- Spain

- /

- Capital Markets

- /

- BME:R4

Undiscovered Gems Featuring 3 Promising Small Caps with Solid Financials

Reviewed by Simply Wall St

As global markets react to political developments and economic indicators, large-cap indexes have generally outperformed their smaller-cap counterparts, yet small-cap stocks remain an intriguing area for investors seeking growth potential. In this environment, identifying small-cap companies with solid financials can offer unique opportunities, as these "undiscovered gems" may benefit from favorable market conditions and emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Miwon Chemicals | 0.22% | 11.24% | 14.59% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

| iMarketKorea | 29.86% | 5.28% | 1.62% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Renta 4 Banco (BME:R4)

Simply Wall St Value Rating: ★★★★★☆

Overview: Renta 4 Banco, S.A. is a financial institution that offers wealth management, brokerage, and corporate advisory services both in Spain and internationally, with a market capitalization of €516.80 million.

Operations: Renta 4 Banco generates revenue primarily through wealth management, brokerage, and corporate advisory services. The company's financial performance is reflected in its net profit margin, which has shown variability across different periods.

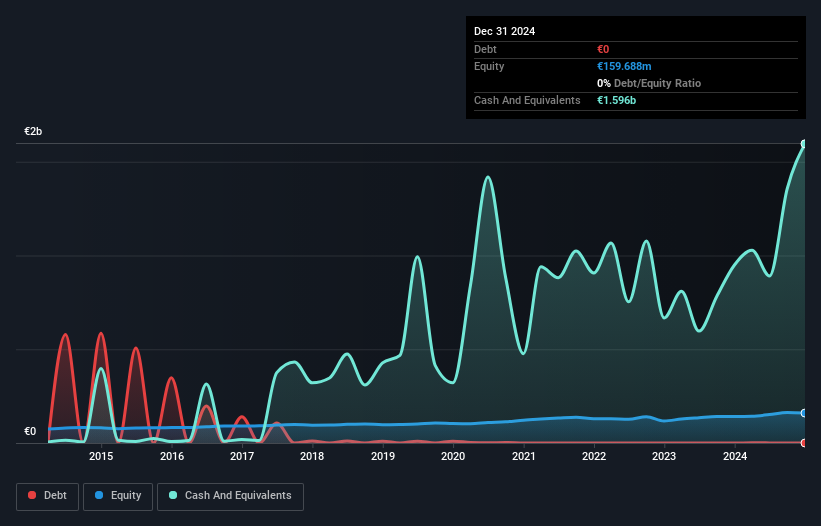

Renta 4 Banco, a nimble player in the financial sector, showcases its strengths with impressive earnings growth of 18.1%, outpacing the Capital Markets industry at 12.9%. The bank's debt-free status and high-quality past earnings highlight its robust financial health. With a price-to-earnings ratio of 17.4x, it appears attractively valued against the Spanish market average of 19.5x. Recent results bolster confidence as net income rose to €8 million for Q3 from €5 million last year, and nine-month figures improved to €23 million from €19 million previously, suggesting positive momentum in its operations.

Jiangsu Leili Motor (SZSE:300660)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Leili Motor Co., Ltd focuses on the research and development, production, and sale of household appliances, micro motors, and intelligent components both in China and internationally, with a market cap of CN¥14.05 billion.

Operations: Jiangsu Leili Motor generates revenue primarily from the sale of household appliances, micro motors, and intelligent components. The company's financial performance includes a focus on optimizing its cost structure to enhance profitability. One notable trend is its net profit margin, which reflects the efficiency of its operations in converting revenue into actual profit.

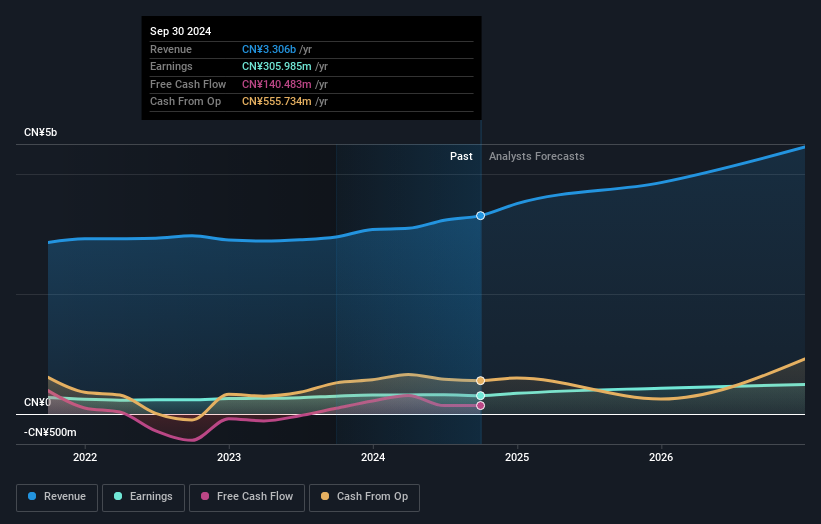

Jiangsu Leili Motor, a smaller player in the electrical industry, has seen its earnings grow by 2.8% over the past year, outpacing the industry's 0.8% growth rate. Despite this positive trend, net income for the first nine months of 2024 was CNY 240.88 million, slightly less than last year's CNY 252.02 million. The company's cash position is strong relative to its debt levels, suggesting financial stability amid a volatile share price environment recently observed over three months. Looking ahead, earnings are expected to grow annually by around 21%, indicating potential for future expansion and value creation in this niche market segment.

- Delve into the full analysis health report here for a deeper understanding of Jiangsu Leili Motor.

Evaluate Jiangsu Leili Motor's historical performance by accessing our past performance report.

Daihatsu Diesel Mfg (TSE:6023)

Simply Wall St Value Rating: ★★★★★★

Overview: Daihatsu Diesel Mfg. Co., Ltd. is a company that specializes in the manufacturing and sale of marine engines, land engines, and industrial instruments both domestically in Japan and internationally, with a market capitalization of ¥62.35 billion.

Operations: The primary revenue stream for Daihatsu Diesel Mfg. comes from marine engines, contributing ¥73.05 billion, followed by land engine-related products at ¥10.67 billion.

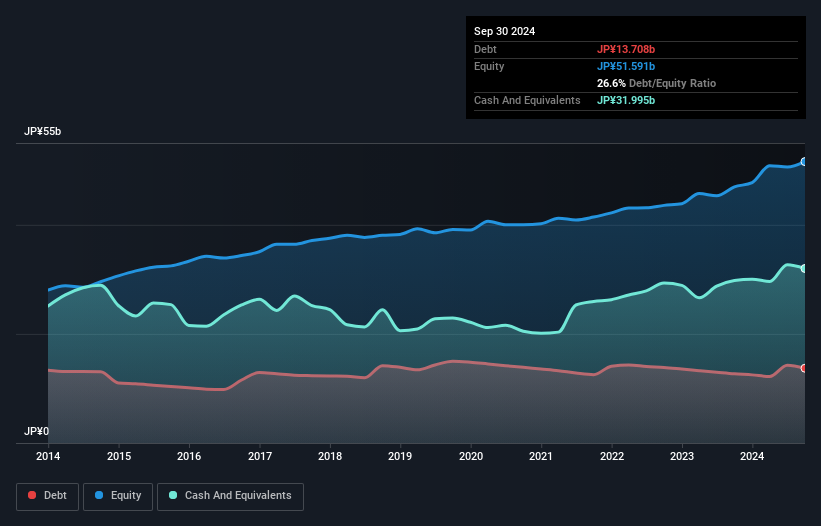

Daihatsu Diesel, a smaller player in the machinery sector, has shown impressive earnings growth of 32% over the past year, surpassing the industry's 1.6%. Its debt-to-equity ratio has improved from 38.3% to 26.6% over five years, and it holds more cash than total debt, indicating solid financial health. Despite high volatility in its share price recently, the company trades at nearly half its estimated fair value. However, recent dividend guidance suggests a decrease to ¥39 per share from ¥49 last year, possibly reflecting strategic reinvestment or market conditions impacting profitability expectations.

- Get an in-depth perspective on Daihatsu Diesel Mfg's performance by reading our health report here.

Gain insights into Daihatsu Diesel Mfg's past trends and performance with our Past report.

Make It Happen

- Click this link to deep-dive into the 4670 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:R4

Renta 4 Banco

Engages in the provision of wealth management, brokerage, and corporate advisory services in Spain and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives