Xuzhou Handler Special Vehicle Co., Ltd (SZSE:300201) Stock Rockets 30% But Many Are Still Ignoring The Company

Xuzhou Handler Special Vehicle Co., Ltd (SZSE:300201) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 13% over that time.

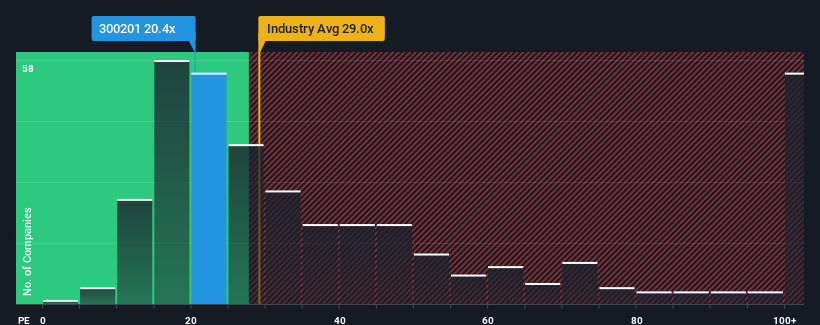

Even after such a large jump in price, Xuzhou Handler Special Vehicle may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 20.4x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 58x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Xuzhou Handler Special Vehicle certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Xuzhou Handler Special Vehicle

How Is Xuzhou Handler Special Vehicle's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Xuzhou Handler Special Vehicle's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 113% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 23% per year as estimated by the one analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 19% each year, which is noticeably less attractive.

With this information, we find it odd that Xuzhou Handler Special Vehicle is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Xuzhou Handler Special Vehicle's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Xuzhou Handler Special Vehicle's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Xuzhou Handler Special Vehicle you should be aware of.

If you're unsure about the strength of Xuzhou Handler Special Vehicle's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300201

Xuzhou Handler Special Vehicle

Engages in research, development, production, and sales of aerial work vehicles, electric emergency support vehicles, military products, and fire trucks.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives