- China

- /

- Commercial Services

- /

- SZSE:000826

There's No Escaping TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT Co., LTD.'s (SZSE:000826) Muted Revenues Despite A 34% Share Price Rise

TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT Co., LTD. (SZSE:000826) shareholders are no doubt pleased to see that the share price has bounced 34% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 25% over that time.

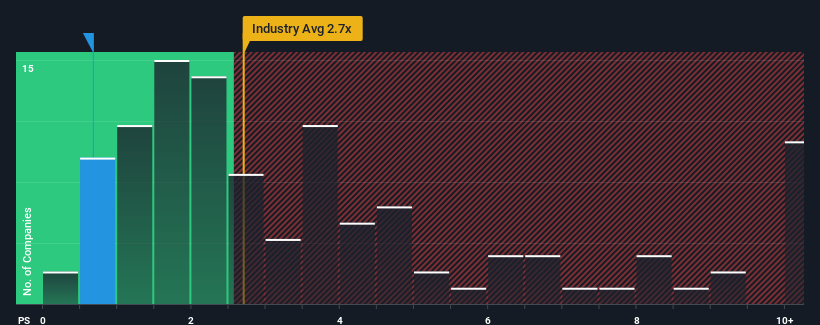

Even after such a large jump in price, TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Commercial Services industry in China have P/S ratios greater than 2.7x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT

How TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT Has Been Performing

As an illustration, revenue has deteriorated at TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT will help you shine a light on its historical performance.How Is TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT's Revenue Growth Trending?

TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 29%. The last three years don't look nice either as the company has shrunk revenue by 40% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 30% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we are not surprised that TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT's P/S Mean For Investors?

Shares in TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT have risen appreciably however, its P/S is still subdued. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Plus, you should also learn about this 1 warning sign we've spotted with TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT.

If you're unsure about the strength of TUS ENVIRONMENTAL SCIENCE AND TECHNOLOGY DEVELOPMENT's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if TUS Environmental Science and Technology Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000826

TUS Environmental Science and Technology Development

Provides environment improvement solutions in China.

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026