- Taiwan

- /

- Semiconductors

- /

- TPEX:5299

3 Dividend Stocks Offering Yields Up To 6.5%

Reviewed by Simply Wall St

As global markets experience a rebound with easing inflation and strong bank earnings, major U.S. stock indexes have surged, supported by value stocks outperforming growth shares and notable gains in the financials sector. In this dynamic environment, dividend stocks present an attractive option for investors seeking steady income streams, offering yields that can provide stability amid market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.17% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.92% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.06% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.82% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1971 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

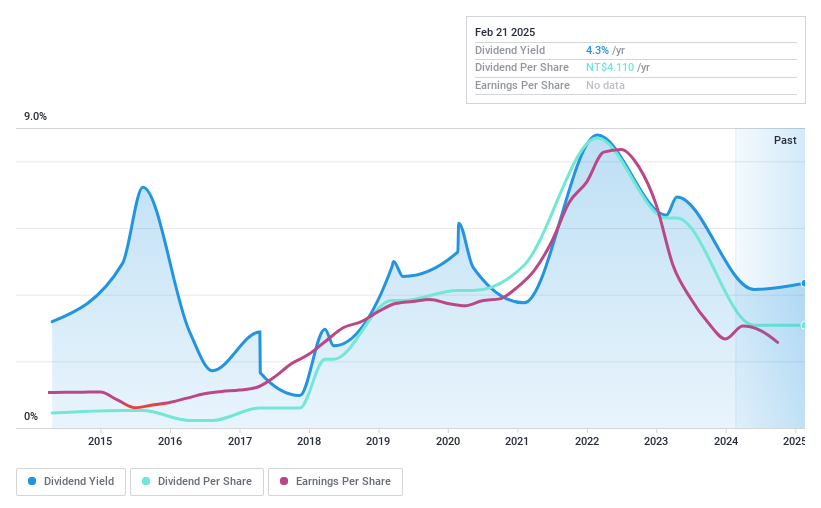

Excelliance MOS (TPEX:5299)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Excelliance MOS Corporation manufactures and sells power components and integrated circuits in Taiwan, with a market cap of NT$4.51 billion.

Operations: Excelliance MOS Corporation generates revenue primarily from its Power Supply Systems segment, amounting to NT$1.71 billion.

Dividend Yield: 4.6%

Excelliance MOS offers a dividend yield of 4.76%, ranking in the top 25% of Taiwan's market, with dividends covered by earnings (84.7% payout ratio) and cash flows (79.6% cash payout ratio). Despite this coverage, the company's dividend history is unstable and unreliable, with past volatility exceeding 20%. Recent earnings show a decline in net income to TWD 38.6 million for Q3 2024 from TWD 87.52 million a year ago, impacting financial stability for future payouts.

- Get an in-depth perspective on Excelliance MOS' performance by reading our dividend report here.

- The valuation report we've compiled suggests that Excelliance MOS' current price could be inflated.

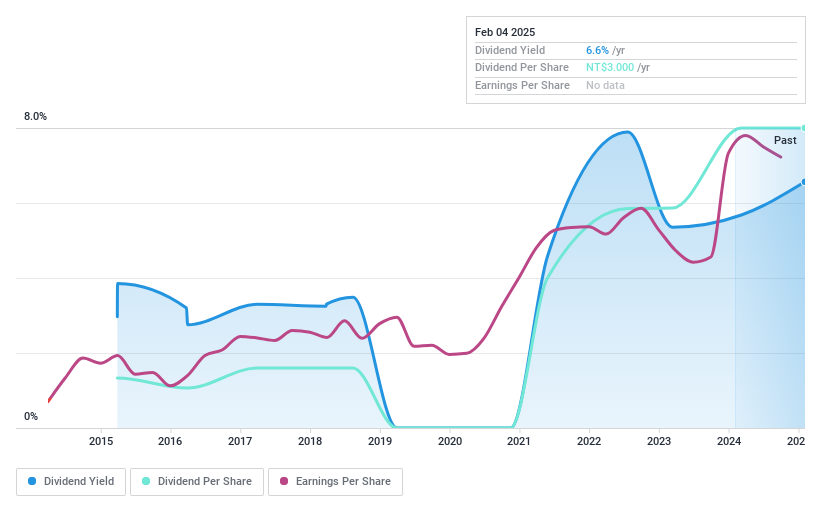

Yen Sun Technology (TPEX:6275)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yen Sun Technology Corporation manufactures and sells home appliances and electronic cooling products across Taiwan, Germany, the United States, Mainland China, Japan, South Korea, and internationally with a market cap of NT$3.56 billion.

Operations: Yen Sun Technology Corporation's revenue is primarily derived from its Electronic Heat Transfer Department, contributing NT$3.16 billion, followed by the Home Electric Appliance Division at NT$581.17 million.

Dividend Yield: 6.6%

Yen Sun Technology's dividend yield of 6.59% places it among the top 25% in Taiwan, yet its sustainability is questionable due to a high cash payout ratio of 407.3%, indicating dividends are not well-covered by free cash flow. Despite a reasonable earnings payout ratio of 74.7%, the dividends have been volatile and unreliable over the past decade. Recent earnings growth, with net income rising to TWD 157.35 million for nine months ending September 2024, may provide some support for future payouts but does not guarantee stability given historical volatility and financial pressures from one-off items impacting results.

- Delve into the full analysis dividend report here for a deeper understanding of Yen Sun Technology.

- In light of our recent valuation report, it seems possible that Yen Sun Technology is trading beyond its estimated value.

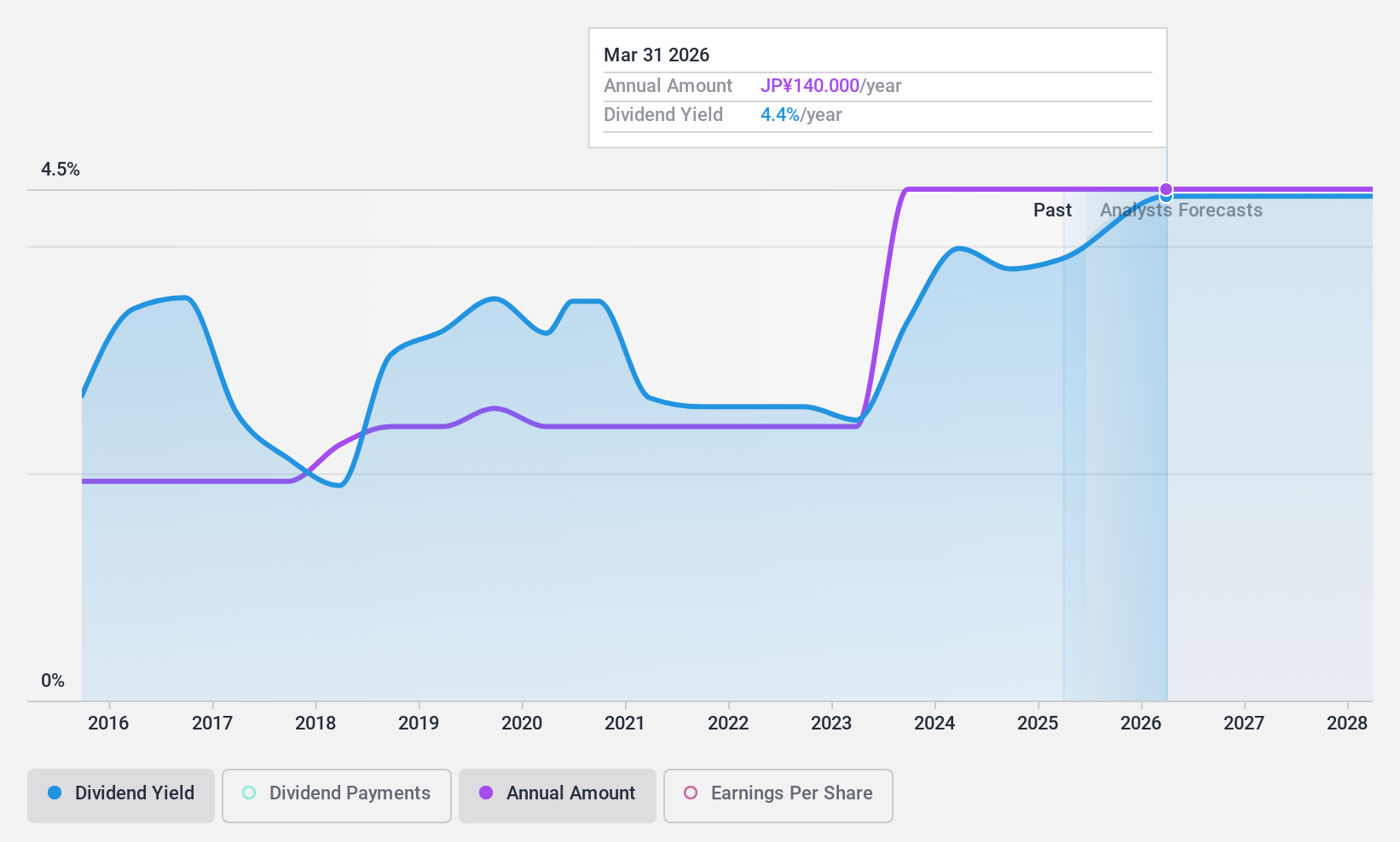

Shibaura MachineLtd (TSE:6104)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Shibaura Machine Co., Ltd. manufactures and sells a range of machines both in Japan and internationally, with a market cap of ¥85.19 billion.

Operations: Shibaura Machine Co., Ltd. generates revenue from several segments, including ¥23.14 billion from Machine Tools, ¥10.76 billion from Control Machines, and ¥132.19 billion from Molding Machines.

Dividend Yield: 3.9%

Shibaura Machine Ltd. offers a stable dividend profile, with dividends consistently paid and growing over the past decade. The company maintains a low payout ratio of 27.7%, ensuring dividends are well-covered by earnings and cash flows, reflected in its cash payout ratio of 23.7%. Despite recent profit margin declines from 13% to 7.3%, its dividend yield remains attractive at 3.89%, ranking in the top quartile within Japan's market, though future earnings may face challenges.

- Take a closer look at Shibaura MachineLtd's potential here in our dividend report.

- Our valuation report here indicates Shibaura MachineLtd may be undervalued.

Seize The Opportunity

- Access the full spectrum of 1971 Top Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Excelliance MOS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5299

Excelliance MOS

Engages in the manufacture and sale of power components and integrated circuits in Taiwan.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives