- China

- /

- Entertainment

- /

- SHSE:601595

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are experiencing a period of mixed performance with the technology-heavy Nasdaq Composite reaching new heights, even as smaller-cap indices like the Russell 2000 lag behind their larger counterparts. Amidst this backdrop of economic indicators and anticipated rate cuts by central banks, investors are closely watching high-growth tech stocks that demonstrate resilience and potential for innovation-driven expansion in an evolving market landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

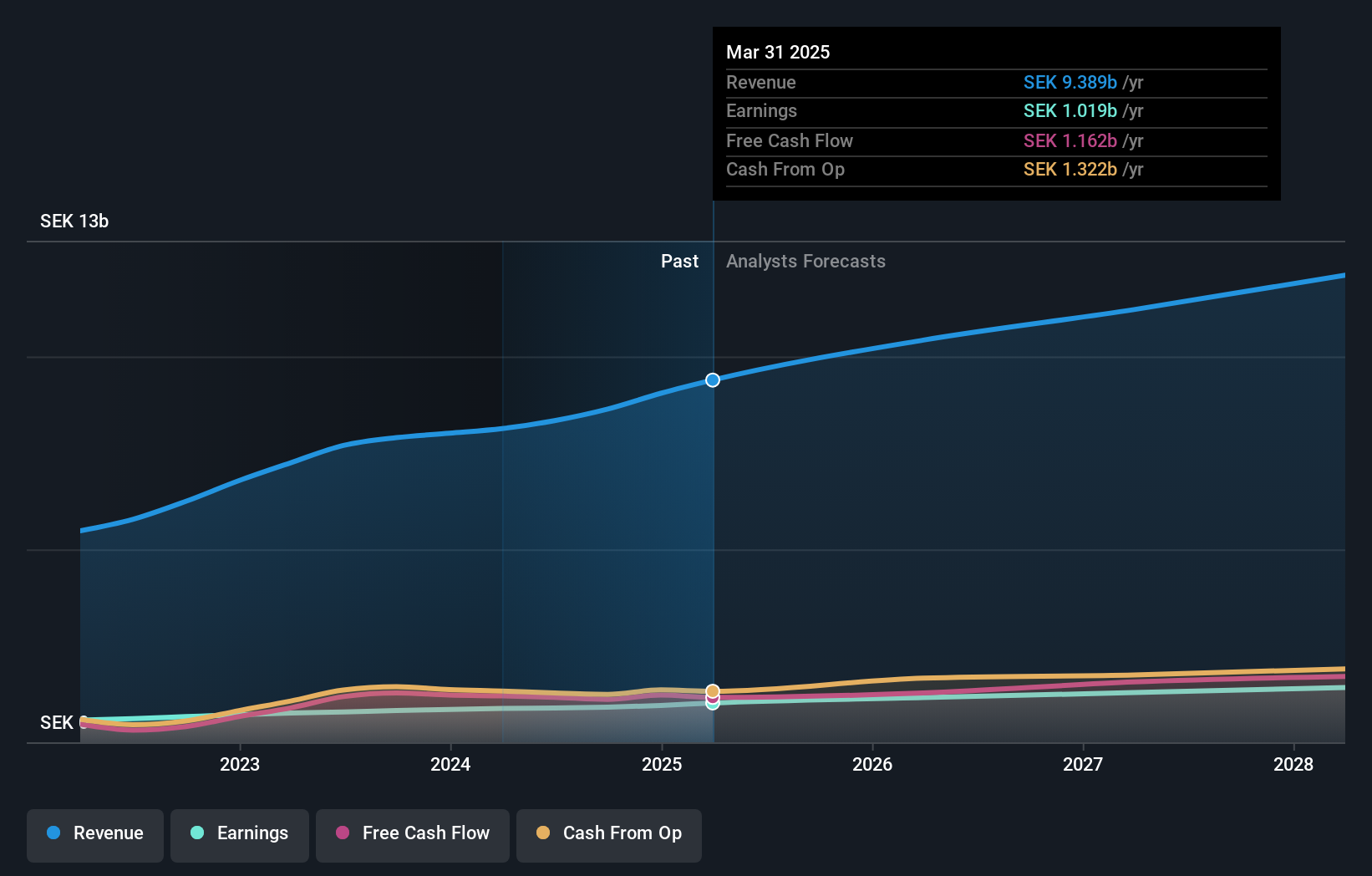

Lagercrantz Group (OM:LAGR B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lagercrantz Group AB (publ) is a technology company that operates through its subsidiaries across various regions including Sweden, Denmark, Norway, Finland, Germany, the United Kingdom, Benelux, Poland, and internationally; it has a market cap of approximately SEK44.26 billion.

Operations: Lagercrantz Group AB generates revenue primarily from its five segments: Tecsec (SEK 2.11 billion), Control (SEK 0.83 billion), Electrify (SEK 2.02 billion), International (SEK 1.54 billion), and Niche Products (SEK 2.18 billion). The company operates across multiple regions, contributing to its diverse revenue streams in the technology sector.

Lagercrantz Group has demonstrated a robust performance with a 16% increase in sales reaching SEK 2.17 billion this quarter, underscoring its strong position in the electronics sector. Notably, the company's net income rose to SEK 224 million, marking an improvement from previous figures. This growth is supported by a strategic focus on R&D which aligns with industry trends towards enhanced technological solutions. Despite facing challenges like high debt levels, Lagercrantz continues to outpace average market revenue growth at 12% annually compared to just 1.2%, reflecting potential for sustained advancement especially given its forecasted high Return on Equity of 25%.

- Click here to discover the nuances of Lagercrantz Group with our detailed analytical health report.

Evaluate Lagercrantz Group's historical performance by accessing our past performance report.

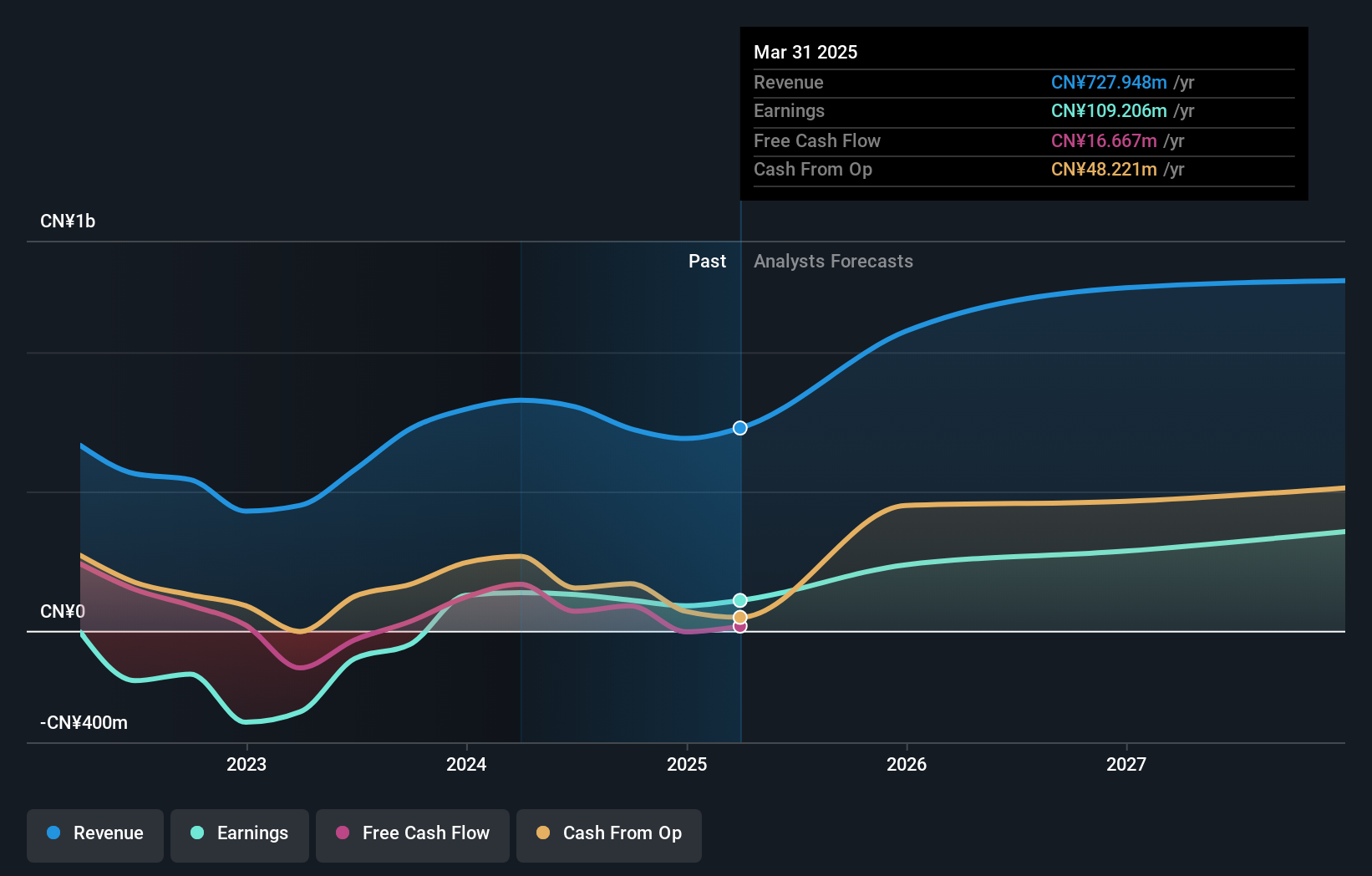

Shanghai Film (SHSE:601595)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Film Co., Ltd. engages in film distribution and screening activities in China and has a market cap of CN¥12.01 billion.

Operations: Shanghai Film Co., Ltd. generates revenue primarily through its film distribution and screening operations within China. The company's business model focuses on leveraging its presence in the Chinese film market to drive sales, with a significant portion of income derived from these core activities.

Shanghai Film has navigated a challenging fiscal period with revenues dipping to CNY 559.75 million from the previous year's CNY 629.42 million, reflecting a dynamic yet volatile market landscape. Despite this, the company's earnings forecast remains robust, predicting an annual growth rate of 53.8%, significantly outpacing the broader Chinese market's expectation of 25.7%. This growth is underpinned by strategic investments in R&D and a focus on high-quality earnings, despite recent downturns in net income and basic earnings per share metrics which have seen reductions from CNY 124.52 million to CNY 107.41 million and CNY 0.28 to CNY 0.24 respectively.

- Dive into the specifics of Shanghai Film here with our thorough health report.

Gain insights into Shanghai Film's past trends and performance with our Past report.

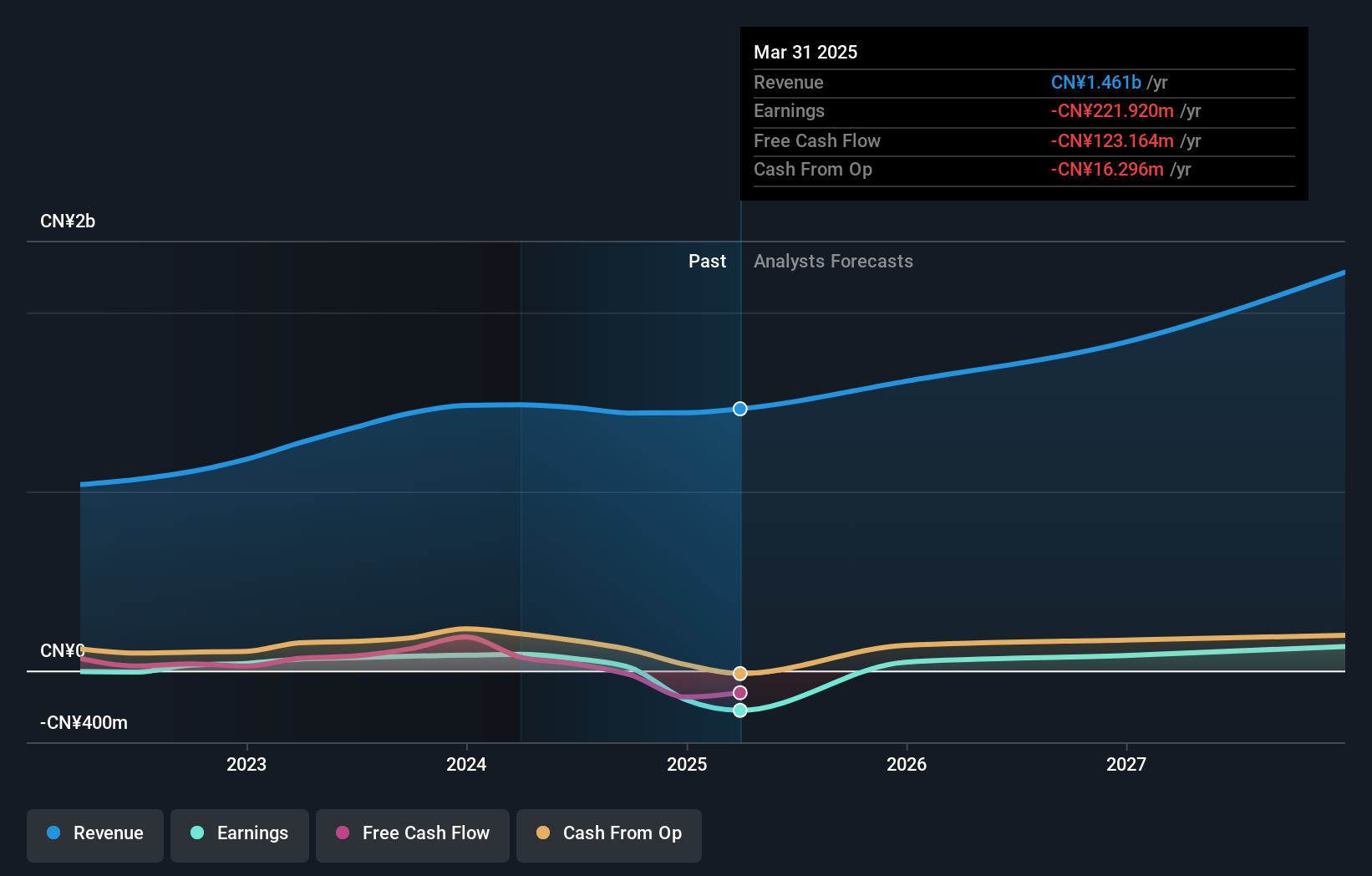

Wondershare Technology Group (SZSE:300624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wondershare Technology Group Co., Ltd. develops application software products in China and internationally, with a market cap of CN¥13.90 billion.

Operations: The company specializes in creating application software products with a focus on both domestic and international markets. It operates within the technology sector, leveraging its expertise to generate revenue through software development and distribution.

Wondershare Technology Group's recent product launches, including Recoverit 13.5 and HiPDF updates, underscore its commitment to innovation in data recovery and PDF editing sectors. With a significant 74.5% forecasted annual earnings growth outpacing the broader market's 25.7%, Wondershare demonstrates robust financial health despite a volatile tech landscape. The company's strategic focus on R&D is evident as they channel substantial resources into developing cutting-edge solutions, ensuring their software remains at the forefront of technological advancement and meets evolving consumer demands efficiently.

Taking Advantage

- Take a closer look at our High Growth Tech and AI Stocks list of 1267 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601595

Shanghai Film

Engages in film distribution and screening activities in China.

Flawless balance sheet with high growth potential.