- China

- /

- Electrical

- /

- SHSE:603063

Insider Picks For Growth Stocks In January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year with inflation concerns and political uncertainties weighing on investor sentiment, growth stocks have faced particular challenges, underperforming their value counterparts. Amidst this backdrop, companies with high insider ownership can offer unique insights into potential growth opportunities, as insiders often have a vested interest in the company's success and may be more attuned to its long-term prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Medley (TSE:4480) | 34% | 27.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.3% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's review some notable picks from our screened stocks.

Shenzhen Hopewind Electric (SHSE:603063)

Simply Wall St Growth Rating: ★★★★☆☆

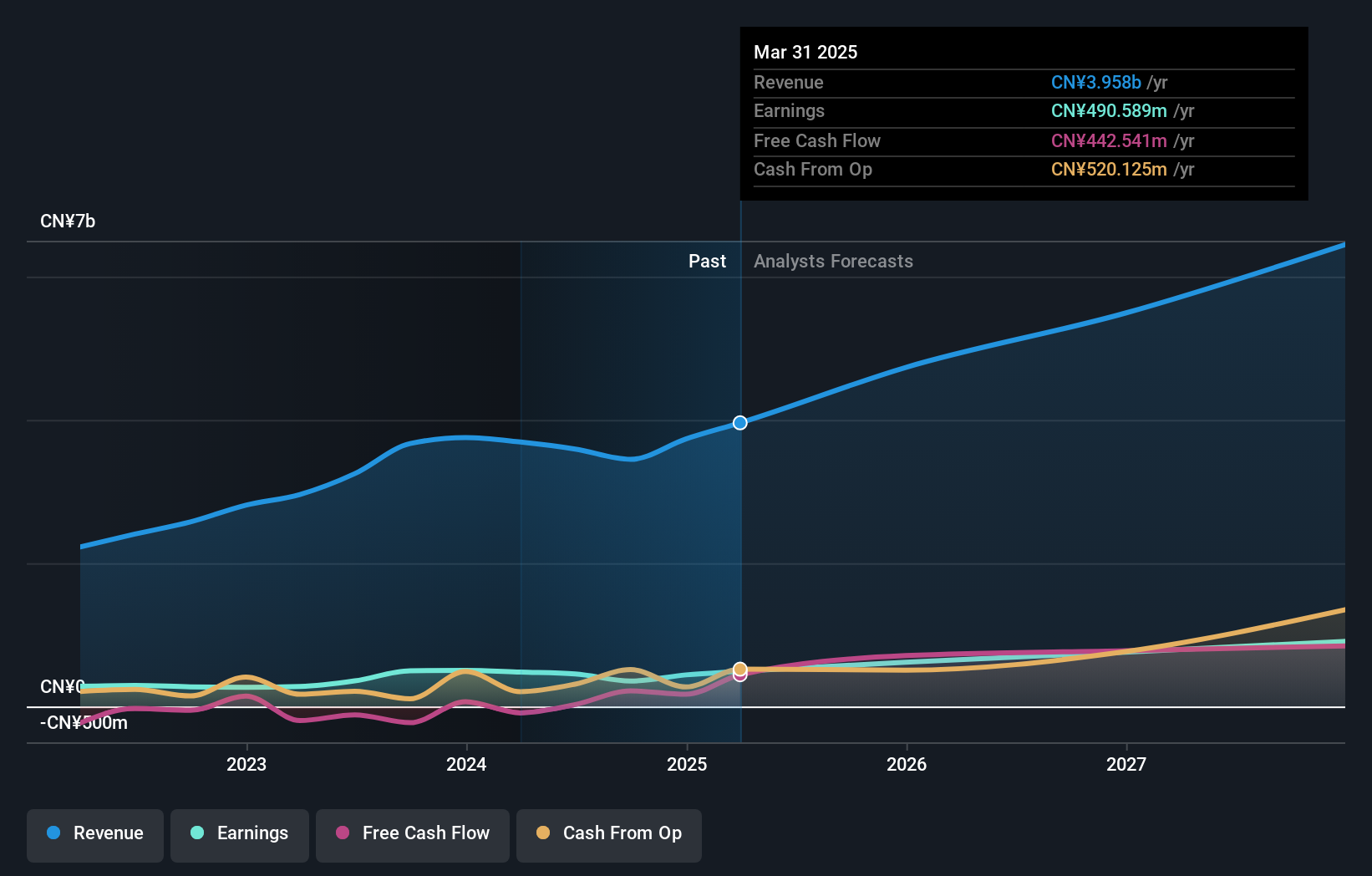

Overview: Shenzhen Hopewind Electric Co., Ltd. focuses on the research, development, manufacture, sale, and service of energy and electric drive products with a market cap of CN¥13.26 billion.

Operations: The company's revenue segments include the provision of energy and electric drive products, which are integral to its operations.

Insider Ownership: 27.3%

Shenzhen Hopewind Electric faces mixed growth prospects with earnings forecast to grow significantly at 24.9% annually, outpacing the CN market slightly. However, its revenue growth of 18.1% lags behind the 20% benchmark but surpasses the market's 13.3%. The company's share price has been highly volatile recently, and it reported a decline in sales and net income for the nine months ending September 2024. Recent buybacks totalled CNY 24.8 million, reflecting strategic financial maneuvers amidst these challenges.

- Navigate through the intricacies of Shenzhen Hopewind Electric with our comprehensive analyst estimates report here.

- Our valuation report here indicates Shenzhen Hopewind Electric may be overvalued.

Offcn Education Technology (SZSE:002607)

Simply Wall St Growth Rating: ★★★★★★

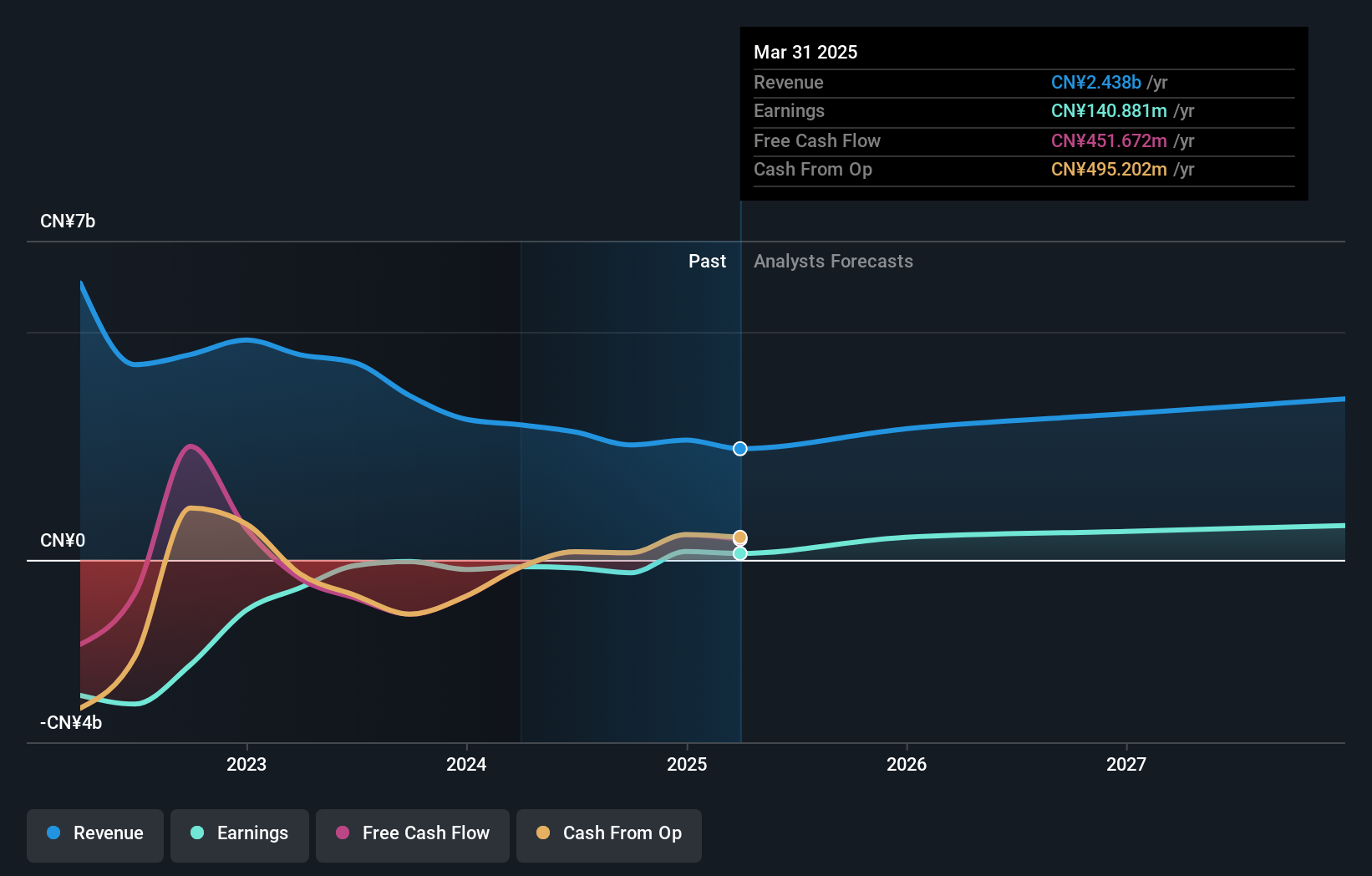

Overview: Offcn Education Technology Co., Ltd. is a vocational education institution in China offering various educational services, with a market cap of CN¥18.90 billion.

Operations: Offcn Education Technology Co., Ltd. generates its revenue through diverse vocational education services in China.

Insider Ownership: 25.3%

Offcn Education Technology shows potential with expected annual profit growth surpassing market averages, forecasting profitability within three years. Revenue is anticipated to grow at 23.1% annually, outpacing the Chinese market's 13.3%. However, recent earnings reports reveal a decline in sales and net income for the nine months ending September 2024. The company's share price has been highly volatile recently, but no substantial insider trading activity was noted over the past three months.

- Dive into the specifics of Offcn Education Technology here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Offcn Education Technology's share price might be too optimistic.

Wondershare Technology Group (SZSE:300624)

Simply Wall St Growth Rating: ★★★★☆☆

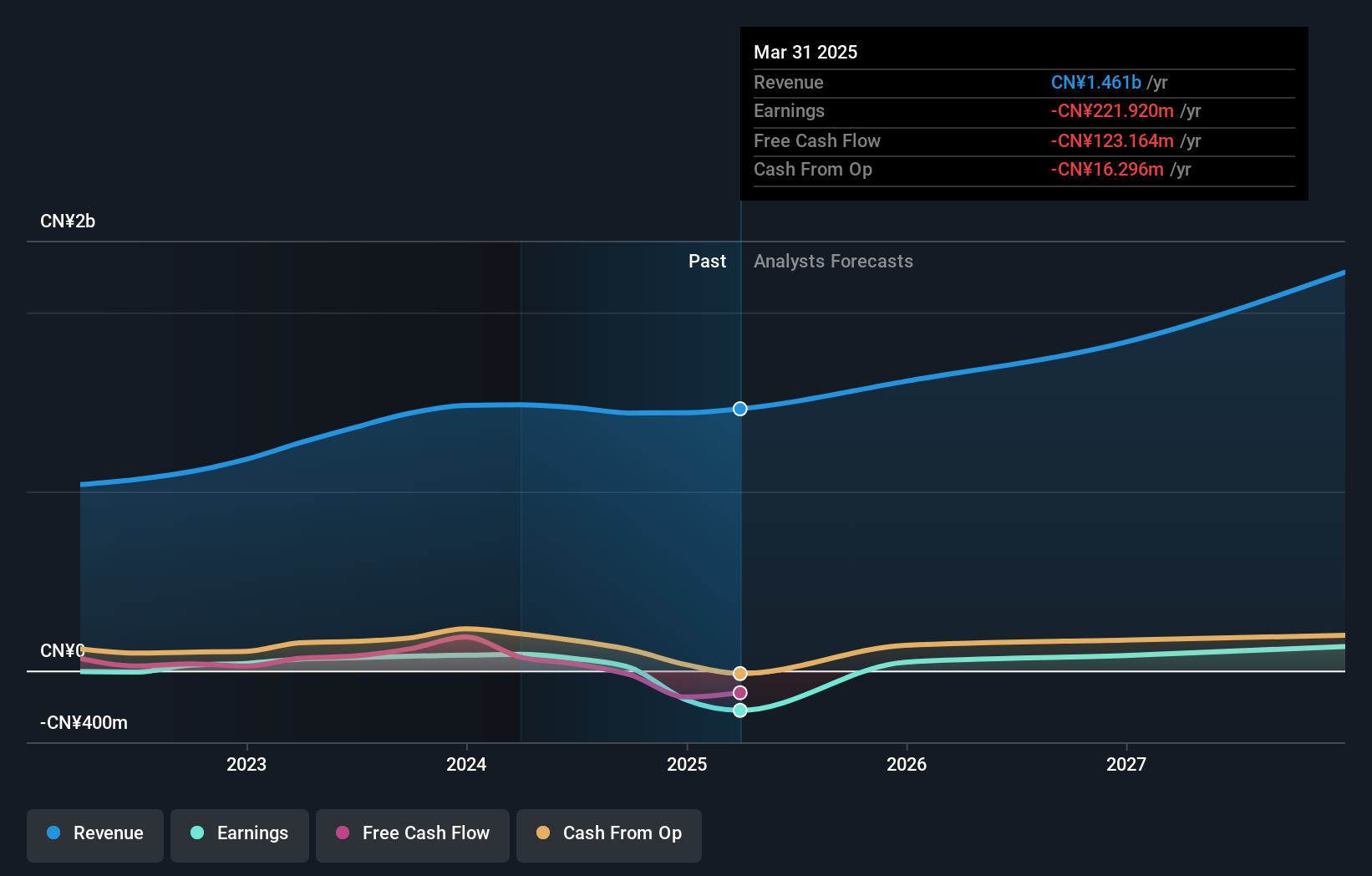

Overview: Wondershare Technology Group Co., Ltd. develops application software products in China and internationally, with a market cap of CN¥11.12 billion.

Operations: The company generates revenue through its application software products, both domestically and internationally.

Insider Ownership: 15.2%

Wondershare Technology Group is positioned for significant earnings growth, projected at 74.53% annually, outpacing the Chinese market's average. Despite this potential, recent financials reported a net loss and declining sales for the nine months ending September 2024. The company has been active in product innovation with updates like Recoverit 13.5 and Filmora 14, enhancing its competitive edge in data recovery and video editing markets. No substantial insider trading activity was observed recently.

- Take a closer look at Wondershare Technology Group's potential here in our earnings growth report.

- The analysis detailed in our Wondershare Technology Group valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Access the full spectrum of 1448 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603063

Shenzhen Hopewind Electric

Engages in the research and development, manufacture, sale, and service of energy and electric drive products.

Excellent balance sheet with reasonable growth potential.