- Taiwan

- /

- Semiconductors

- /

- TWSE:6257

Undiscovered Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets experience a rebound, driven by cooling U.S. inflation and strong bank earnings, small-cap stocks have shown resilience with the S&P MidCap 400 Index gaining 3.81% for the week. In this environment of cautious optimism, identifying promising small-cap companies can be crucial as they often present unique growth opportunities that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Macnica Galaxy | 52.99% | 8.23% | 18.45% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

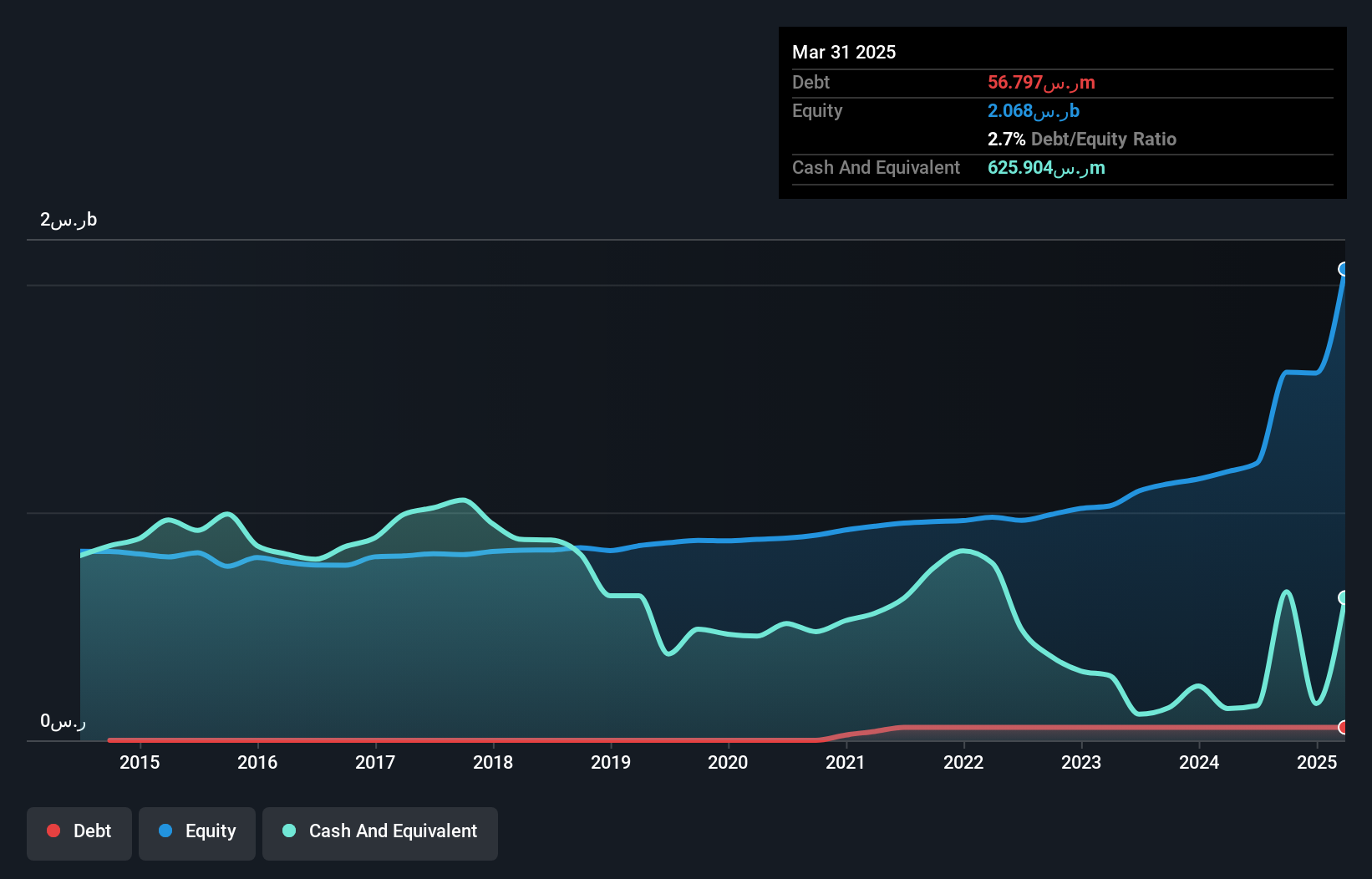

Saudi Reinsurance (SASE:8200)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Saudi Reinsurance Company operates as a provider of diverse reinsurance products across Saudi Arabia, the Middle East, Africa, Asia, and international markets with a market capitalization of SAR6.97 billion.

Operations: Saudi Reinsurance generates revenue primarily from its Property and Casualty (P&C) segments, with notable contributions from Fire (SAR222.93 million), Others (SAR249.10 million), and Engineering (SAR109.28 million). The company also earns income through investment activities, adding SAR69.74 million from unallocated investment income calculated using the effective profit rate. The net profit margin shows a trend worth noting, reflecting the company's ability to manage costs relative to its revenue streams effectively.

Saudi Reinsurance, a relatively small player in its field, has demonstrated remarkable growth with earnings surging 336% over the past year, far outpacing the insurance industry's -6.9%. Despite an increase in debt-to-equity ratio from 0% to 3.5% over five years, it holds more cash than total debt and enjoys strong interest coverage at 25 times EBIT. The company's price-to-earnings ratio of 14.4 is attractive compared to the SA market's average of 24.4. Recent leadership changes aim to enhance digital and operational capabilities under new COO Isa Ali's guidance, which could shape its future trajectory positively.

- Dive into the specifics of Saudi Reinsurance here with our thorough health report.

Examine Saudi Reinsurance's past performance report to understand how it has performed in the past.

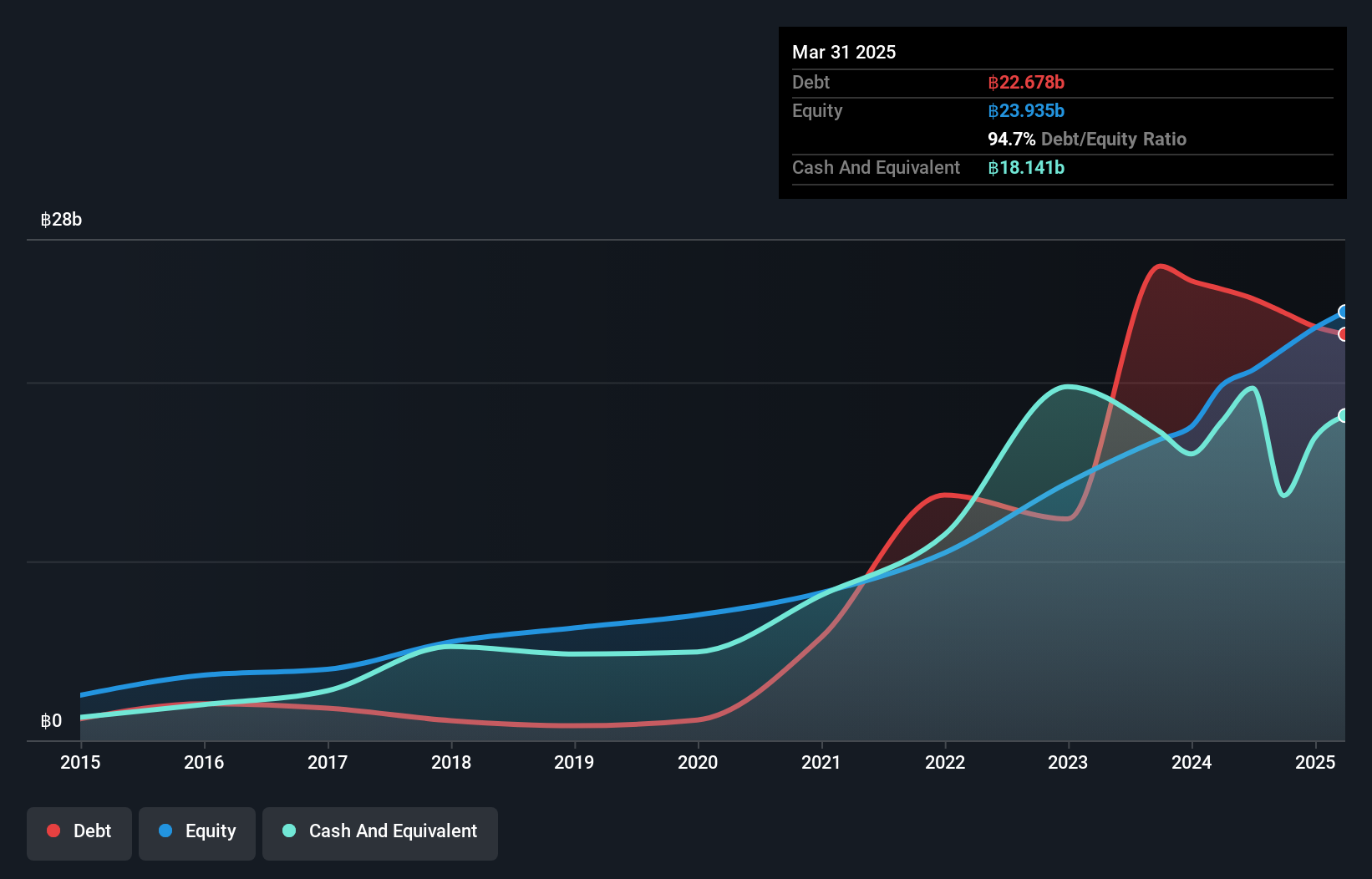

Thai Credit Bank (SET:CREDIT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Thai Credit Bank Public Company Limited is a retail bank offering financial services to micro, small, and medium-sized enterprises in Thailand with a market cap of THB24.94 billion.

Operations: Thai Credit Bank generates revenue primarily through interest income from loans and advances to micro, small, and medium-sized enterprises. The bank's cost structure includes interest expenses on deposits and borrowings, impacting its net profit margin.

Thai Credit Bank, with total assets of THB183.1 billion and equity of THB23 billion, stands out for its primarily low-risk funding structure, as 83% of liabilities are customer deposits. The bank's net interest margin is a robust 8.4%, though it faces challenges with high non-performing loans at 4.5%. Despite this, it has a sufficient allowance for bad loans at 147%. In the past year, earnings grew by 1.9%, surpassing the industry average of 0.6%. Trading at a significant discount to estimated fair value suggests potential upside for investors seeking undervalued opportunities in financials.

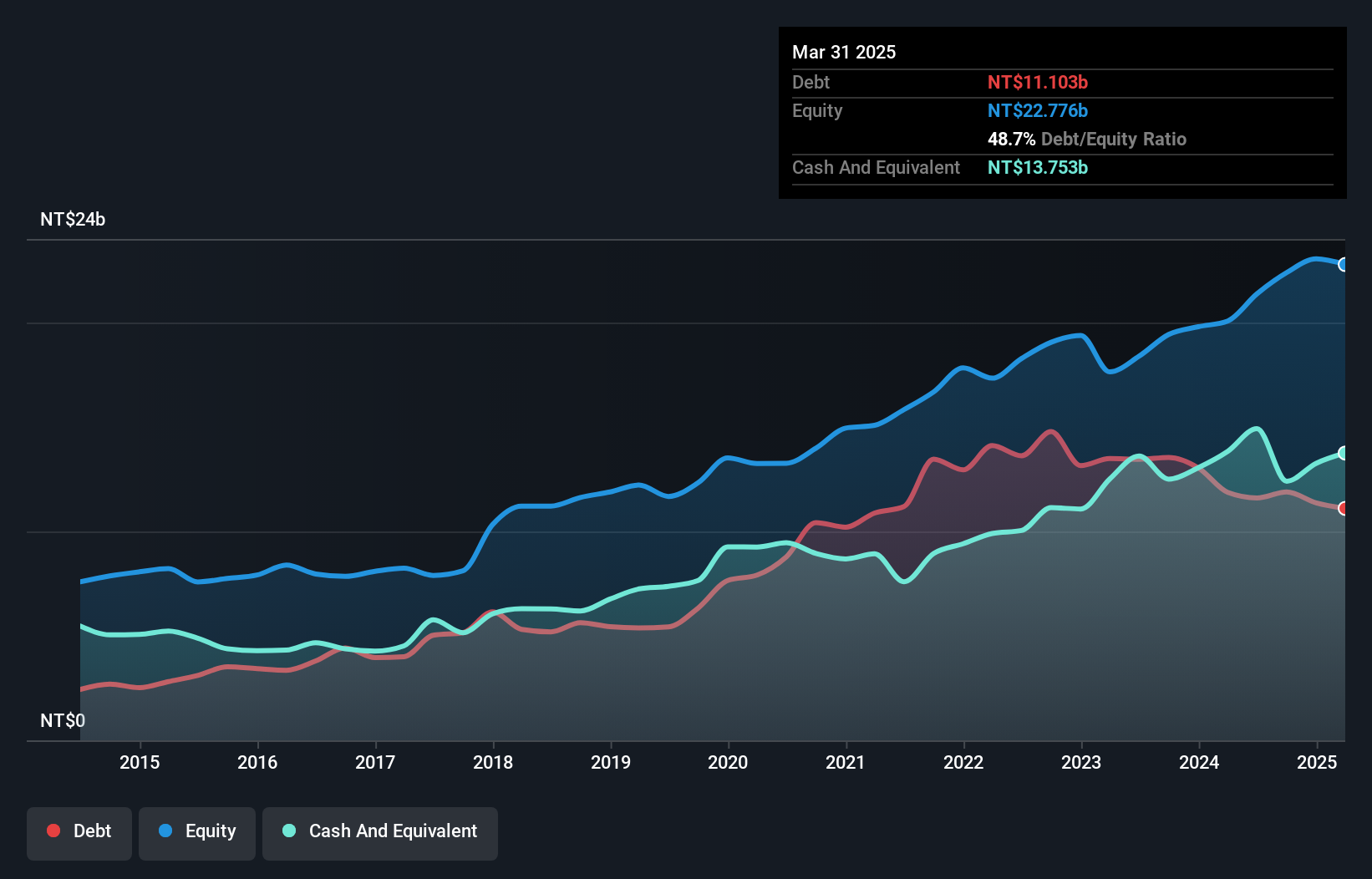

Sigurd Microelectronics (TWSE:6257)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sigurd Microelectronics Corporation operates in the design, processing, testing, burn-in treatment, manufacture, and trading of integrated circuits (ICs) across Taiwan and several international markets with a market cap of approximately NT$33.39 billion.

Operations: Sigurd Microelectronics generates revenue primarily from its packaging and testing business, contributing NT$17.27 billion, while trading activities add NT$42.64 million.

Sigurd Microelectronics, a nimble player in the semiconductor space, has shown robust earnings growth of 30.6% over the past year, outpacing its industry peers' 5.9%. The company's price-to-earnings ratio stands at 15.2x, offering good value against the TW market's 20.5x benchmark. Recent financials reveal third-quarter sales of TWD 4.59 billion and net income of TWD 482.93 million, reflecting a dip from last year's figures but still maintaining high-quality earnings overall. Despite a slight increase in debt-to-equity ratio to 53%, Sigurd remains profitable with positive free cash flow and strong interest coverage capabilities.

- Click to explore a detailed breakdown of our findings in Sigurd Microelectronics' health report.

Gain insights into Sigurd Microelectronics' past trends and performance with our Past report.

Make It Happen

- Navigate through the entire inventory of 4663 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6257

Sigurd Microelectronics

Engages in the design, processing, testing, burn-in treatment, manufacture, and trading of integrated circuits (ICs) in Taiwan, Singapore, America, China, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives