- China

- /

- Commercial Services

- /

- SHSE:603778

Promising Penny Stocks To Consider In January 2025

Reviewed by Simply Wall St

Global markets have been buoyed by cooling inflation and robust bank earnings, with major U.S. stock indexes posting significant gains. As investors navigate these evolving economic conditions, the search for opportunities in smaller, potentially high-growth companies remains compelling. Penny stocks, often seen as relics of past market eras, continue to offer a unique blend of affordability and growth potential when backed by strong financials. In this article, we'll explore three penny stocks that stand out for their financial strength and potential upside in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.68 | HK$42.36B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.74 | MYR437.82M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.00 | HK$634.79M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £153.63M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.395 | £177.66M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

Click here to see the full list of 5,708 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Wanda Hotel Development (SEHK:169)

Simply Wall St Financial Health Rating: ★★★★★★

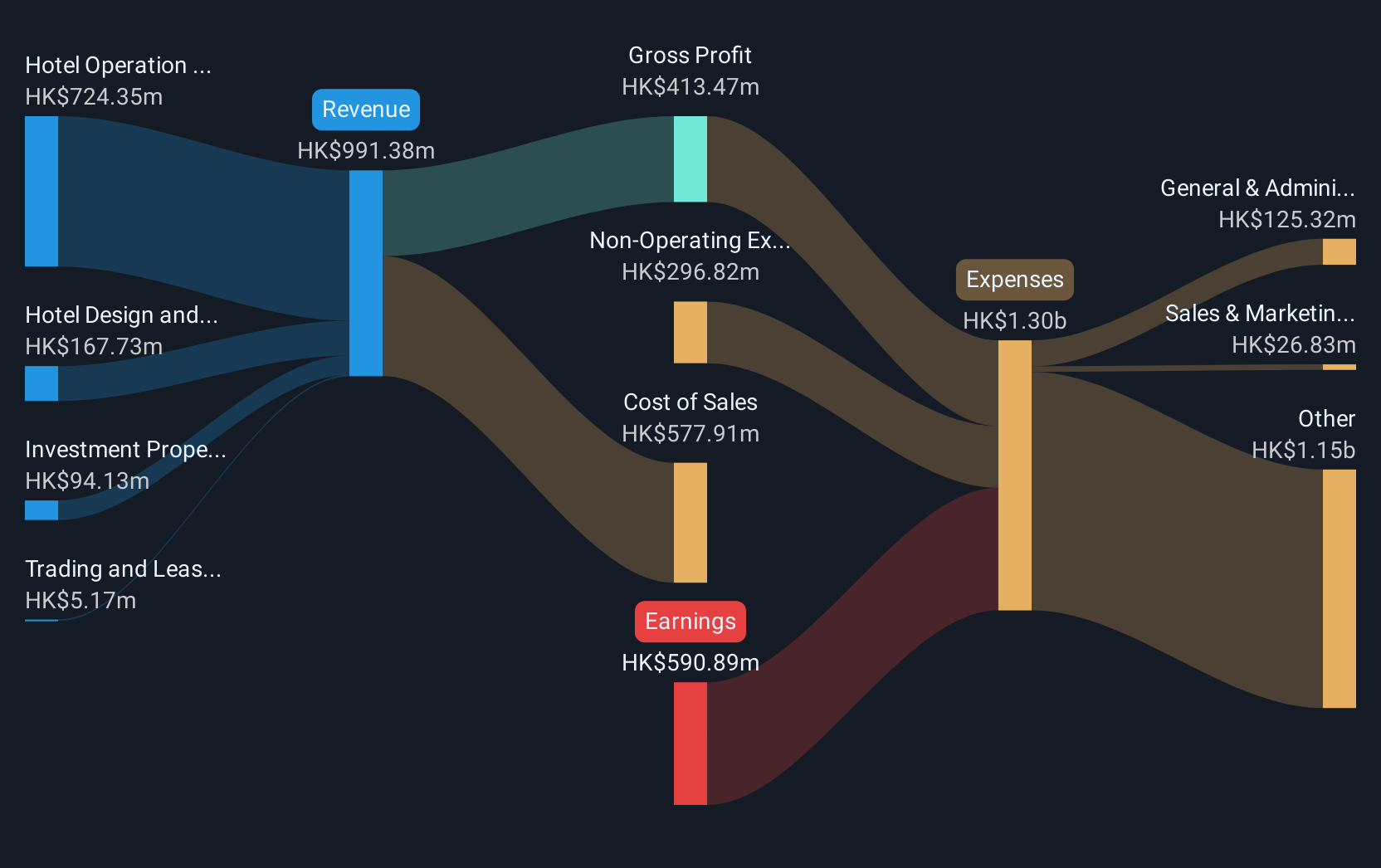

Overview: Wanda Hotel Development Company Limited is an investment holding company involved in property development, investment, leasing, and management both in China and internationally, with a market cap of HK$1.32 billion.

Operations: The company's revenue is primarily derived from three segments: Investment Property Leasing (HK$92.29 million), Hotel Operation and Management Services (HK$746.85 million), and Hotel Design and Construction Management Services (HK$172.80 million).

Market Cap: HK$1.32B

Wanda Hotel Development, with a market cap of HK$1.32 billion, is currently unprofitable but has shown financial resilience through its substantial cash reserves exceeding both short and long-term liabilities. The company has not diluted shareholders over the past year and maintains an experienced board and management team. Despite a volatile share price, it has managed to reduce its debt significantly over five years while maintaining positive free cash flow growth. Recent executive changes include the appointment of Mr. Zhang Chunyuan as a non-executive director, bringing extensive experience from his tenure at Dalian Wanda Group Co., Ltd.

- Get an in-depth perspective on Wanda Hotel Development's performance by reading our balance sheet health report here.

- Gain insights into Wanda Hotel Development's historical outcomes by reviewing our past performance report.

Guosheng Shian Technology (SHSE:603778)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Guosheng Shian Technology Co., Ltd. operates in garden engineering construction, garden landscape design, and seedling sales in China with a market cap of CN¥1.95 billion.

Operations: Guosheng Shian Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥1.95B

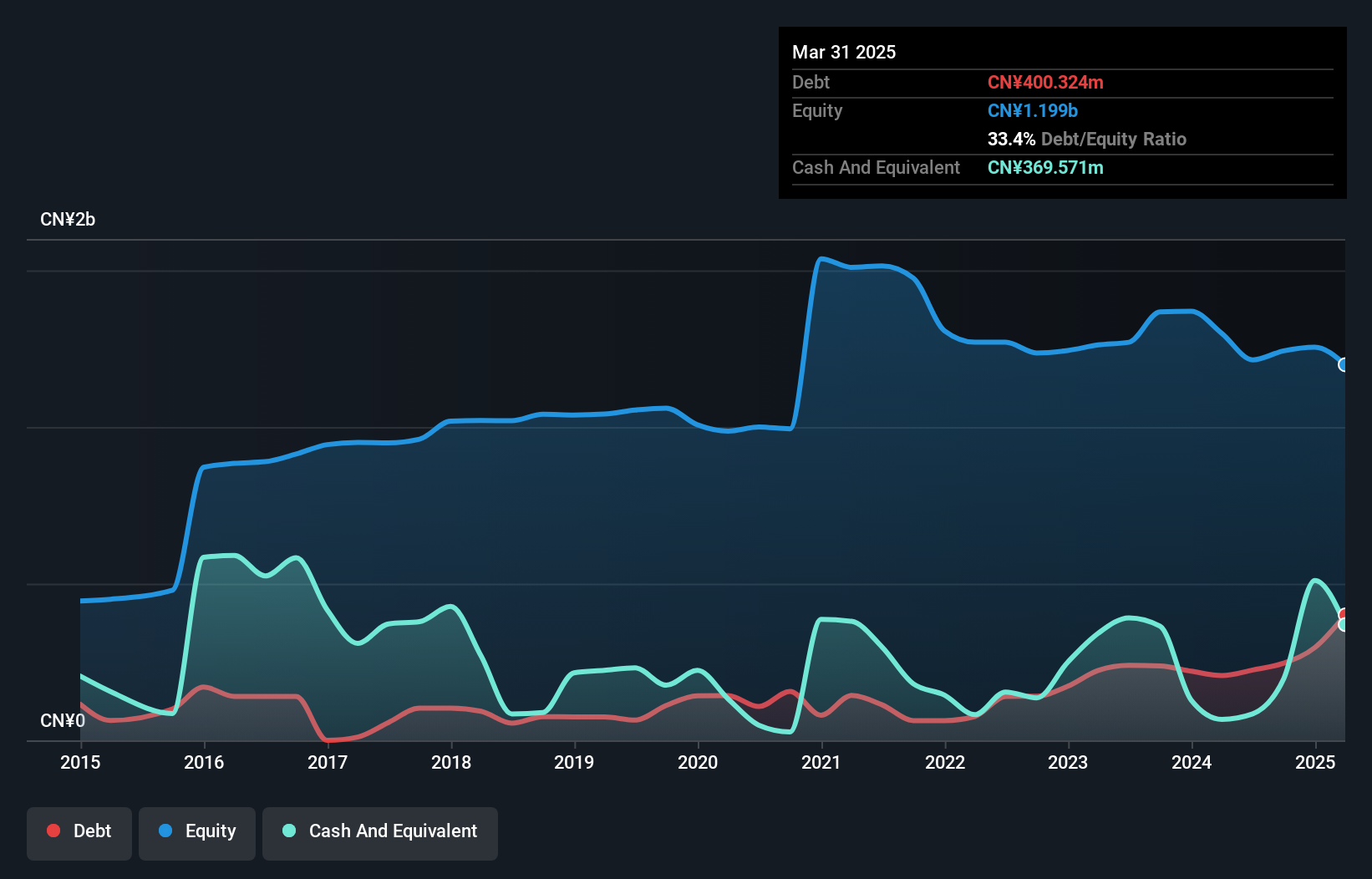

Guosheng Shian Technology, with a market cap of CN¥1.95 billion, has faced challenges despite reporting sales of CN¥1.07 billion for the nine months ending September 2024, an increase from the previous year. The company remains unprofitable with a net loss of CN¥152.37 million and has seen its debt to equity ratio rise over five years. While short-term liabilities exceed assets, long-term liabilities are well-covered by short-term assets. The management team is experienced, though the board is relatively new. A special shareholders meeting is scheduled for January 2025 in Beijing to address ongoing issues.

- Navigate through the intricacies of Guosheng Shian Technology with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Guosheng Shian Technology's track record.

Shenzhen Asia Link Technology DevelopmentLtd (SZSE:002316)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shenzhen Asia Link Technology Development Co., Ltd. operates in the technology sector with a market capitalization of CN¥1.34 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥1.34B

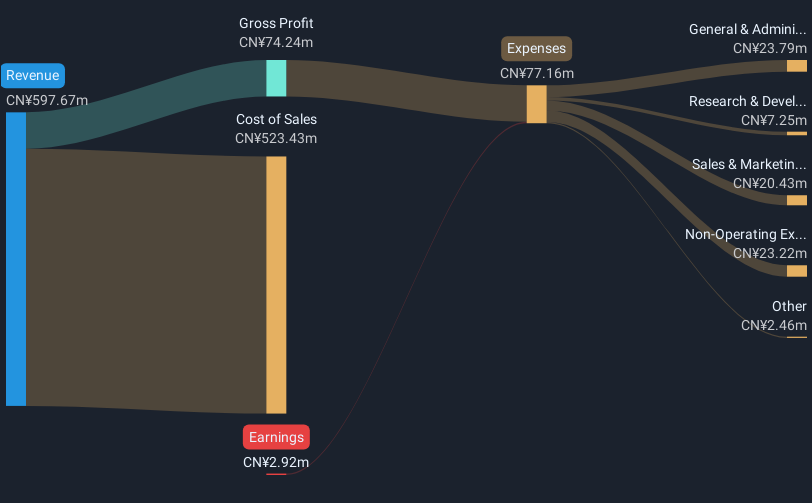

Shenzhen Asia Link Technology Development Ltd., with a market cap of CN¥1.34 billion, reported sales of CN¥424.82 million for the nine months ending September 2024, showing slight decline from the previous year but achieving a net income of CN¥10.81 million compared to a prior loss. Despite unprofitability, the company has reduced its debt to equity ratio significantly over five years and maintains more cash than total debt. Short-term liabilities slightly exceed assets, yet long-term liabilities are well-covered by short-term assets. An extraordinary shareholders meeting is scheduled for December 2024 to discuss strategic changes including business entity type adjustments.

- Take a closer look at Shenzhen Asia Link Technology DevelopmentLtd's potential here in our financial health report.

- Explore historical data to track Shenzhen Asia Link Technology DevelopmentLtd's performance over time in our past results report.

Where To Now?

- Click through to start exploring the rest of the 5,705 Penny Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Guosheng Shian Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603778

Guosheng Shian Technology

Engages in the garden engineering construction, garden landscape design, and seedling sales businesses in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives