Amidst ongoing geopolitical tensions and consumer spending concerns, global markets have experienced volatility, with major indices like the S&P 500 seeing sharp declines despite early-week gains. As investors navigate these uncertain times, dividend stocks can offer a measure of stability by providing consistent income streams even when market conditions are challenging.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.60% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.64% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.79% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.64% | ★★★★★★ |

Click here to see the full list of 2006 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Star Lake BioscienceZhaoqing Guangdong (SHSE:600866)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong manufactures and sells pharmaceutical raw materials, as well as food and feed additives under the Star Lake and Yue Bao brands in China and internationally, with a market cap of CN¥10.75 billion.

Operations: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong generates its revenue through the production and distribution of pharmaceutical raw materials and food and feed additives under the Star Lake and Yue Bao brands.

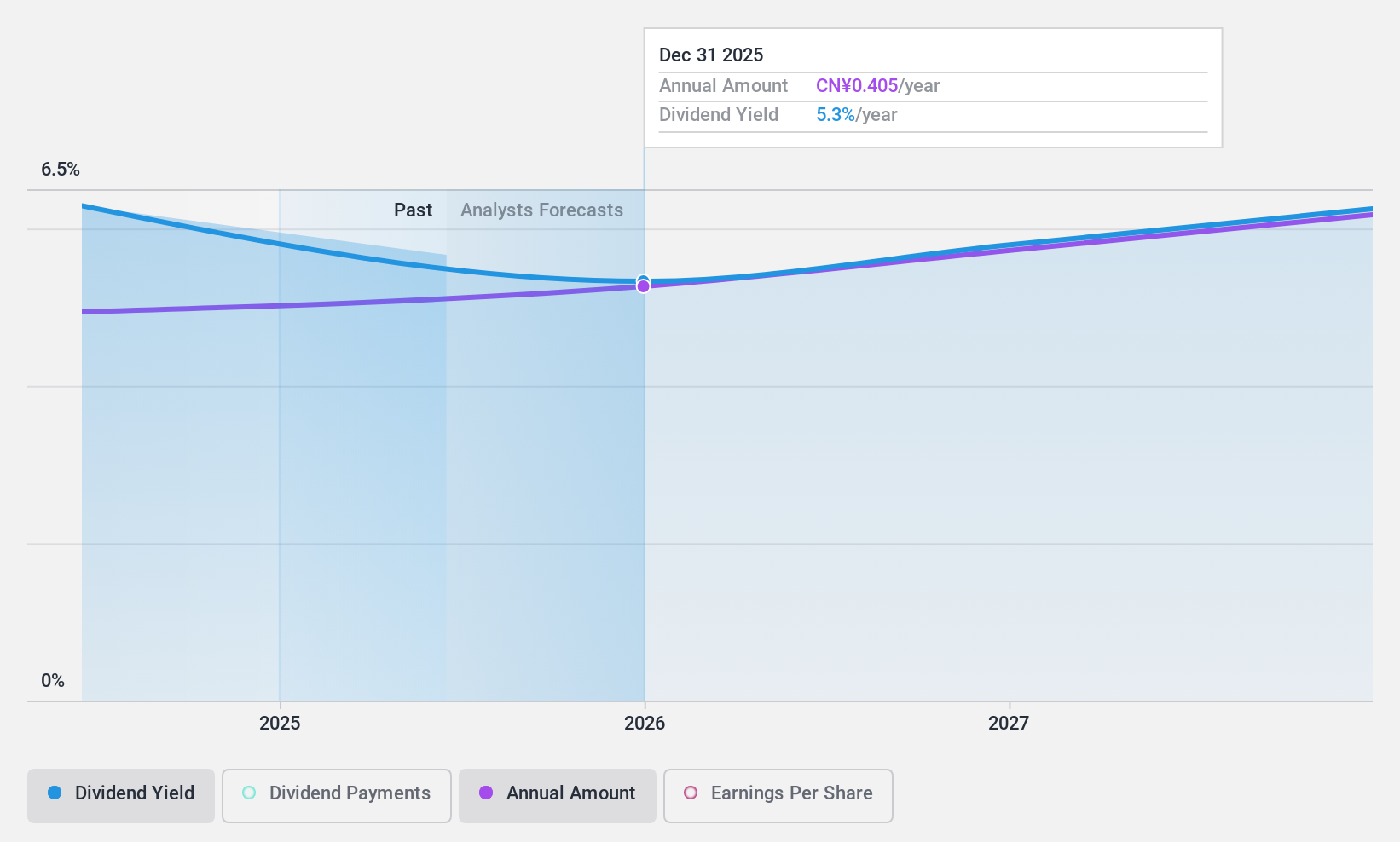

Dividend Yield: 5.7%

Star Lake BioscienceZhaoqing Guangdong recently initiated dividend payments, offering a yield of 5.75%, placing it in the top 25% of dividend payers in the CN market. The dividends are well-covered by earnings and cash flows, with payout ratios at 72.9% and 38.3%, respectively. While trading at a significant discount to its estimated fair value, it's too early to determine stability or growth trends for these dividends given their recent initiation.

- Get an in-depth perspective on Star Lake BioscienceZhaoqing Guangdong's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Star Lake BioscienceZhaoqing Guangdong is priced lower than what may be justified by its financials.

ITOCHU (TSE:8001)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ITOCHU Corporation is involved in the global trading and import/export of various products, with a market cap of ¥8.71 trillion.

Operations: ITOCHU Corporation's revenue is primarily derived from its Food segment at ¥5.01 billion, followed by Energy & Chemicals at ¥3.14 billion, General Products & Realty at ¥1.52 billion, Machinery at ¥1.55 billion, Metals & Minerals at ¥1.26 billion, ICT & Financial Business at ¥992.14 million, Textile at ¥594.88 million and The 8Th segment contributing ¥514.72 million.

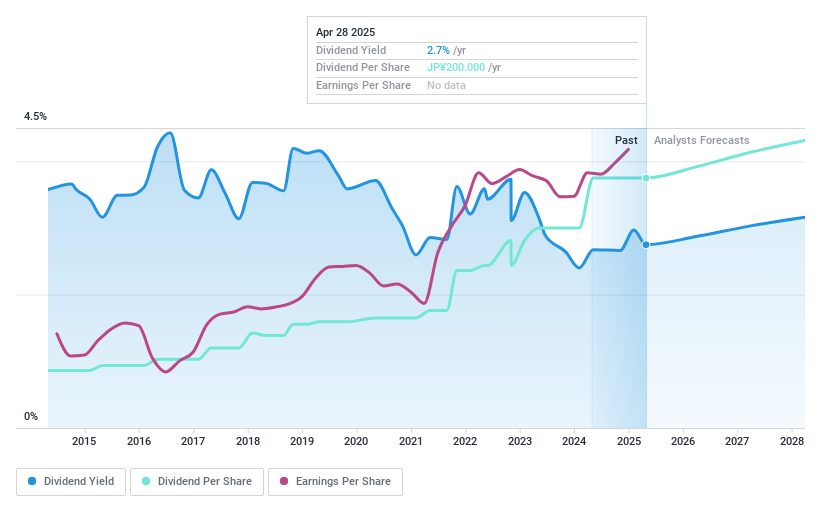

Dividend Yield: 3%

ITOCHU Corporation offers a stable dividend yield of 3.04%, though it trails the top 25% of JP market payers. Its dividends are well-supported by earnings and cash flows, with low payout ratios of 29.8% and 35.2%, respectively, ensuring sustainability. The company has consistently increased its dividends over the past decade without volatility. Recent share buybacks totaling ¥149 billion highlight strong capital management, potentially benefiting long-term dividend stability amidst high debt levels.

- Dive into the specifics of ITOCHU here with our thorough dividend report.

- Our valuation report here indicates ITOCHU may be undervalued.

Mitsubishi (TSE:8058)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsubishi Corporation operates globally across sectors such as natural gas, industrial materials, chemicals, and more with a market cap of ¥9.47 trillion.

Operations: Mitsubishi Corporation's revenue segments include Food Industry at ¥2.31 billion, Power Solution at ¥1.34 billion, Mineral Resources at ¥3.25 billion, Materials Solution at ¥2.30 billion, Smart-Life Creation at ¥3.30 billion, and Environmental Energy at ¥1.09 billion.

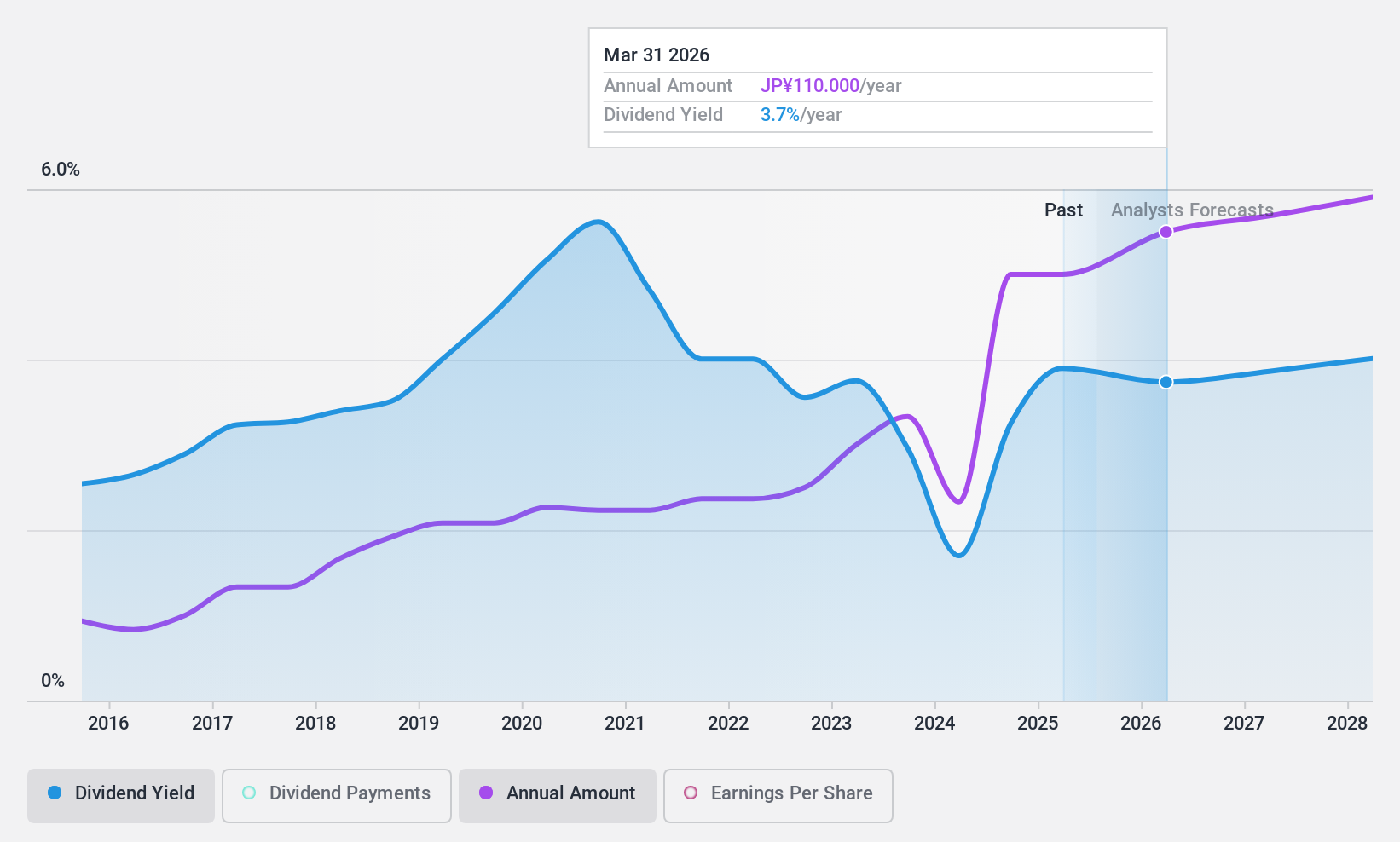

Dividend Yield: 3.9%

Mitsubishi Corporation's dividend yield of 3.86% ranks in the top 25% of Japanese market payers, supported by low payout ratios of 31.4% for earnings and 33.5% for cash flows, indicating sustainability. However, its dividend history shows volatility over the past decade, making it less reliable despite recent profit growth. The strategic partnership with CH4 Global could enhance future revenue streams but does not immediately impact dividend stability or growth prospects significantly.

- Click here to discover the nuances of Mitsubishi with our detailed analytical dividend report.

- Our valuation report unveils the possibility Mitsubishi's shares may be trading at a discount.

Next Steps

- Delve into our full catalog of 2006 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600866

Star Lake BioscienceZhaoqing Guangdong

Engages in the manufacture and sale of pharmaceutical raw materials, and food and feed additives under the Star Lake and Yue Bao brand names in China and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives