- China

- /

- Tech Hardware

- /

- SZSE:002993

Discovering September 2024's Undiscovered Gems in China

Reviewed by Simply Wall St

As global markets face economic headwinds and investor sentiment remains cautious, the Chinese market has also experienced its share of volatility, with key indices like the Shanghai Composite Index and CSI 300 posting declines. Despite this, China's small-cap sector continues to offer intriguing opportunities for discerning investors. In such an environment, identifying stocks with solid fundamentals, growth potential in niche markets, and resilience against broader economic pressures becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IFE Elevators | NA | 14.47% | 19.78% | ★★★★★★ |

| Zhejiang Jolly PharmaceuticalLTD | 8.85% | 20.50% | 47.32% | ★★★★★★ |

| Jinghua Pharmaceutical Group | 0.95% | 5.39% | 47.06% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 16.00% | 5.87% | -14.07% | ★★★★★★ |

| ZHEJIANG DIBAY ELECTRICLtd | 28.50% | 8.58% | -0.18% | ★★★★★☆ |

| Hunan Investment GroupLtd | 7.56% | 29.97% | 17.81% | ★★★★★☆ |

| Qijing Machinery | 46.41% | 3.46% | -1.40% | ★★★★★☆ |

| Sinotherapeutics | 0.00% | 76.64% | 0.81% | ★★★★★☆ |

| Shenzhen Easttop Supply Chain Management | 89.23% | -43.08% | 5.73% | ★★★★★☆ |

| Hubei Sanxia New Building Materials | 27.43% | -9.28% | 22.96% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

HMT (Xiamen) New Technical Materials (SHSE:603306)

Simply Wall St Value Rating: ★★★★★☆

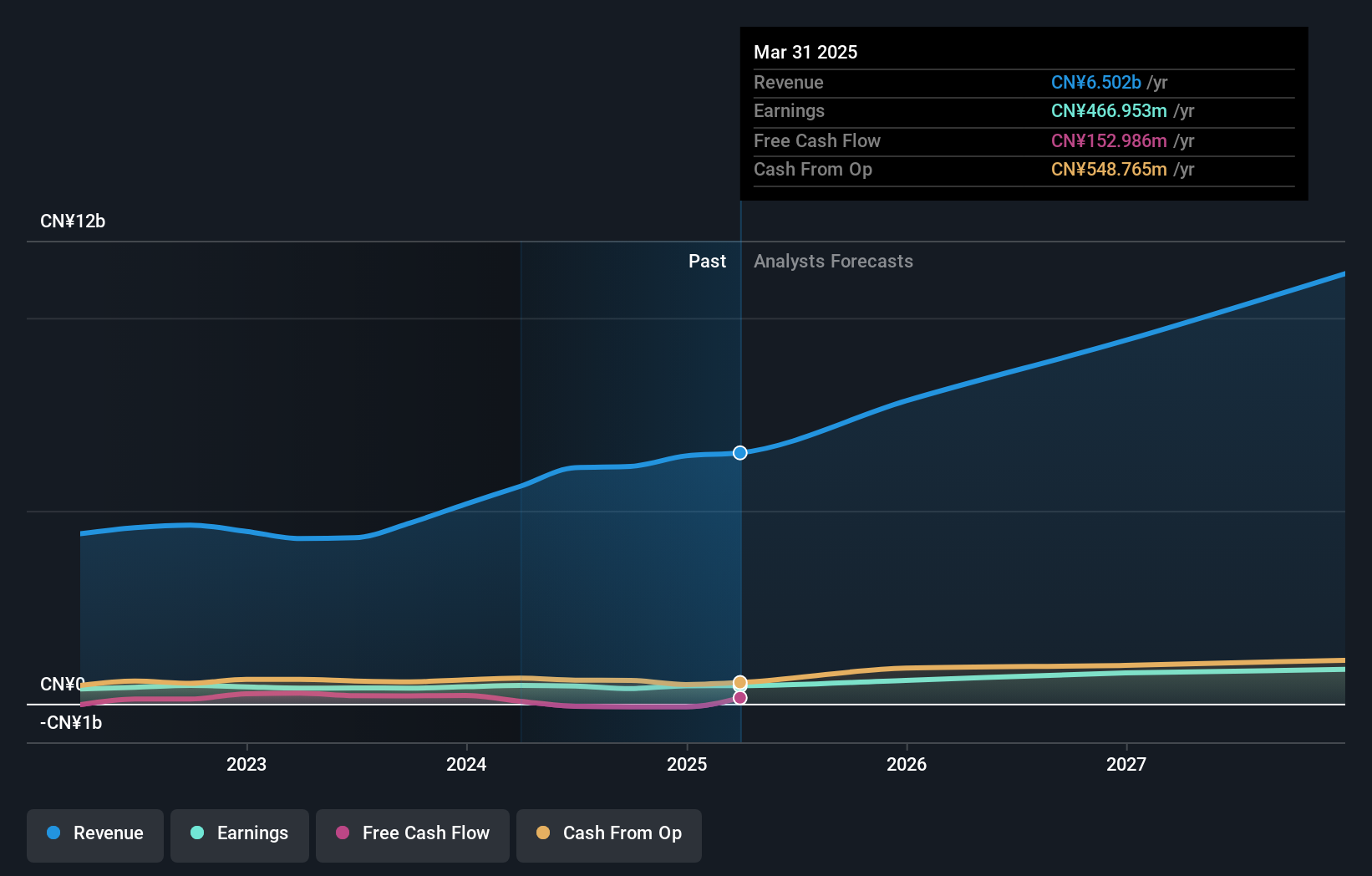

Overview: HMT (Xiamen) New Technical Materials Co., Ltd. (ticker: SHSE:603306) specializes in the development and production of advanced technical materials, with a market cap of CN¥7.12 billion.

Operations: HMT (Xiamen) New Technical Materials generates revenue primarily from the sale of advanced technical materials. The company has a market cap of CN¥7.12 billion.

HMT (Xiamen) New Technical Materials demonstrates strong growth, with earnings rising 43.6% last year, outpacing the Luxury industry’s 12.7%. Their debt to equity ratio increased from 0% to 21.8% over five years, yet they hold more cash than total debt. Recent half-year results show sales of ¥968.8 million and net income of ¥132.33 million, up from ¥76.99 million a year ago. The company repurchased shares worth ¥122.99 million this year, indicating confidence in its future prospects.

Ways ElectronLtd (SHSE:605218)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ways Electron Co., Ltd. engages in the research and development, design, manufacture, and sale of electronic components with a market cap of CN¥5.72 billion.

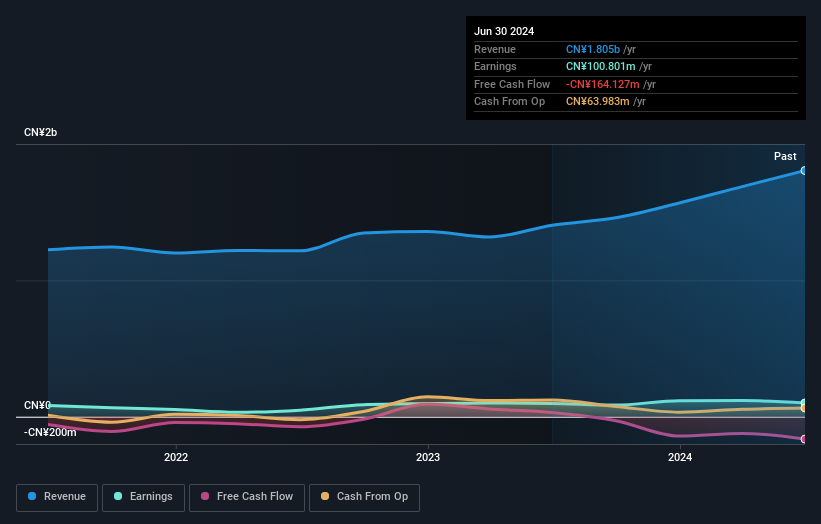

Operations: Ways Electron Ltd. generates revenue primarily through the sale of electronic components. The company reports its financials in millions of CN¥, with detailed breakdowns available for specific segments.

Ways Electron Ltd. has shown promising growth, with earnings up 3.3% over the past year, outpacing the electronic industry’s -4.5%. For the first half of 2024, sales reached CNY 889.4 million compared to CNY 651.72 million a year ago; however, net income dropped to CNY 19.31 million from CNY 36.52 million previously reported. The company’s debt-to-equity ratio increased from 3.2% to 6.2% over five years, indicating rising leverage but manageable interest coverage due to high non-cash earnings levels.

Dongguan Aohai Technology (SZSE:002993)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dongguan Aohai Technology Co., Ltd. researches, develops, produces, and sells consumer electronics products in China and internationally with a market cap of CN¥6.62 billion.

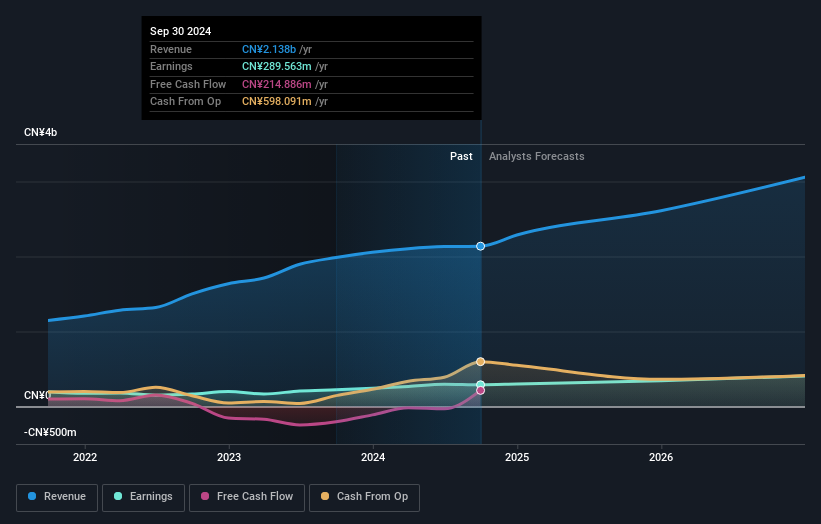

Operations: Aohai Technology generates revenue primarily from the manufacturing of computer, communications, and other electronic equipment, totaling CN¥5.17 billion.

Dongguan Aohai Technology, a promising player in the tech sector, has demonstrated solid financial health. The company’s debt to equity ratio rose from 0.04% to 2.5% over five years, indicating manageable leverage. Its price-to-earnings ratio of 15x is attractive compared to the CN market's 26.6x average. With earnings growth at 0.8%, surpassing the tech industry’s -0.7%, and forecasted annual growth of 23%, Aohai seems poised for steady progress in its niche market.

Taking Advantage

- Embark on your investment journey to our 957 Chinese Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002993

Dongguan Aohai Technology

Research, develops, produces, and sells consumer electronics products in China and internationally.

High growth potential with excellent balance sheet.