- China

- /

- Electrical

- /

- SZSE:300913

Lotus Health Group And 2 Other Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets experience a rebound with easing inflation and robust bank earnings, small-cap stocks are capturing attention, particularly as the S&P MidCap 400 and Russell 2000 indices show significant gains. In this dynamic environment, identifying promising stocks often involves looking for companies with strong fundamentals that can thrive amidst economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 2.05% | 10.66% | ★★★★★★ |

| Lungteh Shipbuilding | 60.46% | 29.56% | 44.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Ningbo Sinyuan Zm Technology | NA | 18.08% | 9.75% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 4.71% | 50.82% | 59.08% | ★★★★★★ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Lotus Health Group (SHSE:600186)

Simply Wall St Value Rating: ★★★★★★

Overview: Lotus Health Group Company focuses on the production and sale of condiments and foods in China, with a market capitalization of CN¥8.25 billion.

Operations: Lotus Health Group's primary revenue stream is from the sale of monosodium glutamate, generating CN¥2.42 billion.

Lotus Health Group, a smaller player in the market, has demonstrated impressive earnings growth of 118% over the past year, outpacing its industry peers. The company boasts high-quality earnings and more cash than total debt, indicating a strong financial footing. Despite having had negative shareholder equity five years ago, it now shows positive equity, highlighting significant improvement. Recent activities include repurchasing 14.55 million shares for CNY 71.17 million and an ongoing buyback plan capped at CNY 150 million to enhance shareholder value further. However, its share price has been highly volatile recently.

- Click here to discover the nuances of Lotus Health Group with our detailed analytical health report.

Weichai Heavy Machinery (SZSE:000880)

Simply Wall St Value Rating: ★★★★★★

Overview: Weichai Heavy Machinery Co., Ltd. focuses on the development, manufacturing, and sale of diesel engines, generating units, and power integration systems for ship power and power generation equipment in China with a market cap of CN¥6.18 billion.

Operations: Weichai Heavy Machinery generates revenue primarily from the General Equipment Manufacturing Industry, amounting to CN¥3.77 billion. The company's financial performance can be assessed by examining its net profit margin, which reflects the efficiency of converting revenue into actual profit.

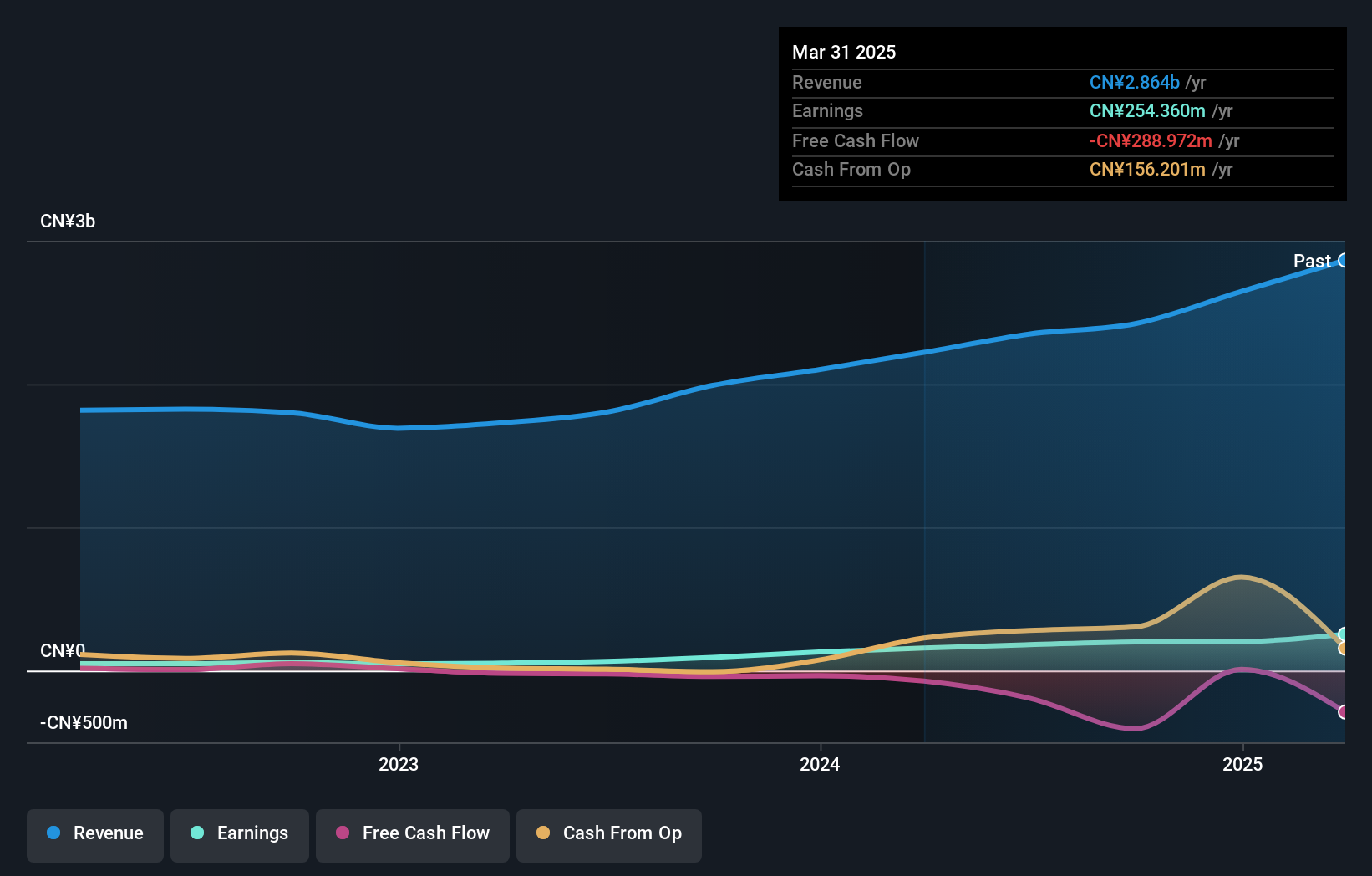

Weichai Heavy Machinery, a relatively small player in the machinery sector, has shown promising financial health with earnings growth of 9.5% over the past year, outpacing the industry's -0.06%. The company is debt-free and boasts high-quality earnings, underscoring its solid financial footing. Recent results highlight a net income of CNY 144 million for nine months ending September 2024, slightly up from CNY 135 million last year. With a cash dividend payout of CNY 0.30 per share approved recently, Weichai seems committed to rewarding shareholders while navigating volatile share prices in recent months.

- Navigate through the intricacies of Weichai Heavy Machinery with our comprehensive health report here.

Understand Weichai Heavy Machinery's track record by examining our Past report.

Zhejiang Zhaolong Interconnect TechnologyLtd (SZSE:300913)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Zhaolong Interconnect Technology Co., Ltd. operates in the digital communication cable industry and has a market capitalization of CN¥14.29 billion.

Operations: Zhaolong Interconnect generates revenue primarily from the digital communication cable industry, amounting to CN¥1.75 billion. The company's financial performance is highlighted by its gross profit margin, which shows a notable trend over recent periods.

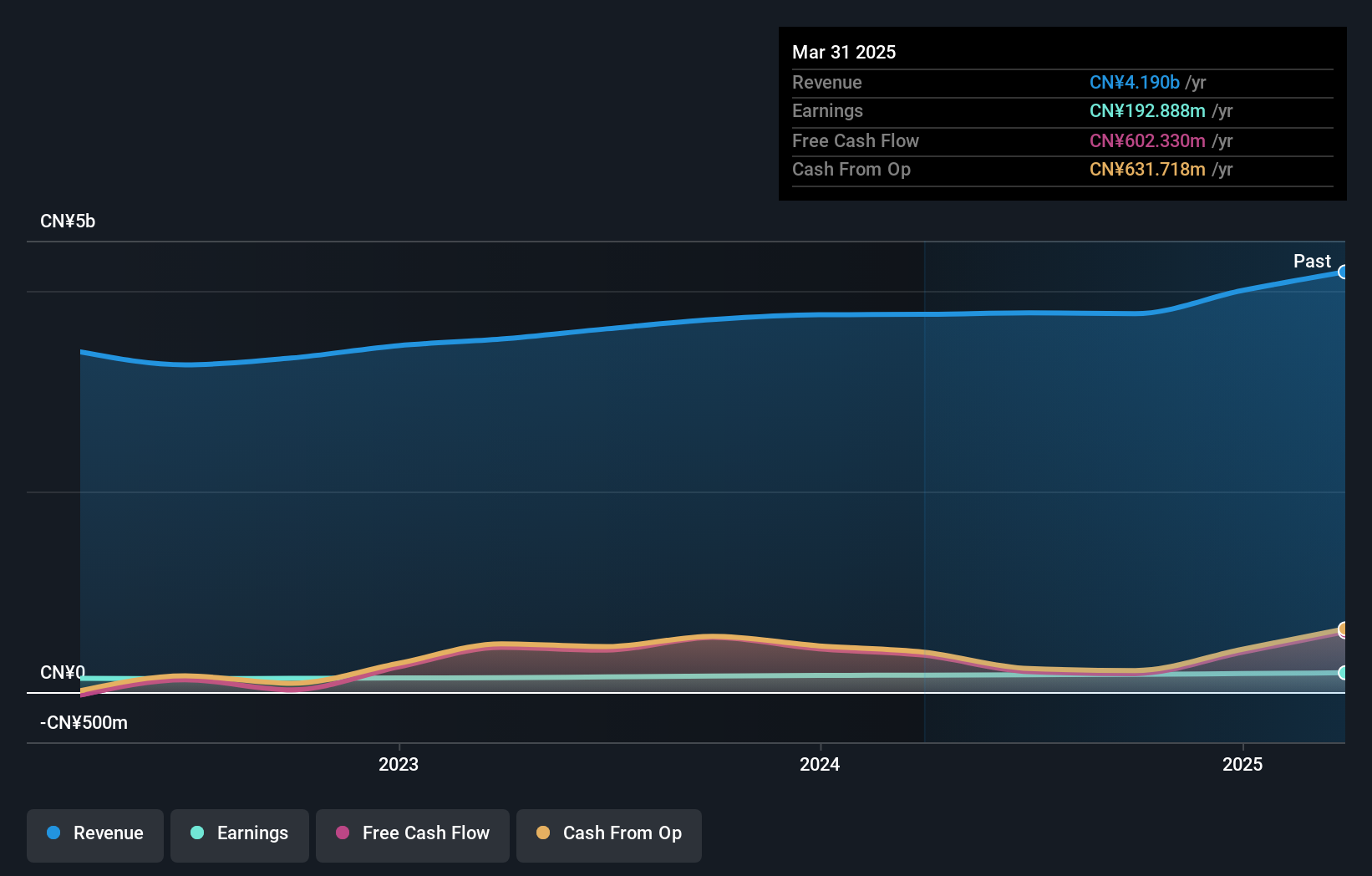

Zhaolong Interconnect Technology, a smaller player in the electrical industry, has shown promising growth with earnings rising 18.1% over the past year, outpacing the industry's 1.1%. The company reported a net income of CN¥89.85 million for the first nine months of 2024, up from CN¥70.17 million in the previous year. Despite experiencing volatility in its share price recently, Zhaolong remains debt-free and boasts positive free cash flow. A significant one-off gain of CN¥39.9 million impacted its financial results last year; however, future earnings are forecast to grow at an impressive rate of over 25% annually.

Taking Advantage

- Investigate our full lineup of 4644 Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Zhaolong Interconnect TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300913

Zhejiang Zhaolong Interconnect TechnologyLtd

Zhejiang Zhaolong Interconnect Technology Co.,Ltd.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives