- China

- /

- Medical Equipment

- /

- SHSE:688617

Should You Be Adding APT Medical (SHSE:688617) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like APT Medical (SHSE:688617), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for APT Medical

How Quickly Is APT Medical Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Recognition must be given to the that APT Medical has grown EPS by 42% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

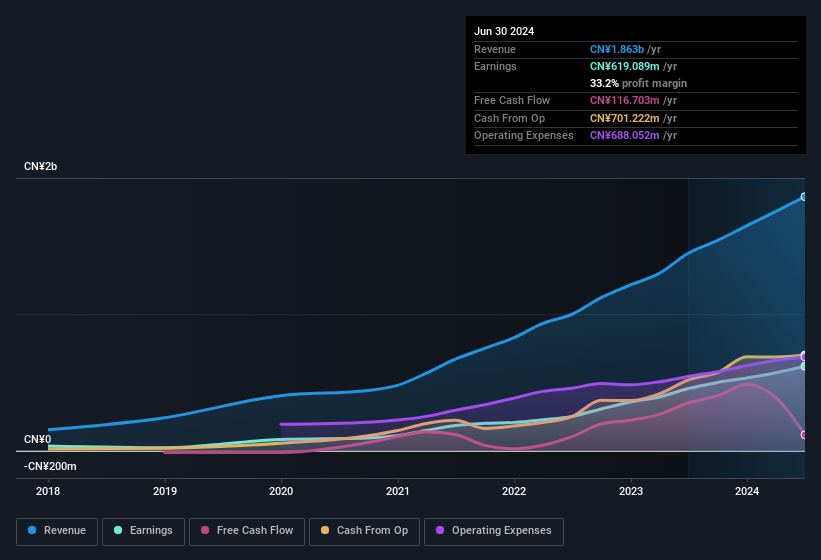

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for APT Medical remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 29% to CN¥1.9b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for APT Medical's future profits.

Are APT Medical Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. APT Medical followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. We note that their impressive stake in the company is worth CN¥10b. Coming in at 32% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Is APT Medical Worth Keeping An Eye On?

APT Medical's earnings per share have been soaring, with growth rates sky high. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. Based on the sum of its parts, we definitely think its worth watching APT Medical very closely. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for APT Medical that you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688617

APT Medical

Engages in the research, development, manufacturing, and supply of electrophysiology and vascular interventional medical devices in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives