- China

- /

- Electrical

- /

- SHSE:600577

Top Growth Companies Insiders Are Betting On

Reviewed by Simply Wall St

As global markets experience a rebound with cooling inflation and strong earnings, particularly in the U.S., investors are keenly observing sectors where value stocks have outpaced growth shares. In this environment, companies with high insider ownership can be particularly attractive as they often signal confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Medley (TSE:4480) | 34% | 27.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 35.8% | 112.9% |

Let's uncover some gems from our specialized screener.

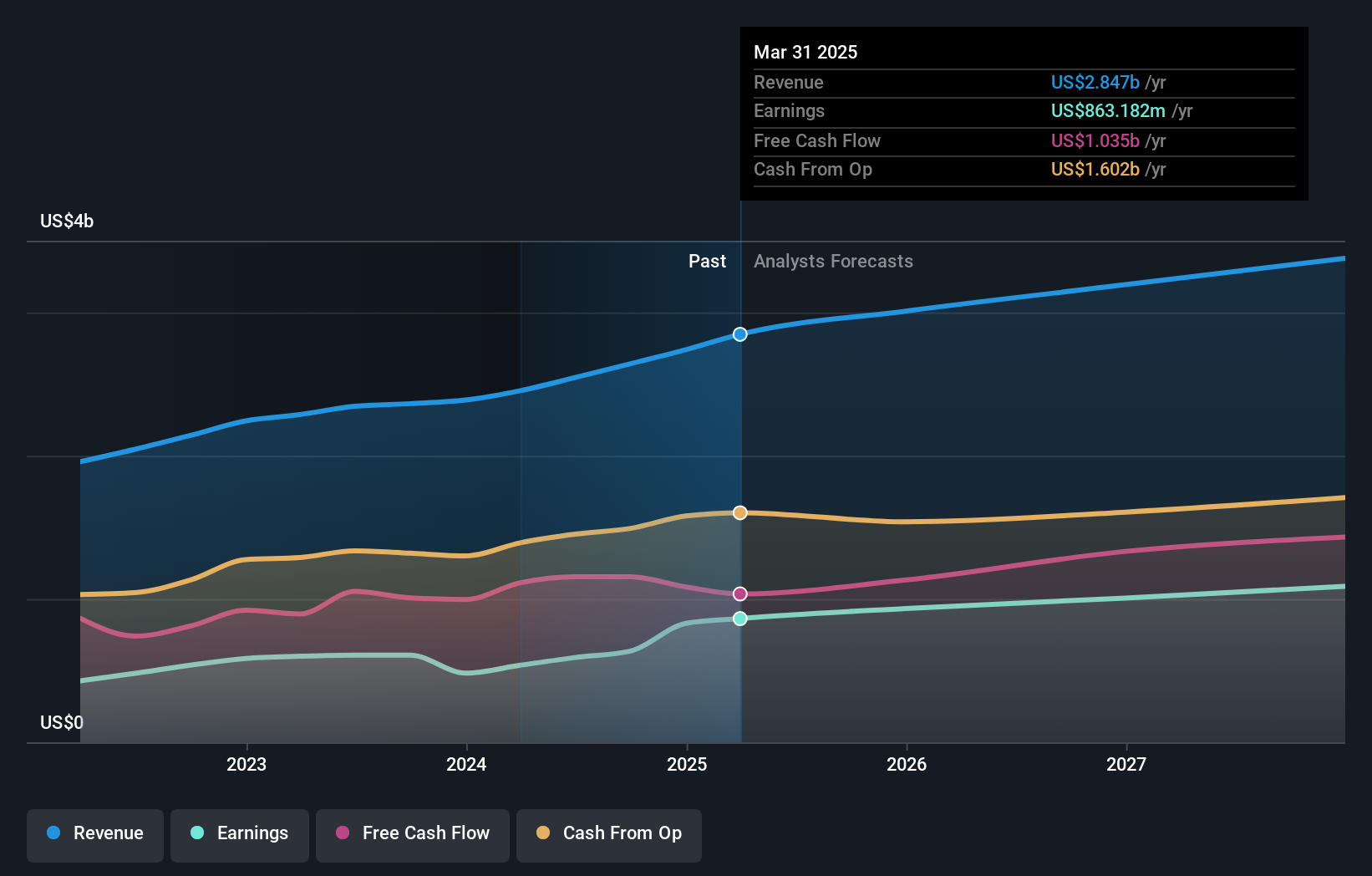

International Container Terminal Services (PSE:ICT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Container Terminal Services, Inc. and its subsidiaries develop, manage, and operate container ports and terminals across Asia, Europe, the Middle East, Africa, and the Americas with a market cap of ₱808.86 billion.

Operations: The company's revenue primarily comes from Cargo Handling and Related Services, which generated $2.64 billion.

Insider Ownership: 36.7%

International Container Terminal Services has demonstrated consistent growth, with earnings increasing by 41.4% annually over the past five years and a forecasted 16.3% annual profit growth, outpacing the Philippine market's average. Recent earnings reports show significant revenue and net income increases, indicating robust financial performance despite high debt levels. Insider activity shows more buying than selling recently, albeit in small volumes. The company's return on equity is projected to remain very high at 46.5%.

- Get an in-depth perspective on International Container Terminal Services' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, International Container Terminal Services' share price might be too optimistic.

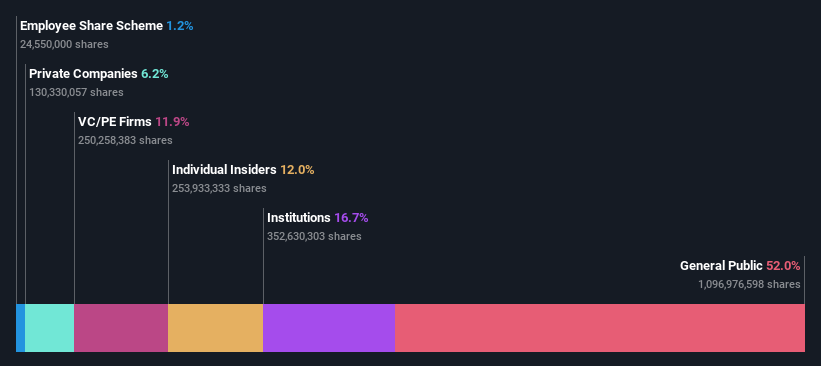

Tongling Jingda Special Magnet Wire (SHSE:600577)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tongling Jingda Special Magnet Wire Co., Ltd. operates in the manufacturing of magnet wires and has a market cap of CN¥14.09 billion.

Operations: The company's revenue is primarily derived from its magnet wire manufacturing operations.

Insider Ownership: 12%

Tongling Jingda Special Magnet Wire has shown substantial revenue growth, reporting CNY 16.09 billion for the first nine months of 2024, up from CNY 13.14 billion a year earlier. Earnings increased by 25.2%, with net income reaching CNY 415.85 million. Despite high share price volatility and debt not well covered by operating cash flow, the company is expected to see significant revenue growth of over 20% annually, outpacing the broader Chinese market forecast.

- Delve into the full analysis future growth report here for a deeper understanding of Tongling Jingda Special Magnet Wire.

- Our comprehensive valuation report raises the possibility that Tongling Jingda Special Magnet Wire is priced higher than what may be justified by its financials.

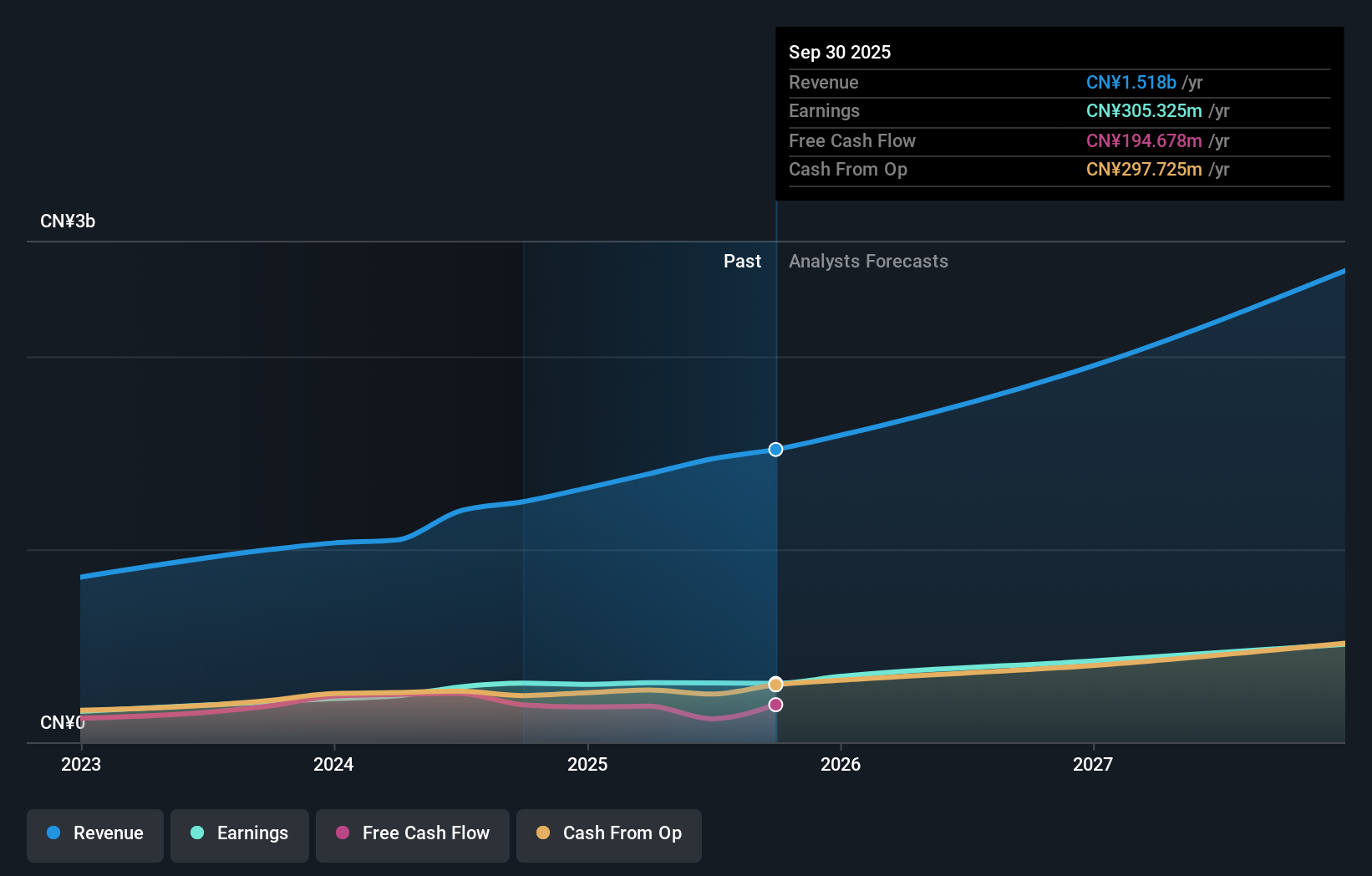

Runben Biotechnology (SHSE:603193)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Runben Biotechnology Co., Ltd. is involved in the research, production, and sale of mosquito repellent products, baby care products, and essential oil products with a market cap of CN¥10.40 billion.

Operations: The company generates revenue from its personal products segment, totaling CN¥1.25 billion.

Insider Ownership: 30.5%

Runben Biotechnology reported significant revenue growth for the first nine months of 2024, with sales reaching CNY 1.04 billion, up from CNY 823.53 million the previous year. Net income rose to CNY 260.88 million from CNY 180.73 million, reflecting strong earnings growth of over 46%. While its forecasted annual revenue growth of approximately 24.8% outpaces the broader Chinese market, expected profit growth at around 22% lags behind market expectations.

- Dive into the specifics of Runben Biotechnology here with our thorough growth forecast report.

- Our valuation report unveils the possibility Runben Biotechnology's shares may be trading at a premium.

Next Steps

- Click through to start exploring the rest of the 1474 Fast Growing Companies With High Insider Ownership now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Tongling Jingda Special Magnet Wire might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600577

Tongling Jingda Special Magnet Wire

Tongling Jingda Special Magnet Wire Co., Ltd.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives