- Taiwan

- /

- Specialty Stores

- /

- TPEX:5312

Discover Cembre And 2 Other Top Dividend Stocks

Reviewed by Simply Wall St

As global markets experience a rebound driven by easing inflation and strong earnings reports, investors are increasingly looking towards dividend stocks as a reliable source of income amidst economic fluctuations. In this context, identifying stocks with solid dividend yields and stable financial health becomes crucial for those seeking to capitalize on favorable market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.17% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.16% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.62% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.82% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

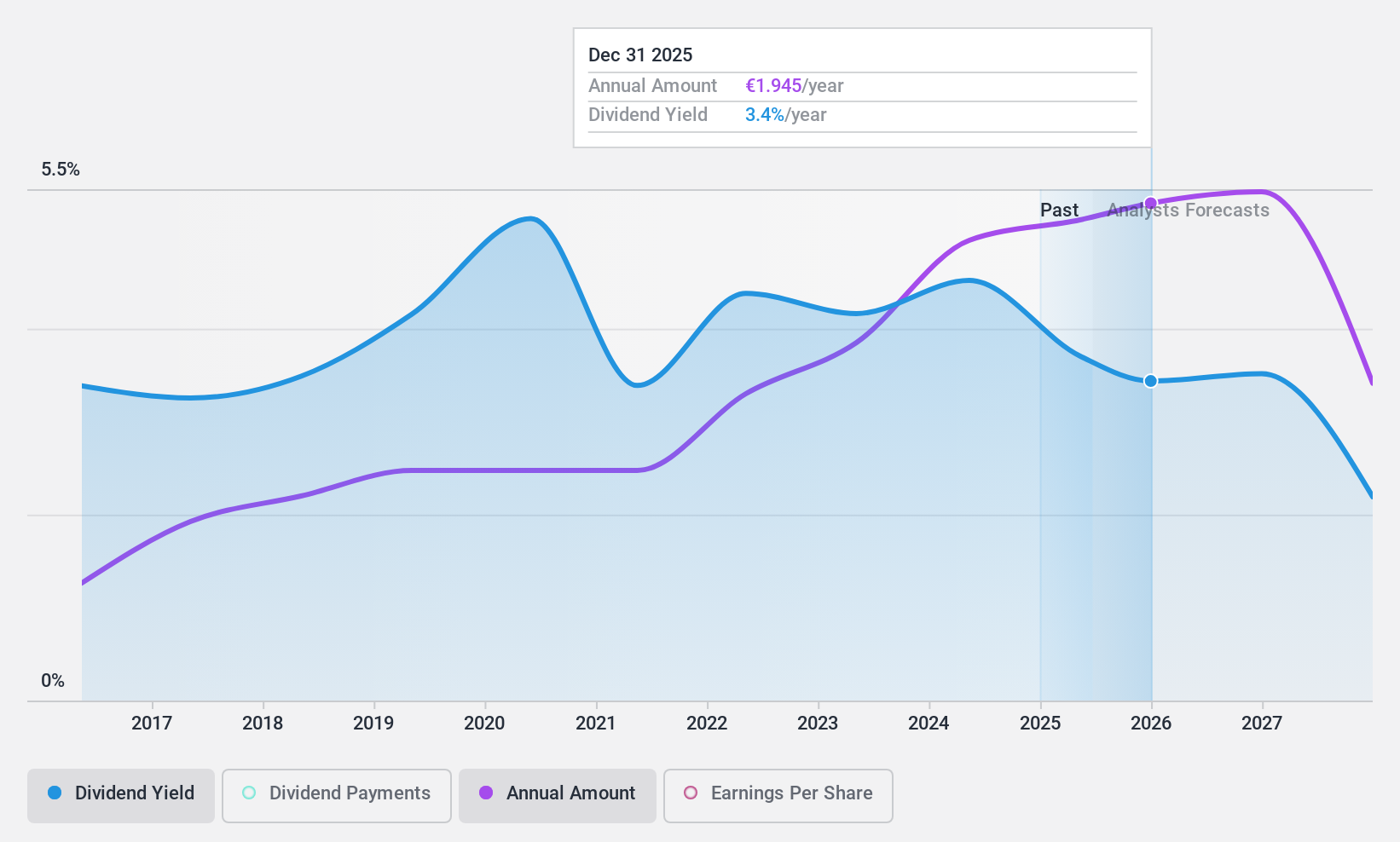

Cembre (BIT:CMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cembre S.p.A. manufactures and sells electrical connectors, cable accessories, and related tools in Italy, Europe, and internationally with a market cap of €687.86 million.

Operations: Cembre S.p.A.'s revenue primarily comes from its Electric Connectors and Related Tools segment, which generated €224.89 million.

Dividend Yield: 4.2%

Cembre's dividend yield of 4.23% is lower than the top 25% in Italy, and while dividends have been stable and growing over the past decade, they are not well covered by free cash flows due to a high cash payout ratio of 148%. The current payout ratio of 80% indicates coverage by earnings, but sustainability concerns remain. Recent earnings show slight revenue growth to €172.64 million, though net income decreased to €29.13 million for nine months ending September 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Cembre.

- Our valuation report unveils the possibility Cembre's shares may be trading at a premium.

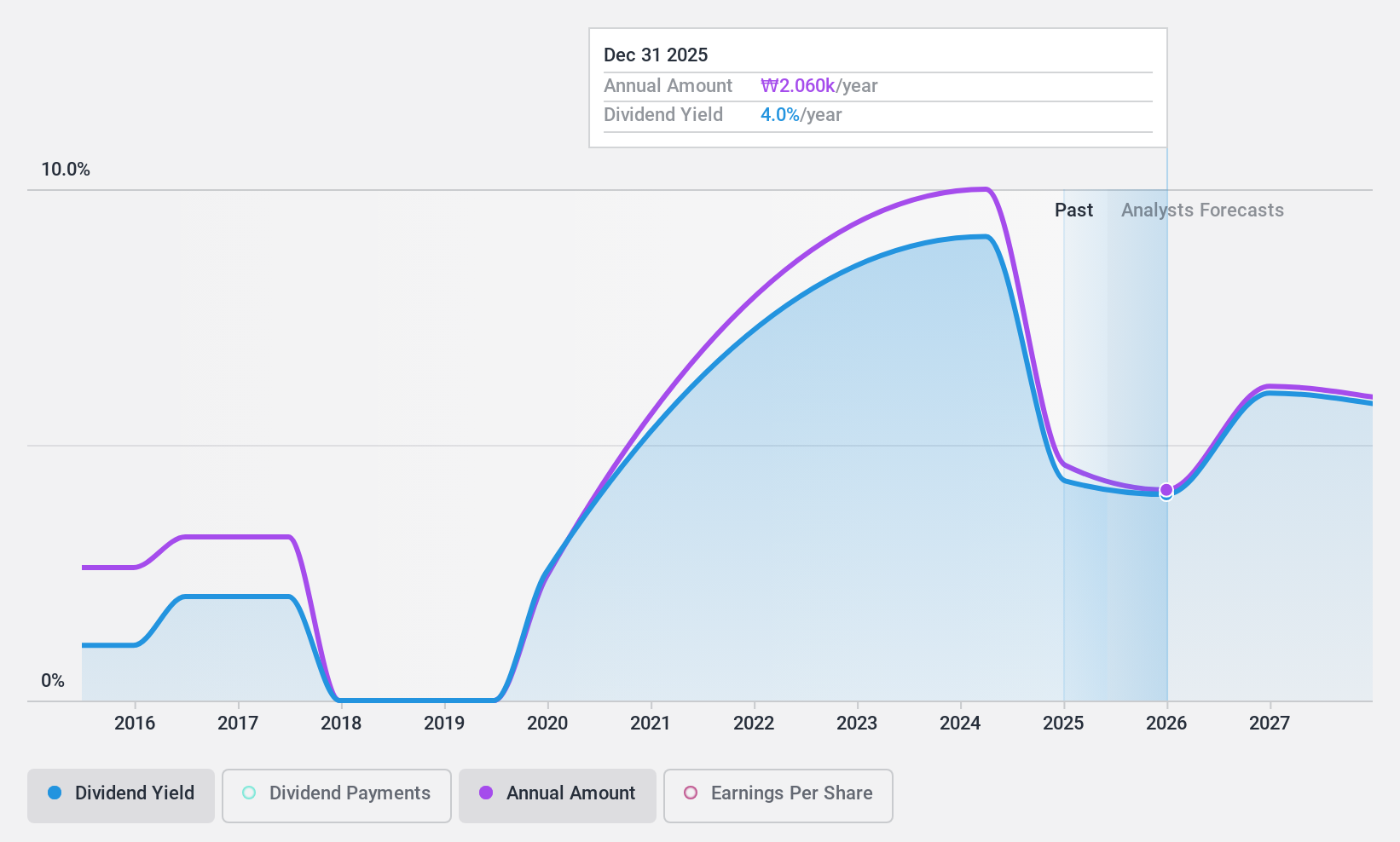

Hanatour Service (KOSE:A039130)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanatour Service Inc. offers travel and related services across South Korea, Northeast and Southeast Asia, the United States, and Europe with a market cap of ₩851.95 billion.

Operations: Hanatour Service Inc.'s revenue is primarily derived from its Trip segment, generating ₩582.45 billion, followed by the Hotel segment at ₩24.71 billion.

Dividend Yield: 4.2%

Hanatour Service's dividend yield of 4.18% ranks in the top 25% of the Korean market, but its sustainability is questionable due to a high payout ratio of 147.8%, indicating dividends are not well covered by earnings. Despite volatile dividend history, cash flows cover payouts with a low cash payout ratio of 26.8%. Recent earnings show growth, with nine-month net income rising to KRW 41.38 billion from KRW 35.86 billion year-over-year, despite declining profit margins.

- Delve into the full analysis dividend report here for a deeper understanding of Hanatour Service.

- Insights from our recent valuation report point to the potential undervaluation of Hanatour Service shares in the market.

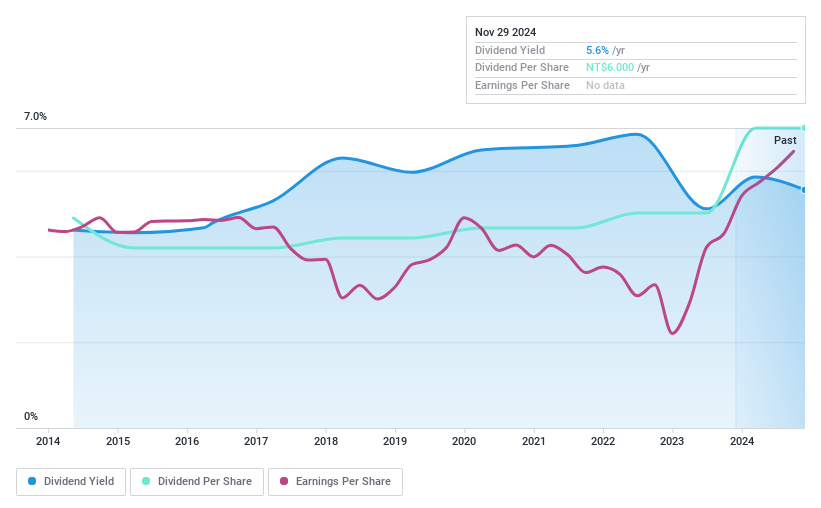

Formosa Optical TechnologyLtd (TPEX:5312)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Formosa Optical Technology Co., Ltd. operates in Taiwan, offering eyecare products, and has a market capitalization of NT$6.67 billion.

Operations: Formosa Optical Technology Ltd. generates revenue primarily from its Bio Division, contributing NT$930.46 million, and Bio Technology segment, which brings in NT$2.91 billion.

Dividend Yield: 5.4%

Formosa Optical Technology's dividend yield of 5.41% is among the top 25% in Taiwan, supported by a sustainable payout ratio of 72.3%, indicating dividends are well-covered by earnings and cash flows. The company has consistently increased dividends over the past decade with minimal volatility. Recent earnings show growth, with Q3 net income rising to NT$149.65 million from NT$118.55 million year-over-year, reflecting solid financial performance that supports dividend stability and growth potential.

- Get an in-depth perspective on Formosa Optical TechnologyLtd's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Formosa Optical TechnologyLtd's current price could be inflated.

Where To Now?

- Click through to start exploring the rest of the 1973 Top Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Formosa Optical TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5312

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives