Discover 3 Promising Penny Stocks With Market Caps Over US$400M

Reviewed by Simply Wall St

Global markets have recently experienced a volatile period, with U.S. equities declining amid inflation concerns and political uncertainty, leading to a correction in small-cap stocks. Despite these challenges, penny stocks continue to capture investor interest as they often represent smaller or newer companies that can offer growth potential at lower price points. While the term "penny stocks" may seem outdated, their appeal remains relevant for those seeking under-the-radar opportunities backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.805 | £463.19M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £3.61 | £413.58M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.898 | £715.19M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.44 | THB2.66B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.575 | A$66.82M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR297.09M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.49 | £66.56M | ★★★★☆☆ |

Click here to see the full list of 5,814 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Fangda Special Steel Technology (SHSE:600507)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fangda Special Steel Technology Co., Ltd. operates in the steel industry, focusing on the production and sale of special steel products, with a market cap of approximately CN¥8.61 billion.

Operations: Revenue Segments: No specific revenue segments have been reported for this company.

Market Cap: CN¥8.61B

Fangda Special Steel Technology, with a market cap of CN¥8.61 billion, has seen a decline in earnings and profit margins over the past year, with net income dropping significantly from CN¥586.75 million to CN¥189 million. Despite this, the company maintains strong financial health as short-term assets exceed both short and long-term liabilities. The recent share buyback program completed in December 2024 reflects efforts to uphold shareholder value amidst challenges like negative operating cash flow and low return on equity (3.1%). The management team is relatively new, averaging 1.6 years in tenure, which may impact strategic continuity.

- Click here to discover the nuances of Fangda Special Steel Technology with our detailed analytical financial health report.

- Examine Fangda Special Steel Technology's earnings growth report to understand how analysts expect it to perform.

China Fangda Group (SZSE:000055)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Fangda Group Co., Ltd. manufactures and sells curtain wall materials both in China and internationally, with a market cap of CN¥3.12 billion.

Operations: The company has not reported specific revenue segments.

Market Cap: CN¥3.12B

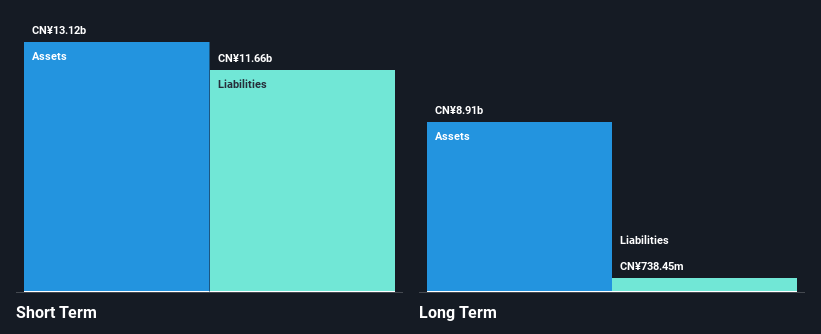

China Fangda Group, with a market cap of CN¥3.12 billion, has faced challenges with declining net income from CN¥266.44 million to CN¥149.71 million over the past year, while maintaining stable weekly volatility at 4%. The company's financial health is supported by short-term assets exceeding both short and long-term liabilities and satisfactory net debt to equity ratio of 29.4%. However, its profit margins have decreased from 7.5% to 3.6%, and earnings growth remains negative, impacting its return on equity at a low 2.6%. Despite these issues, interest payments are well-covered by EBIT at six times coverage.

- Dive into the specifics of China Fangda Group here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into China Fangda Group's track record.

Zhanjiang Guolian Aquatic Products (SZSE:300094)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhanjiang Guolian Aquatic Products Co., Ltd. operates in the aquaculture industry, focusing on the processing and sale of seafood products, with a market cap of CN¥4.03 billion.

Operations: No specific revenue segments are reported for this company.

Market Cap: CN¥4.03B

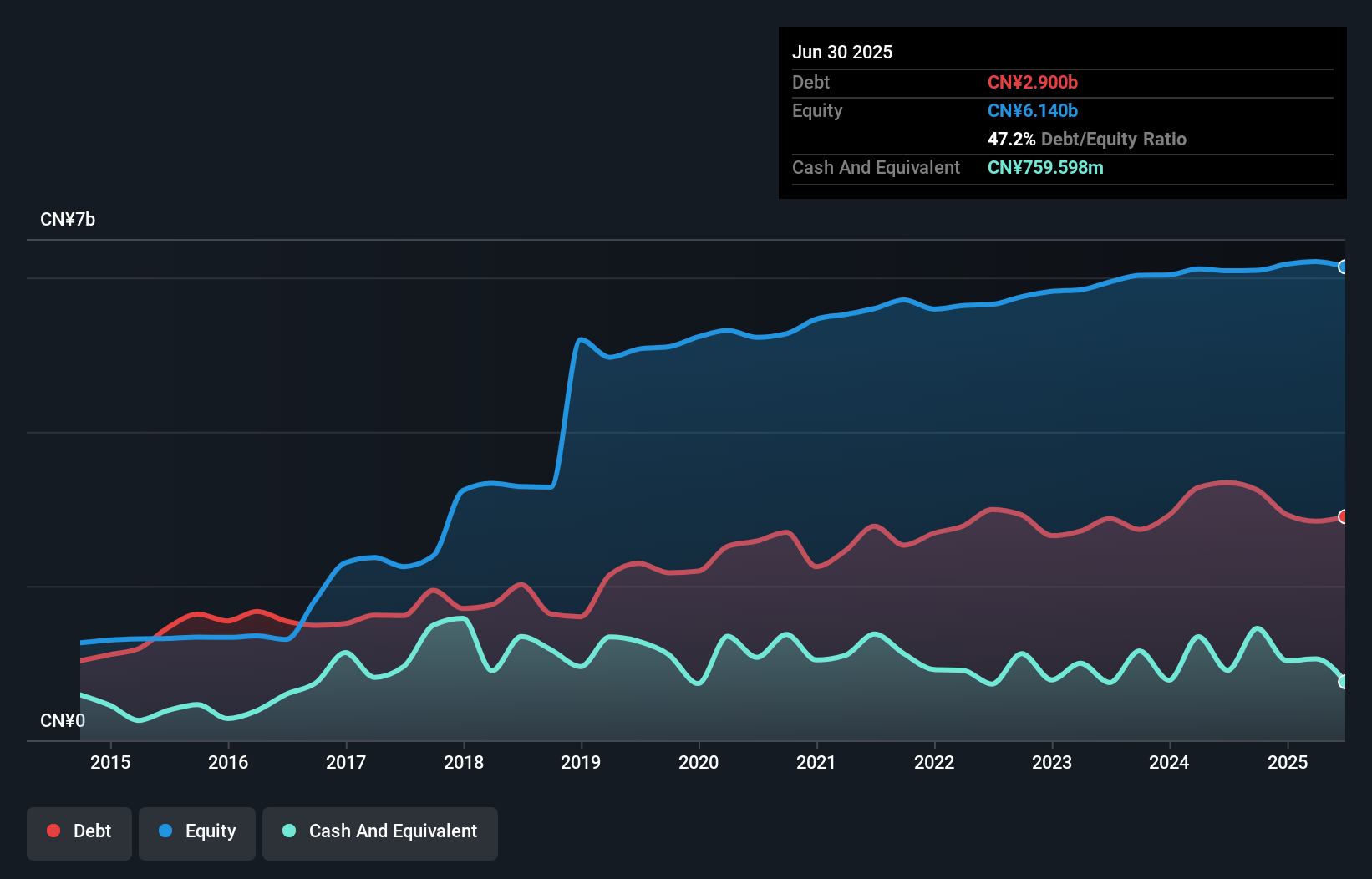

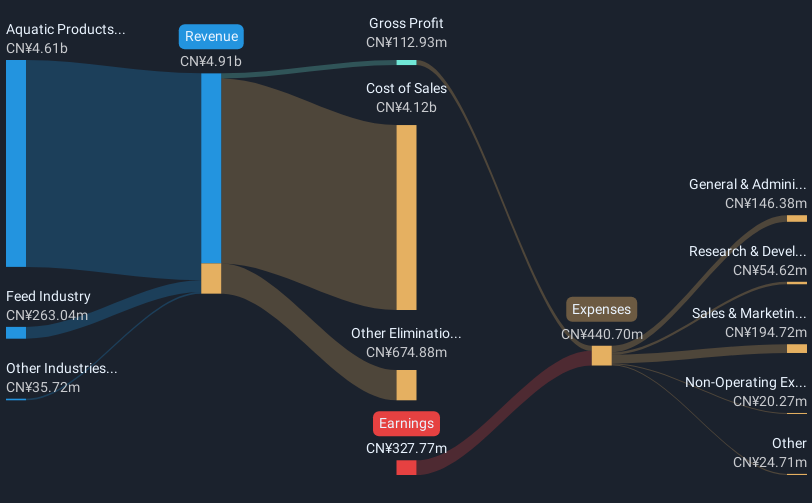

Zhanjiang Guolian Aquatic Products, with a market cap of CN¥4.03 billion, is unprofitable but has reduced its losses over the past five years by 2.1% annually. The company maintains a high net debt to equity ratio of 42.1%, though short-term assets of CN¥3.5 billion effectively cover both short and long-term liabilities. Despite negative return on equity at -15.58%, it benefits from a stable cash runway exceeding three years due to positive free cash flow growth. Recent earnings show reduced net loss from CN¥235.16 million to CN¥79.56 million year-over-year, amidst sales decline and share price volatility.

- Click to explore a detailed breakdown of our findings in Zhanjiang Guolian Aquatic Products' financial health report.

- Learn about Zhanjiang Guolian Aquatic Products' historical performance here.

Where To Now?

- Reveal the 5,814 hidden gems among our Penny Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhanjiang Guolian Aquatic Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300094

Zhanjiang Guolian Aquatic Products

Zhanjiang Guolian Aquatic Products Co., Ltd.

Excellent balance sheet and good value.