Market Participants Recognise Jiugui Liquor Co., Ltd.'s (SZSE:000799) Revenues Pushing Shares 26% Higher

Jiugui Liquor Co., Ltd. (SZSE:000799) shares have continued their recent momentum with a 26% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 17% over that time.

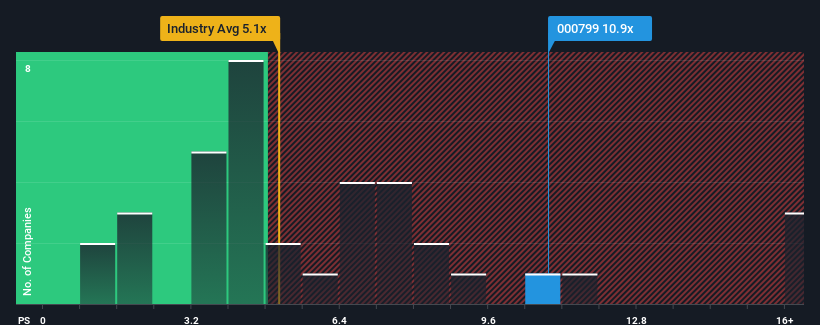

Following the firm bounce in price, given around half the companies in China's Beverage industry have price-to-sales ratios (or "P/S") below 5.1x, you may consider Jiugui Liquor as a stock to avoid entirely with its 10.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Jiugui Liquor

What Does Jiugui Liquor's Recent Performance Look Like?

Jiugui Liquor could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jiugui Liquor.Do Revenue Forecasts Match The High P/S Ratio?

Jiugui Liquor's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 31%. The last three years don't look nice either as the company has shrunk revenue by 44% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 33% each year as estimated by the ten analysts watching the company. That's shaping up to be materially higher than the 13% per year growth forecast for the broader industry.

In light of this, it's understandable that Jiugui Liquor's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Jiugui Liquor's P/S Mean For Investors?

The strong share price surge has lead to Jiugui Liquor's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Jiugui Liquor maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Beverage industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Jiugui Liquor (2 make us uncomfortable!) that you should be aware of.

If these risks are making you reconsider your opinion on Jiugui Liquor, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000799

Jiugui Liquor

Produces and sells liquor series products in China and internationally.

Flawless balance sheet with high growth potential.