- Taiwan

- /

- Real Estate

- /

- TWSE:2520

Undiscovered Gems Three Promising Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, with easing U.S. inflation and strong bank earnings pushing major indices higher, investors are increasingly optimistic about potential opportunities in the small-cap sector. In this environment, identifying promising stocks often involves looking for companies that demonstrate resilience and growth potential amid economic shifts, making them potential hidden gems worth watching.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Macnica Galaxy | 52.99% | 8.23% | 18.45% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Bank of Gansu (SEHK:2139)

Simply Wall St Value Rating: ★★★★★★

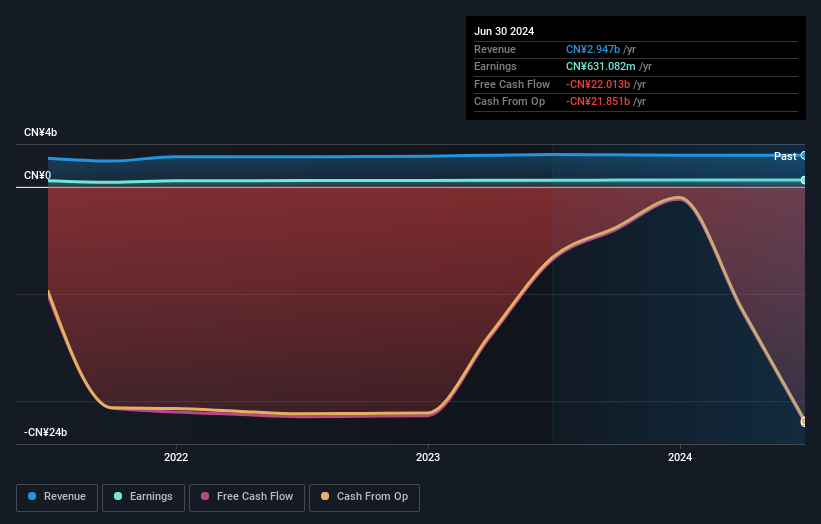

Overview: Bank of Gansu Co., Ltd., along with its subsidiary Pingliang Jingning Chengji Rural Bank Co., Ltd., offers a range of banking services in the People’s Republic of China and has a market capitalization of approximately HK$3.72 billion.

Operations: Bank of Gansu generates revenue primarily from retail banking, contributing CN¥2.10 billion, and corporate banking, which adds CN¥1.21 billion. Financial market operations reflect a negative contribution of CN¥368.60 million to the revenue stream.

With total assets of CN¥422.2 billion, Bank of Gansu stands out with its solid financial footing and a sufficient allowance for bad loans at 135%. Its price-to-earnings ratio of 5.5x suggests it is valued attractively compared to the Hong Kong market average of 9.9x. The bank's earnings growth over the past year has been 2.5%, surpassing the industry average of 2.1%. With customer deposits making up 86% of its liabilities, this low-risk funding structure enhances stability, although earnings have seen a decline by an annual rate of 6.4% over five years.

- Dive into the specifics of Bank of Gansu here with our thorough health report.

Examine Bank of Gansu's past performance report to understand how it has performed in the past.

Sicher Elevator (SZSE:301056)

Simply Wall St Value Rating: ★★★★★★

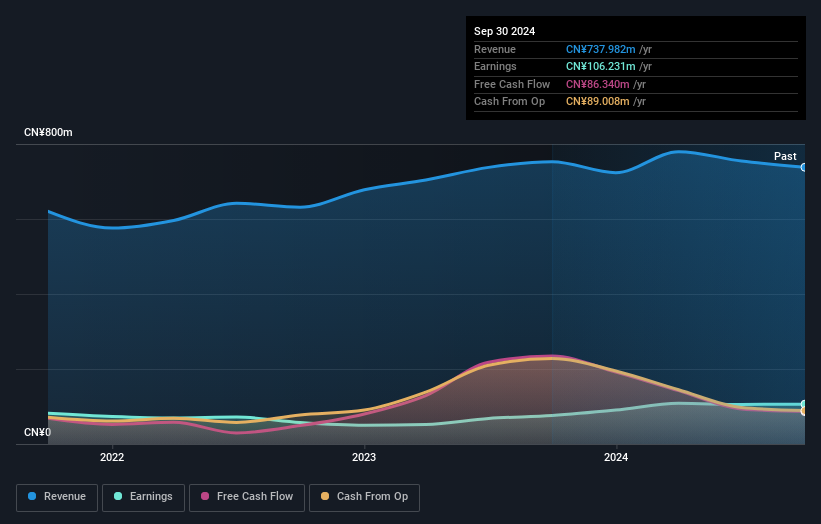

Overview: Sicher Elevator Co., Ltd. is a company that specializes in the manufacturing and sale of elevators, escalators, moving walks, and multi-layer parking equipment with a market cap of CN¥2.36 billion.

Operations: Sicher Elevator generates revenue primarily from its Construction Machinery & Equipment segment, which contributed CN¥730.02 million. The company's market cap stands at approximately CN¥2.36 billion, reflecting its position in the industry.

Sicher Elevator, a modestly sized player in the machinery sector, showcases impressive financial health with no debt and positive free cash flow. Over the past year, earnings surged by 39.9%, outpacing the industry average of -0.2%. The firm reported CNY 540.87 million in sales for the nine months ending September 2024, up from CNY 526.44 million a year prior, while net income rose to CNY 79.6 million from CNY 63.83 million previously. With high-quality earnings and a price-to-earnings ratio of 22x below China's market average of around 35x, Sicher seems well-positioned for continued growth amidst recent board changes including Ying Zhaoyang's election as an independent director.

- Click here to discover the nuances of Sicher Elevator with our detailed analytical health report.

Explore historical data to track Sicher Elevator's performance over time in our Past section.

Kindom Development (TWSE:2520)

Simply Wall St Value Rating: ★★★★★★

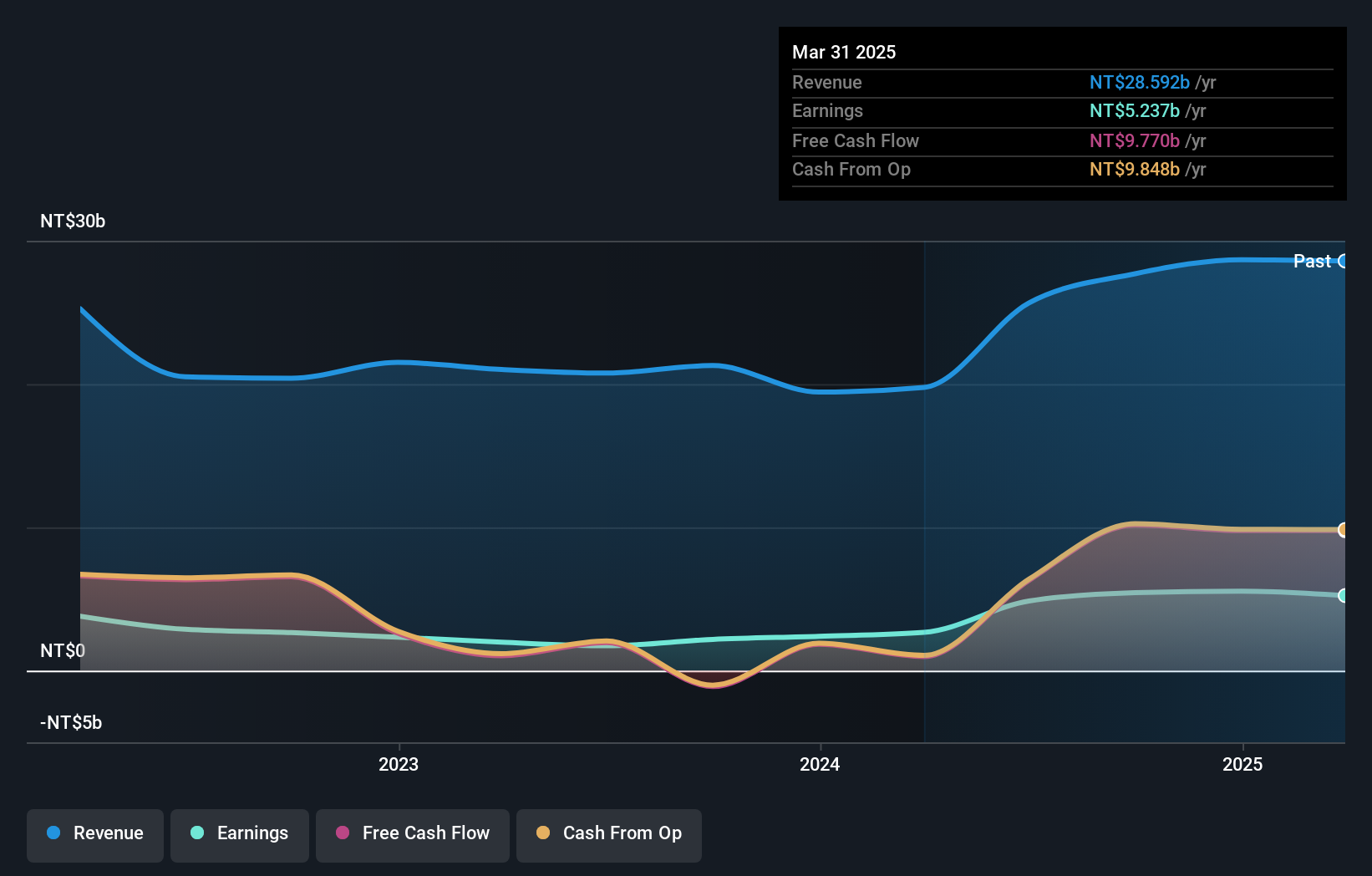

Overview: Kindom Development Co., Ltd. is a Taiwan-based company that engages in the construction, development, and sale of real estate properties, with a market capitalization of approximately NT$27.61 billion.

Operations: Kindom Development generates revenue primarily from its manufacturing and construction segments, contributing NT$15.39 billion and NT$13.98 billion respectively. The department store segment adds NT$1.76 billion to the total revenue, while adjustments and eliminations account for a reduction of NT$3.44 billion in the overall figures.

Kindom Development is making waves with impressive earnings growth, reporting a 149% increase over the past year, far outpacing the real estate industry average of 52%. The company has significantly reduced its debt to equity ratio from 196% to 61% in five years, showcasing financial discipline. Recent expansions include acquiring land worth TWD 1.35 billion and securing a major MRT development project contract valued at TWD 3.93 billion. With sales climbing to TWD 22.16 billion for nine months in 2024 and net income hitting TWD 4.49 billion, Kindom's strategic moves seem poised to bolster its competitive edge further.

Where To Now?

- Gain an insight into the universe of 4663 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kindom Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2520

Kindom Development

Kindom Development Co., Ltd., together with its subsidiaries, constructs, develops, and sells real estate properties in Taiwan.

Outstanding track record with flawless balance sheet and pays a dividend.