- China

- /

- Electrical

- /

- SZSE:300602

Discovering None's Hidden Gems: Three Promising Small Caps

Reviewed by Simply Wall St

As global markets experience a rally driven by easing core inflation and robust bank earnings in the U.S., small-cap stocks have been gaining traction, as evidenced by the S&P MidCap 400's notable rise of 3.81%. This positive sentiment creates an opportune environment for investors to explore promising small-cap companies that demonstrate strong fundamentals and growth potential despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Xiangtan Electrochemical ScientificLtd | 44.62% | 13.70% | 36.55% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 4.71% | 50.82% | 59.08% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Guangzhou Ruoyuchen TechnologyLtd (SZSE:003010)

Simply Wall St Value Rating: ★★★★★☆

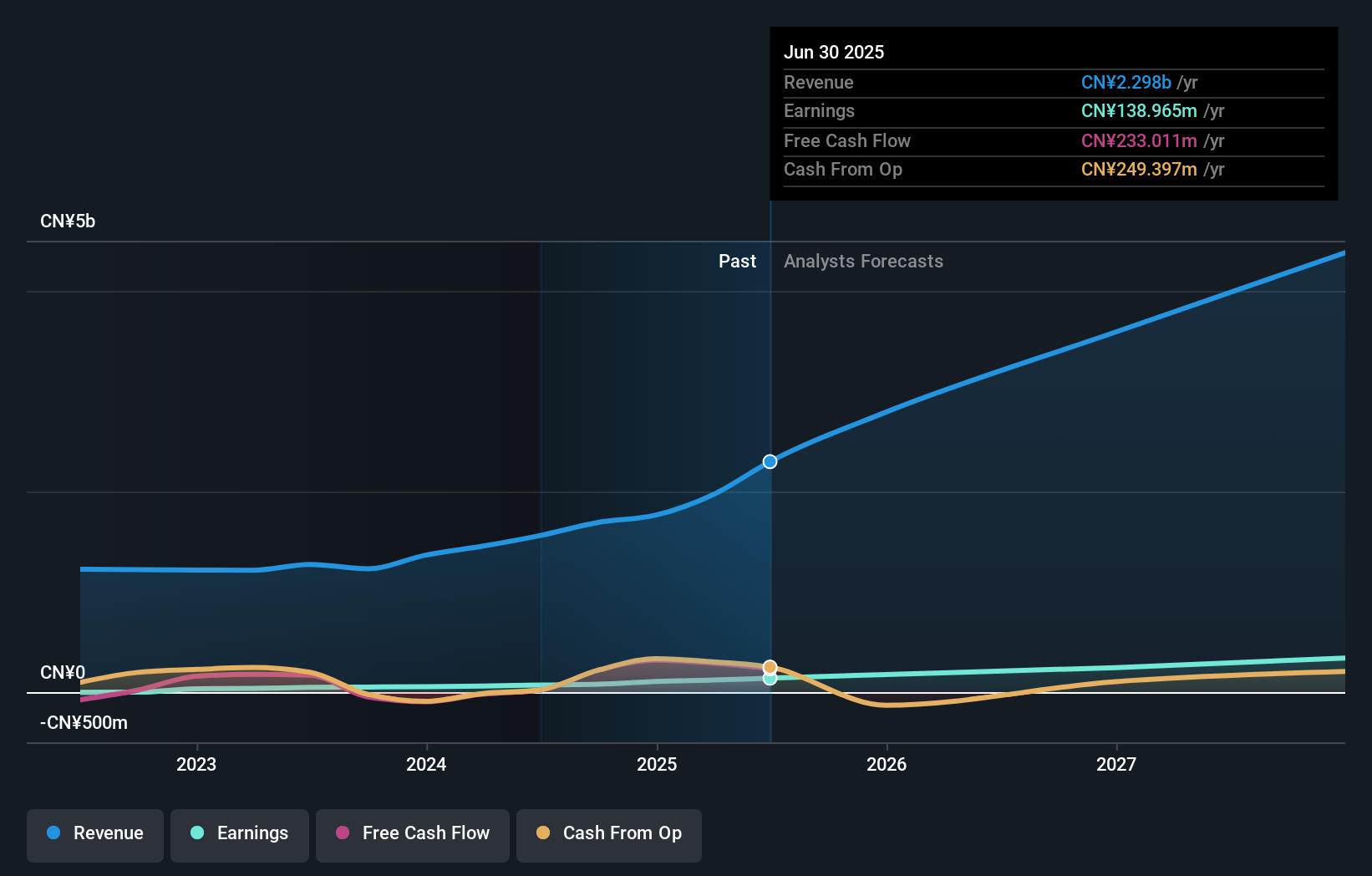

Overview: Guangzhou Ruoyuchen Technology Co., Ltd. offers brand integrated marketing solutions in China and has a market cap of CN¥4.48 billion.

Operations: Ruoyuchen Technology generates revenue primarily from its E-Commerce Service Industry segment, amounting to CN¥1.69 billion. The company's financial performance is reflected in its market capitalization of CN¥4.48 billion.

Guangzhou Ruoyuchen Technology, a small-cap player in the tech scene, has shown impressive growth with earnings up by 54.9% over the past year, outpacing the Consumer Retailing industry’s 6%. The company also boasts high-quality earnings and is free cash flow positive. Despite a volatile share price recently, Ruoyuchen's strategic buybacks have seen them repurchase over 2 million shares for CNY 59.99 million since December 2024. This move likely reflects confidence in its future prospects as earnings are forecasted to grow by an additional 34.61% annually, further enhancing its appeal as an undiscovered gem.

Shenzhen FRD Science & Technology (SZSE:300602)

Simply Wall St Value Rating: ★★★★★☆

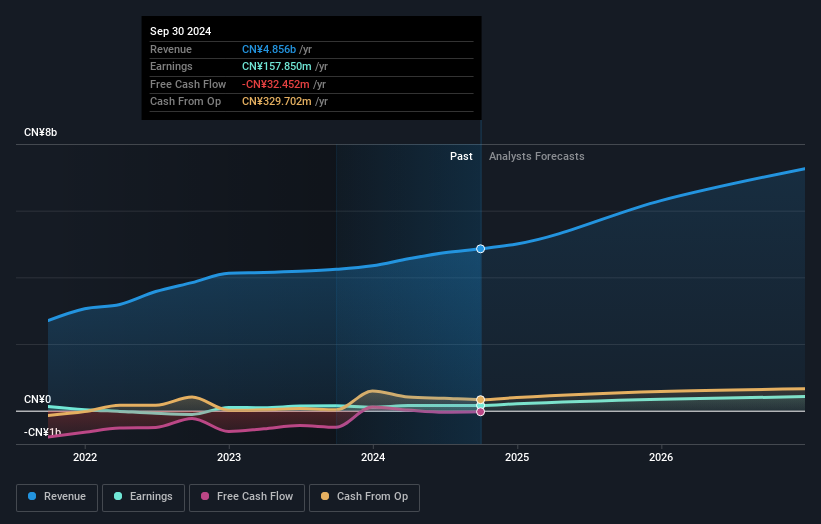

Overview: Shenzhen FRD Science & Technology Co., Ltd. operates in the electronic components manufacturing industry and has a market capitalization of CN¥10.86 billion.

Operations: FRD derives its revenue primarily from the electronic components manufacturing segment, generating CN¥4.86 billion. The company's financial performance reflects a focus on this core segment, which significantly contributes to its overall revenue stream.

Shenzhen FRD Science & Technology has shown promising growth, with earnings increasing by 9.5% over the past year, outpacing the Electrical industry average of 1.1%. Despite a rise in its debt to equity ratio from 16.9% to 38.6% over five years, the company's net debt to equity remains satisfactory at 3.3%. Recent financial results are encouraging; for the nine months ending September 2024, sales reached CNY 3.42 billion compared to CNY 2.91 billion a year earlier, and net income doubled to CNY 103.74 million from CNY 49.11 million previously, indicating robust profitability and operational efficiency improvements.

PixArt Imaging (TPEX:3227)

Simply Wall St Value Rating: ★★★★★★

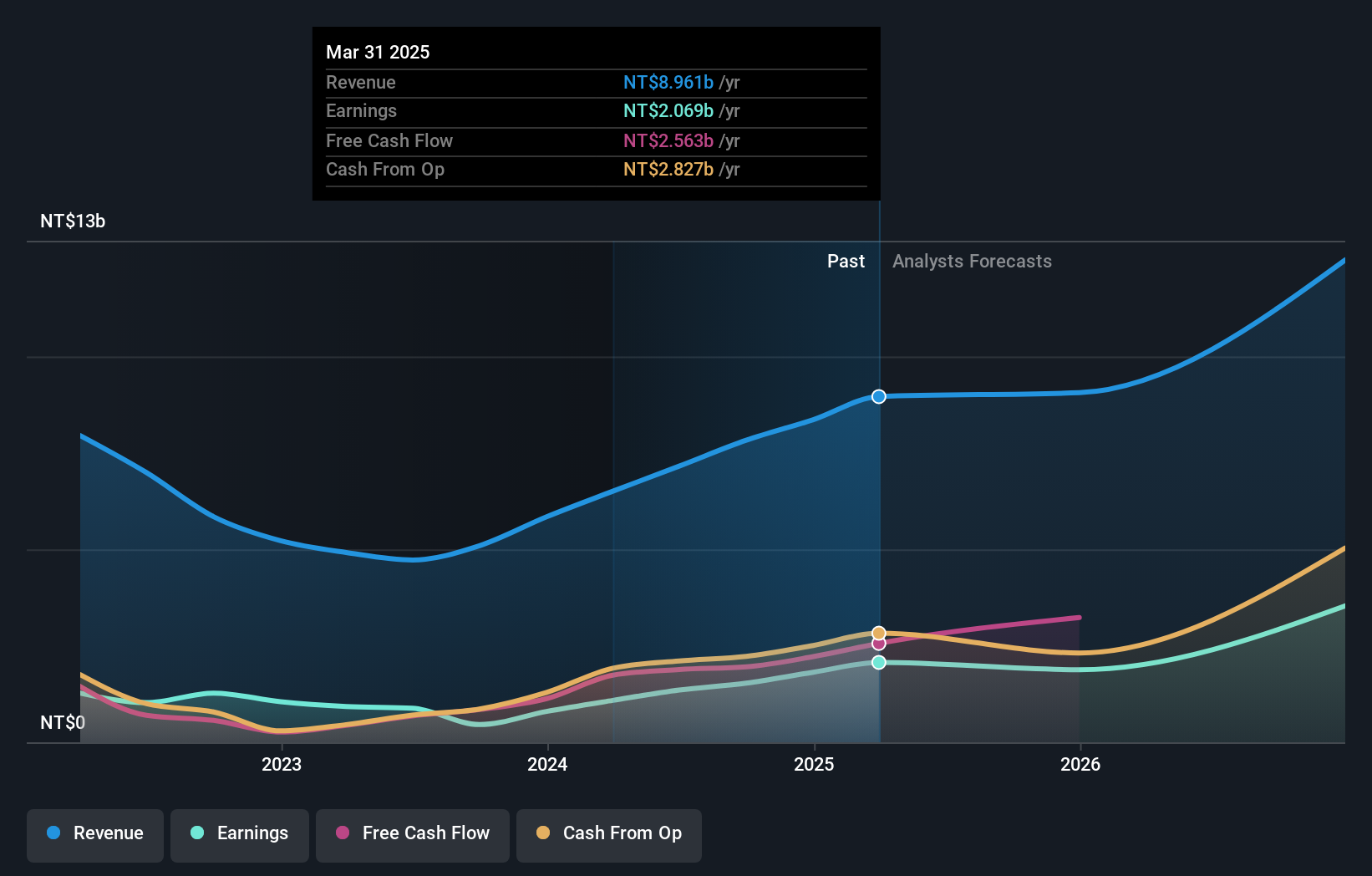

Overview: PixArt Imaging Inc. is a company that, along with its subsidiaries, engages in the research, design, production, and sale of CMOS image sensors and related ICs across Taiwan, Hong Kong, China, Japan, and other international markets with a market capitalization of NT$35.08 billion.

Operations: The primary revenue stream for PixArt Imaging comes from the design and production of CMOS image sensors and related ICs, generating NT$7.83 billion.

PixArt Imaging, a nimble player in the semiconductor space, has shown impressive financial strength. Earnings surged by 234.7% over the past year, far outpacing the industry's 5.9% growth rate. With a debt to equity ratio dropping from 1.5 to 0.4 over five years, it seems they’ve been managing their finances well and have more cash than total debt. Their recent innovation, the PAC9001 sensor, promises significant industry impact with its advanced AI processing and energy efficiency features designed for diverse applications like retail and security sectors. Despite these positives, share price volatility remains a concern for investors seeking stability.

- Get an in-depth perspective on PixArt Imaging's performance by reading our health report here.

Evaluate PixArt Imaging's historical performance by accessing our past performance report.

Make It Happen

- Navigate through the entire inventory of 4642 Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300602

Shenzhen FRD Science & Technology

Shenzhen FRD Science & Technology Co., Ltd.

Excellent balance sheet with reasonable growth potential.