- China

- /

- Entertainment

- /

- SHSE:603444

3 Dividend Stocks To Consider With Up To 4.6% Yield

Reviewed by Simply Wall St

In a week marked by choppy markets and inflation concerns, U.S. equities faced declines as investors weighed resilient labor market data against the Federal Reserve's hawkish stance on interest rates. Amidst this backdrop of uncertainty, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for investors seeking to navigate volatile market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.74% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.21% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.17% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

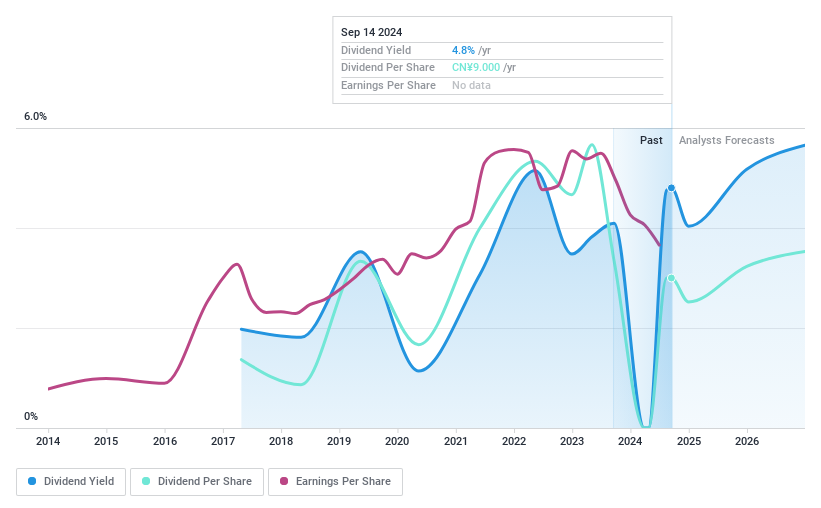

G-bits Network Technology (Xiamen) (SHSE:603444)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: G-bits Network Technology (Xiamen) Co., Ltd. operates in the gaming industry, focusing on the development and distribution of online games, with a market cap of CN¥14.91 billion.

Operations: G-bits Network Technology (Xiamen) Co., Ltd. generates revenue primarily through its activities in the gaming sector, particularly from developing and distributing online games.

Dividend Yield: 3.1%

G-bits Network Technology offers a dividend yield of 3.11%, ranking it in the top 25% of CN market payers. Its dividends are well-covered by earnings and cash flows, with payout ratios at 50.8% and 40%, respectively, though its track record is volatile over its eight-year history. Despite trading at a significant discount to estimated fair value, recent earnings have declined year-over-year, potentially impacting future dividend stability and growth prospects.

- Get an in-depth perspective on G-bits Network Technology (Xiamen)'s performance by reading our dividend report here.

- Our valuation report here indicates G-bits Network Technology (Xiamen) may be undervalued.

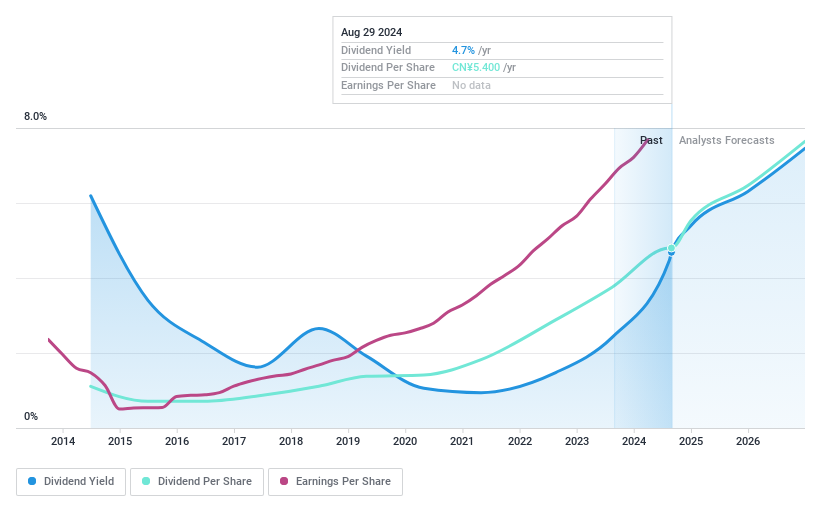

Luzhou LaojiaoLtd (SZSE:000568)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Luzhou Laojiao Co., Ltd is a company that provides liquor products in China with a market cap of CN¥166.83 billion.

Operations: Luzhou Laojiao Co., Ltd generates its revenue from the sale of liquor products in China.

Dividend Yield: 4.6%

Luzhou Laojiao offers a dividend yield in the top 25% of the CN market, with dividends covered by earnings and cash flows, maintaining payout ratios at 55.6% and 62%, respectively. The proposed CNY 13.58 per 10 shares dividend highlights its commitment to shareholders despite a historically volatile track record. Strong recent earnings growth supports future payouts, yet past volatility raises concerns about long-term reliability despite trading below estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of Luzhou LaojiaoLtd.

- In light of our recent valuation report, it seems possible that Luzhou LaojiaoLtd is trading behind its estimated value.

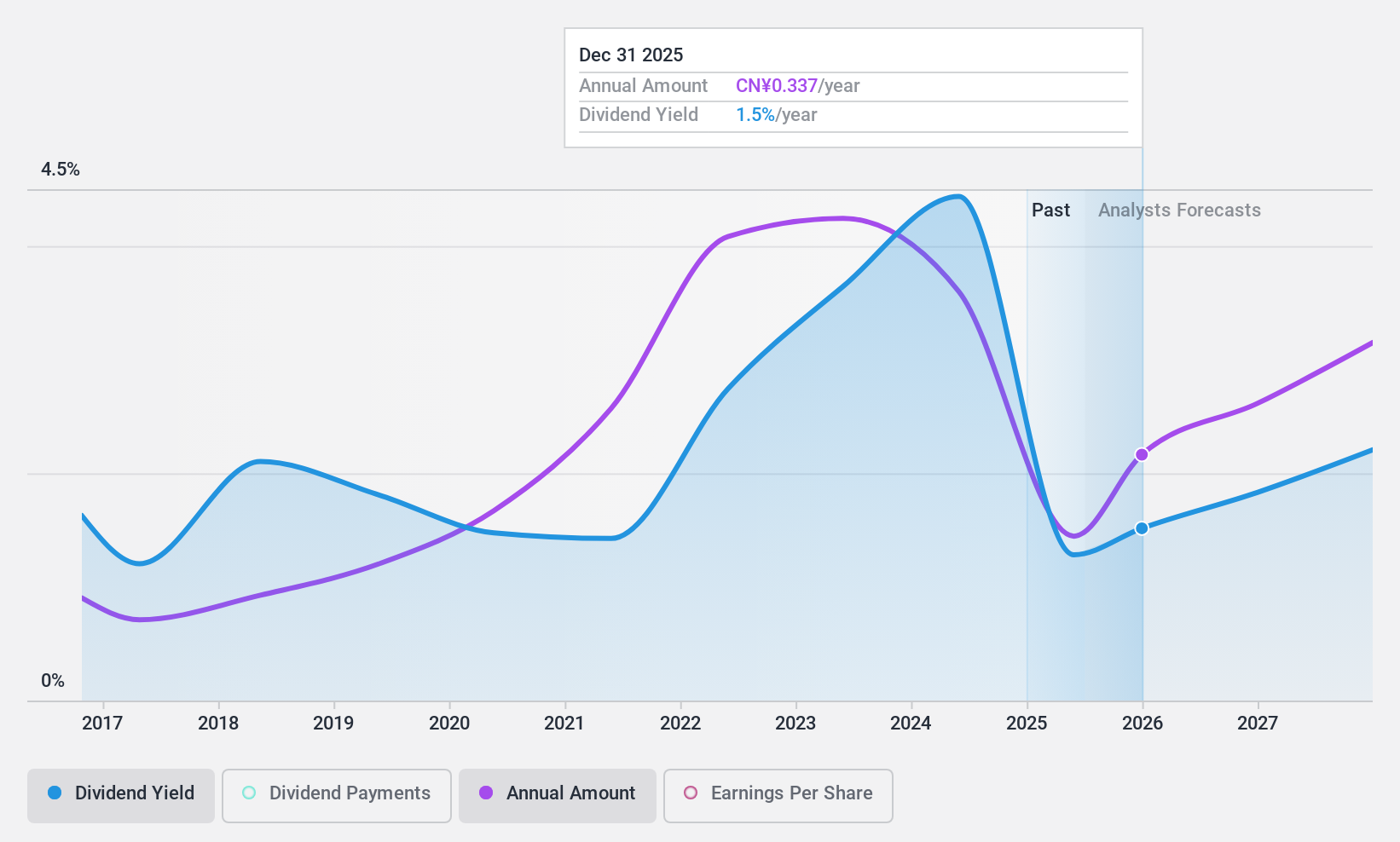

Sinoma Science & TechnologyLtd (SZSE:002080)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinoma Science & Technology Co., Ltd. is involved in the research, development, design, manufacture, and sale of specialty fiber composite materials in China with a market cap of CN¥20.96 billion.

Operations: Sinoma Science & Technology Co., Ltd. generates revenue from its operations in the specialty fiber composite materials sector within China.

Dividend Yield: 4.5%

Sinoma Science & Technology Ltd. provides a dividend yield in the top 25% of the CN market, but its dividends have been historically volatile and are not well covered by cash flows, with a high cash payout ratio of 589.7%. Despite trading at good value with a P/E ratio below the market average, recent earnings declines and reduced profit margins pose challenges for sustaining payouts. Recent board changes may impact future strategic direction.

- Click here to discover the nuances of Sinoma Science & TechnologyLtd with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Sinoma Science & TechnologyLtd is priced lower than what may be justified by its financials.

Make It Happen

- Investigate our full lineup of 2007 Top Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603444

G-bits Network Technology (Xiamen)

G-bits Network Technology (Xiamen) Co., Ltd.

Flawless balance sheet, undervalued and pays a dividend.