Highlighting Quick Intelligent EquipmentLtd And 2 Other Leading Growth Stocks With Insider Stake

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cooling inflation and robust bank earnings, major U.S. stock indexes have rebounded, with value stocks outperforming growth shares amid shifts in the energy sector and profit-taking in large-cap technology stocks. This backdrop of economic optimism presents an opportune moment to explore growth companies where insider ownership signals confidence in their potential; such firms often align well with investors seeking stability and commitment from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 35.8% | 112.9% |

Here's a peek at a few of the choices from the screener.

Quick Intelligent EquipmentLtd (SHSE:603203)

Simply Wall St Growth Rating: ★★★★★★

Overview: Quick Intelligent Equipment Co., Ltd. specializes in the R&D, manufacturing, and sale of precision assembly technology for electronics both in China and globally, with a market cap of CN¥5.85 billion.

Operations: The company's revenue is derived from the Special Equipment Manufacturing Industry, totaling CN¥882.38 million.

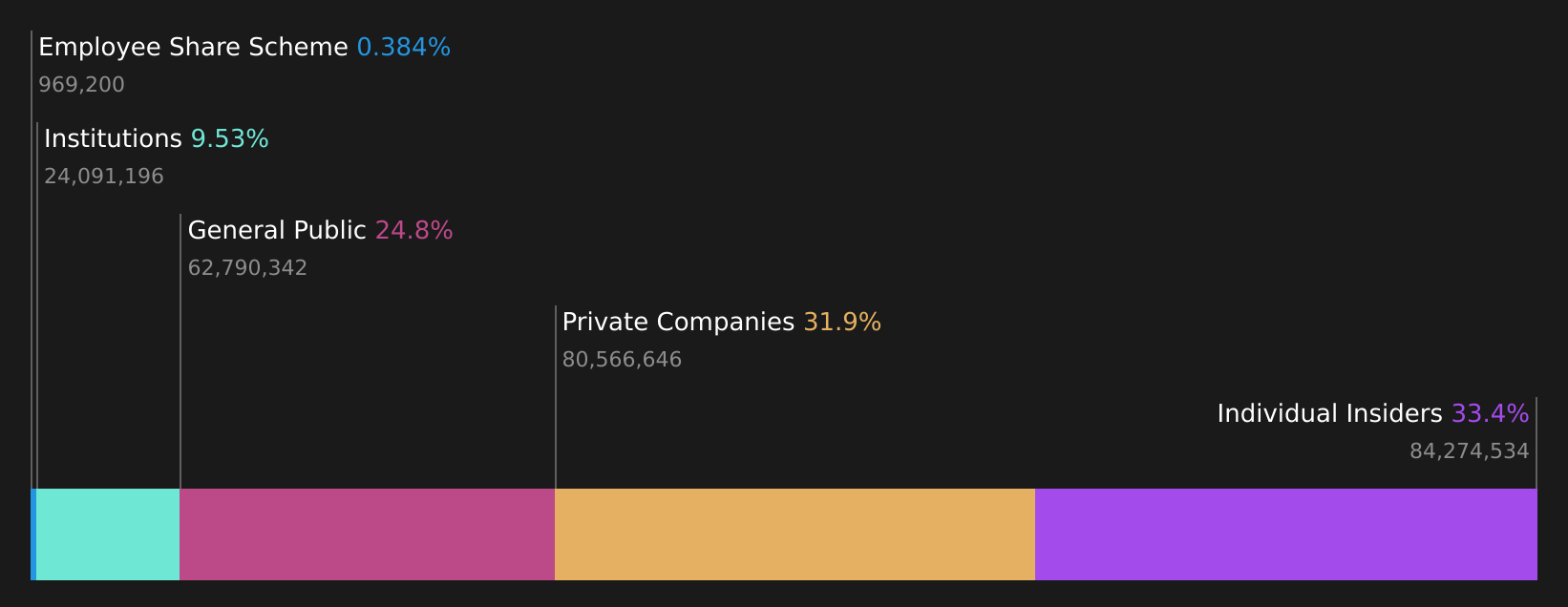

Insider Ownership: 34.2%

Revenue Growth Forecast: 27% p.a.

Quick Intelligent Equipment Ltd. demonstrates strong growth potential with earnings forecasted to grow significantly at 35.56% annually, outpacing the CN market's 25.2%. Revenue is also expected to rise by 27% per year, surpassing the market average of 13.4%. Despite a dividend yield of 2.46% not fully covered by free cash flows, its price-to-earnings ratio of 30.9x offers better value compared to the CN market's average of 34.3x. Recent earnings reports show steady growth in sales and net income for the first nine months ending September 2024, reflecting robust financial performance despite no significant insider trading activity in recent months.

- Unlock comprehensive insights into our analysis of Quick Intelligent EquipmentLtd stock in this growth report.

- Our valuation report here indicates Quick Intelligent EquipmentLtd may be overvalued.

Guangzhou Ruoyuchen TechnologyLtd (SZSE:003010)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Ruoyuchen Technology Co., Ltd. offers brand integrated marketing solutions in China and has a market cap of CN¥4.48 billion.

Operations: The company generates revenue from the E-Commerce Service Industry, totaling CN¥1.69 billion.

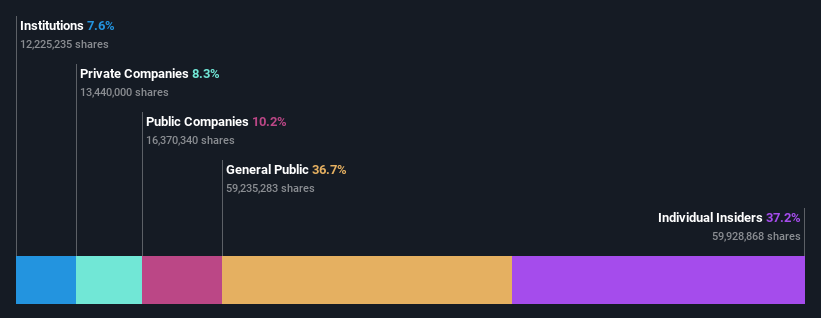

Insider Ownership: 37.2%

Revenue Growth Forecast: 24.9% p.a.

Guangzhou Ruoyuchen Technology Ltd. showcases strong growth prospects with earnings anticipated to grow significantly at 34.61% annually, surpassing the CN market's 25.2%. Revenue is forecasted to increase by 24.9% per year, exceeding the market average of 13.4%. Despite a highly volatile share price recently, the company has completed a buyback program worth CNY 59.99 million for equity incentives and employee stock plans, indicating confidence in its future performance and alignment with shareholder interests.

- Delve into the full analysis future growth report here for a deeper understanding of Guangzhou Ruoyuchen TechnologyLtd.

- Insights from our recent valuation report point to the potential overvaluation of Guangzhou Ruoyuchen TechnologyLtd shares in the market.

Sinofibers TechnologyLtd (SZSE:300777)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sinofibers Technology Co., Ltd. focuses on the research, development, production, and sales of high-performance carbon fibers and fabrics with a market cap of CN¥11.99 billion.

Operations: Sinofibers Technology Co., Ltd. generates revenue through its activities in the research, development, production, and sales of high-performance carbon fibers and fabrics.

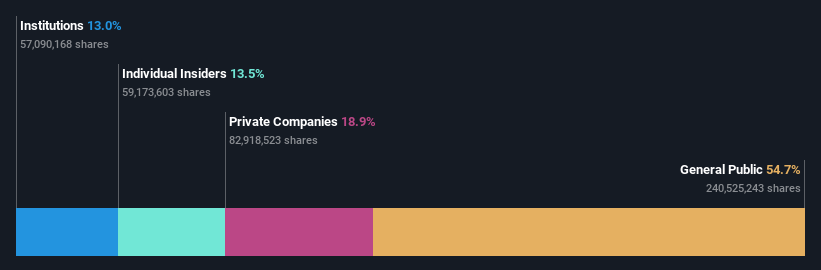

Insider Ownership: 12.5%

Revenue Growth Forecast: 22.6% p.a.

Sinofibers Technology Ltd. is poised for significant growth, with earnings expected to increase by 25.17% annually and revenue projected to grow at 22.6% per year, outpacing the CN market's average of 13.4%. Recent executive changes and amendments to company bylaws reflect strategic realignments, while a completed share buyback of CNY 30 million suggests management confidence despite lower profit margins compared to last year.

- Click to explore a detailed breakdown of our findings in Sinofibers TechnologyLtd's earnings growth report.

- The valuation report we've compiled suggests that Sinofibers TechnologyLtd's current price could be inflated.

Next Steps

- Discover the full array of 1472 Fast Growing Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300777

Sinofibers TechnologyLtd

Engages in the research and development, production, and sales of high-performance carbon fibers and fabrics.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives