- Singapore

- /

- Oil and Gas

- /

- SGX:RE4

Discover Promising Penny Stocks For November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election, with major indices like the S&P 500 reaching near-record highs, investors are considering new avenues for growth amidst shifting economic policies and rate changes. For those willing to explore beyond established giants, penny stocks—typically representing smaller or newer companies—offer intriguing prospects despite their somewhat outdated moniker. By focusing on firms with solid financial foundations, investors can uncover potential opportunities that align with current market dynamics while maintaining a balance of risk and reward.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.24 | MYR349.03M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.495 | MYR2.44B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR135.97M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$138.53M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.59M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR292.11M | ★★★★★★ |

| Shoe Zone (AIM:SHOE) | £1.525 | £70.5M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.80 | £377.93M | ★★★★☆☆ |

Click here to see the full list of 5,742 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

E7 Group PJSC (ADX:E7)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E7 Group PJSC operates in the security, commercial printing, packaging, and distribution sectors within the United Arab Emirates and has a market capitalization of AED21.59 billion.

Operations: The company generates revenue from its operations in printing, amounting to AED564.18 million, and distribution, contributing AED82.58 million.

Market Cap: AED2.16B

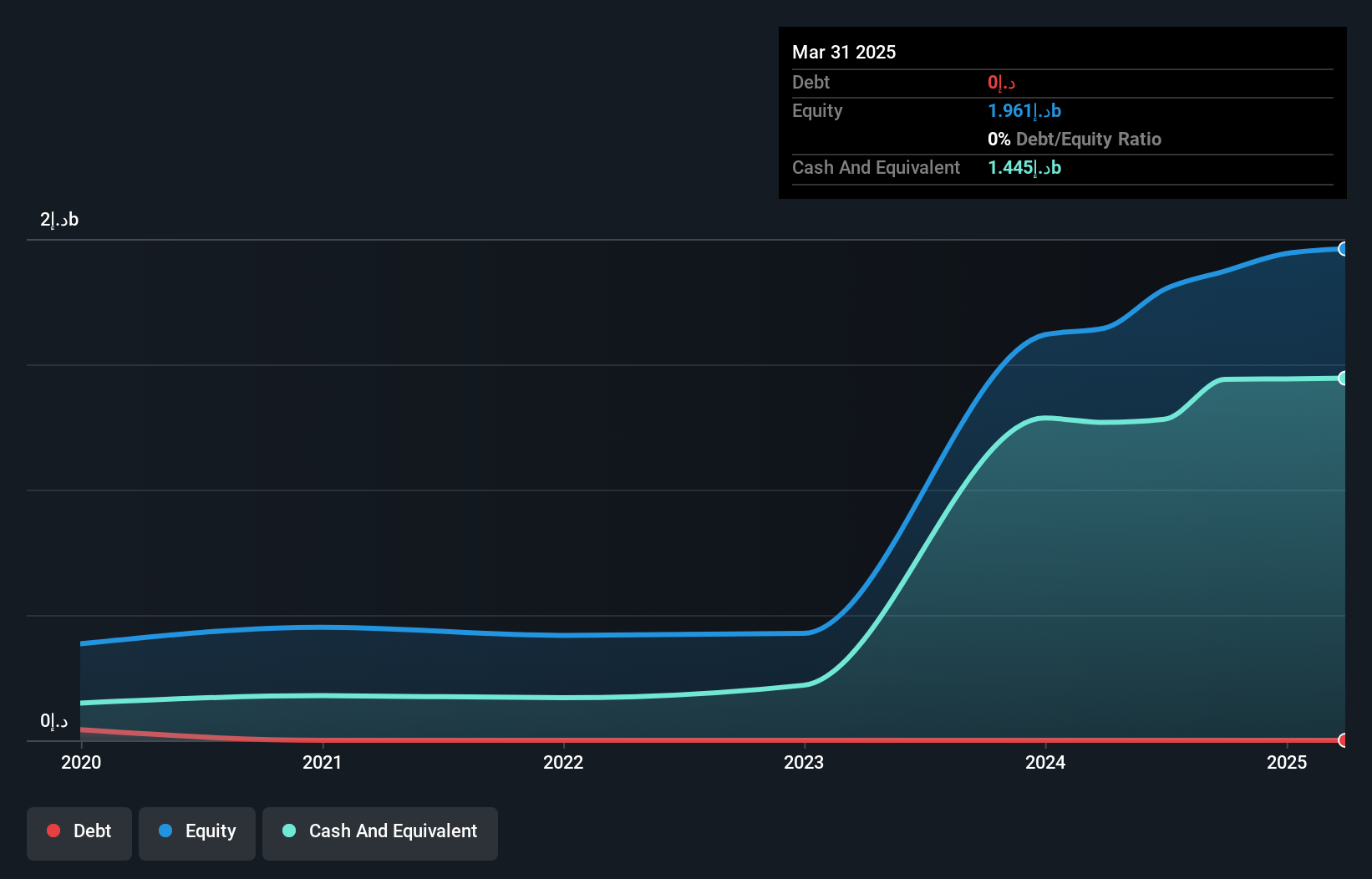

E7 Group PJSC, operating in the UAE's security, commercial printing, packaging, and distribution sectors, has been added to the S&P Global BMI Index. Despite being unprofitable with increasing losses over the past five years and a negative return on equity of -0.67%, E7 maintains financial stability with AED1.8 billion in short-term assets covering both short- and long-term liabilities. The company is debt-free and has a positive cash runway for over three years due to growing free cash flow. Revenue is expected to grow by 8.71% annually despite current profitability challenges.

- Unlock comprehensive insights into our analysis of E7 Group PJSC stock in this financial health report.

- Understand E7 Group PJSC's earnings outlook by examining our growth report.

Geo Energy Resources (SGX:RE4)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Geo Energy Resources Limited is an investment holding company involved in the mining, production, and trading of coal with a market capitalization of SGD378.49 million.

Operations: The company generates revenue primarily from its coal mining operations, amounting to $418.63 million.

Market Cap: SGD378.49M

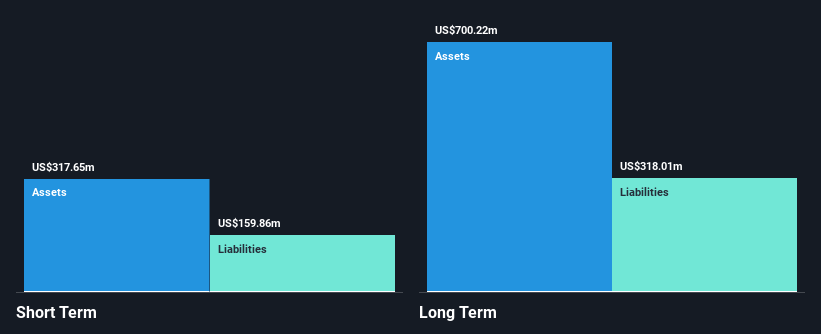

Geo Energy Resources Limited, with a market cap of SGD378.49 million, primarily generates revenue from coal mining operations totaling $418.63 million. Despite negative earnings growth over the past year, the company has become profitable over five years with annual earnings growth of 24.9%. It trades at a significant discount to its estimated fair value and offers a dividend yield of 7.21%, though not fully covered by free cash flows. The management team is experienced; however, the board lacks tenure experience. Short-term assets exceed short-term liabilities but fall short against long-term obligations, while interest payments are well covered by EBIT.

- Click to explore a detailed breakdown of our findings in Geo Energy Resources' financial health report.

- Learn about Geo Energy Resources' future growth trajectory here.

Topscore Fashion (SHSE:603608)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Topscore Fashion Co., Ltd. operates in the fashion shoes and apparel industry, as well as mobile Internet marketing in China, with a market cap of CN¥1.34 billion.

Operations: No specific revenue segments are reported for Topscore Fashion Co., Ltd.

Market Cap: CN¥1.34B

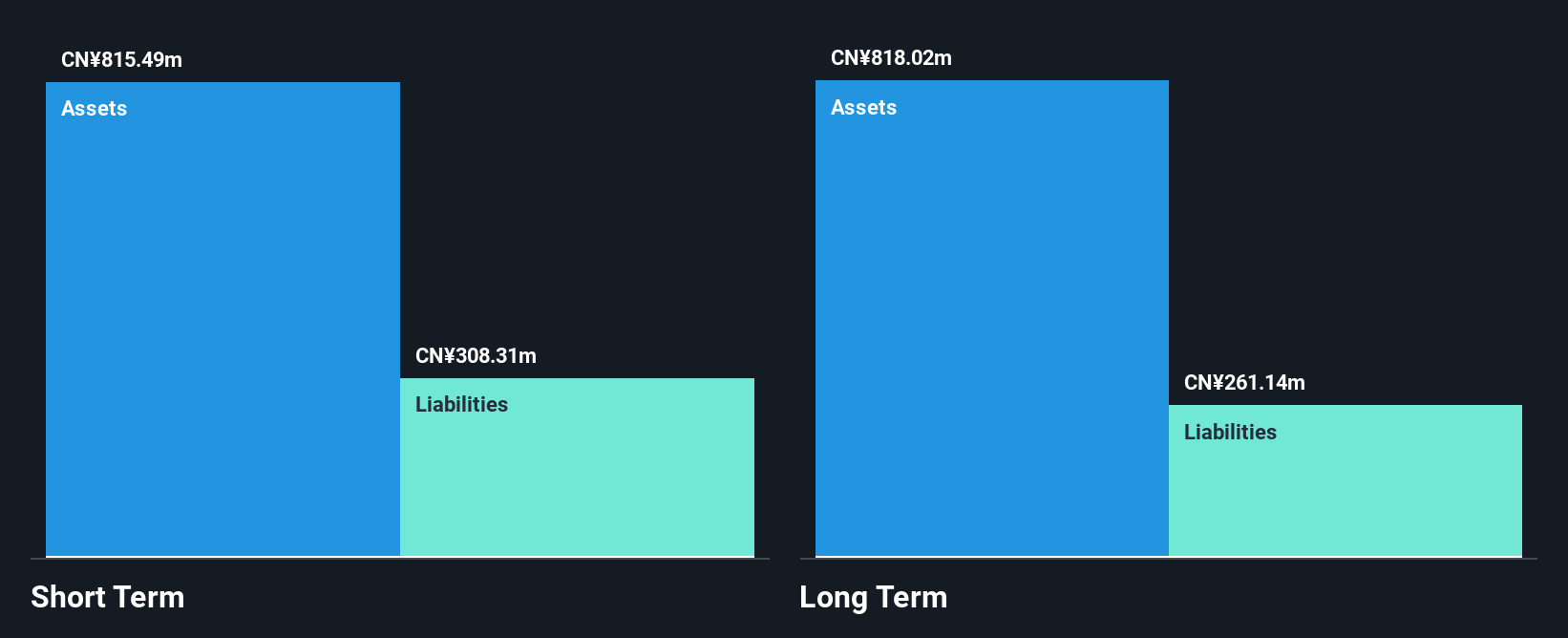

Topscore Fashion Co., Ltd. reported sales of CN¥800.67 million for the first nine months of 2024, down from CN¥944.57 million the previous year, with a net loss widening to CN¥30.76 million. Despite being unprofitable and experiencing increased losses over five years, its short-term assets surpass both short-term and long-term liabilities, indicating solid liquidity management. The company completed a share buyback totaling 1.64% of shares for CN¥15.25 million, reflecting potential confidence in its valuation as it trades below estimated fair value by 49%. However, negative return on equity and increasing debt-to-equity ratio remain concerns.

- Dive into the specifics of Topscore Fashion here with our thorough balance sheet health report.

- Gain insights into Topscore Fashion's past trends and performance with our report on the company's historical track record.

Make It Happen

- Embark on your investment journey to our 5,742 Penny Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:RE4

Geo Energy Resources

An investment holding company, engages in the mining, production, and trading of coal.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives