- China

- /

- Medical Equipment

- /

- SHSE:603301

Global Undiscovered Gems Featuring Shanghai Yaohua Pilkington Glass Group And Two Promising Small Caps

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates and economic indicators, smaller-cap stocks have shown resilience, benefiting from recent hopes of potential rate cuts. In this environment, identifying undiscovered gems becomes crucial, as these stocks often possess unique growth potential and can thrive amid broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 5.00% | 14.21% | 13.26% | ★★★★★★ |

| Natural Food International Holding | NA | 8.04% | 37.71% | ★★★★★★ |

| VICOM | NA | 6.95% | 4.06% | ★★★★★★ |

| Daphne International Holdings | NA | -5.92% | 82.03% | ★★★★★★ |

| HG Metal Manufacturing | 3.75% | 8.47% | 6.94% | ★★★★★★ |

| Taiyo KagakuLtd | 0.67% | 5.77% | 2.06% | ★★★★★☆ |

| CTCI Advanced Systems | 33.93% | 20.38% | 21.25% | ★★★★★☆ |

| China New City Group | 85.52% | 30.33% | 17.38% | ★★★★☆☆ |

| Li Ming Development Construction | 170.96% | 14.13% | 22.83% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Shanghai Yaohua Pilkington Glass Group (SHSE:600819)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Yaohua Pilkington Glass Group Co., Ltd. operates in the glass manufacturing industry and has a market capitalization of CN¥5.41 billion.

Operations: The company generates revenue primarily from its glass manufacturing operations. The net profit margin has shown fluctuations, reflecting changes in operational efficiency and market conditions.

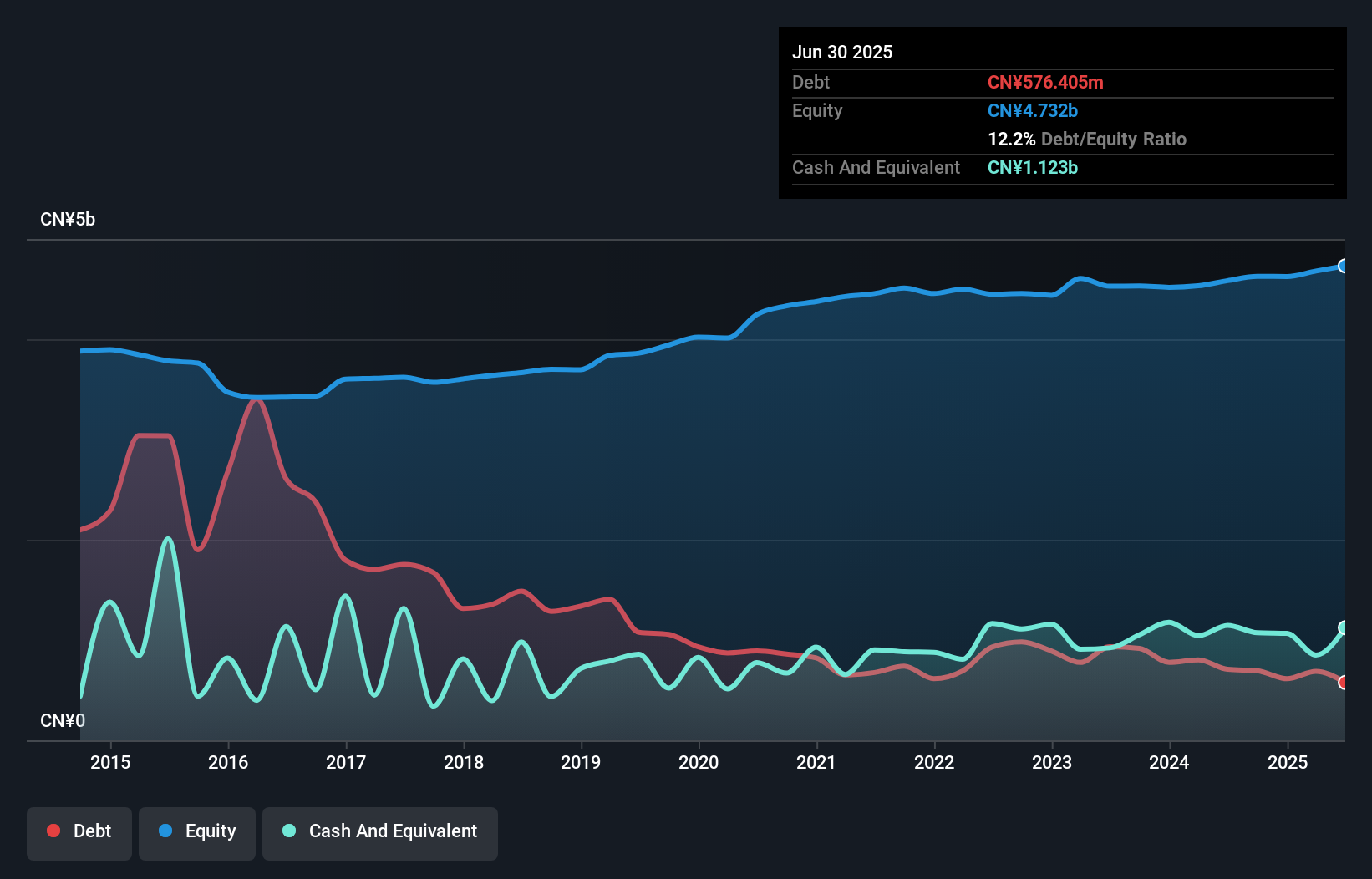

Shanghai Yaohua Pilkington Glass Group, a smaller player in the glass industry, has shown impressive financial resilience. Recently, its earnings surged by 282.5%, far outpacing the Basic Materials industry's 21.2% growth rate. The company's debt to equity ratio improved significantly from 21% to 12.2% over five years, indicating prudent financial management. Despite a slight dip in sales from CNY 2,750 million to CNY 2,618 million for the half-year ending June 2025, net income rose to CNY 86 million from CNY 63 million last year. With interest payments well covered by EBIT at a robust factor of 19x and high-quality earnings reported, Shanghai Yaohua seems poised for continued stability amidst market fluctuations.

Zhende Medical (SHSE:603301)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhende Medical Co., Ltd. focuses on the research, development, production, and sale of medical care and protective equipment in China with a market capitalization of CN¥7.19 billion.

Operations: Zhende Medical generates revenue from the sale of medical care and protective equipment. The company's financial performance is characterized by a net profit margin that reflects its operational efficiency.

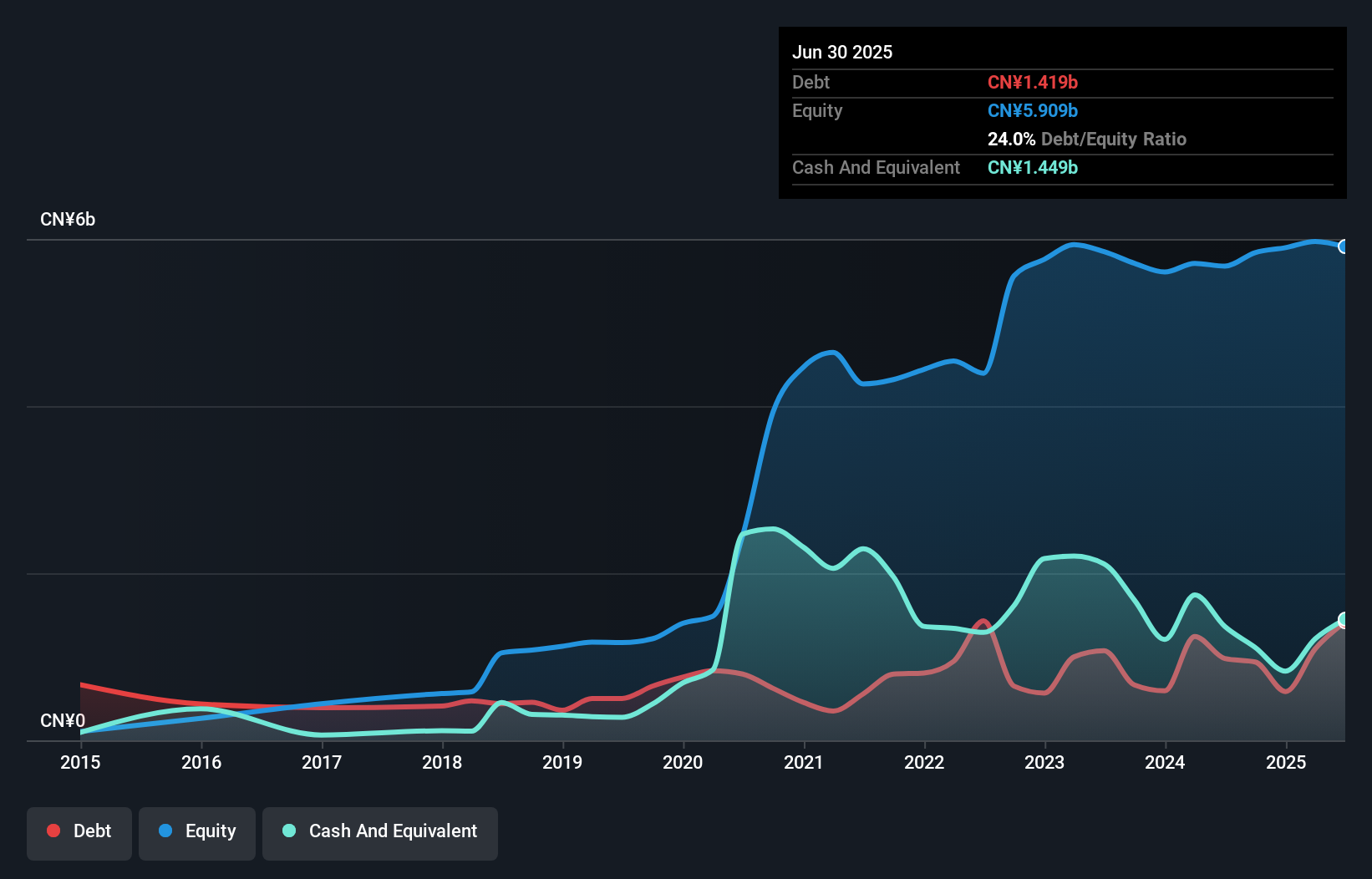

Zhende Medical, a smaller player in the medical equipment sector, has shown impressive earnings growth of 188% over the past year, outpacing industry peers. Despite a dip in net income to CN¥127.76 million for the first half of 2025 compared to CN¥161.11 million last year, its debt management is strong with interest payments covered 341 times by EBIT and a reduced debt-to-equity ratio from 32.3% to 24% over five years. Trading at a value perceived as 32% below fair value suggests potential upside while its strategic ventures like the Saudi joint factory enhance regional market presence and future prospects.

- Unlock comprehensive insights into our analysis of Zhende Medical stock in this health report.

Understand Zhende Medical's track record by examining our Past report.

Convano (TSE:6574)

Simply Wall St Value Rating: ★★★★★★

Overview: Convano Inc. operates in the management and franchising of nail salons in Japan with a market capitalization of ¥103.17 billion.

Operations: Convano generates revenue primarily from its Nail Business, which contributes ¥3.09 billion, supplemented by the Healthcare and Investment and Advisory segments with ¥100.41 million and ¥55.29 million respectively.

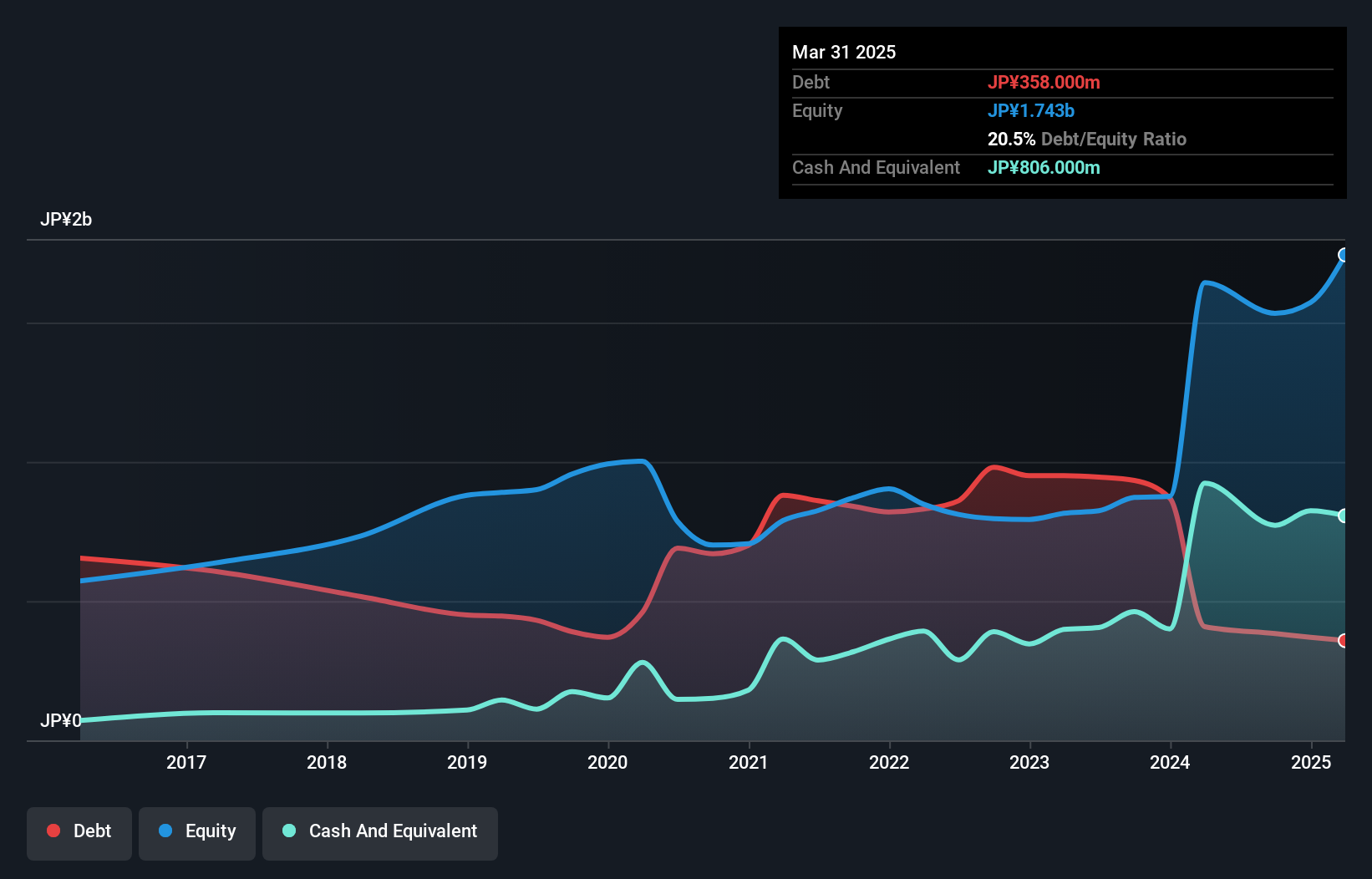

Convano has emerged as a dynamic player, recently achieving profitability and showcasing robust financial health. The company's debt to equity ratio impressively decreased from 45.9% to 20.5% over five years, indicating effective debt management. With interest payments well covered by EBIT at 17.9 times, Convano's financial stability is evident despite a highly volatile share price in recent months. The firm completed a significant stock split and private placement, raising ¥6 billion for strategic initiatives with an exercise period extending until July 2027. These developments suggest Convano is positioning itself for future growth within its industry landscape.

- Delve into the full analysis health report here for a deeper understanding of Convano.

Review our historical performance report to gain insights into Convano's's past performance.

Next Steps

- Embark on your investment journey to our 2946 Global Undiscovered Gems With Strong Fundamentals selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhende Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603301

Zhende Medical

Engages in the research and development, production, and sale of medical care and protective equipment in China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)