTRA:ZAL)

Overview: Zalando SE operates an online platform for fashion and lifestyle products, with a market cap of €8.91 billion.

Operations: The company generates revenue from its online platform dedicated to fashion and lifestyle products, with segment adjustments amounting to €24.79 billion.

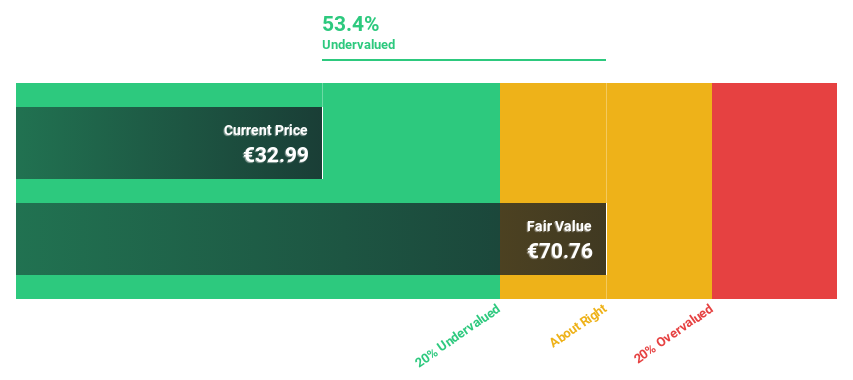

Estimated Discount To Fair Value: 49.9%

Zalando is trading at €34.7, significantly below its estimated fair value of €69.28, suggesting it is undervalued based on cash flows. The company reported Q3 sales of €2.39 billion and net income of €44.3 million, a notable turnaround from the previous year's loss. Earnings are forecast to grow 21.9% annually over the next three years, outpacing the German market's growth rate, despite a modest revenue growth forecast of 5.8%.

- According our earnings growth report, there's an indication that Zalando might be ready to expand.

- Take a closer look at Zalando's balance sheet health here in our report.

Summing It All Up

- Click through to start exploring the rest of the 887 Undervalued Stocks Based On Cash Flows now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AEFES

Anadolu Efes Biracilik ve Malt Sanayii Anonim Sirketi

Engages in the production, bottling, distribution, and sale of beer, malt, and non-alcoholic beverages in Turkey and internationally.

High growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives