As global markets grapple with policy risks and growth concerns, investor attention is increasingly turning towards Asia's diverse economic landscape. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.78 | HK$43.33B | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.41 | SGD9.52B | ★★★★★☆ |

| Activation Group Holdings (SEHK:9919) | HK$0.86 | HK$640.48M | ★★★★★★ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.01 | CN¥3.49B | ★★★★★★ |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.475 | SGD452.86M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.30 | HK$825.23M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.30 | THB2.58B | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.21 | SGD41.83M | ★★★★★★ |

| Jiumaojiu International Holdings (SEHK:9922) | HK$2.98 | HK$4.16B | ★★★★★★ |

| China Zheshang Bank (SEHK:2016) | HK$2.38 | HK$80.24B | ★★★★★★ |

Click here to see the full list of 1,171 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Anacle Systems (SEHK:8353)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anacle Systems Limited develops enterprise business and energy management software solutions across Singapore, Malaysia, Thailand, the People’s Republic of China, and internationally with a market cap of HK$411.05 million.

Operations: Anacle Systems generates revenue through its Starlight segment, contributing SGD 1.52 million, and its Simplicity (including Spacemonster) segment, which accounts for SGD 28.47 million.

Market Cap: HK$411.05M

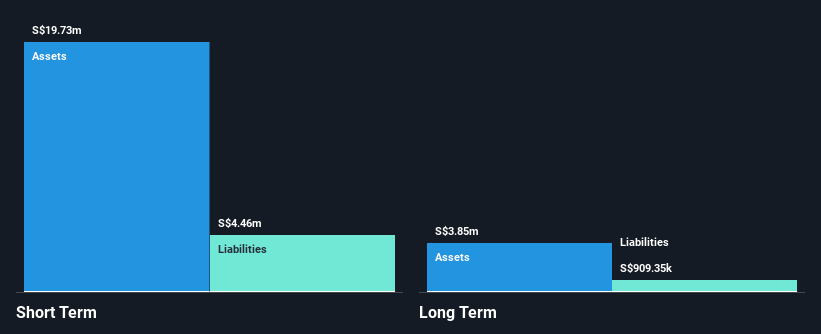

Anacle Systems, with a market cap of HK$411.05 million, has shown revenue growth in its Starlight and Simplicity segments, totaling SGD 14.5 million for the past six months. Despite being debt-free and having experienced management and board teams, the company faces challenges with low return on equity at 6.1% and recent negative earnings growth of -55.9%. While short-term assets comfortably cover liabilities, profit margins have declined from 9.3% to 3.7%. Recent earnings reports indicate increased sales but also a net loss for the quarter, highlighting volatility in financial performance amidst stable shareholder dilution levels.

- Dive into the specifics of Anacle Systems here with our thorough balance sheet health report.

- Understand Anacle Systems' track record by examining our performance history report.

CnlightLtd (SZSE:002076)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cnlight Co., Ltd is a company that manufactures and sells lighting products in China, with a market capitalization of CN¥4.34 billion.

Operations: Cnlight Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥4.34B

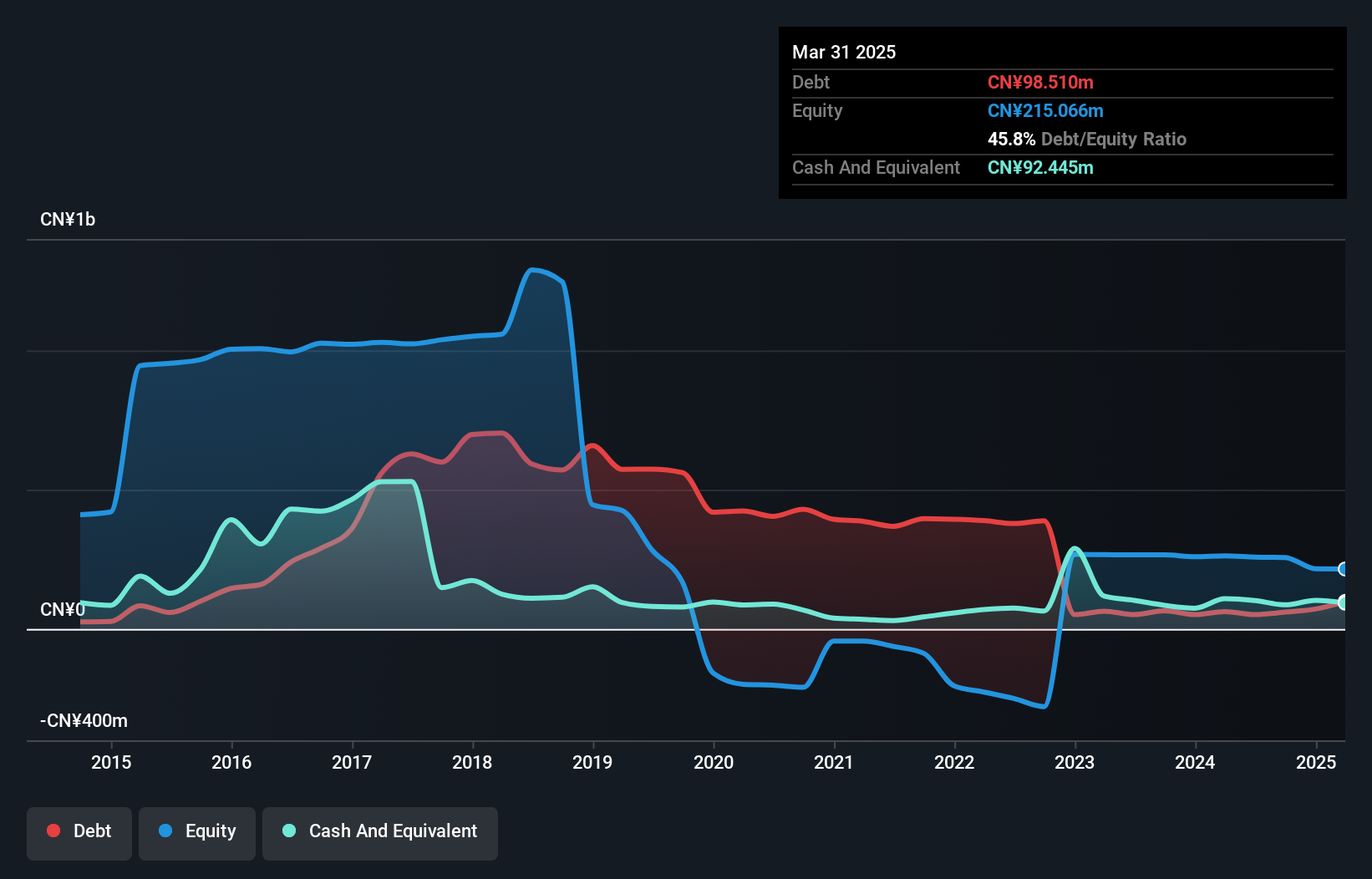

Cnlight Co., Ltd, with a market cap of CN¥4.34 billion, is currently unprofitable but has made strides in reducing its debt-to-equity ratio from 335.9% to 23.6% over five years and now holds more cash than total debt. Its short-term assets (CN¥267.8M) exceed both short-term (CN¥187.7M) and long-term liabilities (CN¥59.2M), indicating a solid financial position despite having less than a year of cash runway if free cash flow continues to decline at historical rates. Recent changes include amendments to the company's articles and the election of Ni Zhennian as an independent director, suggesting governance adjustments amidst high share price volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of CnlightLtd.

- Learn about CnlightLtd's historical performance here.

Nanfang Zhongjin Environment (SZSE:300145)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nanfang Zhongjin Environment Co., Ltd. operates in the general equipment manufacturing sector through its subsidiaries and has a market capitalization of CN¥8.55 billion.

Operations: Nanfang Zhongjin Environment Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥8.55B

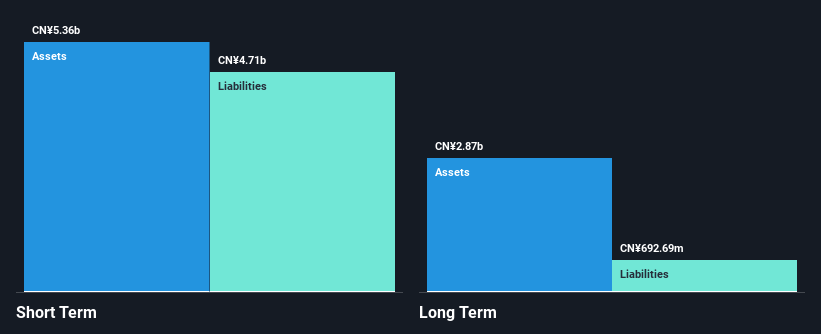

Nanfang Zhongjin Environment, with a market cap of CN¥8.55 billion, demonstrates a mixed financial profile. The company has become profitable over the past five years, growing earnings by 30.1% annually, yet it carries high net debt to equity at 63.3%. Its short-term assets (CN¥5.4 billion) comfortably cover both short-term and long-term liabilities, indicating liquidity strength despite high debt levels and low return on equity at 9.2%. Recent board changes include the appointment of Li Qian as an independent director amid ongoing governance adjustments, reflecting potential strategic shifts in management amidst stable but higher-than-average stock volatility.

- Jump into the full analysis health report here for a deeper understanding of Nanfang Zhongjin Environment.

- Gain insights into Nanfang Zhongjin Environment's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Unlock our comprehensive list of 1,171 Asian Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Anacle Systems, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8353

Anacle Systems

Develops enterprise business and energy management software solutions in Singapore, Malaysia, Thailand, the People’s Republic of China, and internationally.

Flawless balance sheet slight.