- China

- /

- Electronic Equipment and Components

- /

- SZSE:002600

3 Stocks Estimated To Be Trading Below Their Intrinsic Value By Up To 48%

Reviewed by Simply Wall St

As global markets navigate a period of uncertainty marked by inflation concerns and political developments, investors are increasingly focused on identifying opportunities amidst the volatility. With U.S. equities experiencing declines and small-cap stocks underperforming, attention turns to value stocks that may be trading below their intrinsic value. In such a climate, recognizing undervalued stocks can be crucial for investors looking to capitalize on potential market inefficiencies while maintaining a balanced approach in their portfolios.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥17.11 | CN¥34.17 | 49.9% |

| Clear Secure (NYSE:YOU) | US$26.72 | US$53.44 | 50% |

| NBTM New Materials Group (SHSE:600114) | CN¥15.33 | CN¥31.06 | 50.6% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.35 | CN¥100.73 | 50% |

| Ningbo Haitian Precision MachineryLtd (SHSE:601882) | CN¥20.34 | CN¥40.47 | 49.7% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.99 | CLP580.39 | 49.9% |

| Constellium (NYSE:CSTM) | US$10.35 | US$20.64 | 49.8% |

| Andrada Mining (AIM:ATM) | £0.0235 | £0.047 | 49.9% |

| Vogo (ENXTPA:ALVGO) | €2.95 | €5.88 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5874.00 | ¥11676.73 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

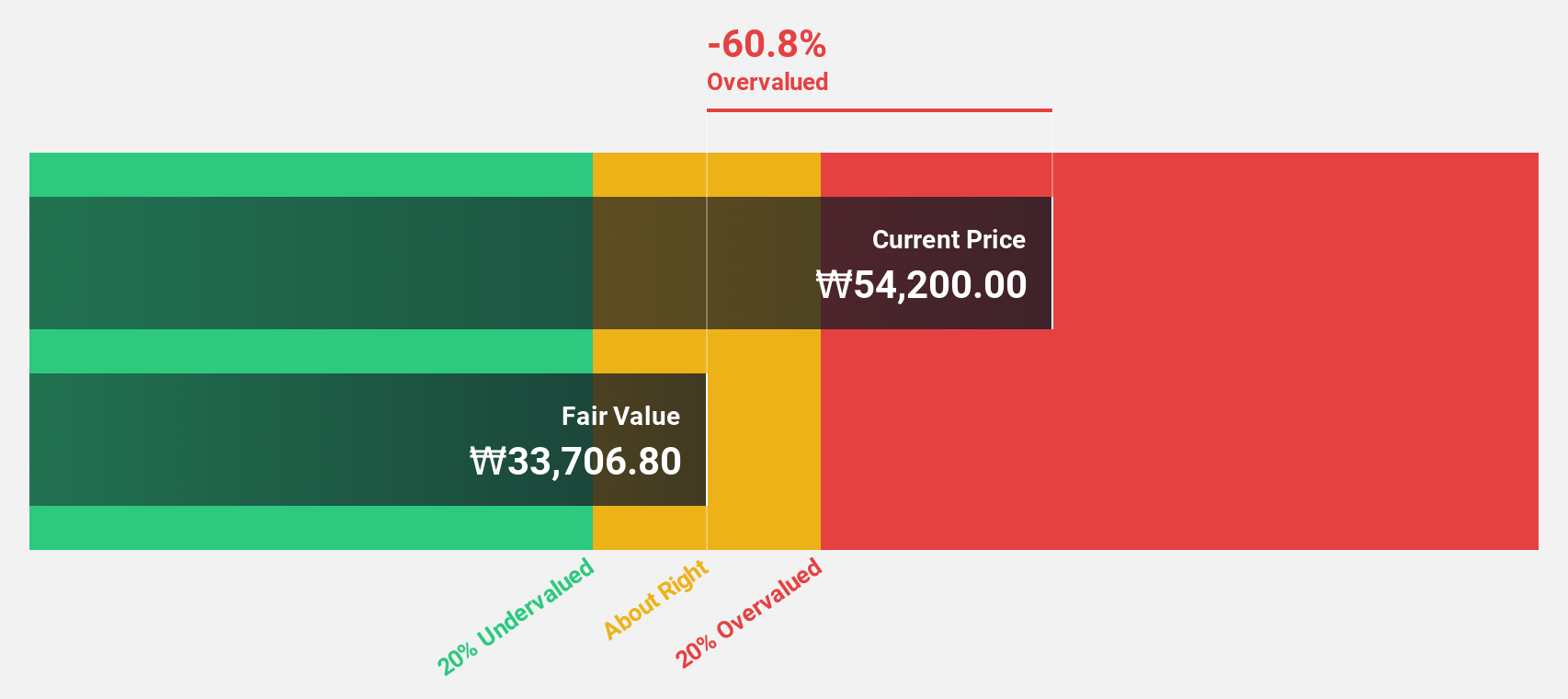

Hanwha Systems (KOSE:A272210)

Overview: Hanwha Systems Co., Ltd. manufactures and sells various military equipment in South Korea and internationally, with a market cap of ₩4.38 trillion.

Operations: The company's revenue is primarily derived from the Defense Sector at ₩1.96 trillion and the ICT Division at ₩685.09 billion, with additional contributions from New Business at ₩11.53 billion.

Estimated Discount To Fair Value: 48%

Hanwha Systems is currently trading at ₩23,750, significantly below its estimated fair value of ₩45,645.6, suggesting it may be undervalued based on cash flows. Despite a volatile share price and reduced profit margins from 11.6% to 5.2%, the company's earnings are forecasted to grow significantly at 31% annually over the next three years, outpacing the South Korean market average of 28.9%.

- The growth report we've compiled suggests that Hanwha Systems' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Hanwha Systems' balance sheet health report.

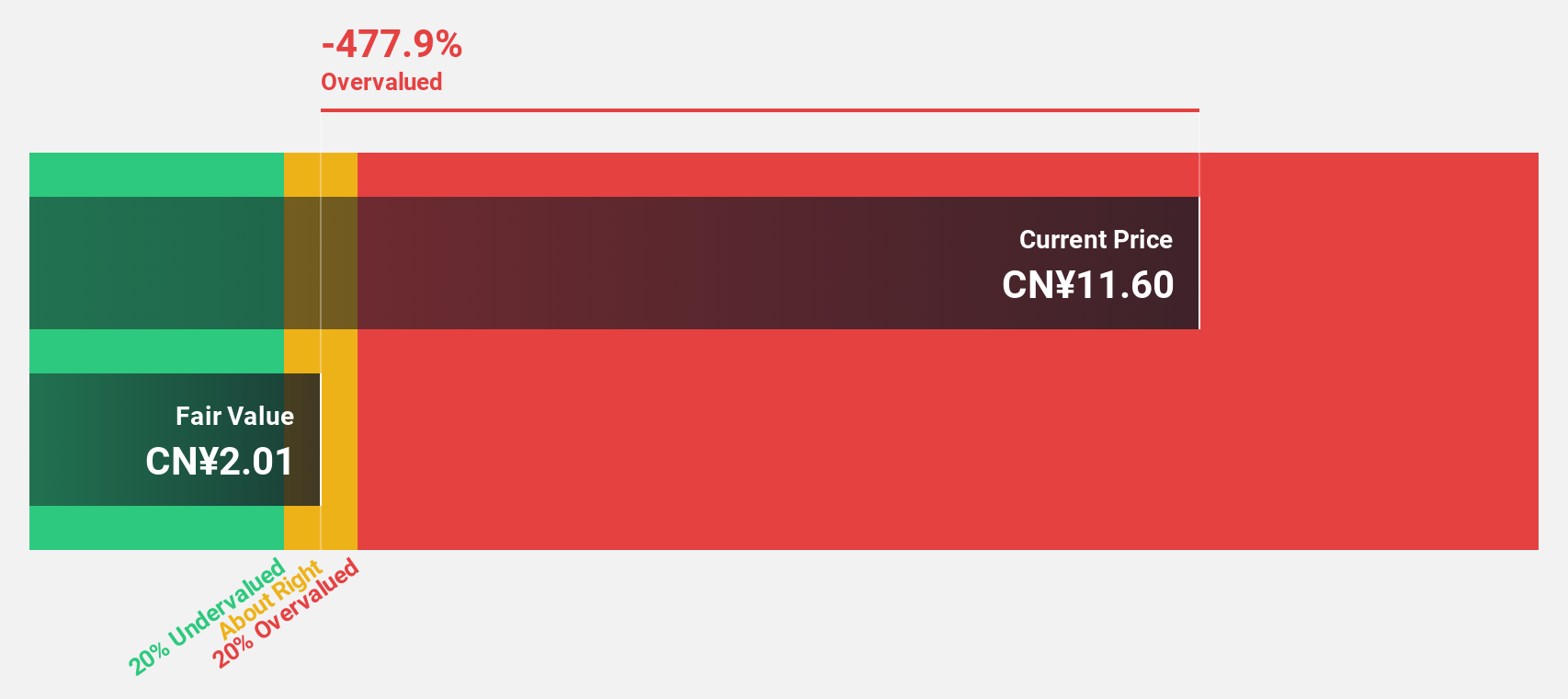

Shanghai Pret Composites (SZSE:002324)

Overview: Shanghai Pret Composites Co., Ltd. is involved in the R&D, production, sale, and service of polymer and composite materials in China with a market cap of CN¥9.63 billion.

Operations: Shanghai Pret Composites Co., Ltd. generates revenue through its activities in the research, development, production, sale, and service of polymer and composite materials within China.

Estimated Discount To Fair Value: 29.6%

Shanghai Pret Composites is trading at CN¥8.75, 29.6% below its estimated fair value of CN¥12.43, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from 5% to 3.5%, the company is projected to experience substantial revenue growth at 21.2% annually over the next three years, surpassing the Chinese market average of 13.3%. However, its return on equity is expected to remain low at 8.9%.

- In light of our recent growth report, it seems possible that Shanghai Pret Composites' financial performance will exceed current levels.

- Dive into the specifics of Shanghai Pret Composites here with our thorough financial health report.

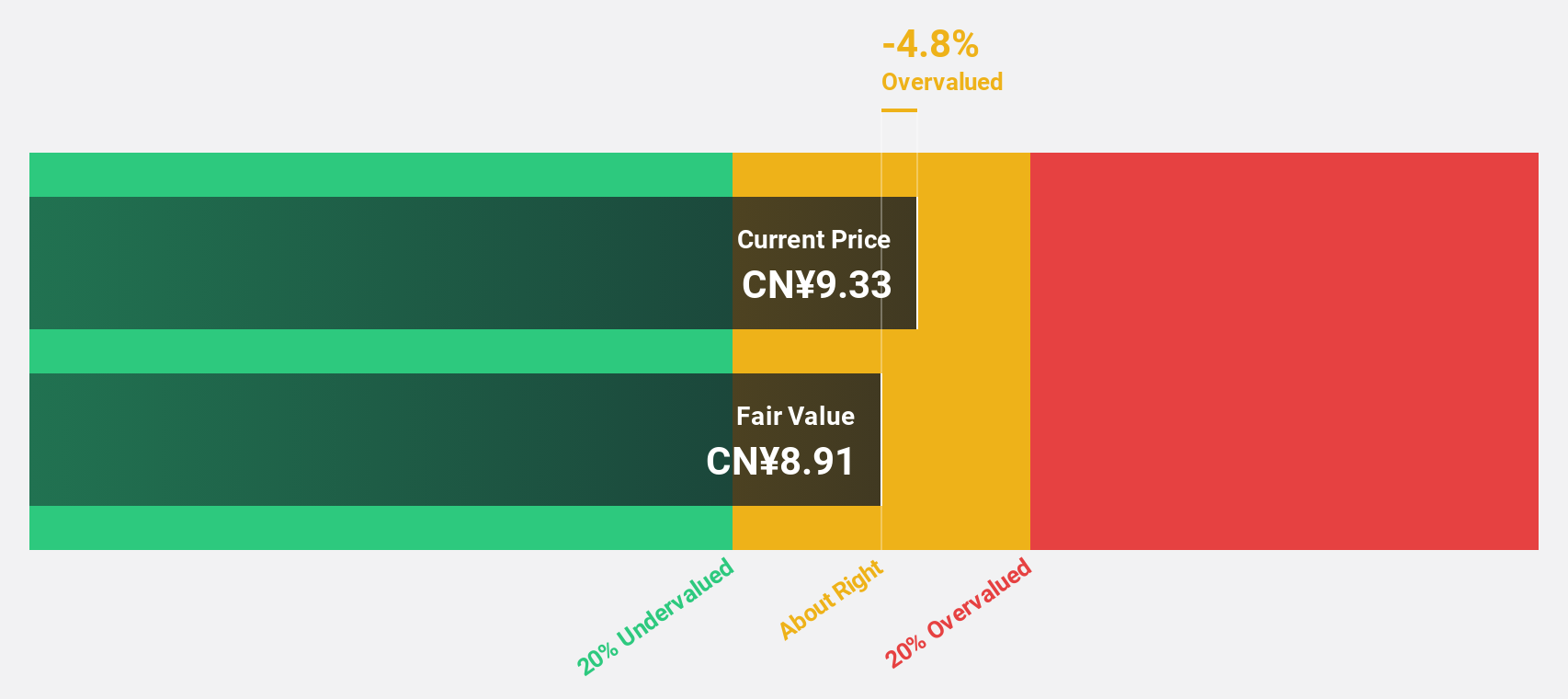

Lingyi iTech (Guangdong) (SZSE:002600)

Overview: Lingyi iTech (Guangdong) Company offers smart manufacturing services and solutions, with a market cap of CN¥52.20 billion.

Operations: Lingyi iTech generates its revenue through diverse segments, including smart manufacturing services and solutions.

Estimated Discount To Fair Value: 26.2%

Lingyi iTech (Guangdong) is trading at CN¥7.48, 26.2% below its fair value estimate of CN¥10.14, suggesting it may be undervalued based on cash flows. The company's earnings are forecast to grow significantly at 25.5% annually, outpacing the Chinese market's average growth rate of 24.8%. However, despite strong revenue growth from CN¥24.65 billion to CN¥31.48 billion year-over-year, profit margins have decreased from 6.5% to 3.9%.

- Insights from our recent growth report point to a promising forecast for Lingyi iTech (Guangdong)'s business outlook.

- Navigate through the intricacies of Lingyi iTech (Guangdong) with our comprehensive financial health report here.

Taking Advantage

- Gain an insight into the universe of 875 Undervalued Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002600

Lingyi iTech (Guangdong)

Provides smart manufacturing services and solutions in China and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion