- China

- /

- Electrical

- /

- SZSE:002298

Discovering Value: 3 Penny Stocks With Market Caps Under US$800M

Reviewed by Simply Wall St

Global markets have been experiencing volatility, with U.S. equities facing declines amid inflation concerns and political uncertainty, while small-cap stocks have notably underperformed their larger counterparts. In such a fluctuating market landscape, investors often seek opportunities in less conventional areas like penny stocks—an investment category that, despite its old-fashioned name, remains significant for those looking to uncover potential value in lesser-known companies. These smaller or newer firms can present intriguing prospects when they possess solid financials and growth potential; here we explore three penny stocks that exemplify these qualities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.75 | MYR443.74M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.67 | £419.81M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.015 | £770.58M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £180.2M | ★★★★★☆ |

| Starflex (SET:SFLEX) | THB2.56 | THB1.99B | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.50 | £68.28M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

Click here to see the full list of 5,706 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Jiangsu ZongyiLTD (SHSE:600770)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jiangsu Zongyi Co., LTD operates in the clean energy, advanced technology, and integrated finance sectors, with a market capitalization of CN¥5.37 billion.

Operations: Jiangsu Zongyi Co., LTD has not reported specific revenue segments.

Market Cap: CN¥5.37B

Jiangsu Zongyi Co., LTD, with a market cap of CN¥5.37 billion, has recently transitioned to profitability, though its Return on Equity remains low at -0.7%. The company's financial health appears robust as it holds more cash than total debt and boasts a reduced debt-to-equity ratio from 15% to 5.2% over five years. Short-term assets significantly surpass both short and long-term liabilities, indicating strong liquidity. However, earnings have been impacted by a large one-off gain of CN¥32.9 million in the past year, suggesting potential volatility in future results despite stable weekly volatility compared to most Chinese stocks.

- Dive into the specifics of Jiangsu ZongyiLTD here with our thorough balance sheet health report.

- Gain insights into Jiangsu ZongyiLTD's historical outcomes by reviewing our past performance report.

Anhui Sinonet & Xinlong Science & Technology (SZSE:002298)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Anhui Sinonet & Xinlong Science & Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥3.57 billion.

Operations: The company generates its revenue primarily from China, amounting to CN¥2.07 billion.

Market Cap: CN¥3.57B

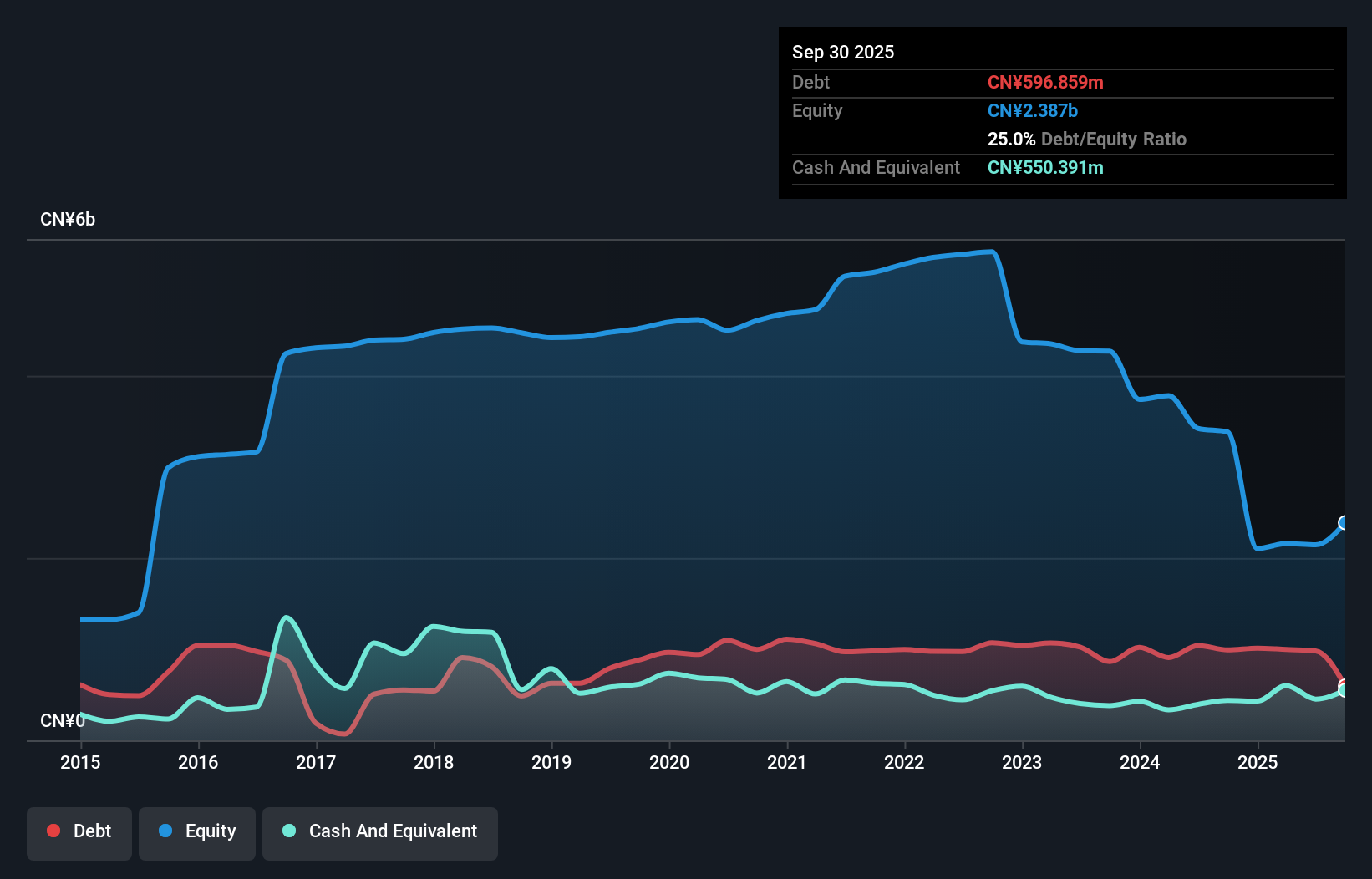

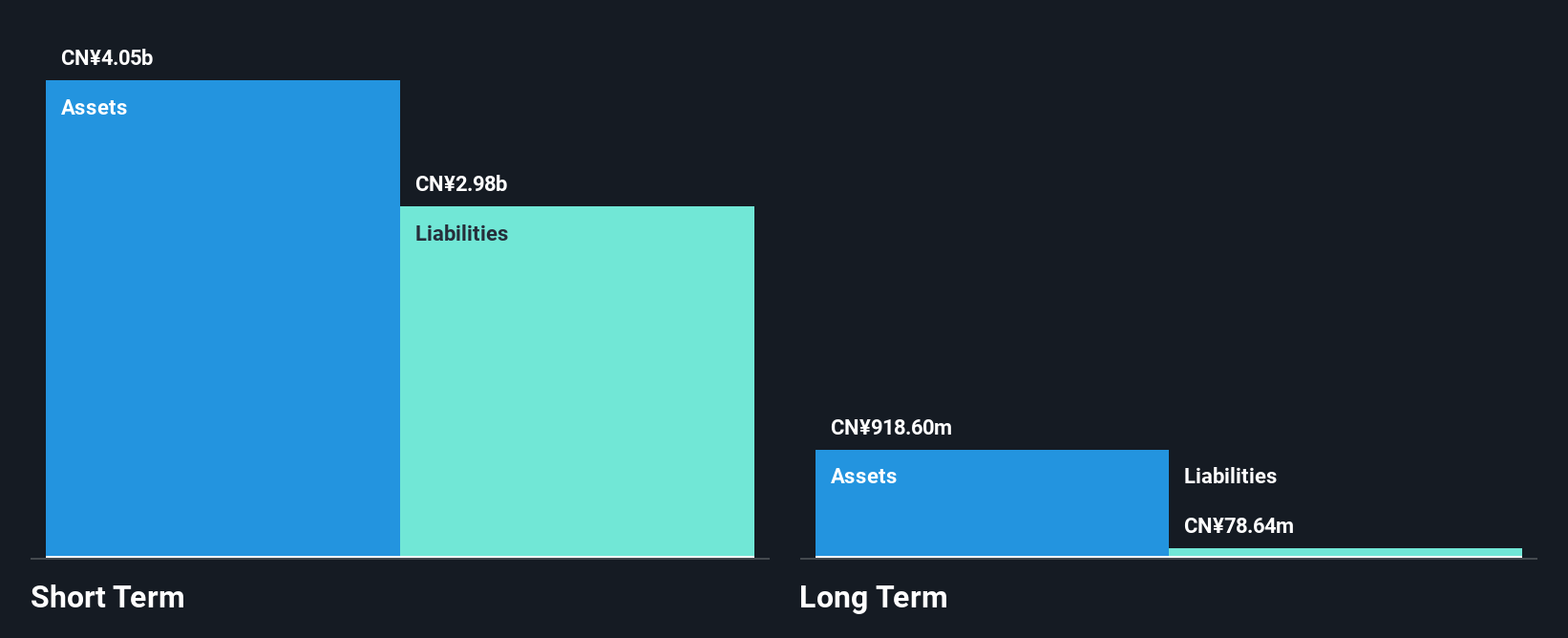

Anhui Sinonet & Xinlong Science & Technology Co., Ltd. has a market capitalization of CN¥3.57 billion, operating primarily in China with revenues of CN¥1.35 billion for the first nine months of 2024, down from CN¥1.51 billion the previous year. The company remains unprofitable, with net losses widening to CN¥375.95 million from CN¥114.6 million year-on-year, and a negative return on equity at -25.5%. Despite its financial struggles, it maintains a satisfactory net debt to equity ratio of 16.4% and has sufficient cash runway for over three years due to positive free cash flow growth.

- Jump into the full analysis health report here for a deeper understanding of Anhui Sinonet & Xinlong Science & Technology.

- Assess Anhui Sinonet & Xinlong Science & Technology's previous results with our detailed historical performance reports.

Hiconics Eco-energy Technology (SZSE:300048)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hiconics Eco-energy Technology Co., Ltd. operates in industrial control, residential energy storage, and distributed PV EPC sectors both in China and internationally, with a market cap of CN¥5.47 billion.

Operations: Hiconics Eco-energy Technology Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥5.47B

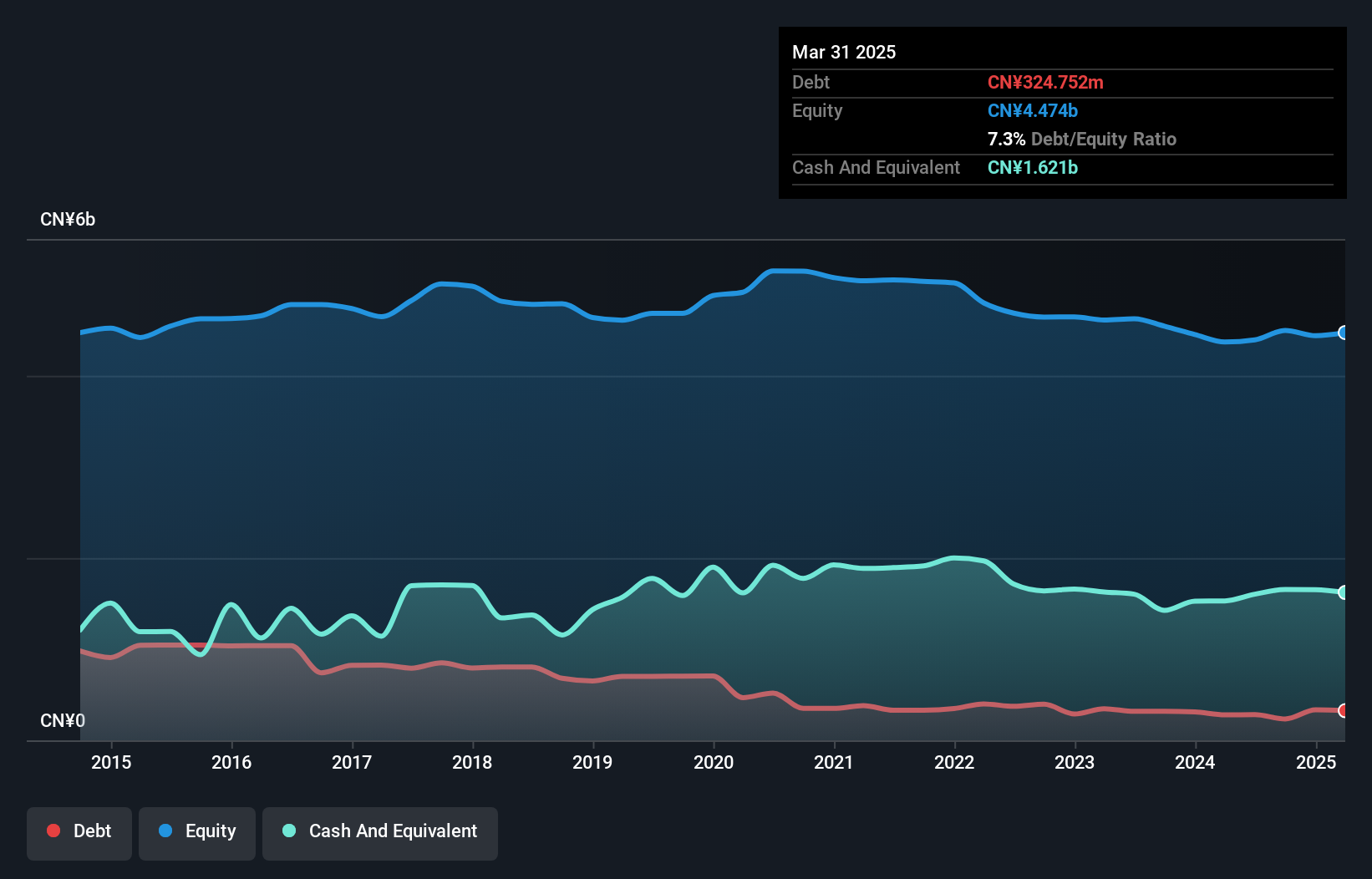

Hiconics Eco-energy Technology Co., Ltd. has shown significant revenue growth, reporting CN¥3.11 billion for the first nine months of 2024, a substantial increase from CN¥992.37 million the previous year, turning a net income of CN¥10.81 million from a prior loss of CN¥35.3 million. Despite being unprofitable with negative return on equity and an inexperienced board, it benefits from strong financial health with short-term assets covering both short- and long-term liabilities and more cash than total debt. The company’s cash runway extends beyond three years due to positive free cash flow growth, indicating potential resilience in its operations.

- Unlock comprehensive insights into our analysis of Hiconics Eco-energy Technology stock in this financial health report.

- Explore Hiconics Eco-energy Technology's analyst forecasts in our growth report.

Taking Advantage

- Jump into our full catalog of 5,706 Penny Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002298

Anhui Sinonet & Xinlong Science & Technology

Anhui Sinonet & Xinlong Science & Technology Co., Ltd.

Excellent balance sheet and slightly overvalued.