- China

- /

- Electronic Equipment and Components

- /

- SZSE:300567

3 Growth Companies Insiders Own With Revenue Growth Up To 34%

Reviewed by Simply Wall St

In a week marked by mixed performances across global indices, with the Nasdaq Composite reaching new highs while other major indexes declined, growth stocks have continued to outpace their value counterparts. Amidst this backdrop of economic uncertainty and anticipated interest rate adjustments, companies exhibiting strong revenue growth and significant insider ownership can present unique opportunities for investors.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We'll examine a selection from our screener results.

Shenzhen Envicool Technology (SZSE:002837)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Envicool Technology Co., Ltd. specializes in producing and selling temperature control solutions and products in China, with a market cap of CN¥24.52 billion.

Operations: The company generates revenue from its Precision Temperature Control Energy Saving Equipment segment, amounting to CN¥4.33 billion.

Insider Ownership: 19.5%

Revenue Growth Forecast: 27.9% p.a.

Shenzhen Envicool Technology has demonstrated robust growth, with earnings increasing by 30.2% over the past year and revenue rising to CNY 2.87 billion for the first nine months of 2024, up from CNY 2.07 billion a year ago. Analysts expect significant annual profit growth of nearly 30% over the next three years, outpacing market averages. The company's high return on equity forecast and strong revenue growth projections underscore its potential as a dynamic player in its sector.

- Click here to discover the nuances of Shenzhen Envicool Technology with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Shenzhen Envicool Technology is priced higher than what may be justified by its financials.

Guangzhou Goaland Energy Conservation Tech (SZSE:300499)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Goaland Energy Conservation Tech, with a market cap of CN¥5.04 billion, specializes in providing energy conservation solutions and technologies.

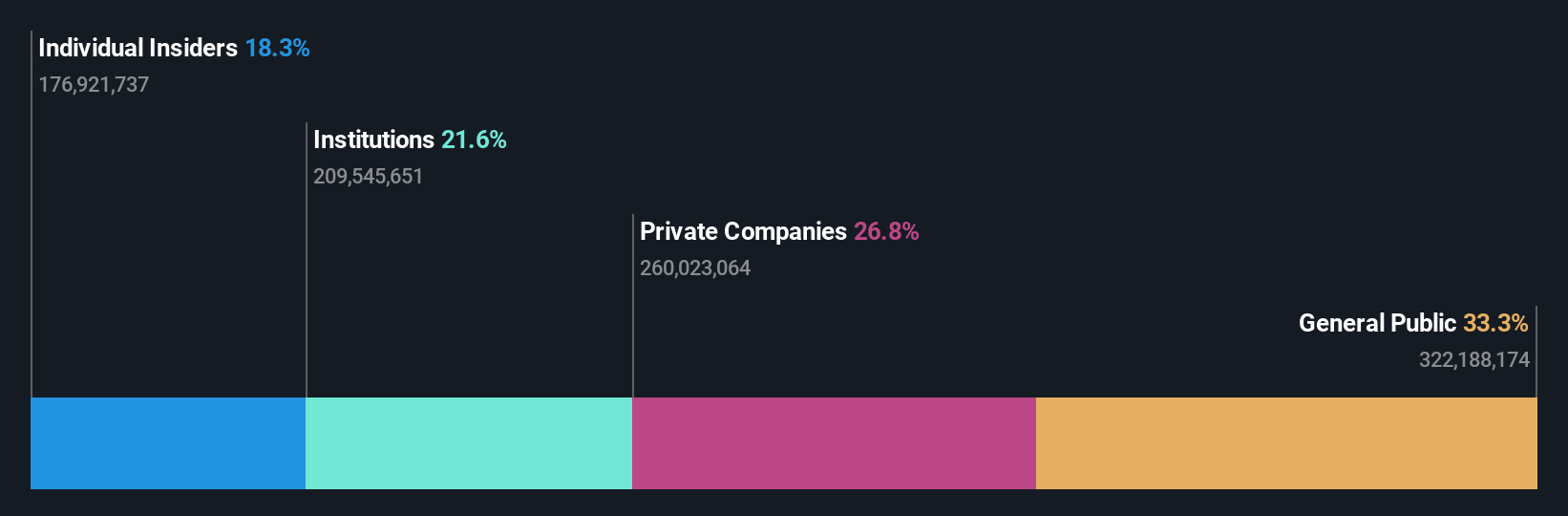

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 21.2%

Revenue Growth Forecast: 34.9% p.a.

Guangzhou Goaland Energy Conservation Tech is poised for substantial growth, with revenue projected to increase by 34.9% annually, outstripping the CN market average. Despite a current net loss of CNY 17.65 million for the first nine months of 2024, analysts anticipate profitability within three years, reflecting above-average market growth expectations. However, its low forecasted return on equity (6.6%) and recent earnings decline highlight potential challenges amidst high insider ownership stability.

- Click here and access our complete growth analysis report to understand the dynamics of Guangzhou Goaland Energy Conservation Tech.

- Our valuation report here indicates Guangzhou Goaland Energy Conservation Tech may be overvalued.

Wuhan Jingce Electronic GroupLtd (SZSE:300567)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Jingce Electronic Group Co., Ltd engages in the research, development, production, and sale of display, semiconductor, and new energy detection systems with a market cap of CN¥18.25 billion.

Operations: The company's revenue is primarily derived from its Electron Product segment, totaling CN¥2.72 billion.

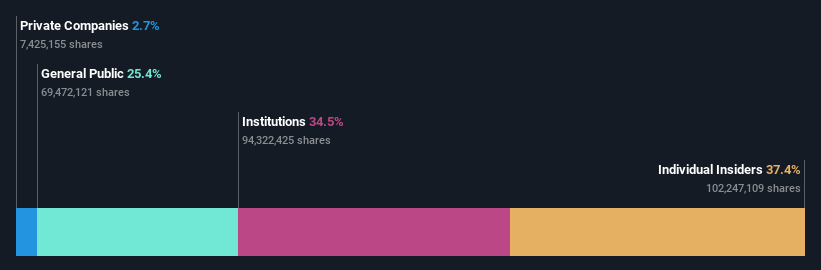

Insider Ownership: 37.4%

Revenue Growth Forecast: 20.2% p.a.

Wuhan Jingce Electronic Group's revenue is expected to grow by 20.2% annually, surpassing the Chinese market average. Recent earnings for the first nine months of 2024 show a turnaround with a net income of CNY 82.24 million, compared to a loss last year. Despite high forecasted annual profit growth of 35.7%, challenges include low return on equity and insufficient operating cash flow coverage for debt, alongside volatile share prices affecting stability perceptions.

- Delve into the full analysis future growth report here for a deeper understanding of Wuhan Jingce Electronic GroupLtd.

- Upon reviewing our latest valuation report, Wuhan Jingce Electronic GroupLtd's share price might be too optimistic.

Turning Ideas Into Actions

- Embark on your investment journey to our 1529 Fast Growing Companies With High Insider Ownership selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Jingce Electronic GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300567

Wuhan Jingce Electronic GroupLtd

Researches, develops, produces, and sells display, semiconductor, and new energy detection systems.

High growth potential with acceptable track record.