- China

- /

- Hospitality

- /

- SZSE:000796

Strong week for Caissa Tosun DevelopmentLtd (SZSE:000796) shareholders doesn't alleviate pain of three-year loss

The truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term Caissa Tosun Development Co.,Ltd. (SZSE:000796) shareholders know that all too well, since the share price is down considerably over three years. Regrettably, they have had to cope with a 68% drop in the share price over that period. And over the last year the share price fell 33%, so we doubt many shareholders are delighted. Furthermore, it's down 10% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

While the stock has risen 9.9% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Caissa Tosun DevelopmentLtd

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Caissa Tosun DevelopmentLtd moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

We think that the revenue decline over three years, at a rate of 38% per year, probably had some shareholders looking to sell. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

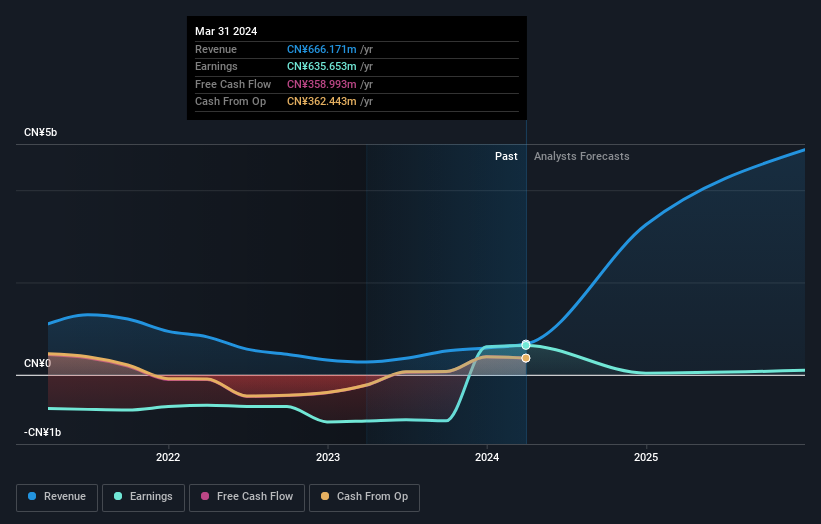

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Caissa Tosun DevelopmentLtd has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Caissa Tosun DevelopmentLtd

A Different Perspective

We regret to report that Caissa Tosun DevelopmentLtd shareholders are down 33% for the year. Unfortunately, that's worse than the broader market decline of 13%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Caissa Tosun DevelopmentLtd you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000796

Caissa Tosun DevelopmentLtd

Engages in travel and tourism related businesses in China and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives