- China

- /

- Electrical

- /

- SZSE:300477

Amidst increasing losses, Investors bid up Hezong Science&Technology (SZSE:300477) 10% this past week

Hezong Science&Technology Co., Ltd. (SZSE:300477) shareholders will doubtless be very grateful to see the share price up 68% in the last quarter. But over the last three years we've seen a quite serious decline. Tragically, the share price declined 59% in that time. So it is really good to see an improvement. After all, could be that the fall was overdone.

On a more encouraging note the company has added CN¥383m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for Hezong Science&Technology

Hezong Science&Technology wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Hezong Science&Technology saw its revenue grow by 8.7% per year, compound. That's a pretty good rate of top-line growth. That contrasts with the weak share price, which has fallen 17% compounded, over three years. The market must have had really high expectations to be disappointed with this progress. So this is one stock that might be worth investigating further, or even adding to your watchlist.

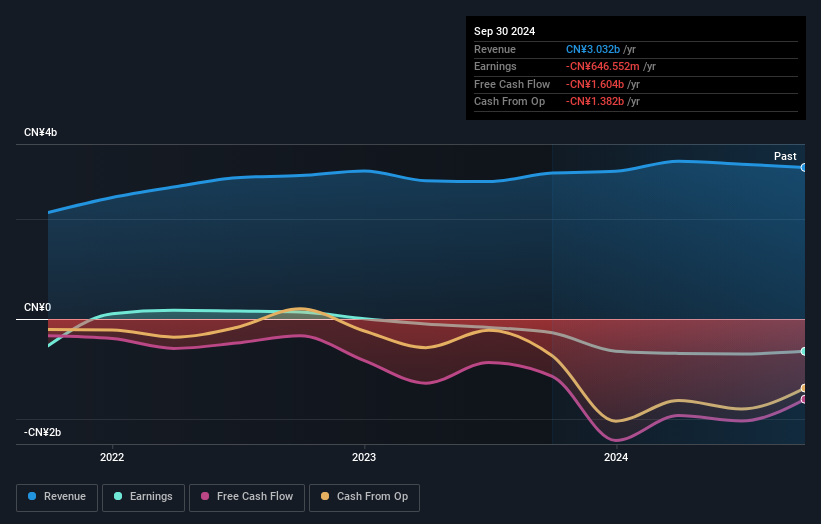

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Hezong Science&Technology provided a TSR of 2.7% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 8% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Hezong Science&Technology better, we need to consider many other factors. For example, we've discovered 3 warning signs for Hezong Science&Technology (2 make us uncomfortable!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hezong Science&Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300477

Hezong Science&Technology

Manufactures and distributes power distribution systems in China and internationally.

Low and slightly overvalued.