- China

- /

- Electronic Equipment and Components

- /

- SZSE:301458

Longyan Kaolin Clay Among 3 Undiscovered Gems With Strong Fundamentals

Reviewed by Simply Wall St

As global markets experience a rebound, with major U.S. stock indexes climbing higher due to easing core inflation and robust bank earnings, investors are increasingly looking at small-cap stocks for opportunities. The S&P MidCap 400 and Russell 2000 indices have shown significant gains, suggesting a renewed interest in companies that may not be household names but possess solid fundamentals. In this environment, identifying stocks with strong financial health and growth potential can be key to uncovering undiscovered gems like Longyan Kaolin Clay.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 2.05% | 10.66% | ★★★★★★ |

| Lungteh Shipbuilding | 60.46% | 29.56% | 44.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Ningbo Sinyuan Zm Technology | NA | 18.08% | 9.75% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 4.71% | 50.82% | 59.08% | ★★★★★★ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Longyan Kaolin Clay (SHSE:605086)

Simply Wall St Value Rating: ★★★★★★

Overview: Longyan Kaolin Clay Co., Ltd. is involved in the production and supply of kaolin for ceramic raw materials in China, with a market cap of CN¥5.11 billion.

Operations: Longyan Kaolin Clay generates revenue primarily from its specialty chemicals segment, amounting to CN¥314.38 million.

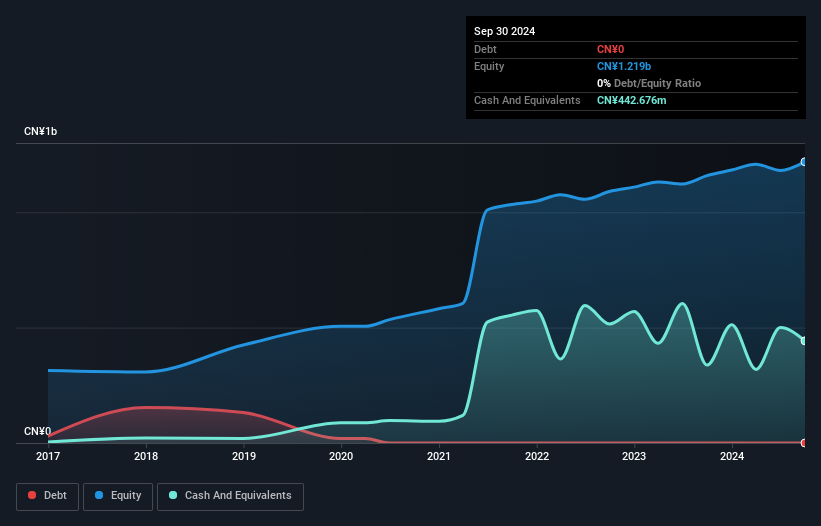

Longyan Kaolin Clay, a small player in the market, has shown resilience with an 8% earnings growth over the past year, outpacing the Basic Materials industry's -22.9%. The company is debt-free now, a significant improvement from five years ago when it had a debt-to-equity ratio of 9.9%, and this provides flexibility for future opportunities. Recent developments include Longyan Hongtong Investment acquiring a 3.35% stake for CNY 100 million at CNY 17.26 per share, signaling confidence in its prospects. With high-quality past earnings and positive free cash flow of CNY 122.77 million as of September 2024, Longyan seems well-positioned in its niche market segment.

Juneway Electronic Technology (SZSE:301458)

Simply Wall St Value Rating: ★★★★★☆

Overview: Juneway Electronic Technology Co., Ltd. designs, develops, and produces circuit protection components with a market capitalization of CN¥8.92 billion.

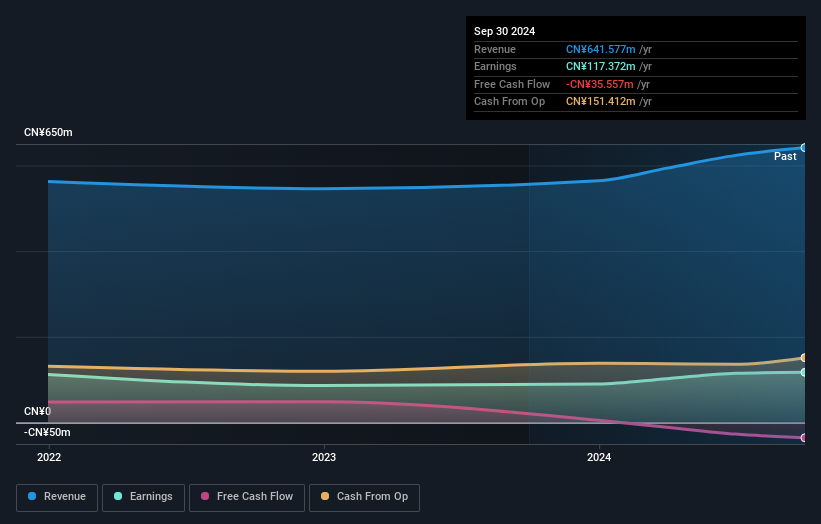

Operations: Juneway's primary revenue streams are from current sensing precision resistors and fuses, generating CN¥340.01 million and CN¥129.52 million, respectively. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Juneway Electronic Technology recently made a splash with its IPO, raising CNY 693.33 million and joining the Shenzhen Stock Exchange Composite Index, signaling increased visibility. Over the past year, Juneway's earnings rose by 4.2%, outpacing the electronic industry average of 2.3%. Despite having more cash than total debt, shares remain highly illiquid which might concern investors seeking liquidity. The company's high-quality earnings suggest a solid foundation, although data on free cash flow is unavailable to assess long-term sustainability fully. With these dynamics in play, Juneway presents an intriguing opportunity in the electronics sector amidst evolving market conditions.

AblePrint Technology (TPEX:7734)

Simply Wall St Value Rating: ★★★★★☆

Overview: AblePrint Technology Co., Ltd. is a process solution provider addressing process issues across various industries both in Taiwan and internationally, with a market capitalization of NT$34.95 billion.

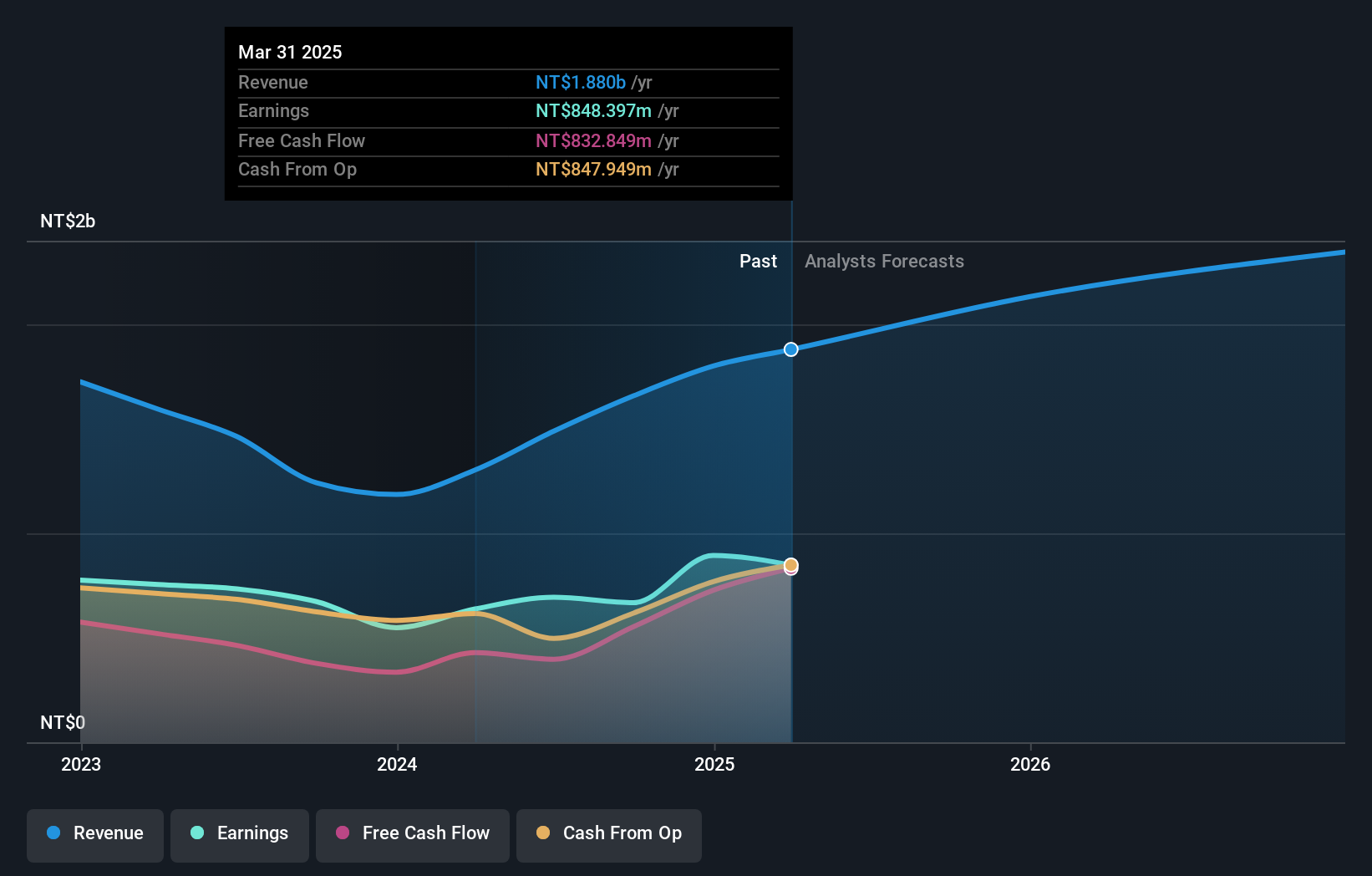

Operations: AblePrint Technology generates revenue primarily from its Automation System Solutions and Pneumatic and Thermal Process Solutions segments, with the latter contributing NT$1.24 billion. The company's market capitalization stands at NT$34.95 billion.

AblePrint Technology, a nimble player in its field, showcases robust financial health with high-quality earnings and positive free cash flow. Despite facing a slight dip in earnings growth at -0.7%, the company remains profitable and covers interest payments comfortably. Recent figures reveal sales of TWD 394 million for Q3 2024, up from TWD 225 million the previous year, though net income fell to TWD 97.88 million from TWD 123.92 million. A follow-on equity offering of TWD 3.15 billion likely aims to bolster growth prospects amidst these mixed results, highlighting strategic financial maneuvers to enhance value creation.

- Unlock comprehensive insights into our analysis of AblePrint Technology stock in this health report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 4644 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301458

Juneway Electronic Technology

Designs, manufactures, and sells circuit protection components.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives