Market Participants Recognise Guangxi Huaxi Nonferrous Metal Co.,Ltd's (SHSE:600301) Revenues Pushing Shares 28% Higher

Guangxi Huaxi Nonferrous Metal Co.,Ltd (SHSE:600301) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 17% in the last twelve months.

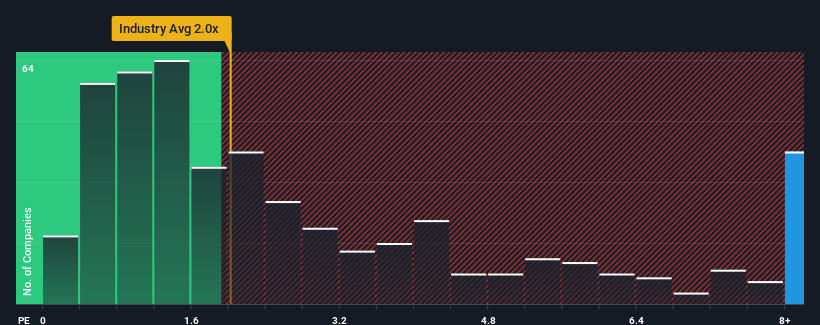

Following the firm bounce in price, when almost half of the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2x, you may consider Guangxi Huaxi Nonferrous MetalLtd as a stock not worth researching with its 17.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Guangxi Huaxi Nonferrous MetalLtd

How Has Guangxi Huaxi Nonferrous MetalLtd Performed Recently?

Guangxi Huaxi Nonferrous MetalLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Guangxi Huaxi Nonferrous MetalLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Guangxi Huaxi Nonferrous MetalLtd?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Guangxi Huaxi Nonferrous MetalLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 78%. As a result, revenue from three years ago have also fallen 39% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 489% during the coming year according to the only analyst following the company. That's shaping up to be materially higher than the 25% growth forecast for the broader industry.

With this information, we can see why Guangxi Huaxi Nonferrous MetalLtd is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Guangxi Huaxi Nonferrous MetalLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Guangxi Huaxi Nonferrous MetalLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Guangxi Huaxi Nonferrous MetalLtd, and understanding should be part of your investment process.

If you're unsure about the strength of Guangxi Huaxi Nonferrous MetalLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600301

Guangxi Huaxi Nonferrous MetalLtd

Trades in steel, bulk commodities, and other products in China.

Outstanding track record and undervalued.